Rising Prices Hit American Families

KEY TAKEAWAYS

- Americans are paying higher prices for many of the goods and services they can’t do without.

- The Labor Department reported that consumer prices rose 5.4% in June from one year ago, following a 5% jump in May.

- Democrats passed a unilateral $2 trillion spending law earlier this year, despite warnings from Republicans and others that excessive spending could pressure inflation. Now Democrats want to spend trillions of dollars more.

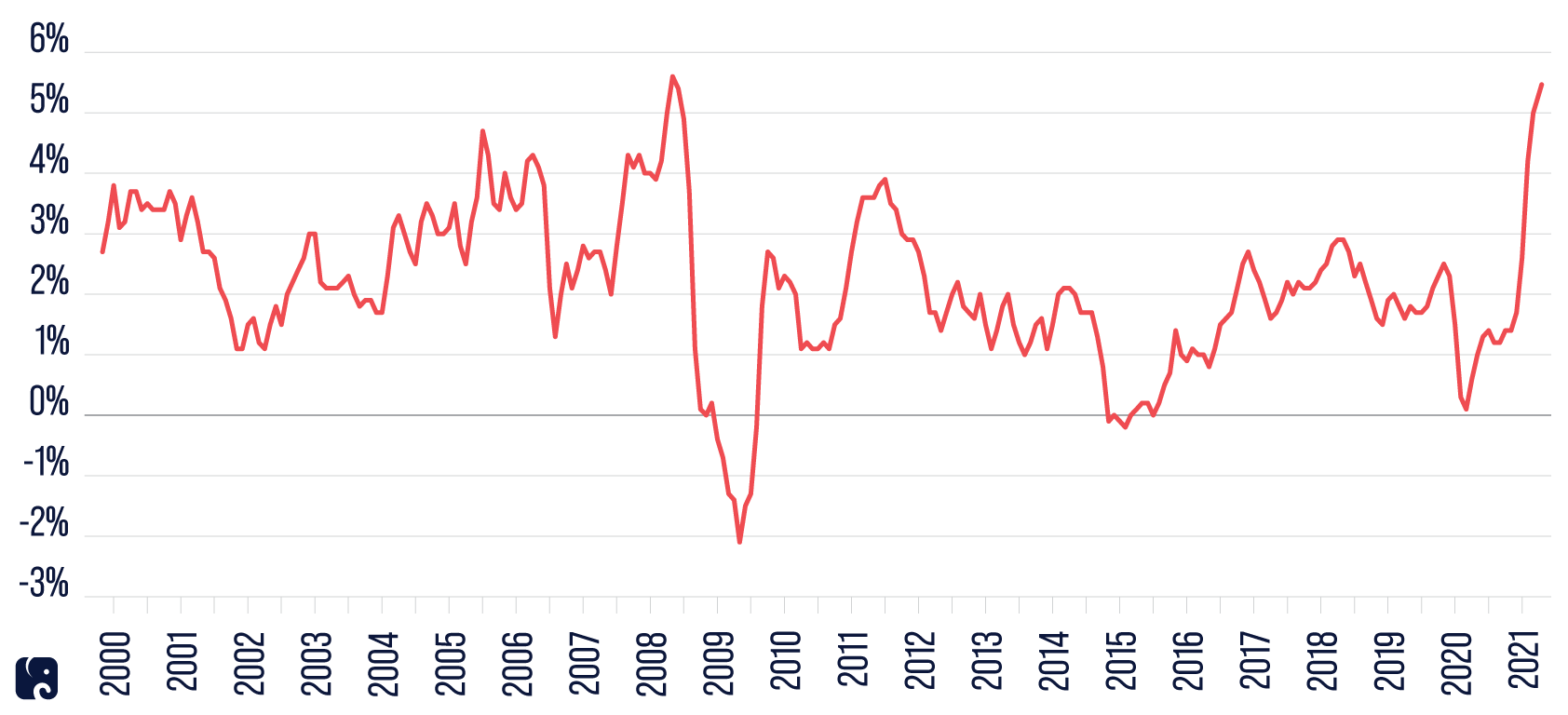

Recently, Americans have watched as prices have soared on many of the things they buy – big purchases like cars and vacations, but also everyday items like groceries and clothes. The Department of Labor reported that consumer prices in June were up 5.4% from one year ago, the largest increase since August 2008. This latest increase follows a 5% jump in May.

