Biden Breaks Tax Pledge

KEY TAKEAWAYS

- President Biden has repeatedly pledged that he would not raise taxes on any American making less than $400,000 a year, but his agenda would hike taxes on average Americans nationwide.

- Even the liberal Tax Policy Center estimates that 60% of taxpayers would lose money next year under the president’s plan.

- Alongside reversing Republican-enacted tax cuts on job creators and workers, the president’s budget does not prevent individual tax increases across the board.

As a candidate for president, Joe Biden repeatedly pledged that he would not raise taxes on any American making less than $400,000 a year – not “one more penny in taxes, guaranteed, my word on it.” This campaign line was coupled with a commitment to spend trillions of taxpayer dollars without increasing the deficit. When he put pen to paper, it became clear that these parallel promises simply cannot co-exist. The president’s tax-more-spend-more agenda violates his middle class tax pledge.

Biden’s Plan Would Raise Tax Burden Nationwide

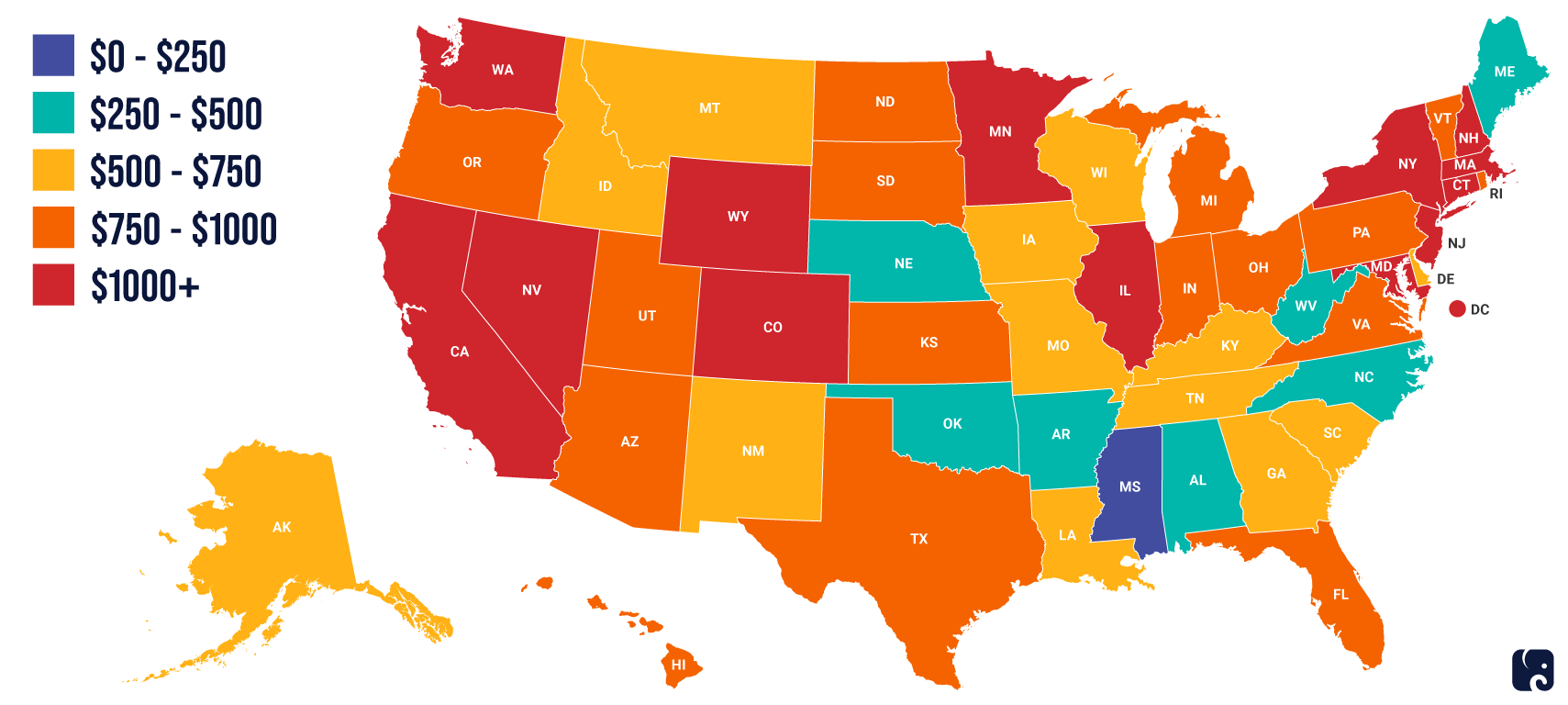

Average Tax Increase in Each State in 2026 Under Biden Plan

Across the board increases

According to an analysis from the Tax Foundation, President Biden’s 10-year plan, as outlined in his fiscal year 2022 budget, would mean higher average taxes nationwide. In some states, the average taxpayer would see increases immediately. In others, the hikes would grow larger over time as various provisions change. After 2025, the average tax burden in every state would be higher by hundreds or thousands of dollars. In New Hampshire, the tax burden of the average tax filer would be $1,072 higher in 2026 than it is today. In Nevada, it would $1,293 higher.

In another analysis from the liberal Tax Policy Center, 60% of taxpayers would lose money in 2022 under the president’s plan. Among families earning $75,000 to $100,000 a year, 75% would be worse off under the Biden plan. By 2031, the organization estimates 79% of all taxpayers will suffer losses – including 95% of people making $75,000 to $100,000.

The president’s “Jobs” and “Families” plans, which are incorporated in his budget, envision monster tax hikes on corporations and small businesses. Workers could bear 50% or more of the burden of these tax increases in the form of lower wages and reduced hours.

Initially, the president’s plan would mitigate these harms with a massive benefit expansion that is unconnected to work or need, but the sky-high cost of these proposals requires that he phase them out, exacerbating the middle class tax increase after 2025.

The president’s budget also declines to maintain the individual tax cuts enacted by Republicans in the Tax Cuts and Jobs Act of 2017. The TCJA reduced individual tax rates, cutting taxes for Americans across income levels, but these provisions must be extended in 2025. Inaction, as the president has proposed, will mean that someone making $94,000 per year will see her marginal tax rate jump from 24% to 28%. By failing to extend these rate cuts, this is another way the president violates his pledge, raising taxes on people earning less than $400,000.

“wealth” tax on the middle class

The president’s proposal to tax capital gains at ordinary income rates would hit some small business owners and family farmers, including those who have never before had an annual income of $400,000 or more, when they try to sell their business to fund their retirement.

His proposal to tax unrealized gains at death would also violate his pledge by imposing potentially massive tax increases on some people whose income is well below $400,000, including people with negative net worth. People who inherit or are given a valuable asset, such as a family home, could be on the hook for a supersized second tax bill that is well beyond what they may be able to afford based on their income or wealth. They may be force to sell it in order to afford inheriting it.

Notably, instead of advocating for these middle-class Americans, Democrats in Congress are fixated on restoring a tax break that disproportionately benefits high-income Americans in high-tax states. They are pushing to allow people to deduct more than $10,000 in state and local taxes on their federal returns. Their scheme would allow the top 1% of earners to increase their after-tax incomes by an average of 2.79%. The bottom 60% of filers would gain less than o.o1% on average.

It’s clear that President Biden’s tax hikes will hit a lot of Americans earning less than $400,000. These higher tax bills for the middle class loom as massive federal spending is contributing to a spike in inflation, raising the cost of living for Americans recovering from the economic ravages of the COVID-19 pandemic. Democrats continue to march forward with their bigger government agenda, hoping Americans don’t understand who will pay the bill.

Next Article Previous Article