Inflation Hits Home

KEY TAKEAWAYS

- Americans are being squeezed by rising rents, and buying a home is getting more expensive with high prices, low supply, and rising interest rates.

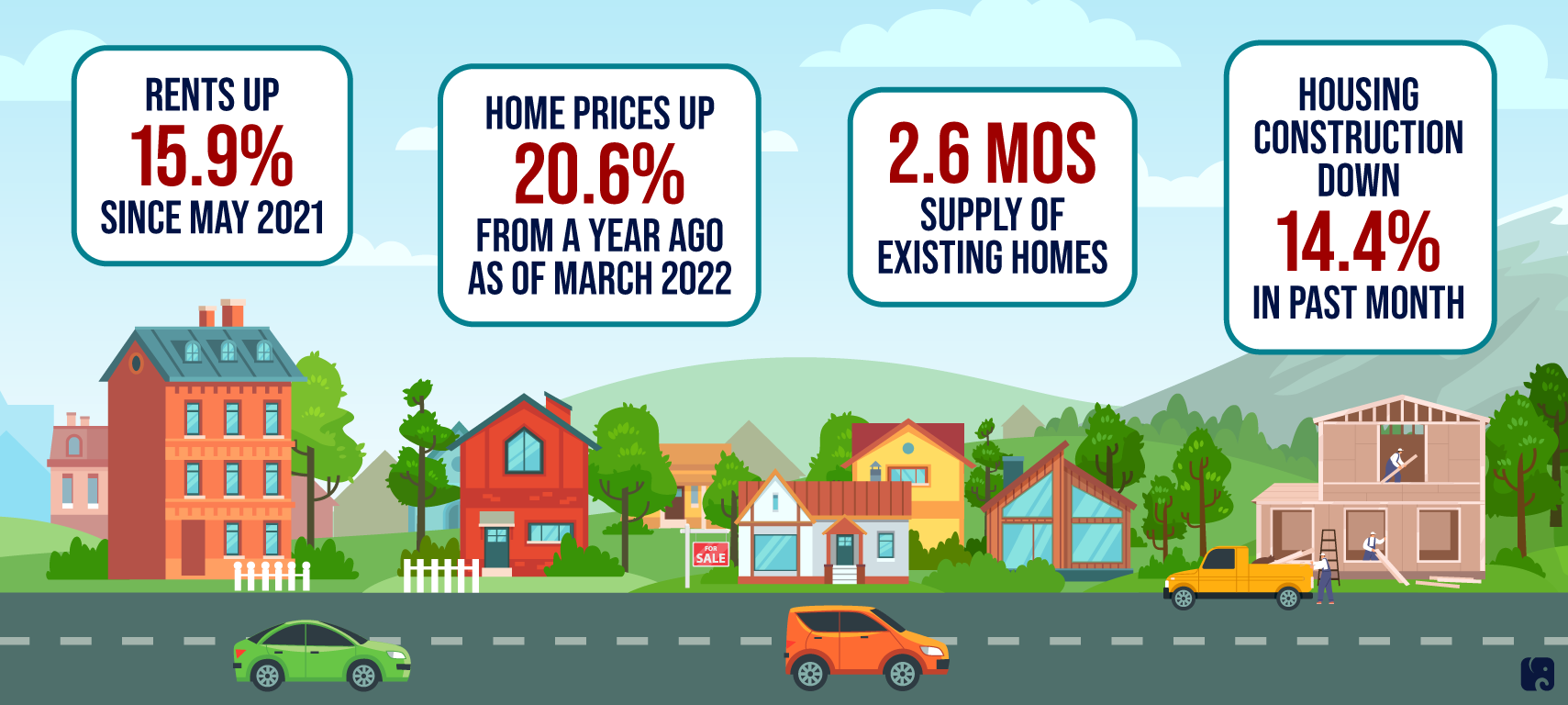

- The typical asking price for a place to rent jumped nearly 16% in May from a year ago. As of March, home prices were up more than 20% from one year earlier.

- Democrats’ flawed “solutions” to surging inflation in housing is to spend massive amounts of taxpayer money and expand the federal government.

Americans looking for an apartment to rent or a home to buy are being squeezed by higher prices, as inflation has not spared the housing market. The typical asking rental price was up by almost 16% in May from one year earlier, according to Zillow. People trying to buy homes have it no easier, with low inventory and rapidly rising mortgage rates. Average house prices were up 20.6% in March from a year ago, according to the latest S&P CoreLogic Case-Shiller Index. Inflation has surged since Democrats poured $2 trillion in stimulus into the economy, and Americans are paying more for essentials like gas, groceries, and home energy. Congressional Democrats’ reckless tax and spending spree uses the same flawed playbook: massive federal spending and bigger government. These “solutions” would not alleviate housing inflation.

