Coronavirus Relief for State, Local, and Tribal Governments

KEY TAKEAWAYS

- The CARES Act included a $150 billion Coronavirus Relief Fund to help state, local, territory, and tribal governments pay for unanticipated expenses related to COVID-19.

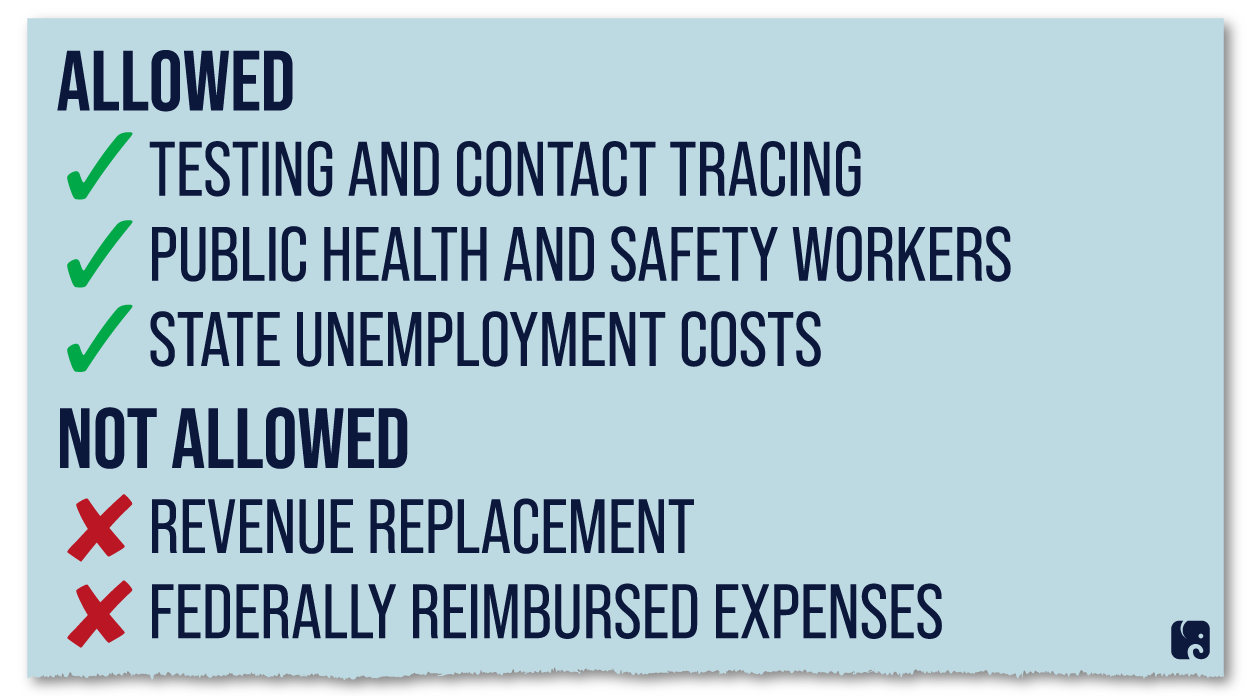

- Governments may use the funds for costs ranging from COVID-19 testing and contact tracing to payroll for public health and safety workers, though not to make up for revenue shortfalls.

- States are taking different approaches to spending their share of the funds.

In the Coronavirus Aid, Relief, and Economic Security Act, Congress created a $150 billion coronavirus relief fund to help state, local, territory, and tribal governments cover unexpected expenses during the COVID-19 emergency. These could include contact tracing to help slow the spread of the disease, paying for state unemployment insurance costs, or covering payroll costs for public health and safety workers. The Treasury Department has sent payments to states, territories, the District of Columbia, and to other large places eligible for direct payments. States are making different decisions about how and when to use their funds to meet their specific needs.

Relief Funds for COVID-19 Costs

how the relief fund works

The CARES Act reserved $3 billion from the relief fund for the District of Columbia and U.S. territories, $8 billion for tribal governments, and $139 billion for the states. Allocations depended on population and ranged from a minimum of $1.25 billion in states such as Wyoming and Idaho to $15.3 billion in California. The District of Columbia got $495 million. The law allowed local governments with at least 500,000 people to receive direct payments as well. For example, out of Georgia’s $4.1 billion allocation, Treasury sent $3.5 billion to the state and the rest to Atlanta and four large counties.

