Coronavirus and the Oil Industry

KEY TAKEAWAYS

- As people stopped commuting to work and taking leisure trips due to concerns about spreading the coronavirus, gasoline consumption plummeted.

- The decline in worldwide economic activity has dramatically reduced oil demand and oil prices, leading to oil production cuts around the world.

- When—and where—the industry recovers remains to be seen.

Colossal changes in consumer behavior, driven by the coronavirus, have upended the global oil industry. By the end of March, lockdown measures had caused a 50% decline in road transport activity from a year earlier. Air travel fell by more than 90% in some European countries and 58% in the United States. Those changes, coupled with a general decline in economic activity, have pushed the price of oil to record lows. While low oil prices can be beneficial for consumers, producers around the world are abandoning operations that are unprofitable at low prices.

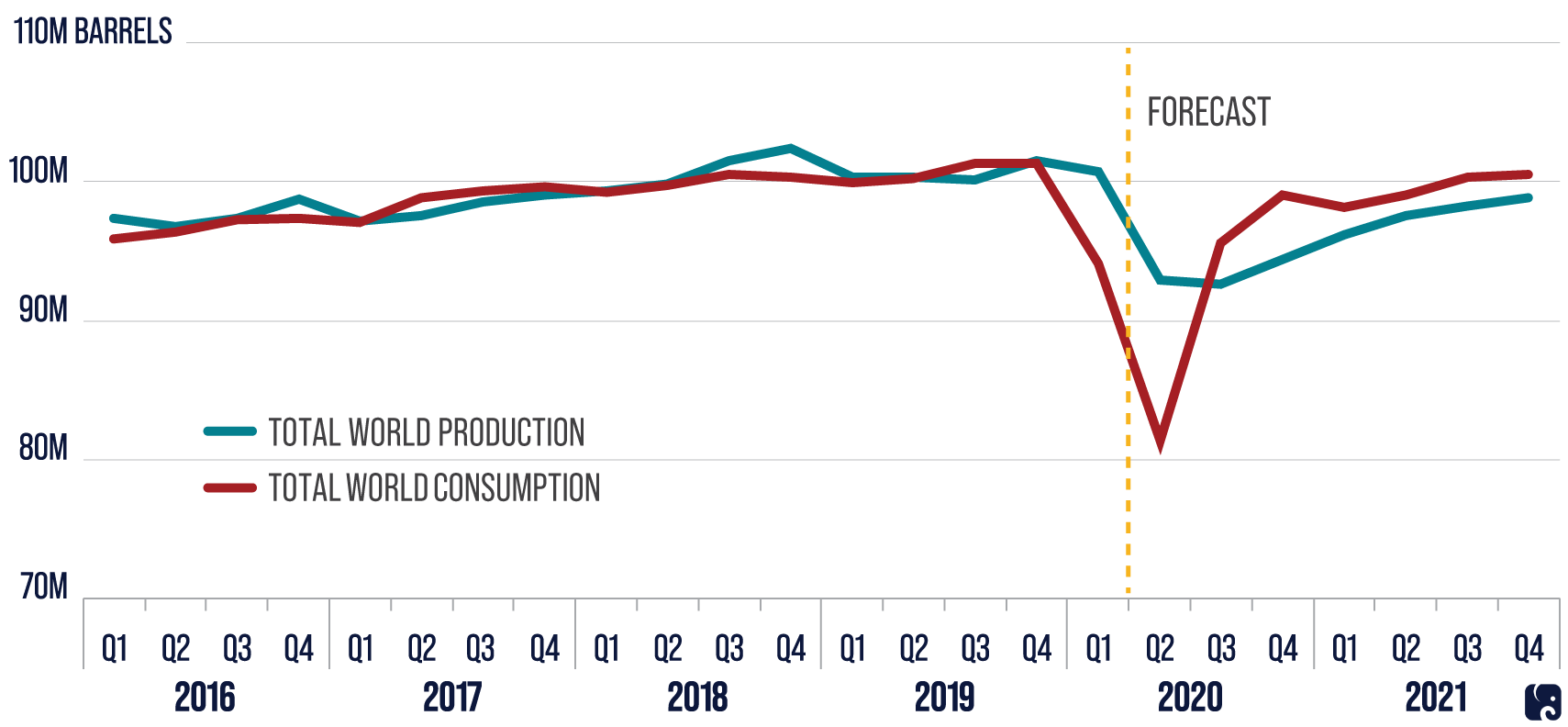

World Liquid Fuels Production and Consumption Collapse

Source: Energy Information Administration

Demand Collapse, Negative Prices

The collapse in U.S. demand for oil is without precedent. While there is always some seasonal variability in consumption, it is far less than the reductions we have seen because of the coronavirus.