It’s an Expensive Time to Rent or Buy

paying more to rent or buy a home

Housing is a major expense for most Americans, making rising prices especially painful. Zillow reported that the typical asking price for a rental in the U.S. hit $1,979 in May, a 15.9% increase from one year ago and a 1.2% jump from April. Cities like Miami, Phoenix, Orlando, and Knoxville, Tennessee, saw prices go up by even more in the past year.

The Department of Labor reported that rents were up 5.2% in May from a year ago, but its consumer price index reflects rates in current leases, only some of which were renewed recently. The Zillow figure represents what someone signing a new lease or renewing their lease could expect to pay. As more leases are renewed at higher rates, rents will continue to rise in the CPI data.

People looking for more space or to avoid rising rents may be trying to buy a home, but they also face soaring costs. Prices for single-family homes were up 20.6% in March from one year earlier, a continuation of the recent surge in the wake of the pandemic. While mortgage rates are still low by historical standards, they have increased rapidly: the rate for a 30-year fixed-rate mortgage jumped from just below 3% in November 2021 to nearly 6% in June. At the current median sales price of about $408,000, and assuming a 20% down payment, the difference between a 3% and 6% rate amounts to $580 more each month in mortgage payments.

After months of stimulating the economy, partly by buying billions of dollars in mortgage-backed securities and keeping interest rates near zero, the Fed pivoted to fight inflation. It has increased its main interest rate three times and said more rate hikes are likely this year. This influences other interest rates in the economy, such as those for car loans, credit cards, home equity lines of credit, and mortgages. Higher rates may cool the housing market, but they also can force some buyers to the sidelines, at least temporarily. Current homeowners may delay selling their homes. Renters who can’t afford to buy at higher rates may continue to rent longer, which could put upward pressure on prices. In turn, rising rents can make it more difficult for renters to save for a down payment.

One fundamental problem in the housing market is that there are too few homes available for the number of people who want them, especially “starter homes.” The Commerce Department recently reported that the number of new residential construction projects started in May fell by 14.4% from April, and building permits for new construction dropped by 7%. The National Association of Realtors has reported that the supply of existing homes on the market at the end of May was enough to meet the demand for just 2.6 months at the current sales pace. This remains below the six months level the organization says historically is associated with normal price gains. The supply of new homes for sale in May amounted to a 7.7 month supply, according to the Commerce Department. A low housing supply means renters who cannot find a home to buy may have to stay put, pressuring rental prices.

The Congressional Research Service explained in a February report that housing inventories before the pandemic were “relatively low compared to levels in the late 1990s and early 2000s.” Construction costs have also soared. Pandemic-related factors, like people wanting more space and the Fed’s monetary policy decisions to stimulate the economy, have further encouraged demand in the housing market.

democrats’ Flawed “solutions”

Experts warned that Democrats’ “COVID stimulus” bill last year could set off inflationary pressures, but they went ahead anyway. Inflation surged after that, recently hitting a 40-year high of 8.6%, far above the Fed’s 2% target level. Democrats’ partisan stimulus bill injected massive amounts of money into the economy, and it included billions in additional money for federal housing programs. This included more than $21 billion for rental assistance, on top of what Congress provided on a bipartisan basis in a prior pandemic relief laws, as well as billions of dollars across programs like a homeowner assistance fund and housing vouchers.

Then Democrats tried to barrel ahead with their reckless tax and spending spree, which they claimed would tackle inflation. Though their partisan plan has been repackaged in various iterations, they have proposed spending more than $300 billion dollars for new and current housing programs, an amount several times the size of the discretionary budget for the Department of Housing and Urban Development. This included more money for rental and down payment subsidies, such as $10 billion for a new program that would give $20,000 or more to “first-time,” “first-generation” homebuyers. Critics have said the program would not actually be targeted to these people or to people with low incomes.

Democrats have also proposed $80 billion for public housing, including a $40 billion “Schu-mark” for New York’s public housing authority. CRS notes that “demand-side subsidies can contribute to home price pressures,” even if the intent was to help people afford housing. Democrats’ solution of billions of dollars in subsidies risks further driving up demand for housing at a time when there is limited supply, putting even more pressure on prices. Even Vox criticized Democrats’ housing inflation plans, saying, “if you pursue demand-side policies when you are facing a massive supply shortage, you end up increasing prices, not decreasing them.”

Americans are trying to afford necessities like gas and food, and rising housing costs are only adding to their headaches. The policies coming from Democrats in Washington are more of the same, giving Americans no reason to be optimistic that things will get better soon.

Next Article Previous Article