Restart the Paycheck Protection Program

KEY TAKEAWAYS

- On April 3, the Paycheck Protection Program started approving loans to help small businesses stay open and keep paying their workers.

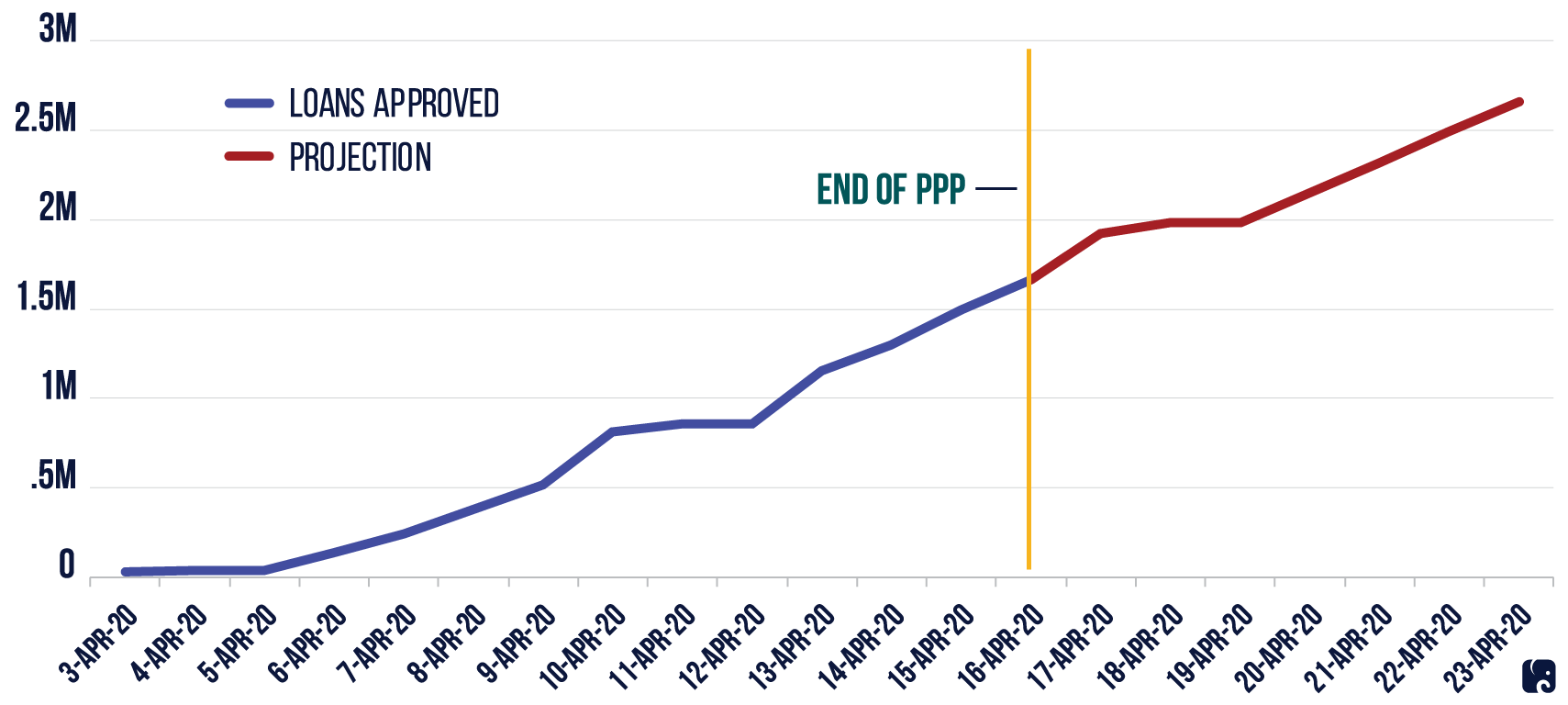

- On April 16, the program ran out of the nearly $350 billion Congress initially provided, after nearly 1.7 million loans were approved in just under two weeks.

- The Trump administration has requested about $250 billion more in program authority and additional appropriations to restart the Paycheck Protection Program.

