Biden Tax Hikes: A Plan to Put America Last

KEY TAKEAWAYS

- Prior to the passage of the Tax Cuts and Jobs Act in 2017, there was bipartisan consensus that we needed to bring the tax burden on U.S. businesses in line with our global competitors.

- Now President Biden wants to go backward by raising taxes on U.S. job creators, putting them at a significant disadvantage against their foreign competitors.

- Higher taxes are not a way to advance American innovation and leadership; they are a mistake that will alter the trajectory of our economic growth.

To sell President Biden’s massive tax and spend boondoggle, Democrats cast themselves as defenders against a global “race to the bottom” on business tax rates. In their telling, higher taxes on job creators provide economic opportunity for workers, and the rest of the world will soon catch up to the new rules of the game. This idea is unconnected to reality.

Corporate Tax Rates Were Finally Competitive with the Rest of the World

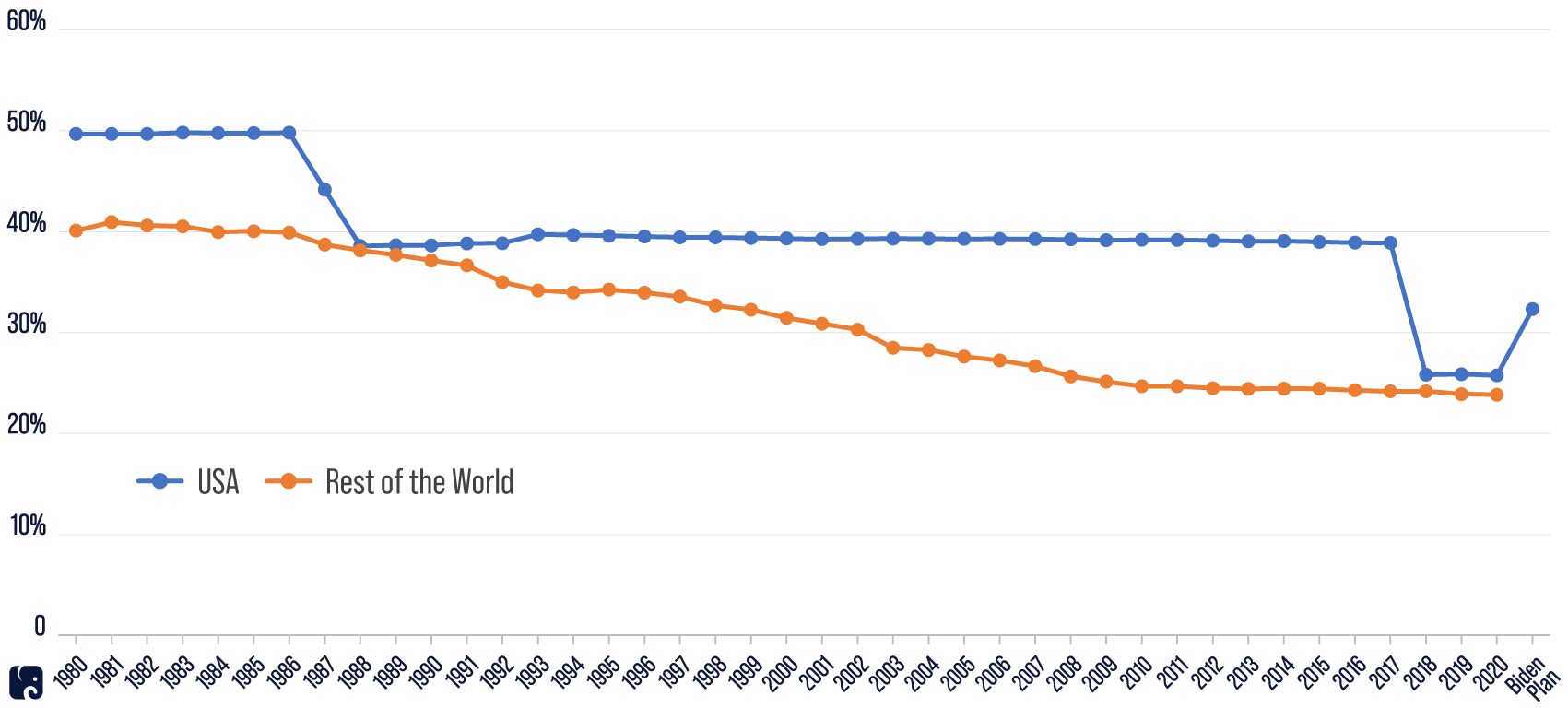

It is true that global corporate tax rates have declined over time – from an average of 40.1% in the early 1980s to 23.9% in 2020. The largest reductions by our international competitors occurred between 2000, when 42% of countries had a statutory tax rate of 30% or less, and 2010, when 78% did. Since then, the worldwide average has not changed significantly, a fact in sharp contrast to the administration’s talking points. What’s also irrefutable is that the nation left behind in this global race toward competitiveness was the United States.

By 2017, the U.S. had the fourth-highest statutory corporate income tax rate in the world. And we had the results to prove it, including a hemorrhaging U.S. tax base, stagnant growth, and potential investments in the U.S. locked offshore.

That’s why, prior to the passage of the Tax Cuts and Jobs Act, there was bipartisan consensus that we needed to bring the U.S. in line with our global competitors. Senator Ron Wyden, President Barack Obama, and House Ways and Means Committee Chairman Dave Camp all offered proposals to level the playing field for American companies and workers by lowering the corporate income tax rate.

The Republican-led tax law finally reduced the rate from 35% to 21% and reformed our broken “worldwide” international tax system. This rate reduction neither positioned the U.S. as a low tax outlier nor ushered in a new wave of global rate reductions. Rather, it brought the U.S. combined tax rate much closer to the global average and led to more jobs, higher wages, and more investment in the United States.

Back in Last Place

Now President Biden wants to go backward. He is planning to raise taxes on U.S. job creators as part of his $3.4 trillion tax hike, including increasing the corporate tax rate. But the higher tax rates are only part of the story.

The TCJA was a broad reform of America’s tax code, trading the elimination of deductions and credits some companies used to lower their tax burden for a lower universal statutory rate. Hiking the rate on top of these “base broadeners” as President Biden is proposing would be a double whammy that amplifies the effect of the rate increase. The president’s plan also would impose tax increases specifically on U.S. companies with operations abroad, putting them at a significant disadvantage against their foreign competitors.

Undermining american competitiveness

There is bipartisan agreement that we must ensure U.S. companies can compete with their foreign counterparts, including those in China. But the president’s plan would impose a combined corporate tax rate on U.S. businesses that is higher than every other developed country.

What’s more, his proposed 32.3% combined tax rate for U.S. companies would far exceed the 25% rate their competitors in China pay. The Chinese government already distorts this competition by giving generous grants, subsidies, and special tax preferences to strategic industrial sectors. Since 1995, the number of Chinese companies on the Fortune Global 500 list has increased significantly, as the number of U.S. companies on that list has declined. Imposing higher taxes will only exacerbate this trend.

The president’s tax hikes would harm American businesses competing in the connected global economy just as they are trying to recover from the profound effects of the COVID-19 pandemic. Higher taxes are not a way to advance American innovation and leadership; they are a mistake that will alter the trajectory of our economic growth. Democrats should work with Republicans on policies that help the United States compete, not push a partisan agenda that puts our economy last.

Next Article Previous Article