The Economy Can't Handle A Reckless Tax and Spend Spree

KEY TAKEAWAYS

- The U.S. economy shrank at a 0.9% annual rate from April to June, the second consecutive quarter that gross domestic product declined.

- Soaring prices are hitting families hard, and consumer sentiment and small business optimism have plummeted.

- Democrats’ latest reckless tax and spending spree would make things worse, dealing a harsh blow to the economy.

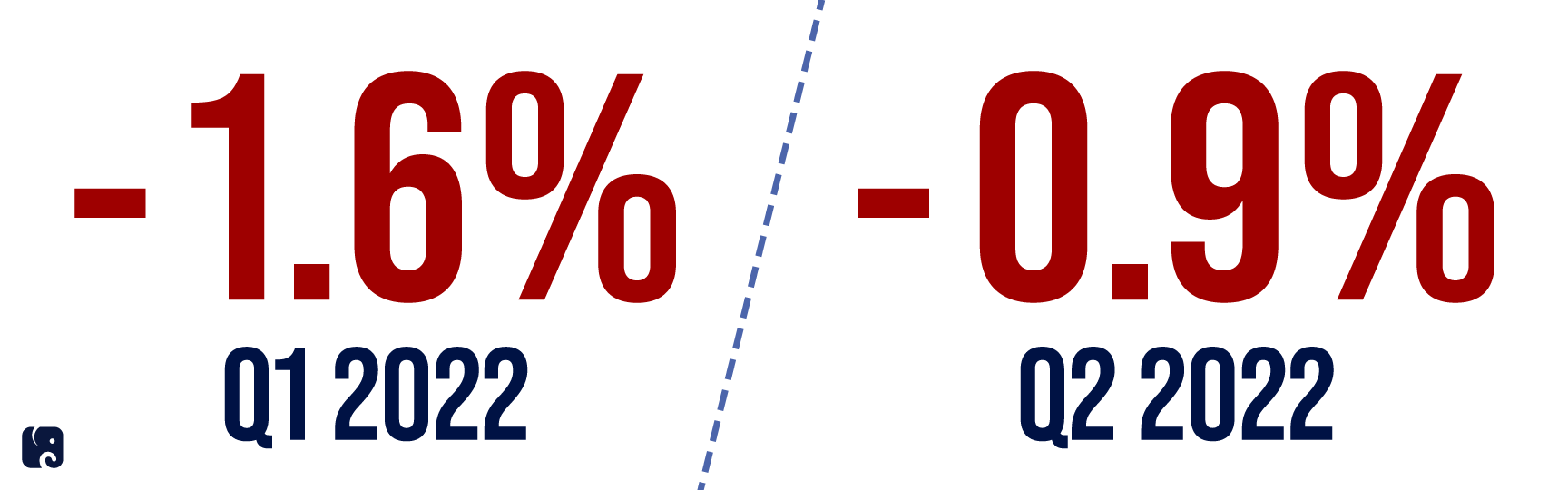

From April to June, the economy shrank by 0.9% on an annual basis, after it already declined by 1.6% in the first quarter. Two consecutive quarters of negative growth in GDP is a commonly used marker for a recession. The Commerce Department reported that consumer spending growth slowed from the first quarter, and private business investment decreased, driven by a drop in inventory investment. Historically high inflation is weighing on businesses and consumers, but Democrats aren’t heeding the warning signs in the economy. The Biden administration is downplaying the bad economic news, and Democrats in Congress are marching forward with their reckless tax and spending spree – the opposite of what the economy needs.

