Inflation Weighs Down the Federal Budget

KEY TAKEAWAYS

- The burden of inflation weighs down the U.S. fiscal outlook, but President Biden insists on downplaying the threat.

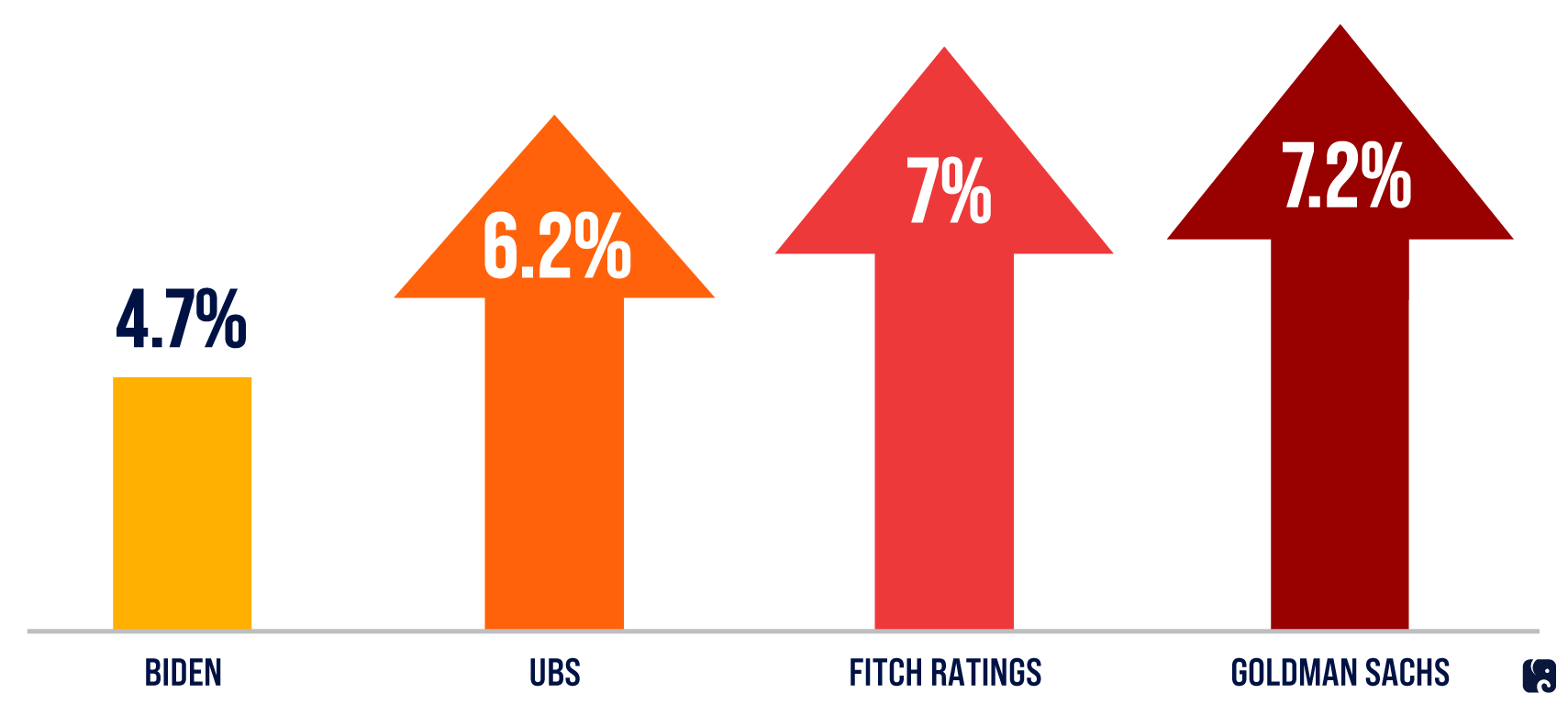

- The president’s new budget assumes average inflation of 4.7% in 2022, but independent experts estimate it will be between 6.2% and 7.2% this year.

