Status of Major Federal Trust Funds

KEY TAKEAWAYS

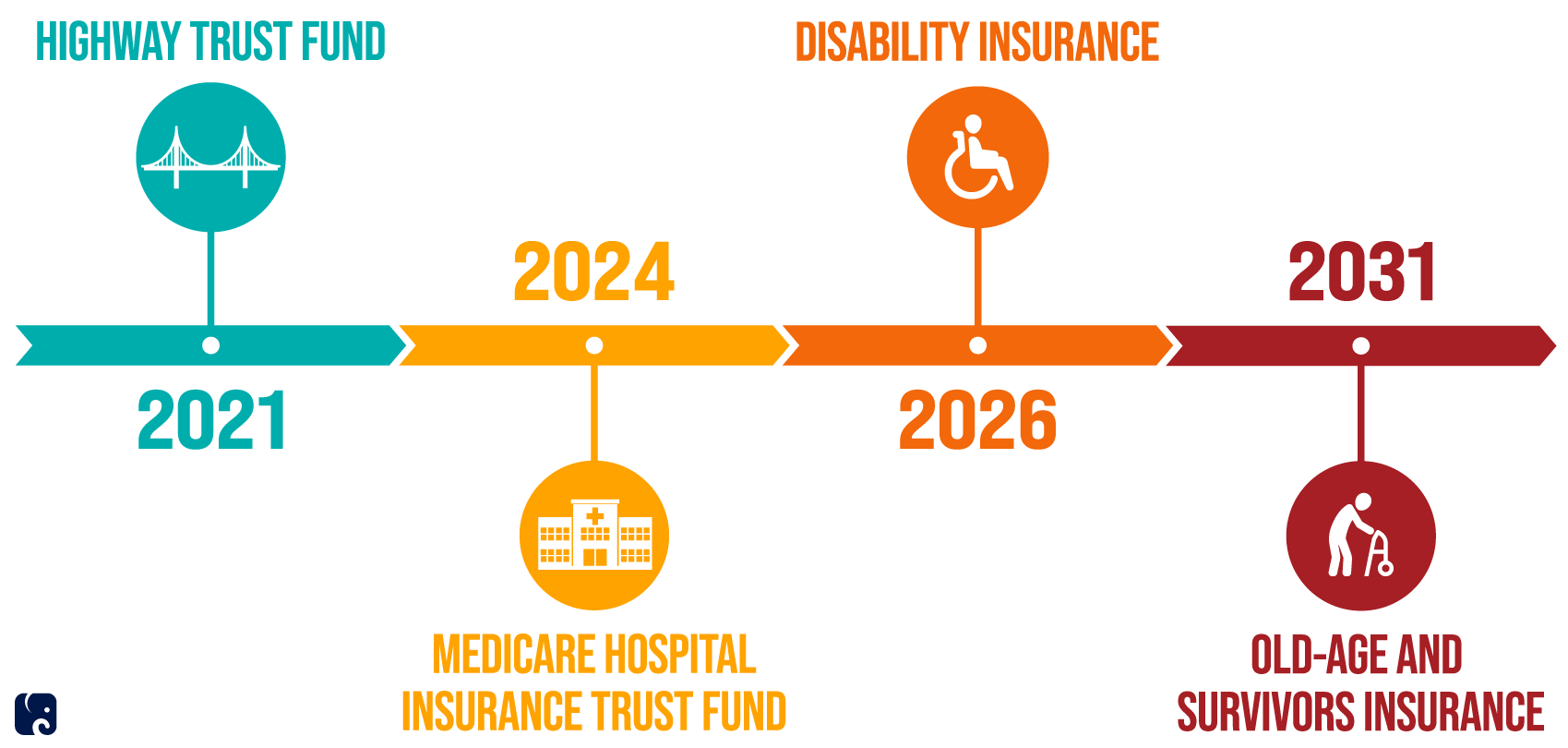

- The federal trust funds that pay for transportation projects, seniors’ health care, and retirement benefits all are expected to run short of funds in the near future.

