Helping Unemployed Americans

KEY TAKEAWAYS

- Business closures and reduced economic activity due to the COVID-19 pandemic have left millions of Americans out of work.

- In the CARES Act, Congress temporarily made more types of workers eligible for unemployment insurance and added an extra $600 per week for recipients through July, on top of state benefits.

- With states reopening, Congress will have to decide the best federal approach to encourage millions of people to return to work and assist those who cannot do so quickly.

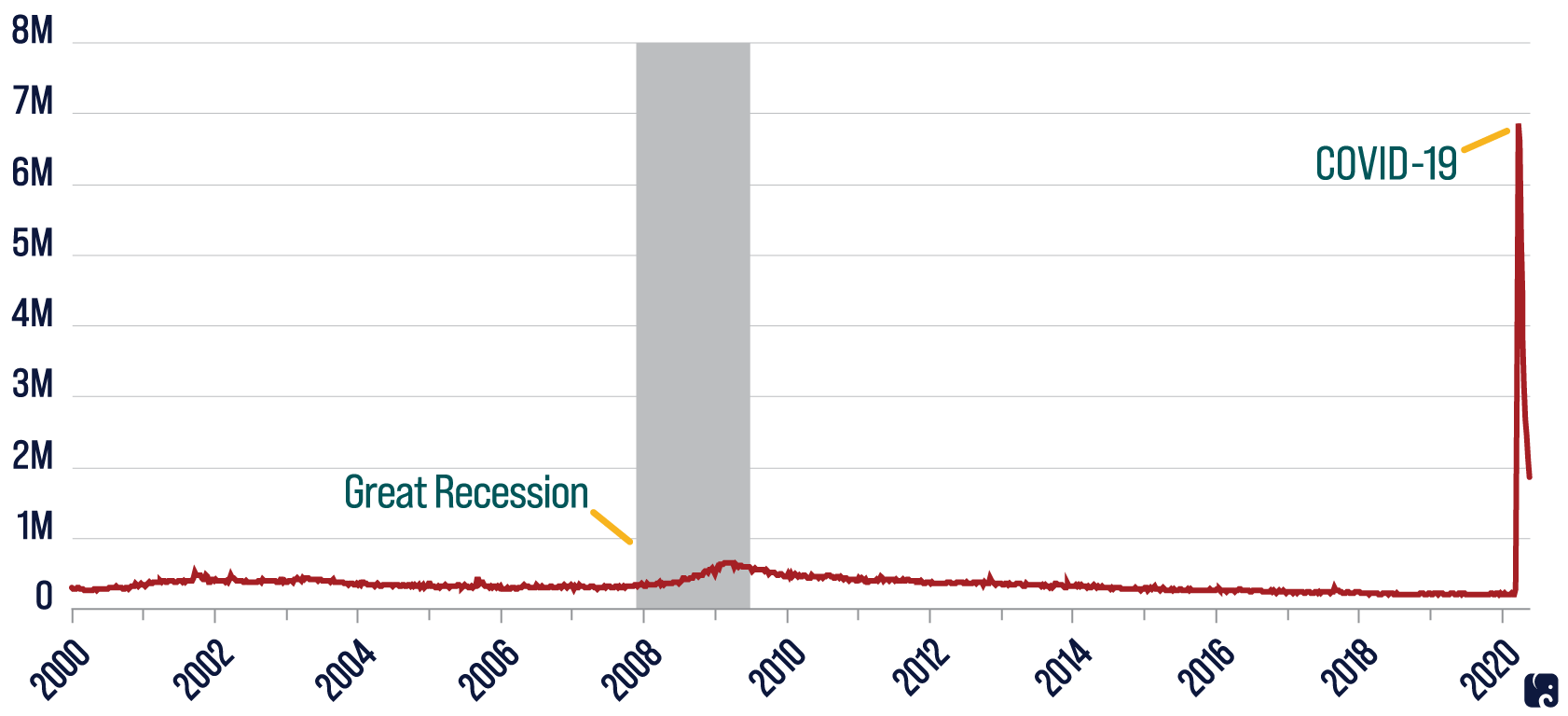

More than 40 million people have applied for unemployment insurance benefits since mid-March, as businesses closed due to COVID-19 and related state orders. Initial claims by people seeking UI benefits jumped by nearly 7 million the week of March 22. In a survey by the Census Bureau, 47% of adults said someone in their household has lost job income since March 13. The Coronavirus Aid, Relief, and Economic Security Act that Congress passed in late March temporarily expanded the level and duration of UI benefits. As states reopen, businesses will call back or hire workers, but the economy will recover unevenly across sectors and regions. Some workers may not find jobs right away if their previous employers close for good. Congress will have to decide how to help states encourage people to return to work and aid those unable to do so quickly.

