The Fed Finally Pivots to Control Inflation

KEY TAKEAWAYS

- As the Fed tries to control soaring inflation, it hiked the target range for the federal funds interest rate by 0.5% and said it will begin trimming its $9 trillion balance sheet on June 1.

- The Fed waited months before taking action to reverse its economic stimulus policy and curb inflation, maintaining that high inflation was temporary and due to pandemic related factors.

- Now that it is catching up and trying to bring inflation down to a sustainable level swiftly, its challenge is to avoid causing a recession.

This week, the Federal Reserve announced new moves to try to tackle inflation. It implemented a 0.5% interest rate hike and will begin reducing its $9 trillion balance sheet on June 1, at first by $47.5 billion per month and then at a monthly pace of $95 billion by September. Fed Chair Jerome Powell said inflation is “much too high” and the Fed is “moving expeditiously” to lower it. Inflation is rising at a pace not seen in 40 years, and the economy shrank in the first quarter of 2022, sparking worries of the combination of rising inflation and a stagnating economy. After waiting months to reverse its policy of monetary stimulus, the Fed now has to move more quickly and try not to cause a recession in the process.

THE FED AND INFLATION

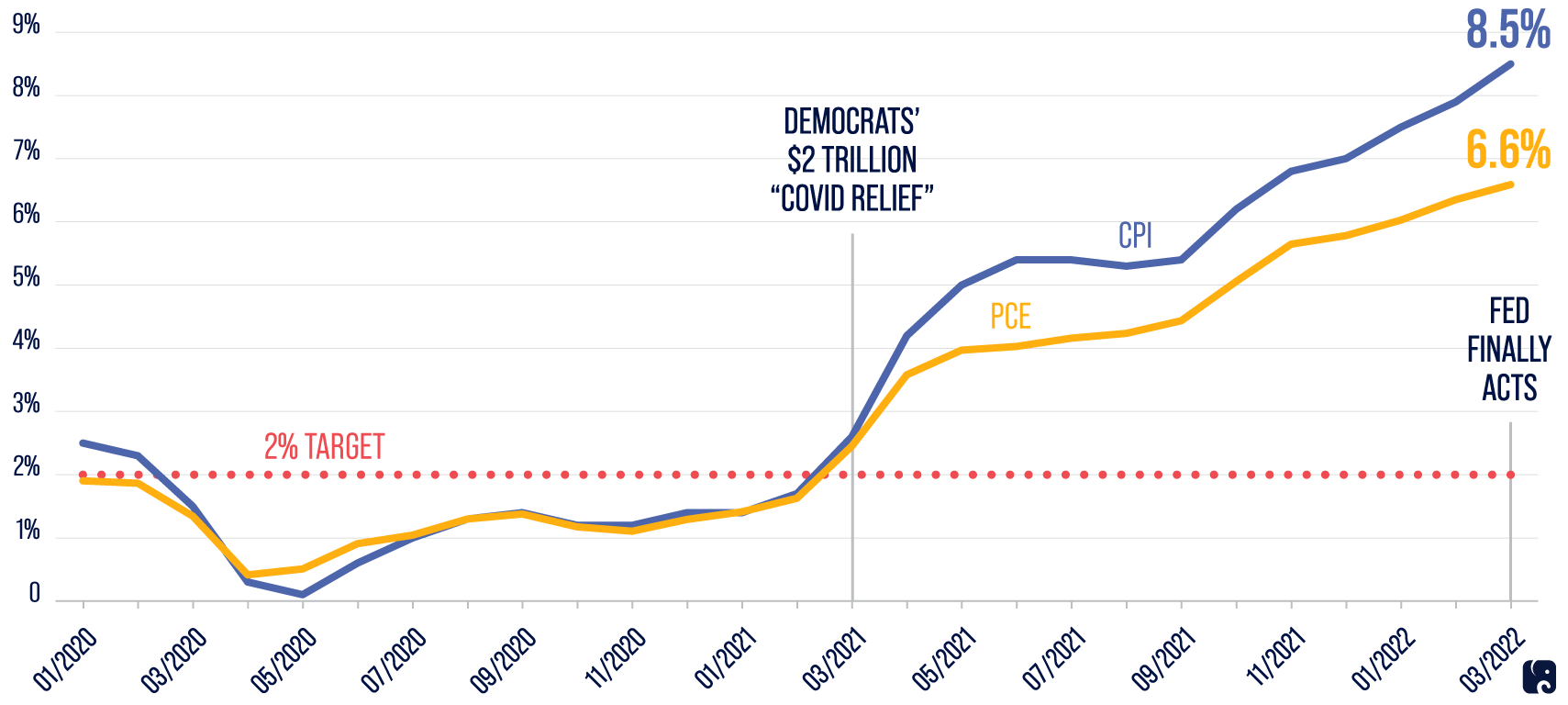

Congress charged the Fed with making monetary policy decisions that promote stable prices and maximum employment. Since 1996, the Fed has used a 2% inflation target, though it didn’t formally set that rate until 2012. It uses the personal consumption expenditures price index, produced by the Commerce Department, as its main inflation gauge, as opposed to the more well-known consumer price index from the Labor Department. The two measures are calculated differently, and PCE tends to be a little lower than CPI, but both measures rose above 2% in March 2021. By then the Fed had already switched, in August 2020, to a new policy of “flexible average inflation targeting.” Because inflation has been low in recent years, the Fed decided to let it run above 2% for an undetermined amount of time before acting to bring it down.

For much of 2021, the Fed and the Biden administration maintained that surging inflation was temporary and primarily due to pandemic related factors like supply chain bottlenecks. Inflation kept soaring above the Fed’s longer-run target of 2%.

The Fed Let Inflation Run High for Months Before Taking Action

In January 2022, Senator Toomey said that the new inflation policy “subordinated the Fed’s price stability mandate to try and maximize employment by allowing inflation to run hot.” He said the new strategy, combined with inflation staying higher than expected, meant the Fed got behind the curve on inflation.

In March, after meeting seven times since inflation topped 2%, the Fed moved squarely into inflation-fighting mode. It announced it was using its primary tool, the target range for the federal funds interest rate, which it increased to between 0.25% and 0.5%.

the fed’s latest actions

At the start of the pandemic, the Fed had slashed the federal funds rate target range to near zero. This week’s 0.5% interest rate hike shows the Fed is working to temper inflation more quickly. It is trying to influence other interest rates and increase the costs of borrowing in a bid to slow down the economy. The federal funds rate is what banks charge each other to borrow money on an overnight basis. It can affect other interest rates that consumers and businesses pay, like personal loans, credit cards, and mortgages, though the effect is not perfectly correlated. More rate hikes are expected this year, and Powell said Fed officials generally think additional 0.5% increases “should be on the table at the next couple of meetings.”

