Growing the Welfare State in the Name of COVID Relief

KEY TAKEAWAYS

- What American workers need is an open economy, a bridge of support as the economy rebounds, and a federal benefit structure that does not serve as a disincentive to return to work.

- Democrats’ $1.9 trillion spending law is a massive expansion of the federal welfare state, with direct government support decoupled from need and disconnected from the dignity of work.

- This radical expansion of the federal government’s income support is made worse by a looming benefit cliff and an incentive for states and cities to maintain crushing restrictions to economic activity.

As a result of the COVID-19 pandemic, the U.S. unemployment rate soared to 14.7% in April 2020. According to the Bureau of Labor Statistics, this was “the highest rate and the largest over-the-month increase in the history of the data.” Congress reacted swiftly, enacting the largest relief package in history: $4 trillion in five laws that passed with bipartisan support.

Thanks in part to these efforts, the economy is showing strong signs of recovery, with the unemployment rate falling to 6.2% in February. Despite these gains, a significant number of people – and a disproportionate number of low-income Americans – continue to experience financial hardship due to pandemic-related economic restrictions.

A sidelined workforce needs the job creation that comes from strong economic growth; and a growing economy requires an available workforce. What American workers need is an open economy, a bridge of support as the economy rebounds, and a federal benefit structure that does not serve as a disincentive for them to return to work when they’re able.

What they got from the Democrats’ partisan $1.9 trillion spending law was a massive expansion of the federal welfare state. H.R.1319, the so-called American Rescue Plan Act, is a costly grab bag of long-standing liberal priorities to expand the reach of the federal government under the auspices of COVID relief. The law, labeled “the most progressive piece of legislation in history” by the president’s press secretary, decouples direct government support from need and disconnects it from the dignity of work. This is made worse by a looming benefit cliff and an incentive for states and cities to maintain crushing restrictions to economic activity.

decoupled from need

In Democrats’ “COVID relief” legislation, vast expansions in federal benefits are not tied to any actual harm caused by the pandemic. Millions of Americans who have experienced no financial hardship get thousands of dollars in federal welfare.

Under the law, a single woman living in Georgia who earns $75,000 and had no COVID-related change in her income just got a $1,400 bonus. She has gotten a total of $3,200 in direct payments from the federal government since March 2020, which is like receiving three extra weeks of net salary.

