Status of Social Security

KEY TAKEAWAYS

- The 2019 report by the Social Security trustees says the program faces long-term funding shortfalls and the trust funds will be depleted by 2035.

- Demographic challenges to the program include a large number of baby boomers collecting benefits while subsequent generations with lower birth rates are adding fewer workers to the pool of contributors.

- The last large-scale reforms to Social Security were in 1983, just prior to the program’s predicted insolvency. The trustees say that new reforms are needed “sooner rather than later.”

The Social Security trust funds face depletion in 2035, according to the Social Security Board of Trustees’ annual report. The shortfall is driven by changing demographics of the U.S. population, including lower birth rates and longer life spans. This has led to a decline in the number of payroll-tax paying workers per Social Security beneficiary.

The trustees repeated their previous calls for action to address the shortfalls so that future retirees receive benefits. The report comes as no surprise, as each year the trustees have highlighted the need for targeted reforms “sooner rather than later” to allow beneficiaries and workers time to adjust to the changes.

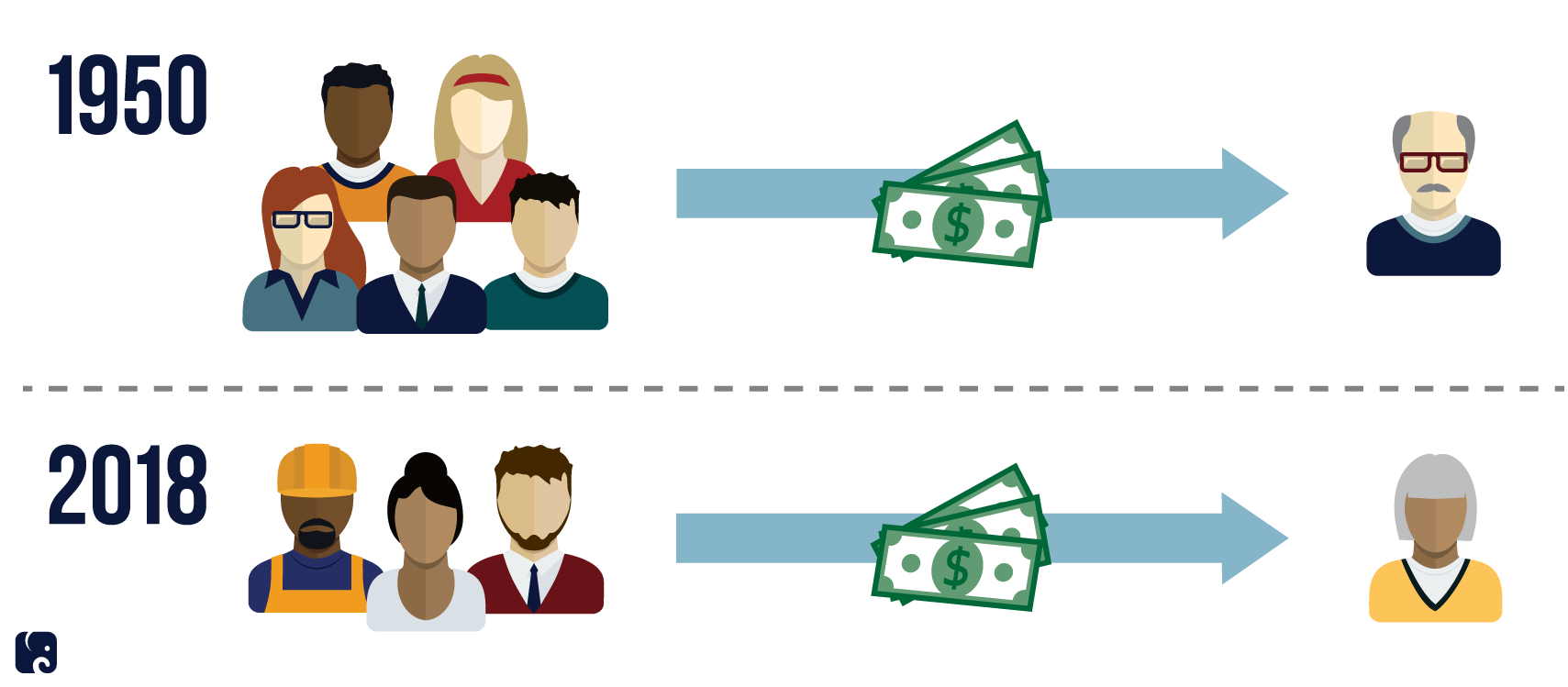

Worker to Beneficiary Ratio

how the program works

The Social Security program began in the 1930s to provide retirement income for older Americans, disability insurance, survivors’ benefits, and health insurance. Rather than serving as a “piggy bank” for saving, Social Security is more of a pay-as-you-go system in which current workers are taxed a portion of their earnings to pay for the benefits of people who are collecting from the program. In 2018, 63 million people received Social Security payments, and the trustees estimate that 176 million people were paying into the program through payroll taxes on their earnings. Any excess money that is collected but not yet needed for benefits is held in trust funds: one for the Old-Age Survivors Insurance program and one for the Disability Insurance program.

The amount of a workers’ retirement benefits is calculated based on work and earnings history and is adjusted based on the age at which a worker retires. People can increase their monthly Social Security benefits by delaying the date they begin collecting. Workers can collect reduced Social Security benefits when they turn 62. For people born in 1960 and later, the full retirement age is 67.

Current status of the funds

The trustees estimate that, combined, the OASI Trust Fund and the DI Trust Fund will be exhausted in 2035, one year later than last year’s report predicted. While the Social Security OASI Trust Fund is projected to be exhausted in 2034, actuaries expect the disability fund to remain solvent until 2052, or 20 years longer than previously expected. The trustees attribute this change to economic improvements and the Social Security Administration’s increased attention to fraud and abuse in the system, which have caused disability applications to decline. Disability applications have been falling since 2010 as the economy has improved. When the DI trust fund is depleted, the income taxes collected on some Social Security Benefits will be able to pay out only 91 percent of the promised disability benefit.