Economy Shrinks in Back-to-Back Quarters

an economy under pressure

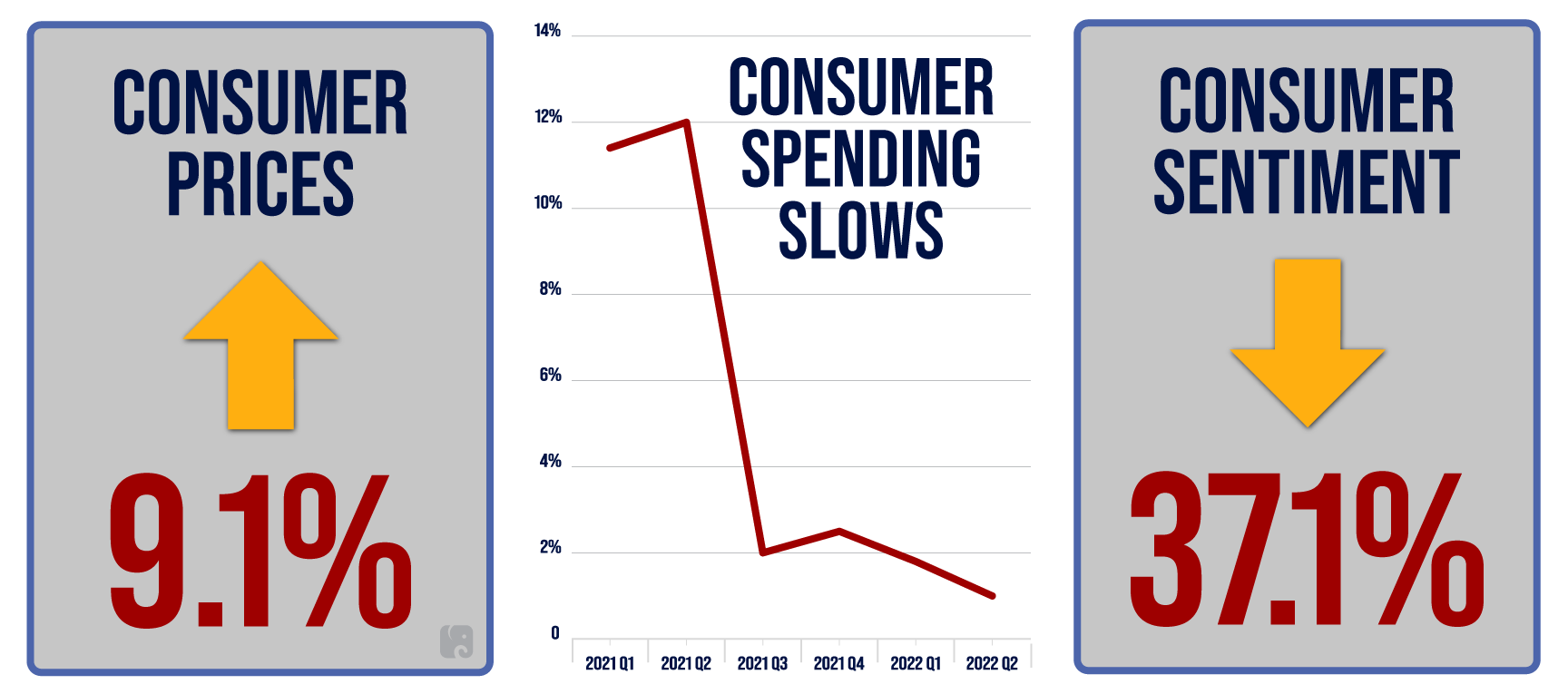

It’s hard to see how the administration can justify its optimism. Since President Biden took office, American consumers have seen prices surge, with costs up 9.1% in June from one year earlier, the fastest pace since 1981. The Commerce Department reported that consumer spending slowed to an annual rate of 1% during the second quarter, down from annual rates of 1.8% and 2.5% in the prior two quarters. People spent less on goods but more on services like eating out.

Consumers’ attitudes toward the economy are getting worse because of historic inflation as well. According to the University of Michigan, consumer sentiment was down 37% this month from one year ago. The share of people who said that inflation is lowering their standard of living “continued its rise to 49%, matching the all-time high reached during the Great Recession.” The Conference Board released its own survey, showing that in June consumer confidence dropped for the third straight month. People’s views on current conditions and their expectations for the near term both declined.

