When the Fed Changes Rates

KEY TAKEAWAYS

- On March 3, the Federal Reserve announced an unscheduled 0.5% cut to the “federal funds rate” target range due to economic risks posed by the coronavirus.

- This rate is what banks charge each other to borrow money overnight. Changes to the rate can influence consumer interest rates for auto loans, credit cards, and savings accounts.

- The rate is one tool the Fed has to set monetary policy in support of the U.S. economy.

On March 3, the Federal Reserve’s Federal Open Market Committee lowered the target range for the “federal funds rate” by 0.5% due to economic risks posed by the coronavirus outbreak. The federal funds rate is what banks charge each other to borrow money overnight. This short-term interest rate is one tool the Fed uses to meet its congressionally mandated goals of ensuring stable prices, full employment, and moderate long-term interest rates. A change to this rate does not immediately lead to identical changes in the interest rates banks charge for auto loans, credit cards, and mortgages, but it can affect these other rates.

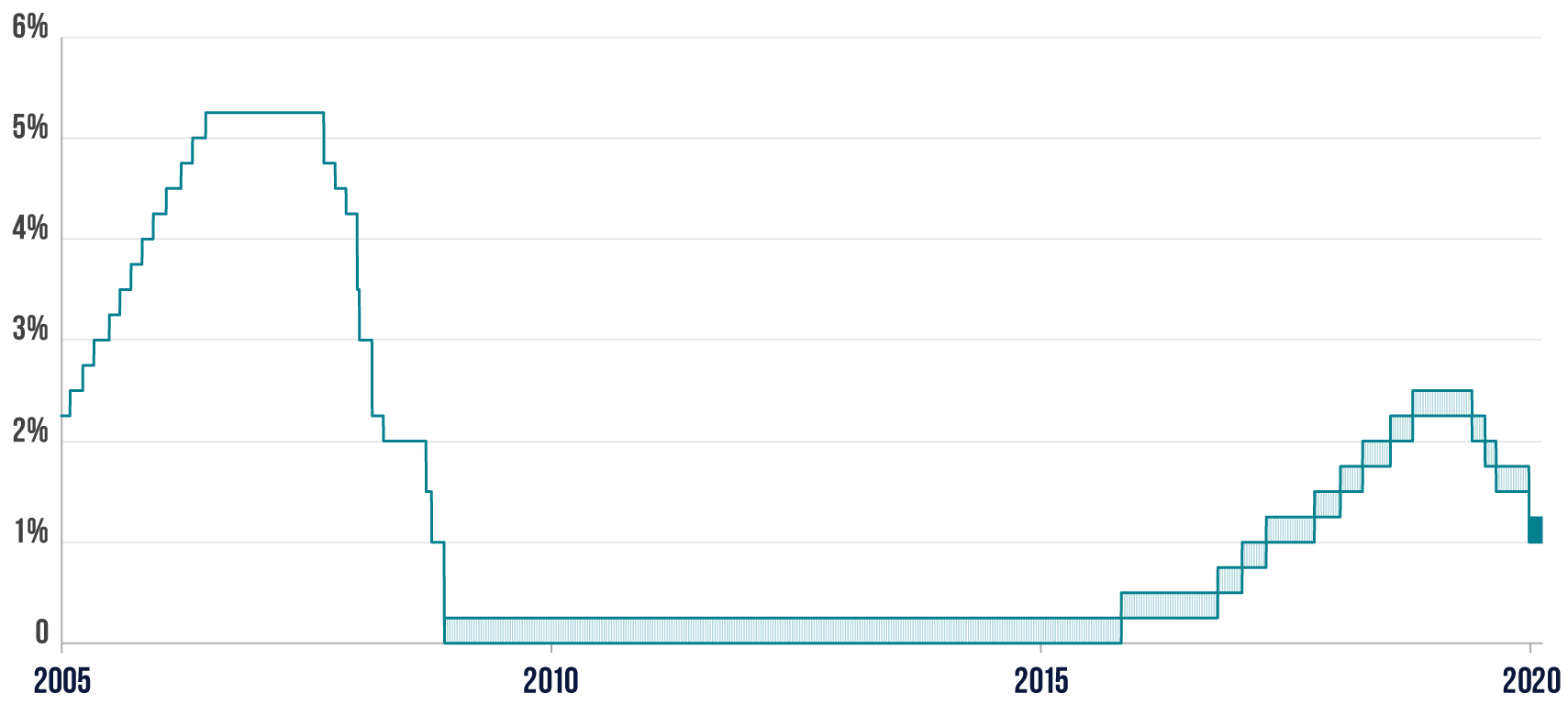

Recent History of Changes to the Federal Funds Rate

*In December 2008, the Fed switched from setting a specific target rate to setting a target range for the federal funds rate.

how the fed adjusts the federal funds rate

The Federal Open Market Committee consists of 12 members: the seven members of the Fed’s board of governors; the New York reserve bank president; and four other reserve bank presidents who rotate through one-year terms. It meets eight times a year to assess the U.S. economy and financial system and to set monetary policy. The committee usually announces any rate changes after these meetings, though in rare cases such as last week it can act outside regular meetings. It did so during the financial crisis and right after the 9/11 terrorist attacks.

The Fed has a range of tools for conducting monetary policy. Until the financial crisis of 2008, the main way the Fed historically affected monetary policy and managed the federal funds rate was through “open market operations,” buying and selling securities on the open market. Since then, it has mostly used its power to set interest rates on reserves that banks keep at Federal Reserve banks, to influence the federal funds rate. The Fed also communicates what it expects future monetary policy to be, or what it calls “forward guidance,” which can alter decisions of businesses and individuals decisions on lending and borrowing.

Banks hold their required reserves as well as excess reserve funds with the Fed. They can borrow and lend this money, called federal funds, to other banks on an overnight basis. One bank can borrow from another to cover temporary reserve shortages, for example. The federal funds rate is the interest rate charged. The Fed sets a target range for this rate, and the market determines the specific rate within that range – called the “effective” federal funds rate – on a given day. Changes to the federal funds rate will alter banks’ cost of borrowing, which influences how much they charge businesses and households that want to borrow. Lowering rates tends to stimulate economic activity. In contrast, if the Fed is worried too much activity could lead to excessive inflation, it can discourage lending by raising rates.

For example, for much of 2007, the federal funds target rate was at 5.25%, but that September the Fed began lowering it amid signs the economy was slowing. By December 2008, it had brought the target near zero. That month it also began setting a target range, instead of a specific target rate. In December 2015, it began raising the rate’s target range as part of a broader effort to return monetary policy to normal after the financial crisis and recession were over. Since August 2019, the Fed has lowered the federal funds target range four times. The March 3 cut brought it to 1.0%-1.25%.

what it means for consumers

Changes to the federal funds rate have a ripple effect on other interest rates in the financial system, though the Congressional Research Service notes that “this relationship is far from being on a one-to-one basis.” In general, consumers may see interest rates go down on business and personal loans, mortgages, credit cards, and savings accounts when the federal funds rate is reduced. The opposite may happen when the federal funds rate is increased.

Next Article Previous Article