- The funds have longstanding structural problems with their spending and revenue that pose risks to the programs that they support.

- The coronavirus pandemic and the drop in economic activity it caused have worsened the trust funds’ finances and may accelerate when they run out of money.

The federal trust funds that provide health and retirement benefits for seniors and help pay for highway and transit projects are on a path to insolvency. Without policy changes, they all will exhaust their cash balance, which will hurt the people and projects the trust funds support. Structural imbalances in the funds were well known for decades before the coronavirus and had already put these funds on an unsustainable course. The sudden decline in U.S. economic activity this year due to the pandemic is just compounding the problems.

Insolvency Looms for Major Trust Funds

medicare trust funds

The Medicare program provides health insurance for Americans aged 65 and older, as well as benefits for younger people with certain disabilities. In 2019, the program covered 61.2 million people. Medicare has two separate trust funds: Hospital Insurance and Supplemental Medical Insurance. The HI trust fund monitors revenues and payments for Medicare Part A services like hospital stays, skilled nursing facilities, some home health visits, and hospice care. The SMI trust fund monitors revenues and payments for two accounts: Part B services, which include physician visits, outpatient services, preventive services, and some home health visits; and Part D, which includes prescription drug benefits. Costs for Part C, the Medicare Advantage program, are paid from the HI and SMI trust funds on a proportional basis.

Every year the Medicare trustees warn of the funds’ fiscal troubles. Medicare Part A is financed by a 2.9% hospital insurance payroll tax that is split between employers and employees. Last year, 181.9 million people paid this payroll tax. The Affordable Care Act mandated an additional 0.9% payroll tax for single filers earning more than $200,000 and couples above $250,000. The trust fund also earns interest on its reserves, which are invested in U.S. government securities.

In the long term, HI trust fund spending is projected to grow rapidly as the remainder of the baby-boom generation reaches eligibility and health care costs continue to rise. The decline in the number of workers per Medicare enrollee also will erode the program’s finances. To keep the HI trust fund solvent for the next 75 years, the Medicare Trustees in charge of the program estimate the standard 2.9% payroll tax would need to rise to 3.66%.

The trustees released a report on the program’s finances in April, but they did not account for the pandemic’s impact on Medicare’s finances. Though the economy has started recovering and created more than 9 million jobs since May, about 22 million jobs were lost between February and April. Fewer people working causes a decline in payroll tax revenues, which Medicare relies on. Even without accounting for the pandemic, the trustees projected the HI trust fund will no longer be able to fully pay for its obligations by 2026. Once the fund becomes insolvent, the trustees expect it will have sufficient income to provide 90% of planned benefits. The SMI trust funds’ two accounts receive some revenue from taxes and premiums, but most of the fund’s income comes from automatic transfers from general tax revenue − $268.2 billion last year. While the SMI trust fund cannot become insolvent due to its funding structure, the rapid growth in its costs, which greatly exceed revenue from premiums and other funding sources, will continue to burden taxpayers and beneficiaries.

Prior to the COVID-19 pandemic, the Medicare trust funds were already on an unsustainable path with spending growing faster than revenue. On September 2, the Congressional Budget Office released an estimate that the HI trust fund will be exhausted in fiscal year 2024, which is two years earlier than the agency estimated in March.

social security trust fund

The Social Security program was established in 1935 to help Americans pay their bills in old age. Today it also provides income for disabled people and the survivors of a worker who dies while paying into the program. The program is primarily funded through payroll taxes of 6.2% on the employee and 6.2% on the employer. The program taxes only the first $137,700 of wages. Self-employed workers pay 12.4%. At the end of calendar year 2019, approximately 64 million people received benefits from Social Security, with 178 million workers paying payroll taxes to fund the program. Any money not used for current benefits is held in two Social Security trust funds: Old-Age and Survivors Insurance; and Disability Insurance.

The same demographic shifts working against the Medicare trust funds also are causing financial shortfalls for Social Security: the retirements of members of the baby-boom generation and lower birth rates in succeeding generations. There is now a smaller workforce paying taxes to support more people getting benefits. According the Social Security Board of Trustees’ annual report, the Social Security trust funds together face depletion in 2035, the same year as the trustees projected in last year’s report. The trustees have repeatedly warned of insolvency and called for changes to ensure future retirees get benefits.

