Democrats' Tax and Spend Monster

KEY TAKEAWAYS

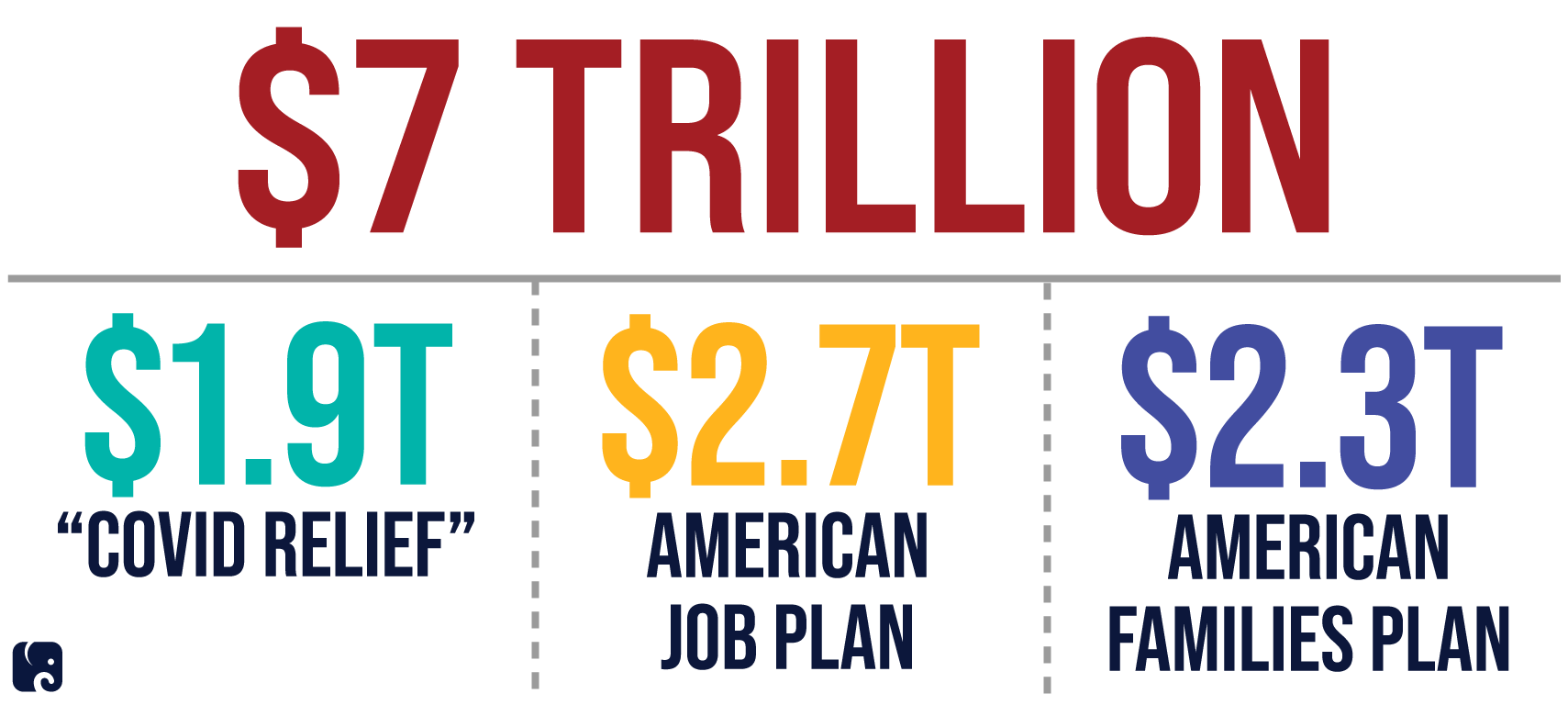

- The Biden administration laid out plans for $7 trillion in new spending in less than four months in office. This dwarfs previous federal spending and is nearly as much as what the U.S. has spent on all wars since World War I.

