Democrats Plot Tax Hikes Across Entire U.S. Economy

KEY TAKEAWAYS

- President Biden and Democrats in Congress plan to raise taxes across every facet of our recovering economy to help pay for their sweeping liberal agenda.

- Democrats are pushing ahead on reckless tax increases even as the Congressional Budget Office predicts revenues as a share of the economy will continue to match the 50-year average in the coming years.

- Democrats’ tax hikes will hit small businesses, family farms, and the paychecks and retirement plans of working Americans, while raising prices for consumers.

President Joe Biden and Democrats in Congress are determined to enact their sweeping liberal agenda at any cost. Undeterred by growing inflation concerns from their constituents – and trying to capitalize on the unprecedented federal response to the COVID-19 pandemic – they are ploughing ahead on their $3.5 trillion big-government spending spree.

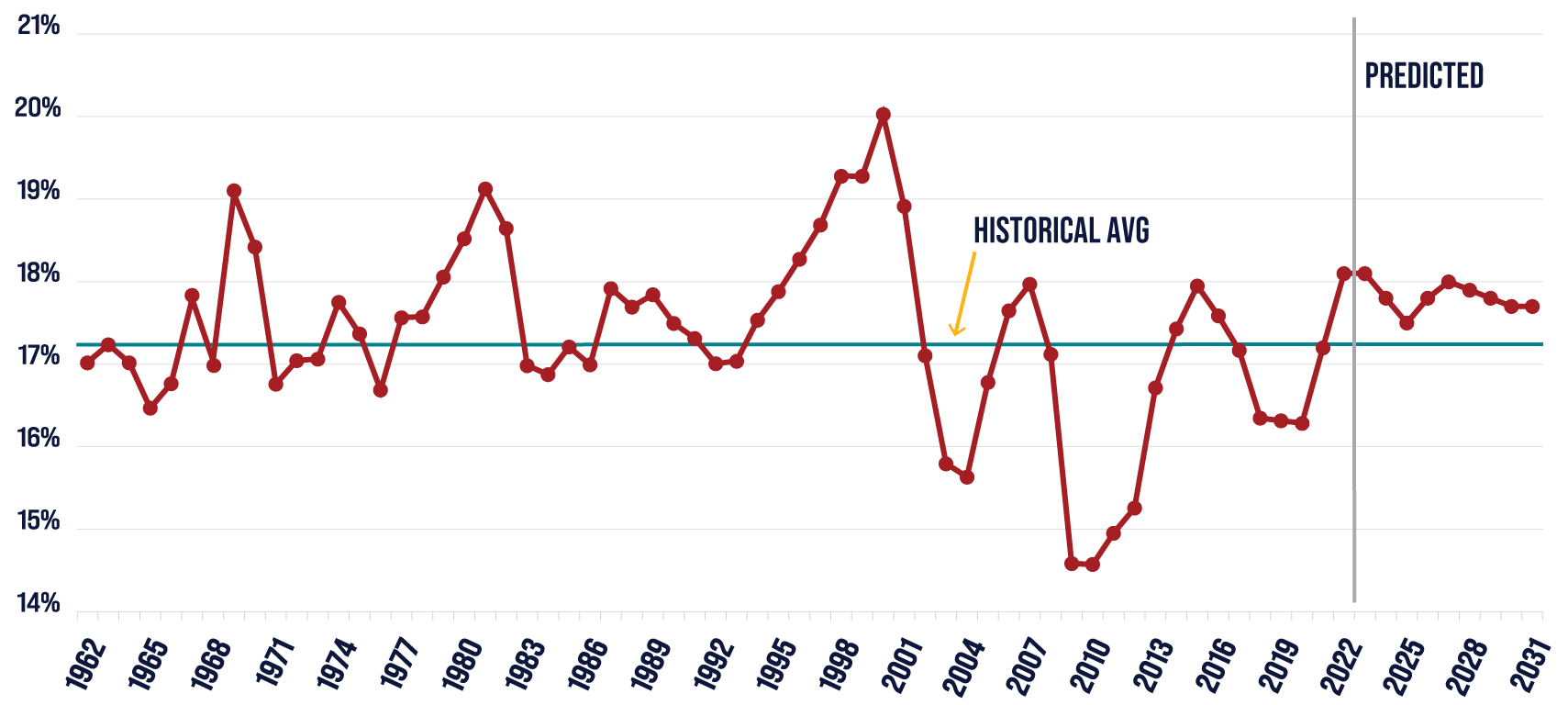

Federal Revenue as a Percentage of Gross Domestic Product

To help pay for it, they will raise taxes across every facet of our recovering economy. In an attempt to obscure the size of these job-killing tax hikes, Democrats have argued Washington does not have enough money. However, the Congressional Budget Office predicts federal revenue as a share of the economy in 2021 will be nearly the average of the past 50 years, and it will grow to exceed this average in the next few years.

In its latest Budget and Economic Outlook, CBO projected that tax receipts this year will be 17.2% of GDP, almost exactly the 17.3% average from 1971-2020. CBO expects that as the economy continues to recover from the pandemic, revenues will “grow to 18.1% of GDP in 2022 and fluctuate between 17.5% and 18.1% of GDP through 2031.” These estimates assume no changes to the current tax laws.

Contributing to this revenue growth, CBO projects corporate tax receipts will climb to $379 billion in 2023, or 1.5% of GDP. According to the Tax Foundation, this will be “a record high in nominal terms and nearly matching average corporate tax collections as a share of GDP” prior to the 2017 Republican tax reform.