Runaway Inflation Weighs on Consumers

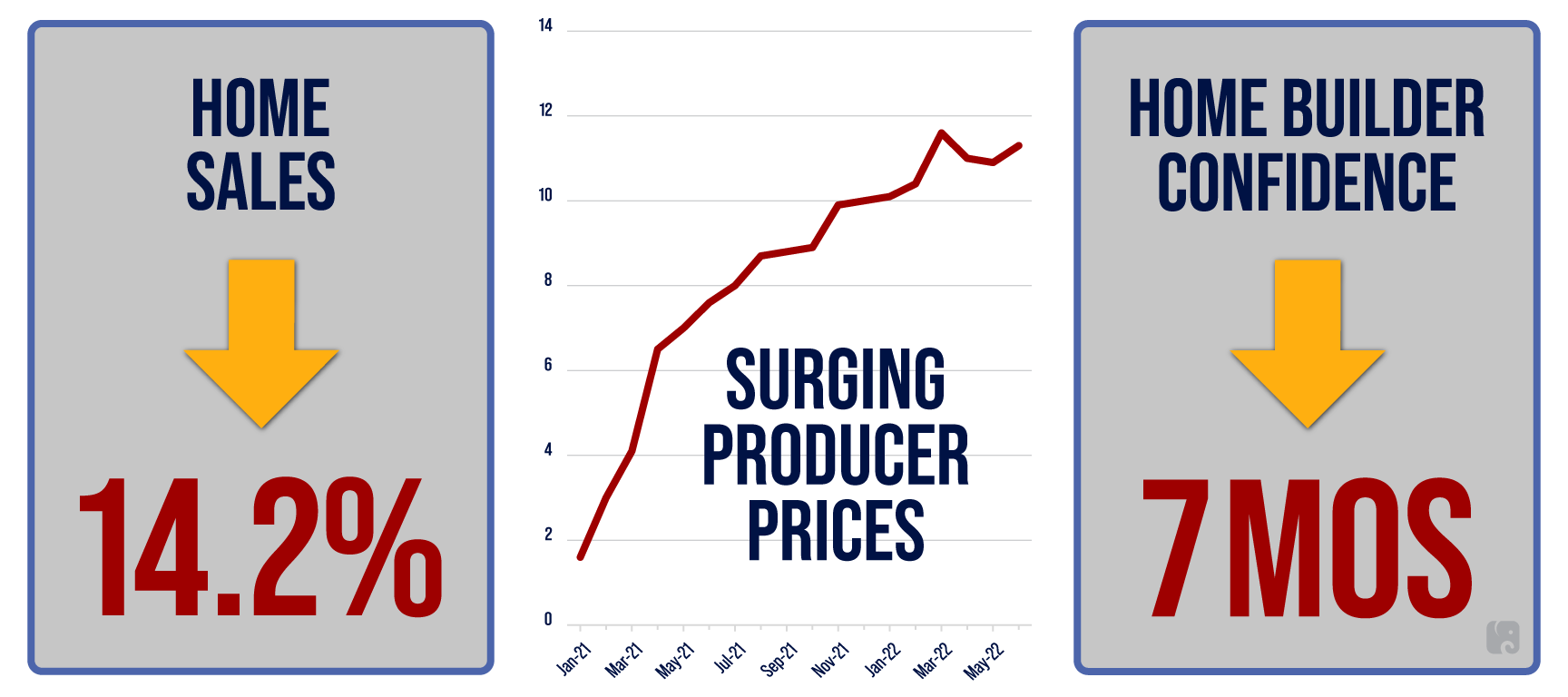

In another sign of trouble in the economy, producer prices are surging. The “final demand” measure increased at an 11.3% rate in June from a year earlier, the seventh month of double-digit increases. Prices have climbed quickly for goods in earlier stages of production, such as diesel, natural gas, grains, and materials that are essential for construction projects. This shows the pressure businesses are feeling and suggests higher consumer prices down the line. Businesses also can’t find enough workers, with more than 11 million jobs unfilled across the economy. Some businesses have increased wages to attract workers, which adds to their costs and can cause inflation.

According to the National Federation of Independent Business, small business optimism has plummeted. NFIB found in June that about one-third of small business owners said inflation was their biggest problem, and their expectations that things will get better has declined every month this year. Only 3% of these job creators said the next three months would be a good time to expand their business, down from 28% before the pandemic. In the Federal Reserve’s “Beige Book,” businesses and other contacts in some areas reported “moderated” consumer spending due to higher prices, ongoing worker shortages and supply chain disruptions, and weaker demand for housing. Places like Chicago, Cleveland, Philadelphia, and New York reported flat or modestly declining manufacturing activity.

The Fed is urgently trying to control runaway inflation, and this week it increased the federal funds interest rate target by another 0.75%, its fourth interest rate hike this year. Discussing this rate hike, Fed chair Jerome Powell said that “recent indicators of spending and production have softened,” and he noted the slowdown in consumer spending and weaker housing market. The Fed’s rate hikes send other interest rates in the economy higher, raising the cost of borrowing.

Inflation Takes a Toll

The housing market also is showing signs of a slowdown. Americans must contend with surging prices whether they rent or are trying to buy a home. According to the National Association of Realtors, the median sales price for existing homes hit $416,000, up more than 13% from a year ago. Higher prices and rising interest rates are making homeownership unaffordable for some buyers. In June, home sales decreased for the fifth consecutive month, falling 14% from the level of June 2021. The Mortgage Bankers Association reports that mortgage applications have declined for four weeks. Builder confidence has decreased each month in 2022, according to the National Association of Home Builders and Wells Fargo, and the number of new housing construction projects has decreased for the past two months.

tax and spend spree would infict more harm

Reckless spending and harmful tax hikes are bad ideas, and Democrats have picked the worst time to impose them on the economy. Democrats’ spending spree in March 2021 fed the flames of inflation by dumping $2 trillion into the economy. Larry Summers, President Clinton’s treasury secretary, recently summarized the mistake Democrats made: “Printing money and distributing it well ahead of the supply of goods is a prescription for inflation, and that’s what we did.” In February 2021, he warned that Democrats’ stimulus bill could spur historic inflation. Now Democrats plan to hit American workers and businesses with billions of dollars in higher taxes. Businesses are facing strong headwinds, and American families are seeing their paychecks eroded by the inflation that Democrats already voted for. They don’t need more of Democrats’ failed policies.

Next Article Previous Article