Inflation Takes Off

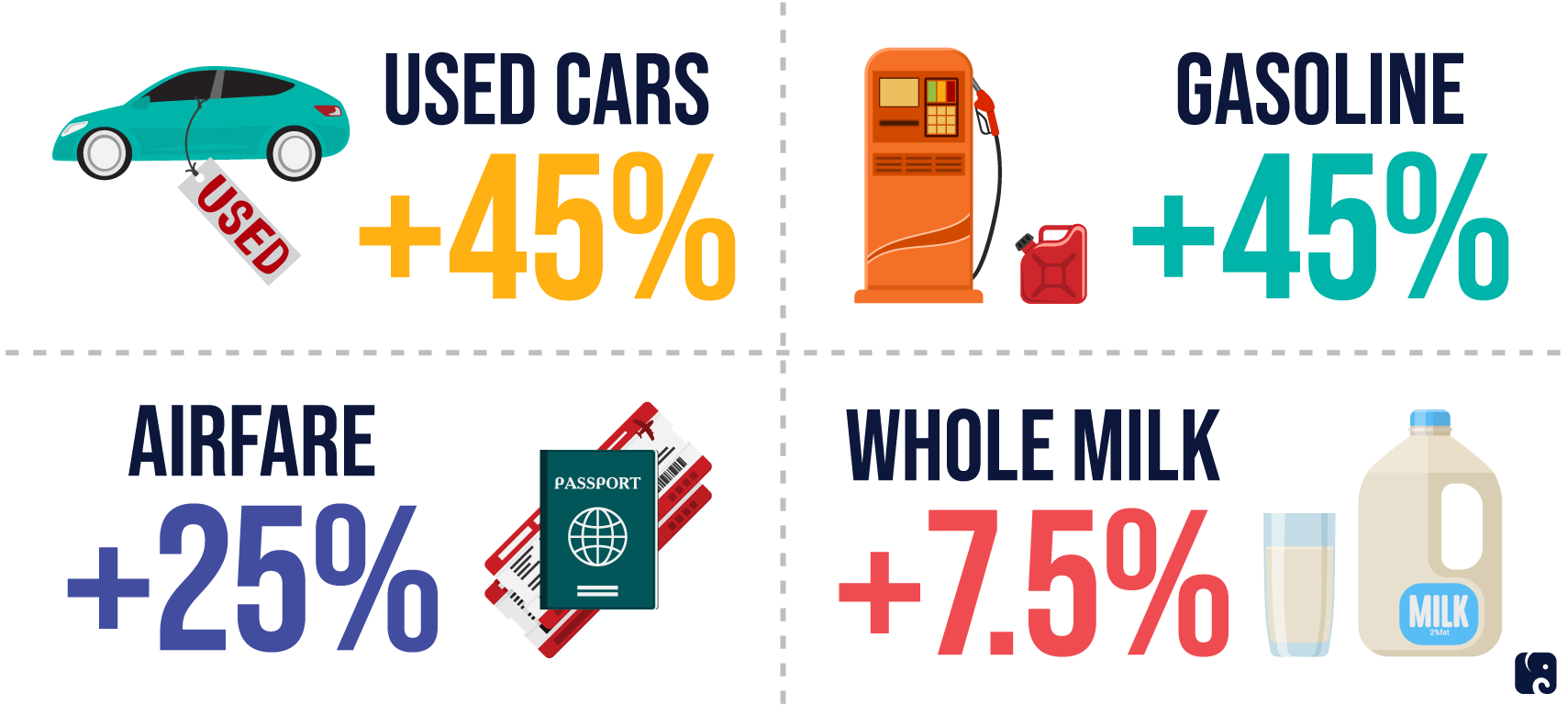

Removing the more volatile categories of food and energy, core prices in June were 4.5% higher than one year ago, also following a large increase in May. In June, the cost of whole milk was up 7.5% and gas was up 45%, compared to last June. Prices for used cars and airfare were up substantially, too.

The consumer price index has increased by an average of about 0.8% for each of the last three months on a seasonally adjusted basis, higher than the monthly increases of 0.2% and 0.1% in January and February 2020, before the pandemic began.

democrats’ spending spree

With prices soaring, Americans naturally are worried about inflation. One poll last month found that seven in 10 Americans are concerned that President Biden’s enormous spending plans could cause inflation. Another recent poll, by PBS NewsHour, found that inflation topped the list of Americans’ concerns for the economy.

