Biden Tax Hikes Hurt American Entrepreneurs

KEY TAKEAWAYS

- As part of President Biden’s $3.4 trillion tax hike, he wants to raise taxes on the heart of American entrepreneurship: small businesses and family farms.

- The president’s tax plan would raise the cost of doing business, take a larger chunk if a business is sold, and grab even more if it is passed on when the owner dies.

- Business tax hikes ultimately fall on workers in the form of fewer jobs and lower wages.

As part of President Biden’s $3.4 trillion tax hike, he has proposed raising taxes on the heart of American entrepreneurship: small businesses and family farms. His tax increases on income, capital gains, and death will be borne in part by people who spent their lives building businesses, hiring in their communities, and supporting their local economies. The president says he wants a tax code that “rewards work,” but this is a backward way to go about it.

RAISING THE COST OF DOING BUSINESS

President Biden has offered a plan to raise corporate tax rates from 21% to 28%. The new higher rates would hit any business that files taxes as a C-corp., including more than a million small businesses. The president also would raise taxes on pass-through businesses and family farms that pay taxes at the top marginal rate. These increases would come on top of “base broadeners” enacted in the 2017 Tax Cuts and Jobs Act, amplifying their effect. A business must absorb higher taxes somehow, whether it is by hiring fewer workers, raising prices for consumers, or curtailing plans to grow. This increase in the cost of doing business would be particularly pernicious on the heels of pandemic-related economic shutdowns that devastated small businesses around the country.

TAKING FROM THE NEST EGG

Growing an enterprise requires taking risks with an eye to future gain. For many people who start a business, the potential gain includes eventually selling their business to support their retirement. They may have planned their lives specifically with the expectation that the business will be the bulk of their nest egg. The president’s proposed capital gains tax hike would undermine these plans and one of the incentives for the hard work of entrepreneurship.

A capital gain is the increase in value of an asset – like a business or farm – over time, and this gain is generally taxed when the asset is sold. Biden wants to hike the top federal tax rate on capital gains from 23.8% to 43.4%, which would be would be the highest rate in a century. When combined with state taxes on the gain, it would mean that government could take more than half of a business’s growth in taxes.

imposing a second DEATH TAX

The president also wants to tax unrealized capital gains by eliminating the benefit of the “step-up of basis” provisions of tax law. People who inherit an asset – like a multigenerational small business or family farm – would owe taxes on the appreciation in its value during the former owner’s life. This would be on top of the existing death tax. The value of many of these enterprises is largely tied to illiquid assets, like land, and the tax bill could easily exceed their annual income. The new generation of owners could be forced to sell assets or take on debt, threatening their chances of keeping the business. The president’s proposal does include a vague statement that the new owners would not owe payment until they sell or the business ceases to be family-owned and operated, but it offers no reprieve from the supersized federal tax burden on their success.

Workers Pay the Second Death Tax:

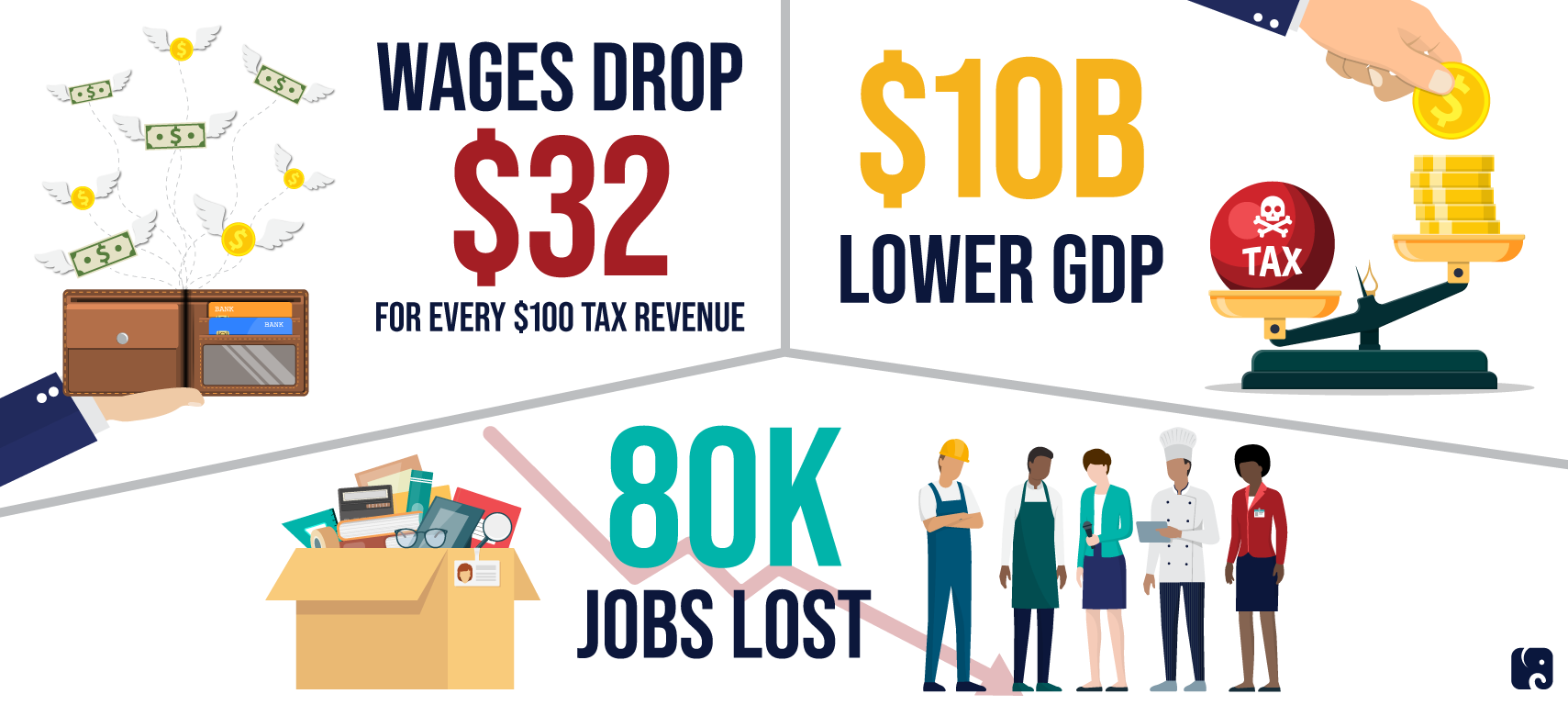

This tax hike does not just affect business owners, it ultimately falls back on workers. An analysis by the consulting firm EY estimates that Biden’s second death tax would kill “80,000 jobs in each of the first ten years; and 100,000 jobs each year thereafter” and that the “burden of the tax is such that nearly one-third of every dollar of revenue raised comes out of the paychecks of US workers.” The analysis also projects an annual $10 billion decrease in GDP as a result of the policy.

Raising taxes on entrepreneurialism drives away the incentive to invest in a local business and, by extension, a local community. It puts additional pressure on small enterprises already struggling against larger competitors. Behind the president’s “fair share” smokescreen, his tax hikes actually promise fewer jobs, lower wages, and more consolidation.

Next Article Previous Article