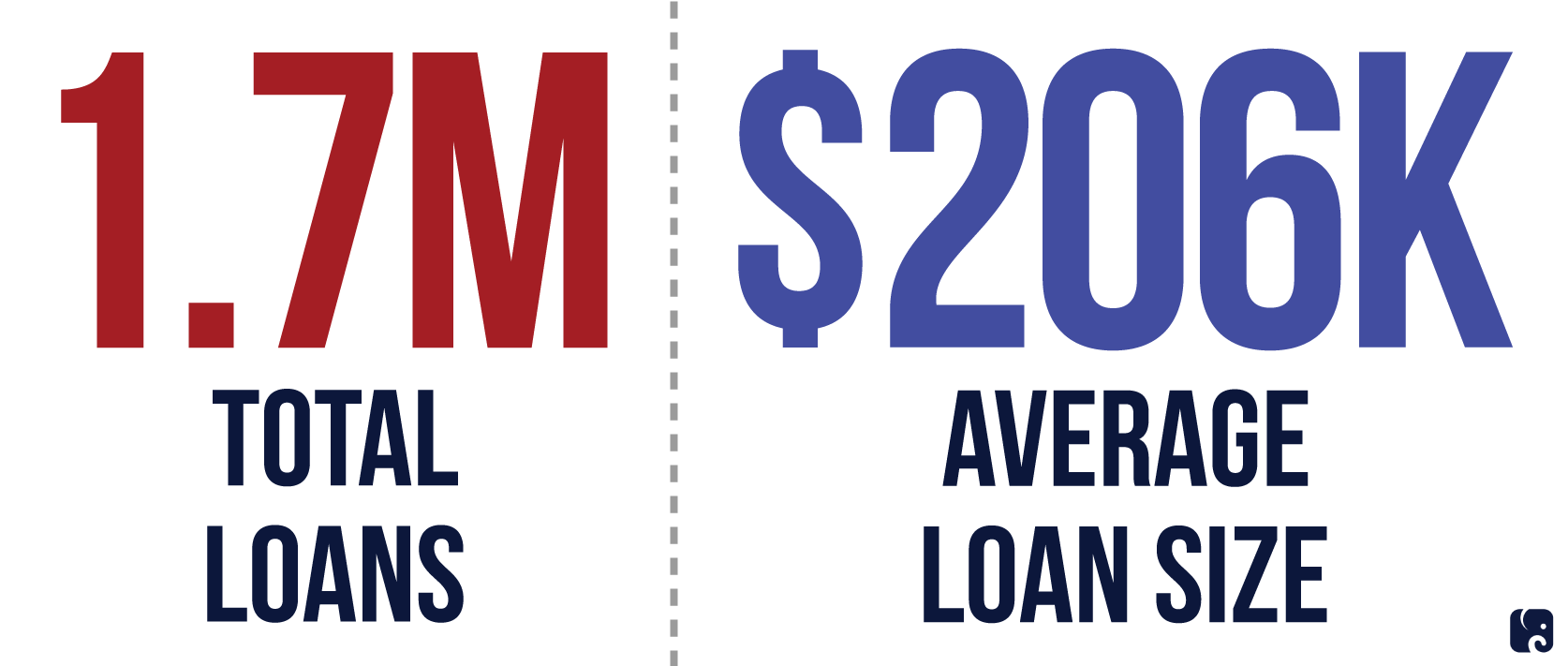

On April 16, the Paycheck Protection Program – created by the CARES Act to help small businesses pay their workers and stay open during the coronavirus emergency – ran out of money. Initially, Congress provided $349 billion to support federally guaranteed Small Business Administration loans under this program. Before the funds ran out, program lenders and the SBA approved nearly 1.7 million loans. The average loan size was $206,000, and 74% of the loans were for $150,000 or less. Without new funding, lenders and the SBA cannot approve more loans.

Projected Loans Issued for the Paycheck Protection Program

Source: Internal model from the Senate Committee on Small Business and Entrepreneurship majority staff projecting what future growth would have looked like had funding not expired.

Before the money ran out, the White House asked Congress to increase the program’s authorization by $251 billion – to bring it to $600 billion total – and for about $261 billion in appropriations to pay for the higher lending. On April 9, Senate Republicans brought up a bill to boost the program’s authorization and funding, but Democrats blocked it. It is clear that more small businesses and their workers have a tremendous need for the program.

Paycheck Protection Program Loans through April 16

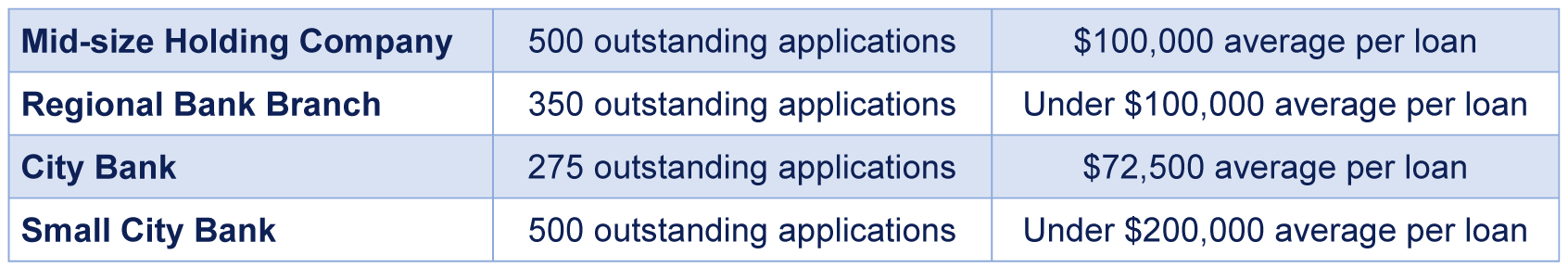

Small businesses are being shut out of the program now that it has run out of money. Self-employed people and independent contractors were hit particularly hard by the funding lapse, because they could not even start applying for funding until April 10 and did not receive guidance on how to complete an application until the afternoon of April 14. Across the country, banks are having to turn away small businesses that are desperate for funding to keep their doors open. Without access to loans from the Paycheck Protection Program, these businesses could be forced to close their doors and lay off employees.

Examples of Need for More Funding for the Paycheck Protection Program

Under the Paycheck Protection Program, businesses can get a loan of up to 250% of their average monthly payroll expenses – excluding compensation above an annual salary rate of $100,000 for any individual – up to $10 million total. The federal government will forgive loan amounts that employers spend on payroll, rent, leases, mortgage interest, and utilities. This loan can help small business stay open during these difficult times. The Treasury Department and SBA have provided program guidance and applications for businesses and lenders.

Next Article Previous Article