States Borrow to Pay Unemployment Benefits

KEY TAKEAWAYS

- The number of people claiming unemployment benefits has fallen since the spring, but it still is historically high.

- Some states have exhausted their unemployment fund reserves and have had to borrow from the federal government to continue providing jobless benefits.

- States may raise taxes on businesses or make other policy changes to their programs as they repay their loans and replenish their unemployment reserves; some states have already taken action to mitigate tax increases.

Months after states saw a surge in unemployment insurance claims due to the coronavirus pandemic, the number of people filing initial claims for benefits remains elevated: 742,000 the week that ended November 14. States pay regular UI benefits out of accounts in a federal unemployment trust fund, and even before the pandemic many of their accounts had fallen below the recommended minimum solvency level. So far this year, 20 states and the U.S. Virgin Islands have borrowed money from the federal government to help pay claims.

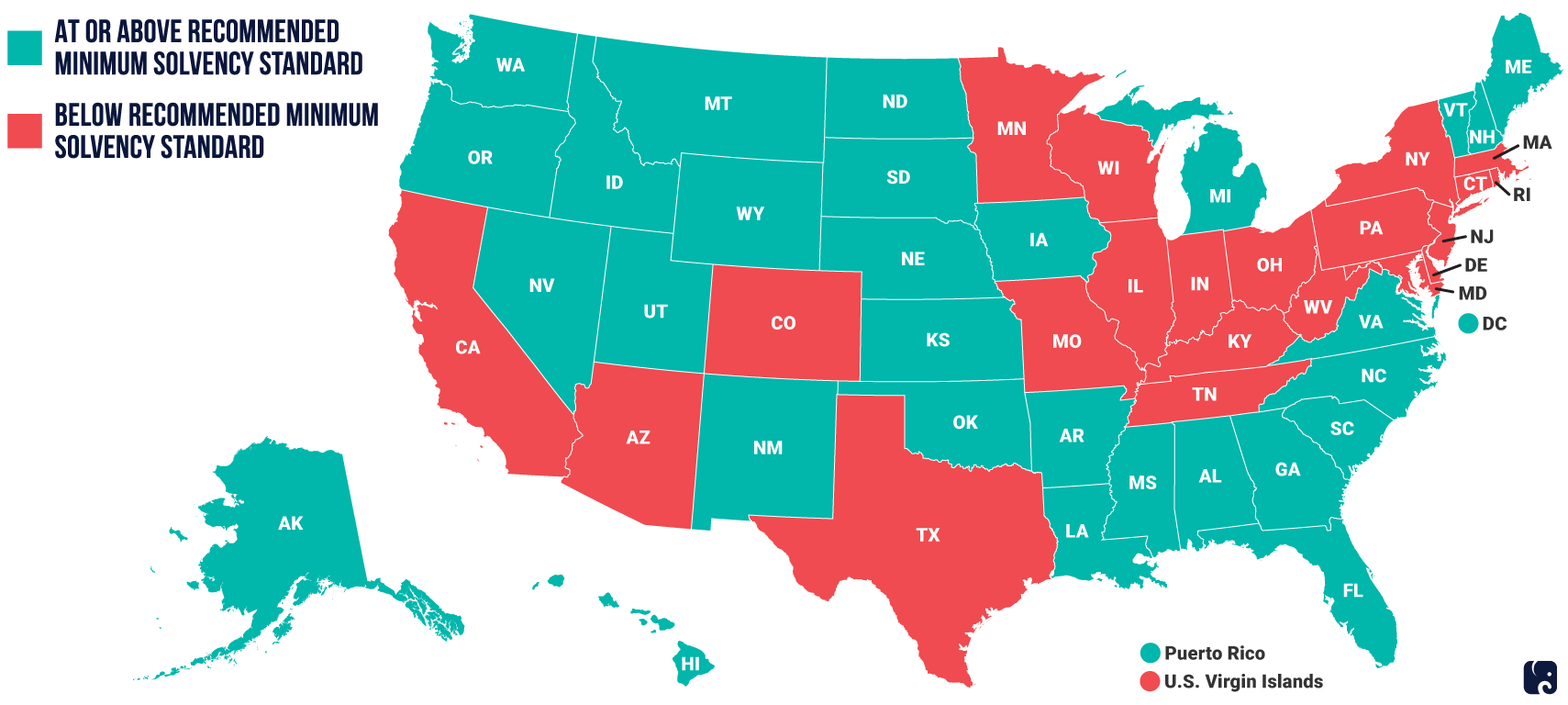

Pre-Pandemic, Many States Were Below the Recommended Solvency Level

funding unemployment benefits

Employers pay federal and state taxes to fund the UI system. The federal UI tax is 6% on the first $7,000 each worker earns. If a state follows federal program rules, its businesses can get credits of up to 5.4 percentage points against the federal tax, lowering the net federal rate to 0.6%, or $42 per worker each year. This goes into the federal unemployment trust fund and pays for program administration and the federal share of extended benefits: normally 50%, but set at 100% through December under the Families First Coronavirus Response Act.