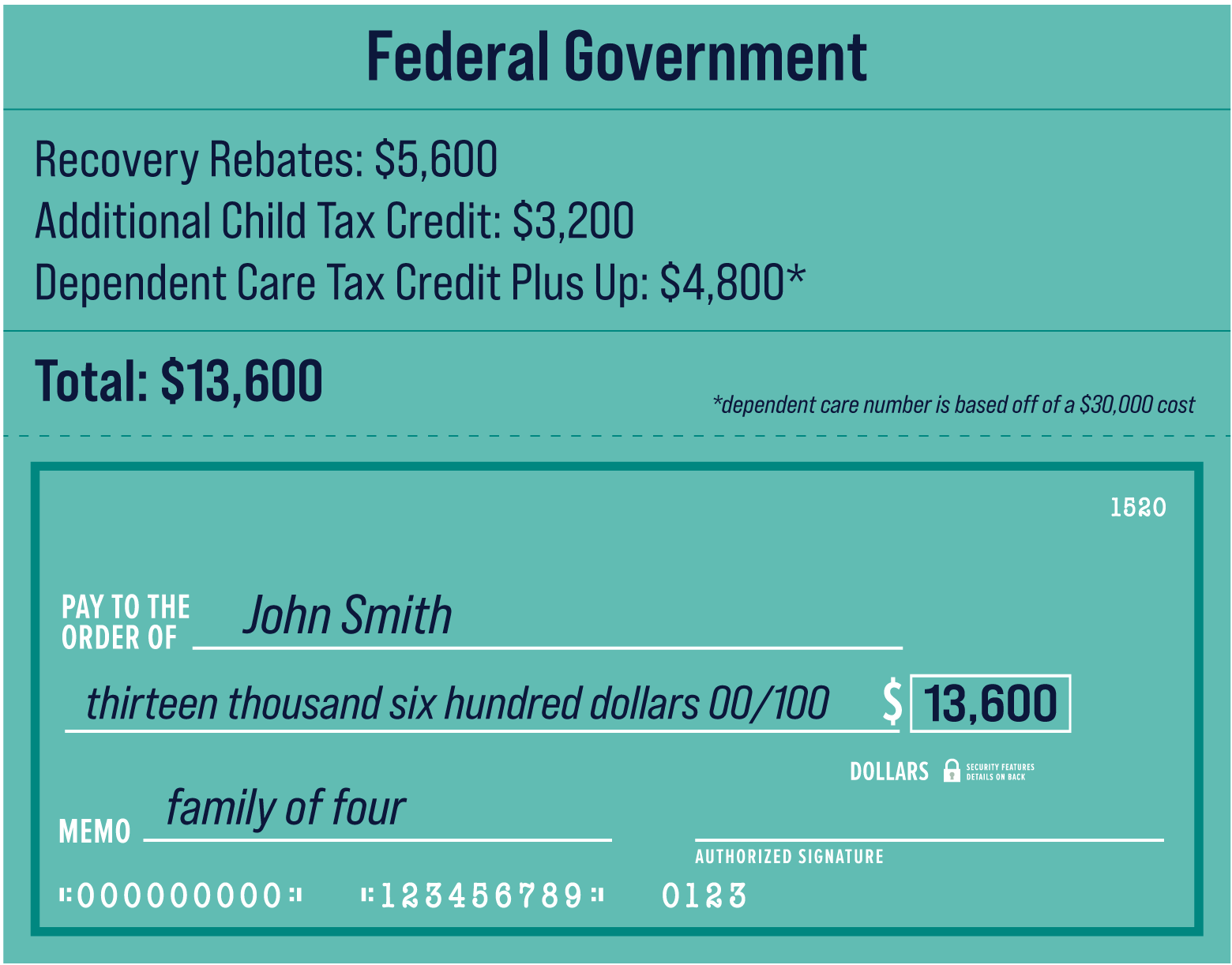

A middle-class family with two young children and an income of $150,000 got at least $13,600 in additional benefits for 2021, including a substantial “recovery rebate,” an increased child tax credit, and a child and dependent care tax credit plus-up. Since March 2020, this family has gotten $11,400 in direct checks from the federal government.

Thousands in Federal Welfare Not Tied to COVID-19

disconnected from work

Democrats’ massive benefit increases could serve as a disincentive for local governments to open up and let people return to work sooner. For people who are actually suffering from the ongoing economic disruption of government-imposed shutdowns, more time stripped of the dignity of their work is not the answer. The law extends pandemic unemployment compensation – $300 per week above normal state benefits – all the way to September, even as GDP is projected to return to its pre-pandemic level by the middle of the year. With the increased benefit, some Americans can earn more to stay home than they would to return to work. This is another disincentive that can hold back the economic recovery if businesses can’t fill jobs when they are ready to open their doors.

One recent analysis looked at a hypothetical married couple living in Georgia with two young children. One spouse worked in 2019, earning $60,000, but lost her job last year because of state shutdowns. “That family will have received $50,840 in federal and state unemployment benefits from April 1, 2020 to September 6, 2021, plus $11,400 in stimulus payments, plus $7,200 in Child Tax Credit, totaling $69,440 in combined COVID-19 relief benefits.”

lOOMING cliff

In one partisan move, Democrats significantly increased short-term federal welfare by redistributing wealth through the tax code. Their law increases the value of the Child Tax Credit, Earned Income Tax Credit, and dependent care tax benefits for 2021. It increases after-tax income of the lowest-wage Americans by 20%, but only for one year. As the cliff approaches, Democrats will be under extreme pressure to make the welfare expansion permanent at a cost of trillions of dollars.

The appropriate size and scope of the federal safety net is a subject of legitimate debate, and there has been bipartisan agreement on policies that help Americans who have been harmed by the pandemic. But Democrats abandoned bipartisanship and used their partisan spending package to secure a one-year foothold toward their far-left agenda in the name of “emergency” relief. By radically expanding federal income supplementation and ignoring the consequences of an outsized, short-term benefit, Democrats could leave many people more vulnerable than ever.

Next Article Previous Article