The trustees estimate the OASI trust fund will reach insolvency in 2034, the same year they projected last year. Trustees expect the fund will only be able to provide approximately 76% of scheduled benefits when it reaches insolvency. The 2020 trustees report does not account for the COVID-19 pandemic, which almost certainly will affect the sustainability of the trust fund. As with Medicare, high unemployment driven by the pandemic reduces payroll taxes that fund Social Security.

The much smaller DI trust fund is projected to be depleted in 2065, which is 13 years later than last year’s estimate of 2052. This is because of a decline in people receiving and applying for the benefits and better control of fraud and abuse in the system. In 2019, there were 9.9 million people receiving DI benefits. Trustees expect the fund will be able to pay 92% of scheduled benefits when it reaches insolvency.

According to CBO’s updated estimate, which accounts for the coronavirus pandemic, the OASI trust fund will become insolvent in 2031. CBO now expects the DI trust fund to be exhausted in 2026, sooner than it previously estimated, due to an expected reduction in payroll tax revenues and increased spending on benefits. Once the Social Security trust funds’ assets have been used up, current law requires the program to reduce benefits to match its income. Unless Congress enacts reforms to the system, extensive cuts to benefits, regardless of beneficiaries’ age or need, will result.

highway trust fund

The Highway Trust Fund is the main source of federal aid to states and local agencies for their highway and public transportation construction and repair. Most HTF revenue comes from federal excise taxes on motor fuel. The excise tax on gasoline is a fixed rate of 18.3 cents per gallon; it was last raised in 1993. Gas tax revenue is expected to decline as people drive more fuel-efficient and electric vehicles. Other HTF revenue comes from a retail sales tax on heavy highway vehicles such as trucks and trailers, as well as an excise tax on heavy vehicle tires and an annual use tax on heavy vehicles. The authorization for the HTF programs and the trust fund’s ability to spend money expire September 30. In July 2019, the Senate Environment and Public Works Committee unanimously passed its part of a reauthorization bill for highway programs. A comprehensive reauthorization also would include provisions under the jurisdictions of the Senate Banking, Commerce, and Finance Committees. Meanwhile, the House passed a partisan bill this past July. By the end of September, Congress will need to pass a comprehensive reauthorization law or an extension of the programs.

For years, the HTF has spent more than it collects in revenue − in fiscal year 2019, it collected $44.5 billion in revenues and spent $56.1 billion. These annual deficits reduce the fund’s cash balance and push it closer to a shortfall. Congress has kept the fund’s balance positive with periodic transfers, mainly from the general fund, which total $143.6 billion since 2008. The Department of Transportation relies on the fund having enough money so it can reimburse states and transit agencies right away for the federal government’s share of project costs. The HTF cannot borrow to mitigate a shortfall. If there were a shortfall, DOT might slow or limit its payments or take other steps to manage the trust fund’s cash.

The coronavirus and resulting economic downturn make matters worse for the HTF. When states and cities issued stay-at-home orders to reduce the spread of the virus, driving and gas consumption fell. DOT reported that motor vehicle travel was down 40% in April from the year before. In May, CBO said that the pandemic-induced decrease in driving would reduce HTF revenues, though spending from the trust fund could also slow if states temporarily stop transportation projects. Some states have delayed or called off planned projects due to losses in state fuel tax and toll revenues. Others have taken advantage of lighter traffic to expedite projects.

Traffic volumes are recovering, but are still well below last year’s level. By July net HTF revenues had begun to recover after several months of declines. Spending from the trust fund’s highway account in July was only a little less than the average spending for July 2018 and 2019.

The economic recovery, employment trends, and the course of the virus will influence how the Highway Trust Fund’s finances rebound, but its cash shortfall still looms. CBO now estimates that both the highway account and transit account will be exhausted in fiscal year 2021.

Next Article Previous Article