Treasury sent 60% of the funding for tribal governments based on population, though not to Alaska Native corporations because of ongoing litigation. Treasury will allocate the remaining 40% of the funds based on tribal governments’ expenditures and number of employees.

spending the funds

State and other governments must spend their relief funds on “necessary expenditures” due to the COVID-19 emergency that they incur from March 1 to December 30. These must be costs that they had not budgeted for prior to the CARES Act becoming law on March 27. Treasury’s guidance documents offer a wide range of eligible activities. Governments may spend the funds on COVID-19 testing, contact tracing, telemedicine, and temporary medical facilities. They may cover payroll costs for police officers, firefighters, and other public safety, health, and human services workers responding to COVID-19. They may use it to enhance teleworking capabilities for public workers; deliver food to seniors; help schools improve technology for distance education; help producers facing supply chain problems to reduce livestock populations; or give grants to small businesses affected by necessary closures. They also may pay unemployment insurance costs for which the federal government is not reimbursing them.

Treasury’s guidance also gives examples of ineligible activities, such as legal settlements, state Medicaid expenses, and costs the federal government will reimburse. Governments may not use the funds to replace lost revenue to cover a cost “that would not otherwise qualify as an eligible expenditure.” For example, Treasury says governments generally may not use the money to help people pay required taxes, such as property taxes, or for payroll for public workers not involved in the COVID-response.

Governments that received direct payments may transfer funds to other governments for eligible activities. They are supposed to keep records of how they use the funds and must return any money they do not spend. Treasury’s inspector general will recoup any funds a government used improperly.

What states are doing

States have been taking different approaches to spending their funds. On May 31, the Associated Press reported that many states were spending their funds slowly, though 32 states were contemplating making some of their funds available to local governments. As of May 18, the National League of Cities had said more than a dozen states had let local governments access the funds. State officials have to decide how to use these relief funds, along with other money Congress has provided, to cover current COVID-19 costs and those they expect to incur. Some examples of what states have done:

-

On May 27, Arizona Governor Doug Ducey said $441 million from the state’s $1.9 billion payment would go to counties and towns that did not receive direct payments. He noted “there are going to be needs that are yet unforeseen,” so the state is not distributing all of its funds yet. Phoenix, which received $293 million directly from Treasury, is using the money for activities such as small business aid, mortgage and rent aid, and COVID-19 tests for city workers.

-

Also on May 27, Wisconsin Governor Tony Evers said the state will send $10 million of its funds to tribal nations. Local governments will receive another $190 million based on population, with each receiving at least $5,000. They may use it for costs including testing and contact tracing.

-

In mid-May, Colorado state leaders decided to spend most of their $1.6 billion in funds on K-12 and higher education activities. Other agencies will receive money for sanitation and social distancing measures at state prisons and increases in human services casework. Smaller local governments will receive a portion, too. Denver city officials said they would spend $20 million of their $127 million direct payment on costs such as housing, food, and small business aid.

-

On May 11, Texas state officials decided to make $1.9 billion of its $8 billion direct payment available to smaller counties and cities. Each locality gets 20% of each its share once it submits certification forms and the rest on a reimbursement basis. Texas’ larger cities and counties received $3.2 billion in combined direct payments.

-

Missouri Governor Michael Parson set up an advisory group led by the state treasurer to devise a plan for spending the state’s $2.1 billion payment. As of early May, Missouri had sent $468 million to local governments. One of them, St. Charles County, will spend $15 million of its $47 million share on safety and other improvements at its jail.

-

North Carolina recently approved a budget to provide $150 million of its $3.6 billion direct payment to counties. By May 29, the state’s pandemic recovery office expected to send $85 million to 62 counties to help them cover the pandemic response costs allowed under the law.

-

Wyoming will direct $325 million of its money to three business aid programs. One of them will grant up to $50,000 each to small businesses affected by required closures.

Next Article Previous Article