Oil and gas exploration and production companies have faced tremendous pressure, and a wide variety of businesses that produce or depend on oil have also been affected. Rental car companies have started selling off inventories to make up for a decline in reservations. Auto manufacturers have faced a major drop in visits to dealer showrooms, as well as production interruptions due to the need for distancing in factories. As unemployment climbed, the ability of consumers to purchase new automobiles also declined.

As demand for oil collapsed, oil futures contracts briefly traded for negative values. On April 20, West Texas Intermediate oil futures contracts for the coming month dipped to negative $37 per barrel. An oil futures contract is an agreement to take delivery of oil in the future. April 21 was the last day to trade futures contracts for oil to be delivered in May, so traders who were not willing or able to purchase and take physical delivery of oil had to sell the contracts they held at a steep loss. For traders who could take delivery, the collapse in demand led to the quick filling of most storage capacity in the U.S. and worldwide. Traders who take physical delivery must store or dispose of the oil in a safe manner, as environmental laws preclude buyers from dumping or burning unwanted oil. So, for a brief period, traders were willing to pay others to take delivery of oil because they had nowhere to store it and nothing to do with it.

As of June 15, the price of WTI oil futures contracts for July had rebounded to about $37 per barrel. In the long term, analysts generally expect worldwide consumption and production of oil to return to something closer pre-crisis levels, but it could be a year or more before that happens. Factors that could delay or inhibit a return to ordinary demand include increased telecommuting and higher air travel costs due to social distancing requirements.

U.S. Production Challenges

Several factors unique to U.S. oil production have resulted in the coronavirus causing particular damage to the domestic exploration and production industry. First, U.S. production is based much more on drilling and producing from oil-bearing shale formations than the production from conventional reservoirs in other oil-rich countries like Saudi Arabia. Drilling shale wells is expensive. They produce the largest volumes of oil and gas shortly after they are drilled and stimulated but their production levels fall relatively quickly. Maintaining overall production levels requires constant development of new areas. However, the rapid decrease in oil prices and logistical challenges resulting from the shutdown have decreased oil and gas investment by more than 40% – companies are not drilling new wells to replace the old ones. Two-thirds of U.S. rigs that had been drilling for oil in mid-March have ceased operations.

While forecasts for production depend on the price of oil, some analysts predict that U.S. production will not recover to pre-pandemic levels until late 2021. Governments across the U.S. have discussed various measures to aid producers. The Texas Railroad Commission, which oversees oil output in Texas, has considered but so far rejected imposing production caps. President Trump has pledged that his administration will offer financial aid to the oil and gas industry.

International Developments

Saudi Arabia and Russia, two of the world’s top oil producers, had cooperated for several years to restrict production levels but had a severe falling out at the beginning of the coronavirus crisis. Russia and OPEC, of which Saudi Arabia is the largest member, engaged in what many observers deemed a price war. Each side ramped up production and tried to undercut the other’s market position. Some experts claim Saudi Arabia needs the price of oil to stay around $80 per barrel in order to fund both its costs of development and its national budget. Russia’s breakeven point is reportedly around $40.

While not directly involved in the dispute, U.S. oil production responds to prices that are driven internationally. Russia allegedly considered damage to the shale industry in the U.S. as a substantial benefit to the price war. President Trump reportedly demanded on April 2 that Saudi Arabia and OPEC cut oil production. Russia, OPEC, and other producing countries, as part of a consortium referred to as “OPEC+” have since agreed to production cuts that currently extend through the end of July.

The potential for instability abroad is magnified by the large drops in oil incomes in smaller, poorer producers. The International Energy Agency estimates that if prices stay where they are, Iraq’s oil income this year could be 68% lower than it was in 2019. That income has accounted for about 90% of the country’s fiscal revenue in recent years. Nigeria’s oil income could drop by 76%, and Ecuador’s by 80%. These kinds of disruptions could lead to severe strains on the countries’ economies and increase volatility in their political situations, as well as threatening ongoing cooperation among the OPEC+ producer group.

Next Article Previous Article