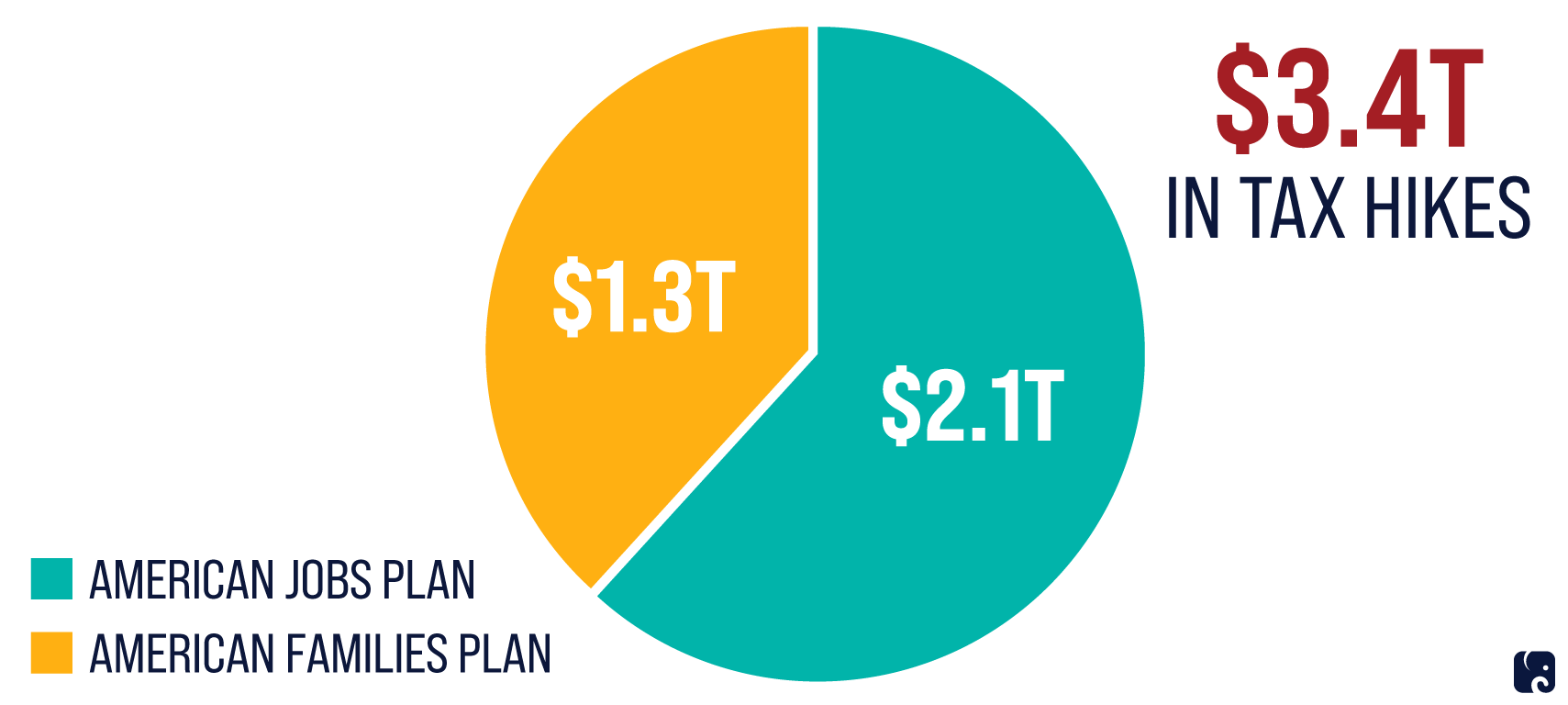

- The administration has also proposed $3.4 trillion in tax hikes on job creators, workers, small businesses, and family farms – the largest tax hike in half a century.

The Biden administration committed to $7 trillion in new spending in its first four months in office. According to the Penn Wharton Budget Model, the administration proposed $5 trillion in new spending on top of the $1.9 trillion from March’s American Rescue Plan Act, along with $3.4 trillion in tax hikes. The White House says that the eight-year cost of its mammoth spending proposals would be offset by 15 years of new tax hikes. Of course, this assumes that Democrats would allow their litany of costly new programs all to end in eight years, which is inconceivable. The Penn Wharton Budget Model also assumes significantly lower potential revenue from enhanced tax collection enforcement, which the White House touts as a central revenue stream to fund its initiatives.