To pay benefits, the states and territories that participate in the UI system set additional tax rates of their own. Most states have more than one UI tax schedule, and each schedule has a range of rates. From year to year, a state may shift to a higher or lower rate schedule as needed. The rate for a business is set under the state’s “experience rating” system. Employers with a history of frequent layoffs that lead to UI benefit claims generally pay higher rates than businesses with fewer layoffs. In 2020, Oregon employers are paying between 0.7% and 5.4% on the first $42,100 of each employee’s wages. In Maryland, rates range from 0.3% to 7.5% on the first $8,500 in wages.

The federal unemployment trust fund has accounts for each state, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands. The states’ UI tax revenues are credited to their individual accounts to pay for regular benefits and the state share of extended benefits. States accumulate reserves in their accounts when the economy is growing and there are few jobless claims. These reserves enable states to pay benefits when unemployment goes up and more people file claims. A deep or long recession can cause a state’s account to become insolvent, leaving it unable to cover benefits with incoming UI tax revenue. The state might need to borrow funds to cover the promised benefits.

The Department of Labor reported at the start of this year that the unemployment funds of 22 states and territories were below the recommended minimum solvency level, leaving them less prepared for an economic downturn. The other 31 state accounts met or exceeded the minimum.

borrowing to cover benefits

Borrowing to pay UI benefits was once rare but became more common beginning in the 1974 recession, and 36 of 53 jurisdictions took out federal loans around the time of the Great Recession in 2007-2009. California finally paid off its loan in 2018, and Connecticut did so in 2016. The U.S. Virgin Islands still had a balance as the coronavirus pandemic began. States that borrowed more and took longer to repay their debt had less time to build up their reserves before this year’s sudden downturn.

States Carried Federal Loan Debt for Years after the Great Recession

.png)

Under the Coronavirus Aid, Relief, and Economic Security Act, the federal government has funded large, temporary expansions in UI benefits this year. States also have spent massive amounts due to increases in claims. According to one estimate, state UI spending was up by 650% in March through July compared that period a year ago. Several states have turned to federal loans to maintain their UI funds.

Twenty states and the U.S. Virgin Islands had taken out more than $41 billion in federal loans as of November 17. California, New York, and Texas account for nearly three-quarters of the total debt outstanding. The Families First Coronavirus Relief Act deferred interest accrual and payments on these loans through December.

replenishing unemplyoment reserves

As the economy regains more jobs, states will collect more tax revenue and have fewer UI claims. They will still need to replenish their trust fund account balances, and may need to repay federal loans as well. So businesses could face higher unemployment taxes in the coming years – something that also happened after the Great Recession – regardless of whether the state has borrowed money or not.

It is common for states to raise or lower their UI tax rates based on factors such as their unemployment account balance. States may also impose solvency taxes and other surcharges on businesses, and some are likely to do so after this downturn as well. Other states, including Idaho, Montana and Arkansas, are replenishing their UI trust fund balances with money from the CARES Act to mitigate tax increases and keep their accounts solvent. South Carolina expects that most businesses in the state will not see UI tax increases next year, partly because the state boosted its UI funds with $920 million in CARES Act money. Alabama’s decision to add $300 million in federal relief money to its UI fund will reduce UI tax increases on employers. Governor Kay Ivey said, “[W]e acted on this so as to not create a burden for our employers that could result in business closures and layoffs of hard-working Alabamians.” Colorado, which has taken out a federal loan, suspended its extra solvency charge on businesses for the next two years while also gradually subjecting more wages to its unemployment tax. New Jersey’s legislature has approved a bill that would spread out a large payroll tax increase over a few years.

Businesses in some states might also pay higher unemployment taxes due to their state’s experience rating system. In May, the Tax Foundation reported that a majority of states said they would not punish employers for coronavirus-related layoffs.

If a state misses the deadline for repaying its federal loans – between 22 and 34 months after borrowing, depending on when it started borrowing – its businesses will pay a higher federal unemployment tax until the loan is repaid. The rate goes up by 0.3 percentage points each year, and other tax increases are triggered starting in the third year. This happened in roughly two dozen states after the Great Recession.

Following the last recession, some states tried to improve their unemployment funds by reducing UI spending. Michigan and North Carolina were among the states that shortened the number of weeks people could receive state benefits. The Federal Reserve Bank of Cleveland found that states that had insolvent unemployment trust fund accounts and also had to pay higher federal unemployment taxes tended to choose this policy response.

Next Article Previous Article