In contrast, the OASI program is still struggling in the face of demographic changes. The large number of Americans in the baby-boom generation have been retiring and drawing benefits. They have been replaced in the workforce by a smaller population, which means the number of workers contributing to the program is declining as the number of people collecting benefits is increasing. For example, in 1950, there were 5.1 workers per beneficiary; in 2018, there were 2.8 workers per beneficiary.

Social Security’s benefit costs have exceeded its non-interest income since 2010. This requires some benefit payments to be financed by interest earned by U.S. Treasury securities held by the trust funds. Beginning in 2020, Social Security’s costs are projected to rise above its total income – payroll taxes, income taxes on some Social Security benefits, and interest from trust fund assets – and Social Security will begin redeeming some of its Treasury securities. The rest of the federal government will have to honor these redemptions by paying money from the General Fund.

The redemptions will continue until the trust funds are depleted of all assets. At that point, current law requires benefits to be cut to whatever level is necessary for benefit payments to match the program’s income. The trustees estimate that, unless reforms are made to the system, this income will only be sufficient to provide roughly 77 percent of promised retirement benefits. There will be an across-the-board cut to benefits regardless of people’s age, income, or degree of need.

reforming Social security

The trustees have continually sounded alarms on the solvency of the trust funds. This year, the trustees note that “taking action sooner rather than later will permit consideration of a broader range of solutions and provide more time to phase in changes so that the public has adequate time to prepare.”

Proposed reforms to ensure the program remains solvent include increasing the retirement age, adjusting the benefit formula for wealthier beneficiaries, using a more accurate measure of inflation in determining cost-of-living adjustments, and increasing payroll taxes on higher earners. The last time major reforms were made to the program was in 1983, just months before it was expected to become insolvent. To ensure that did not happen, Congress opted to gradually increase the full retirement age to 67 and hastened a payroll tax increase. Insolvency was effectively stalled by several decades, and the program began to run a surplus.

The trustees expect that by addressing the funding problems soon, reforms could be appropriately targeted and phased in gradually rather than applying drastic, across-the-board cuts. This would allow workers paying in and people receiving benefits time to adjust to the changes.

Next Article Previous Article