Nearly $7 Trillion in New Spending

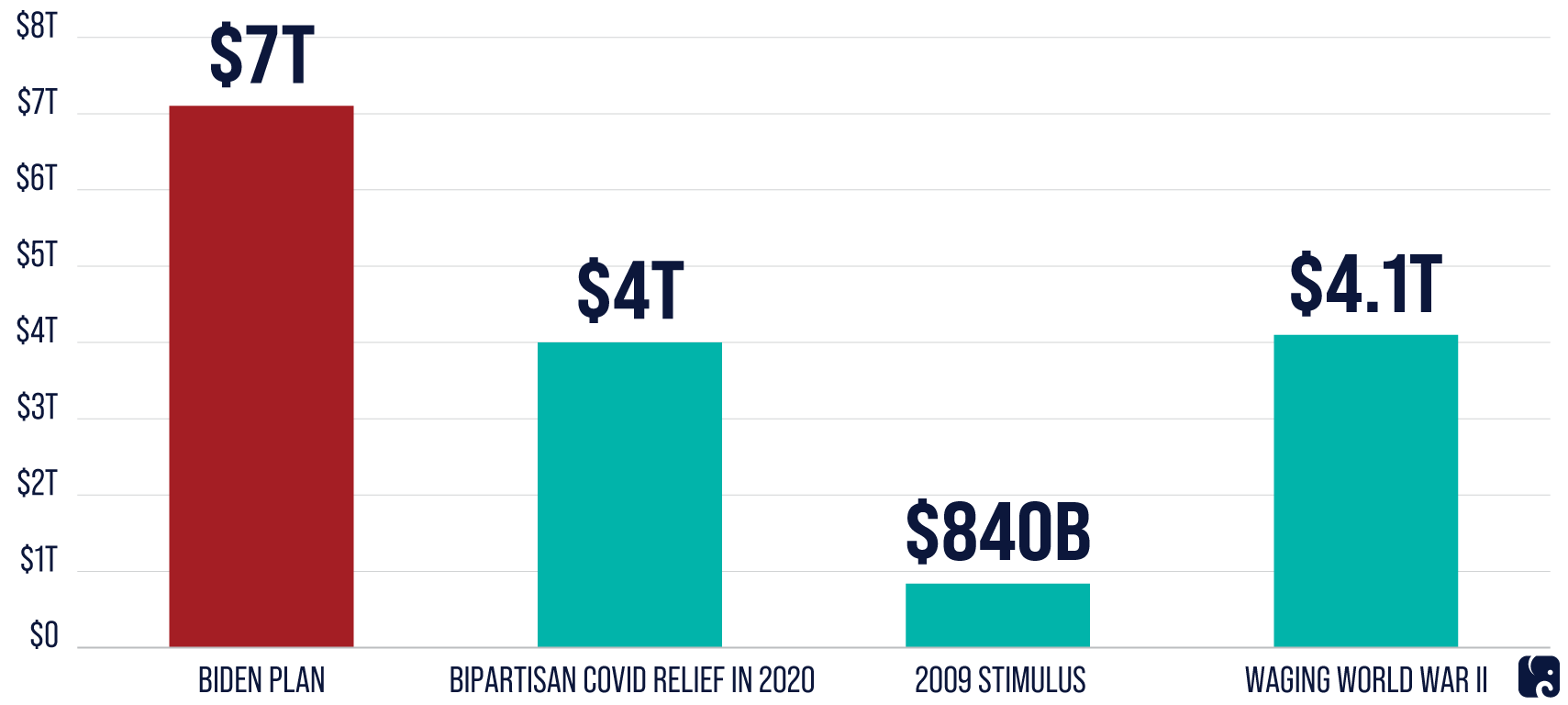

The Biden proposal dwarfs previous federal spending. The $7 trillion Biden boondoggle would nearly double the massive relief the federal government provided in response to the COVID-19 pandemic in 2020. It is eight times the size of the 2009 Obama stimulus Democrats rammed through the last time they controlled Congress and the White House.

It’s more than the U.S. spent winning WWII, and it’s nearly as much as what the U.S. has spent on all wars since World War I.