The Fed also voted to reverse its “quantitative easing” policy and trim its balance sheet. Under QE, it was buying large amounts of Treasury and mortgage-backed securities to keep interest rates low. According to a Brookings Institution explanation, when the Fed buys and holds large amounts of these assets, the supply available that investors can purchase goes down, and “private investors who desire to hold these securities will then bid up the prices of the remaining supply.” This results in lower yields on the securities. These “lower Treasury yields are a benchmark” for other interest rates in the economy. When interest rates are lower, borrowing costs less, so consumers and businesses have more incentive to borrow for big purchases and capital investments. Up until November 2021, the Fed was buying as much as $120 billion in securities per month, and since March 2020, the Fed’s balance sheet has ballooned from about $4.2 trillion to nearly $9 trillion, predominantly due to its QE purchases.

In November, the Fed started “tapering,” or phasing out QE. While it bought less of the securities each month, it was still providing economic stimulus until March, when it finally ended the QE purchases. On June 1, the Fed will start reducing the size of its balance sheet by not replacing securities as they mature, at a pace of $47.5 billion per month for the first three months and then by $95 billion per month beginning in September. At that pace, it would reduce its holdings by about $1 trillion over the next year. The Fed last trimmed its balance sheet, modestly, between 2017 and 2019; it has not said yet when it will stop its balance sheet reductions this time.

The goal of these policies is to influence longer-term interest rates elsewhere in the economy, increasing the costs of borrowing and in that way diminish economic activity. Fed officials, however, do not know the precise effect that balance sheet reduction has on the economy. They are trying to tap the brakes on the economy enough to tame inflation, but not so hard that it causes a recession. Economists have different views on whether the Fed can strike the right balance.

Democrats’ Reckless agenda will not help

Last spring, Democrats poured $2 trillion in “COVID-19 relief” into the economy as it was recovering, and inflation has been rising ever since. High inflation is threatening federal budget priorities like funding our national defense, and it is burdening families at the grocery store, gas pump, and everywhere else.

Even the New York Times reported the Democrat’s stimulus could end up having “a checkered legacy.” The Times quoted Jason Furman, who chaired the Obama administration’s Council of Economic Advisers: “I’m worried that we traded a temporary growth gain for permanently higher inflation.”

In the year since they passed their disastrous legislation, Democrats have pushed different versions of another reckless tax and spend spree that would add more inflationary pressure on the economy. They have made excuses on inflation, deflected blame, and tried to convince Americans not to believe the soaring prices they are paying. Now that the Fed is finally starting to act swiftly, the very least congressional Democrats could do is stop trying to pour gasoline on the inflation fire.

Next Article Previous Article