A Spike in Initial UI Claims

The United States’ unemployment insurance system gives targeted, weekly payments to help people meet basic needs and avoid falling behind on financial obligations while they look for work. The federal government oversees the system, but states set the benefits and eligibility rules. Recipients must be able, available, and actively seeking work, but states have flexibility in deciding what those requirements mean.

Most states pay benefits for up to 26 weeks; the number ranges from 12 weeks in Florida and North Carolina to 30 weeks in Massachusetts. The CARES Act provided an additional 13 weeks of regular benefits beyond what the states pay. After that, people in states with high unemployment may get up to 13 weeks of “extended benefits.” Normally the federal government splits the cost of extended benefits with the states, but through December it is covering the entire cost for states with large increases in jobless claims. As of the end of May, 44 states had qualified for the extended benefits.

Unemployment insurance normally does not replace the full salary of a worker who loses a job temporarily. It has always been a safety net program to help people pay for their most necessary expenses and to help stabilize the economy during economic downturns.

States generally base weekly benefits on the recipient’s recent work history and earnings, but they use different formulas. As wages and the cost of living vary wildly from one state to another, benefits also vary by state. According to a 2019 report by the Congressional Research Service, most states replace roughly half of recipients’ average prior wages up to a weekly limit that ranges from a maximum benefit of $235 in Mississippi to $823 in Massachusetts. Benefits replace a smaller share of lost wages for higher earners than for lower earners. In the U.S., the average weekly benefit in the fourth quarter of 2019 was $378, or an annualized rate of about $19,600.

States levy payroll taxes on employers to build up an unemployment trust fund that pays for benefits. When the economy is doing well, these funds collect more revenue and have lower expenses, building up a surplus for when the economy sours. Additional federal payroll taxes on employers pay for things such as administrative grants to states and the federal share of extended benefits.

expanded benefits due to COVID-19

As states ordered non-essential workers to stay home to help slow the spread of COVID-19, many businesses had to close. In the CARES Act, Congress temporarily expanded UI benefits to help people who were out of work. Congress gave states temporary authority to change work search and other UI program rules in prior COVID-19-related legislation. Major provisions in the CARES Act include:

Expanded eligibility. The new pandemic unemployment assistance program provides up to 39 weeks of benefits for people ineligible for regular UI, such as self-employed workers, independent contractors, and people who have not worked long enough or earned enough to qualify for regular UI. The program ends December 31.

More weeks of benefits. Through the new pandemic emergency unemployment compensation program, the federal government will pay benefits for up to 13 weeks for people who have reached the time limit for state benefits. After using those weeks, people would still be eligible for 13 weeks of extended benefits if their state’s unemployment rate is high. The program ends December 31.

Extra $600 per week. The federal government also is paying an extra $600 per week benefit through the new federal pandemic unemployment compensation program. The payment, equal to an additional $15 an hour for a 40-hour week, is on top of state UI benefits. Once this program expires July 31, people will remain eligible for normal state benefits, extended benefits, and other temporary benefits created by the CARES Act.