Our revenues are right in line with where they have been for a long time. What’s different now is the massive size and scope of Democrats’ spending spree. Democrats are fixated on a reckless tax increase to fund a spending scheme that will make the United States less competitive and hit Americans’ wallets at every turn.

Democrats Push Gigantic Tax Hikes

a tax hike at every turn

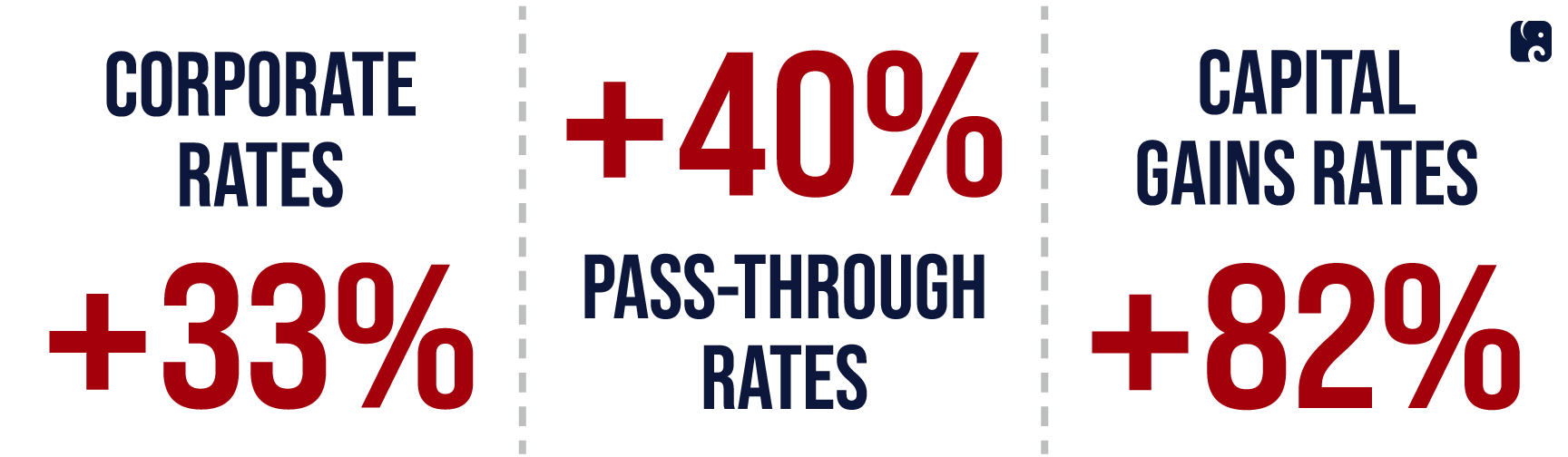

Democrats are targeting several of their tax hikes at America’s small business owners and family farmers. Their plans to raise the corporate tax rate by as much as 33% would hit more than a million small businesses.

Democrats would also target small businesses and family farms organized as pass-through businesses, with proposals to hike their taxes by more than 40% at the top marginal rate. This includes a proposal by Finance Committee Chairman Ron Wyden to significantly roll back the Section 199A pass-through business deduction. Republicans created this deduction in 2017 to ensure our tax code didn’t put pass-through businesses and sole proprietorships at a disadvantage to their corporate competitors.

Despite Democrats’ rhetoric, their tax hikes wouldn’t just force the wealthy to “pay their fair share,” they would also hurt middle-class workers. Increased costs on businesses would reduce the capital they have available to invest in better factories and equipment, leading to less productivity, fewer new jobs, and lower wages. A recent analysis from the Joint Committee on Taxation found that if the corporate rate rises from 21% to 25%, about 57% of the new revenue next year would come from people earning less than $500,000. By 2031, 66% of the increased burden will be borne by these people.

Many middle-class workers and savers are also hit by the burden of business tax hikes. There are 108 million Americans who have an ownership stake in corporations through their retirement accounts, pensions, IRAs, and other investments in stocks and bonds. Democrats’ tax efforts amount to a stealth tax on these savings.

In another setback to Americans’ retirement planning, President Biden is pushing for an 82% hike on the top federal tax rate on capital gains. This would be a devastating blow to the entrepreneurs who consider their business to be their nest egg and hope to eventually sell it to pay for their final years.

Remarkably, President Biden’s sweeping tax hikes even include expanding the tax burden on death. Except for an ineffective and unworkable exemption, he would eliminate the benefit of the “step-up in basis” tax provision that protects many middle-class people from owing a large tax bill when a loved one dies. Unlike current law, under the president’s scheme, the transfer of an appreciated asset at death would be taxable. This means that transfers already subject to the estate tax would also be subject to a second tax at death.

Not satisfied to leave any corner of the economy untouched, Democrats have advanced legislation to distort the tax code against the primary providers of U.S. energy, which will lead to higher consumer costs across the board. They’ve also thrown in a proposal to impose a border adjustment tax on carbon. This protectionist scheme would impose a tax on certain imports – likely to increase the cost of consumer goods and fuel trade tensions – as a backward means of mitigating the high cost of their Green New Deal regulatory agenda.

House Democrats just released a first draft of their tax plan, which includes many of these provisions, alongside other job-killing tax hikes. As they negotiate amongst themselves, no bad idea appears to be off the table in their brazen scheme to reconstruct the American economy. They intend to hike taxes across the economy in order to redistribute income and capital to suit their own preferences.

Democrats would be better served by working with Republicans on policies that ensure a growing, inclusive economy like we enjoyed following enactment of the Republican tax reforms. Americans understand the difference.

Next Article Previous Article