- Bidenflation erodes buying power for priorities like national defense, and interest rate hikes – used by the Fed to tame inflation – raise the government’s cost to borrow and hold debt.

Bidenflation – which hit 8.5% in March − pummels the federal budget like it does families’ budgets. It erodes the buying power of the same dollar from one year to the next and leads to higher costs for government debt. The burden of inflation weighs down the U.S. fiscal outlook, but President Biden insists on downplaying the threat.

Biden’s Rosy Inflation Assumption Is Far Below What Experts Predict

The Biden administration foolishly miscalculated the inflation threat last year. The president’s first budget, released shortly after inflation surpassed 4% for the first time since 2008, projected inflation would rise by 2% between the fourth quarter of 2020 and the four quarter of 2021. Instead, the Consumer Price Index rose 6.7% in that time.

Now the administration is viewing the country’s fiscal outlook through rose-colored glasses once again. The president’s budget for fiscal year 2023 assumes average inflation will be 4.7% in 2022, well below independent estimates. Goldman Sachs expects average inflation this year to be 7.2%, while Fitch Ratings estimates a 7% average in 2022. Investment bank UBS recently projected that the CPI would increase by an average of 6.2% for the year. While administration officials admitted that their estimates were out of step with reality, they refuse to concede the basic misunderstanding of supply and demand that has driven their inflationary economic agenda.

Stretching the Budget

As inflation climbs, the federal government must use more tax dollars to buy the same goods and services. For priorities like providing for the national defense, inflation can diminish the benefit of a budget increase, widening the gap between our defense strategy and the resources available to carry it out. Inflation shortchanges the military’s ability to invest in new technologies and expand, equip, and train our forces to respond to aggression.

President Biden’s request for national security spending ignores this effect. While he has proposed a 4% increase over the enacted amount from FY 2022, even his own lowball estimate of inflation would turn that into a net budget cut for the Department of Defense. Other federal priorities – like funding to advance border security, cybersecurity, and critical medical research –would also see their budgets eroded by sky-high inflation.

Higher debt burden

To curtail spiraling inflation, the Federal Reserve has begun to raise interest rates, and it could begin reducing its nearly $9 trillion balance sheet at a “rapid pace” as soon as its next meeting in early May. The Fed was slow to respond to rising inflation. Under its vague new policy of “flexible average inflation targeting,” the Fed had been waiting for inflation to run above its 2% target for an unspecified period before it acts. Now that it is finally doing something, interest rates paid by the government are climbing, and the government’s cost to borrow and to service existing debt will grow. Washington will pay more for new debt issued to cover President Biden’s deficits and for new debt to replace maturing securities from previous borrowing, all at higher market interest rates.

The Congressional Budget Office recently described how its budget projections from February 2021 would have changed had it assumed higher inflation and interest rates were ahead. To complete its analysis, it used data from 2021 and the average of the 10 highest forecasts for inflation and interest rates projected by several dozen private-sector economists. CBO found that “the projected deficit would be larger by $2.3 trillion from 2022 to 2031” compared to the baseline − primarily because of higher net interest costs. Higher deficits, in turn, drive up the debt, further increasing interest costs for taxpayers.

In FY 2021, before any interest rate hikes, taxpayers shelled out $352 billion in interest payments on the nation’s debt, and the principal kept climbing because of deficit spending. The federal debt is now more than $30 trillion, and President Biden has proposed borrowing another $14.4 trillion over the next decade. While the president’s budget assumes inflation will moderate quickly, and interest rates with it, wishes are not the same as prudent policy.

New debt will be more expensive than the pre-Bidenflation baseline, and paying for it will mean less money is available for things like strengthening our national security, supporting vulnerable Americans, and responding to new crises. Democrats keep denying responsibility and trying to shift blame, but it is time for them to own up to the fact that their inflation crisis will have a lasting effect on the federal budget.

Next Article Previous Article