Unprecedented Levels of Spending

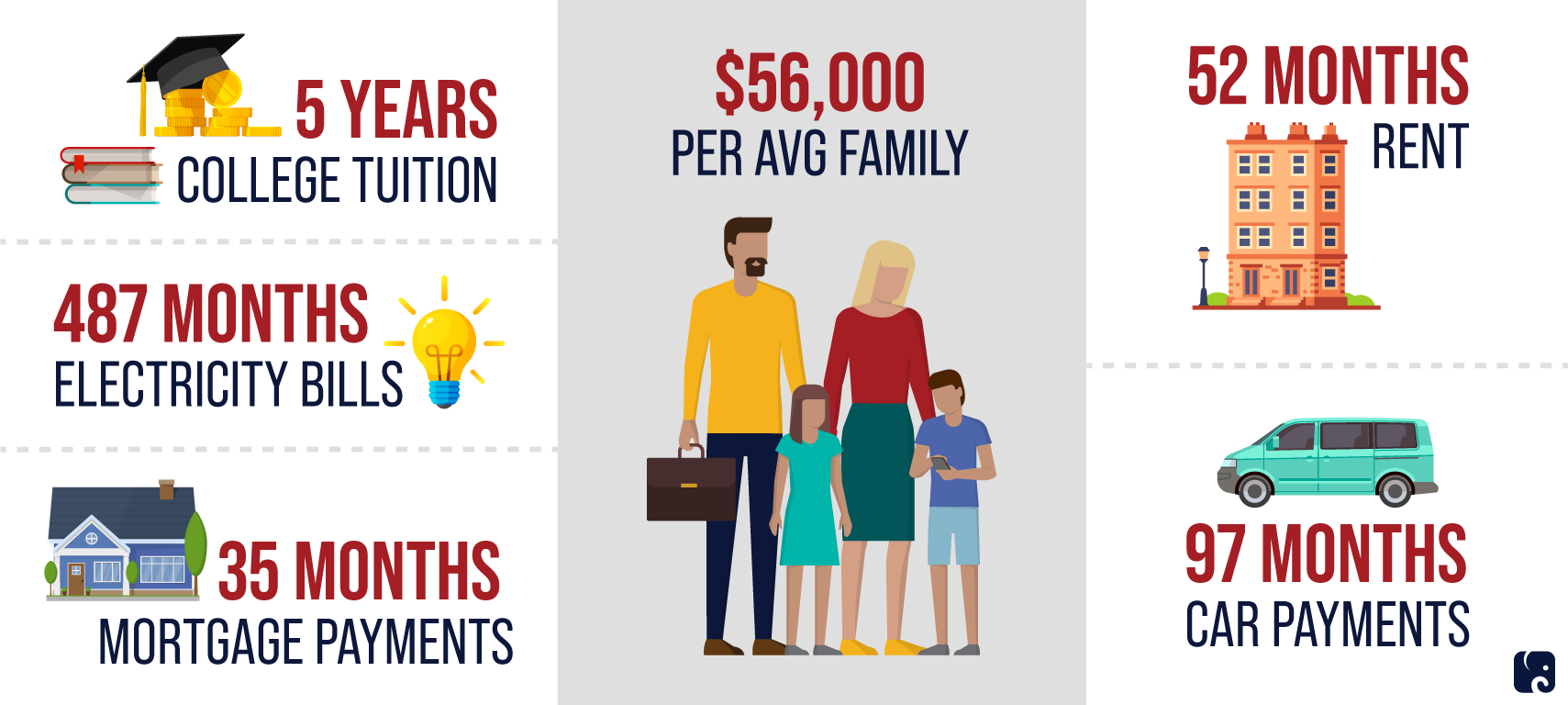

Families are already on the hook for $223,000 each to cover the existing national debt. Democrats’ massive spending proposals amount to another $56,000 from every household in America. Families could do so much more with this money than the federal government. Families could send their children to college; pay their mortgage; cover their rent; buy a car; and forget about their electricity bills for the next 40 years.

$56,000 Per Family Could Do So Much More

The Biden plan also includes $3.4 trillion in tax hikes.

The American Jobs Plan included a $2.1 trillion tax hike on job creators and workers in the midst of an economic recovery. It raises the tax rate from 21% to 28% for the nearly one million U.S. businesses – large and small – organized as a “C corporation.” It undermines international tax reforms of the Tax Cuts and Jobs Act and raises taxes on U.S. multinational companies relative to their foreign counterparts. It imposes an unworkable 15% minimum tax on large firms’ financial profits.

The American Families Plan includes a $1.3 trillion tax hike on small businesses, family farms, investors, and savers. It raises taxes on investments, undermining risk-taking. It eliminates “stepped up basis,” imposing a new “double death tax” on people, small businesses, and family farms.

$3.4 Trillion in Tax Hikes

As Americans recover from the pandemic, President Biden is proposing the largest tax hike on Americans in more than half a century. Studies show Democrats’ tax hikes will lead to lower wages for American workers and drive business investment out of the U.S.

* This paper was updated on May 26 to reflect changes made in the Penn Wharton Budget Model analysis of the American Families Plan.

Next Article Previous Article