Higher Prices Across the Board

The Congressional Research Service explained in a January primer on fiscal policy that “if fiscal stimulus is applied too aggressively or is implemented when the economy is already operating near full capacity, it can result in an unsustainably large demand for goods and services that the economy is unable to supply.”

Republicans have criticized Democrats’ spending plans as untargeted and exorbitant. In June, Senator Mitch McConnell observed that while Democrats said their partisan $2 trillion law from March would create jobs, “so far this multi-trillion-dollar liberal wish list has grown the national debt, spurred inflation, and prevented workers from returning to the labor force.” The law extended an enhanced unemployment benefit that many businesses say has contributed to a worker shortage, despite there being a record 9.2 million open jobs. Recognizing the problem, about half the states have stopped participating in the program. Many businesses have raised wages and offered hiring bonuses, but a lack of workers limits their ability to meet customer demand for goods and services.

Before Democrats passed their partisan spending law, economists on both sides of the aisle cautioned about the risks of the excessive government spending. In February, Larry Summers, President Clinton’s treasury secretary, issued a warning about the risk of inflation and “inflation expectations rising sharply.” At the end of May, he updated his prediction: “Now, the primary risk to the U.S. economy is overheating – and inflation.” He pointed to factors such as large federal stimulus and savings Americans built up when they could not spend on some things during the pandemic. Surveys conducted by the New York Federal Reserve found that people also saved more than a third of their stimulus checks on average. The U.S. savings rate stood at 12.4% as of May 2021, after spiking to 27.6% two months earlier, compared to the 8.3% rate before the pandemic in February 2020. Nearly half of Americans fully vaccinated, so more people are traveling and going to restaurants and sporting events, and many are armed with more savings.

With the economy reopening rapidly, economists say things such as supply chain disruptions and increased costs of materials and transportation also have contributed to higher prices. The computer chip shortage is affecting businesses from automakers to computer and appliance manufacturers, leading to production delays and higher prices. Prices of materials like steel and plastic have gone up. Restaurants are raising prices, as are food and beverage makers, prompting grocery stores to beef up their inventories ahead of expected price hikes. In a June survey of small businesses by the National Federation of Independent Business, 47% reported increasing prices.

While economists have said they expect inflation will ease as some of these problems are resolved, some are forecasting higher inflation rates for the next couple of years. Meanwhile, President Biden’s budget proposed enormous amounts of spending on programs to grow the federal government, and Democrats are pushing for trillions of dollars for “human infrastructure.”

tracking inflation

Policymakers are paying close attention, because persistently high inflation would further erode the value of people’s savings and paychecks, especially if wages cannot keep pace. It would especially hurt low-income families and seniors with fixed incomes.

While Congress controls fiscal policy, the Federal Reserve makes monetary policy decisions, such as interest rate changes, to support its statutory mandate to promote stable prices and maximum employment. The Fed tracks inflation using the “personal consumption expenditures price index.” At their June meeting, Fed officials projected strong economic growth for 2021, as well as inflation of 3.4%, up one percentage point from their March estimate. Previously, the Fed’s monetary policy strategy was to maintain inflation at 2%, but last August it started targeting an average of 2% inflation over time, meaning it could rise higher than that number temporarily. In June, the Fed reiterated that because inflation has been below this threshold for a while, it will aim for “inflation moderately above 2% for some time” to get to the new goal. The Fed also said it would keep rates near zero and continue its $120 billion in monthly asset purchases for now.

Treasury Secretary Janet Yellen has asserted that rising inflation is largely due to temporary factors such as supply chain problems and the economic reopening. Fed officials have expressed similar views. There still are concerns that pressures on inflation could last, or that people could start to expect higher inflation and base decisions for prices, wages buying on it in a self-fulfilling cycle. A New York Fed survey conducted in June found that consumers’ inflation expectations for one year from now jumped 0.8 percentage point to 4.8%, the highest since the survey started in 2013. Three-year inflation expectations stood at 3.6%, the same as in May but up from 3.1% in April. The Fed has said it would act if it saw evidence that inflation or people’s long-term expectations were “moving materially and persistently beyond” its goal.

Republican lawmakers have expressed concerns about the administration’s approach, saying that if inflation is more long-lasting or if inflation expectations increase too much, it could be hard to catch up to it. We could be left needing more severe changes to control inflation. Congressional Republicans also have warned that continuing Democrats’ massively high spending would add to the inflation problem, with Banking Committee ranking member Pat Toomey noting, “More wasteful spending by Congress is not what our economy needs.”

Next Article Previous Article