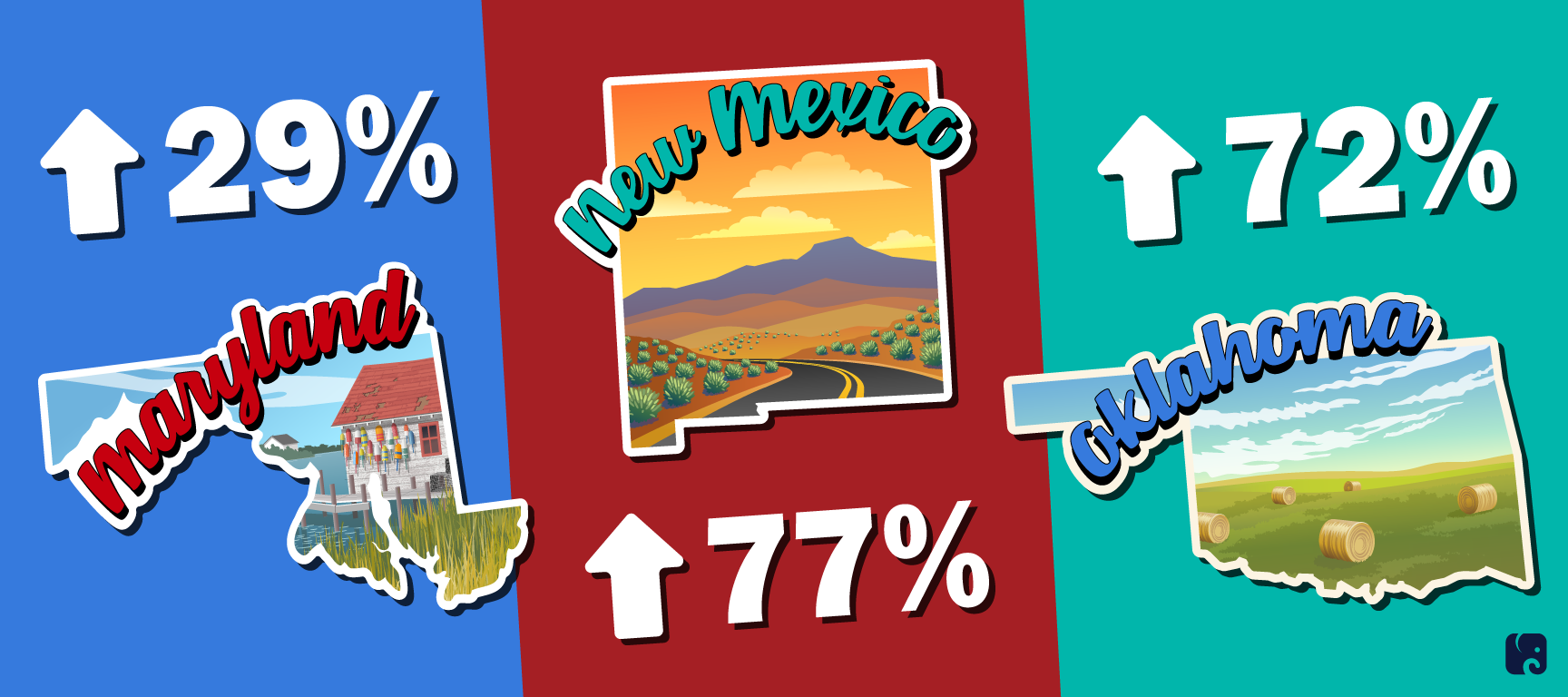

Enhanced Unemployment Benefits Pay More than Work

During the Senate debate on the CARES Act, 47 Republicans voted to cap jobless benefits at a person’s prior earnings, but states said it would have taken six to eight months to set up their systems to do that. The flat $600 payment was something states could set up faster. It was intended to replace 100% of the average worker’s wages prior to the pandemic, when added to the average state benefit. But it gives many people more money from UI benefits than they earned at work before the pandemic. University of Chicago researchers estimated that “68% of unemployed workers who are eligible for UI will receive benefits which exceed lost earnings.” They calculated that the median unemployed worker will see 134% of their prior earnings replaced, though it varies by state. In Maryland, UI benefits provide the average unemployed person with 29% more income than he or she earned while working. In Oklahoma the average unemployment check is 72% higher than the prior earnings, and in New Mexico benefits are 77% higher.

Replacing more than lost earnings may have an unintended consequence. Some businesses reopening are struggling to find workers willing to earn less money than UI benefits provide. People generally cannot refuse work and still collect benefits, but states may be hesitant to enforce that requirement for someone who is concerned about the health risk of returning to work. States and territories will likely enforce the rule and determine UI eligibility differently as they relax COVID-19-related orders.

Other support. The federal government is paying for the first week of regular benefits if states waive their typical one-week waiting period before UI benefits kick in. The law also seeks to boost “short-time compensation” programs, which 27 states have now. Under these plans, employers reduce workers’ hours instead of laying them off, and state UI benefits partially replace the lost wages. Through December, the federal government is paying all of the costs of states’ existing STC programs and half of the costs for states that create them. It also gives $100 million in grants for states to set them up, which Virginia recently enacted a law to do.

The Families First Coronavirus Response Act gave states $1 billion in administrative grants, and states have used hiring authority in the CARES Act to increase staff to answer calls and process claims. Still, the surge in claims has caused clogged phone lines and state computer systems to crash.

the uncertain path ahead

While the economy is expected to start recovering in the second half of this year, it is unclear how quickly the job market and consumer confidence will rebound. Since late April, states have been allowing stay-at-home policies to expire and certain businesses to reopen under enhanced safety rules. Many businesses will call back furloughed workers or hire new people, but one survey found that one out of three small and medium-sized businesses say they do not expect to reopen.

If Congress pursues more COVID-19 response legislation, it will have to decide the best way to work with states as they encourage people to return to work and aid those who have lost income, without penalizing essential workers who have remained on the job. House Democrats voted to extend the extra $600 benefit to January 31, 2021. Senate Republicans are concerned that the extra benefit conflicts with the Paycheck Protection Program and creates perverse incentives by discouraging a return to work. On June 4, the Congressional Budget Office reported that a six-month extension would “weaken incentives to work” and likely result in fewer people employed in the second half of this year than without an extension. CBO said five out of six people would receive more in benefits than “they could expect to earn from work.” In the CARES Act, Congress provided financial help, including payments for tens of millions of Americans; money for states to cover unexpected costs due to COVID-19; UI benefits; and PPP loans to help businesses and workers. It will be important for Congress to review how these approaches affect employment, help people in need, and accelerate the economic recovery.

Next Article Previous Article