Sustaining the Paycheck Protection Program

KEY TAKEAWAYS

- On March 27, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act, which includes the Paycheck Protection Program to help small businesses stay open.

- The CARES Act provided about $350 billion to support the federally guaranteed loans through the Small Business Administration. The Trump administration has requested about $250 billion more in lending authority for the new program and appropriations to pay for this increase.

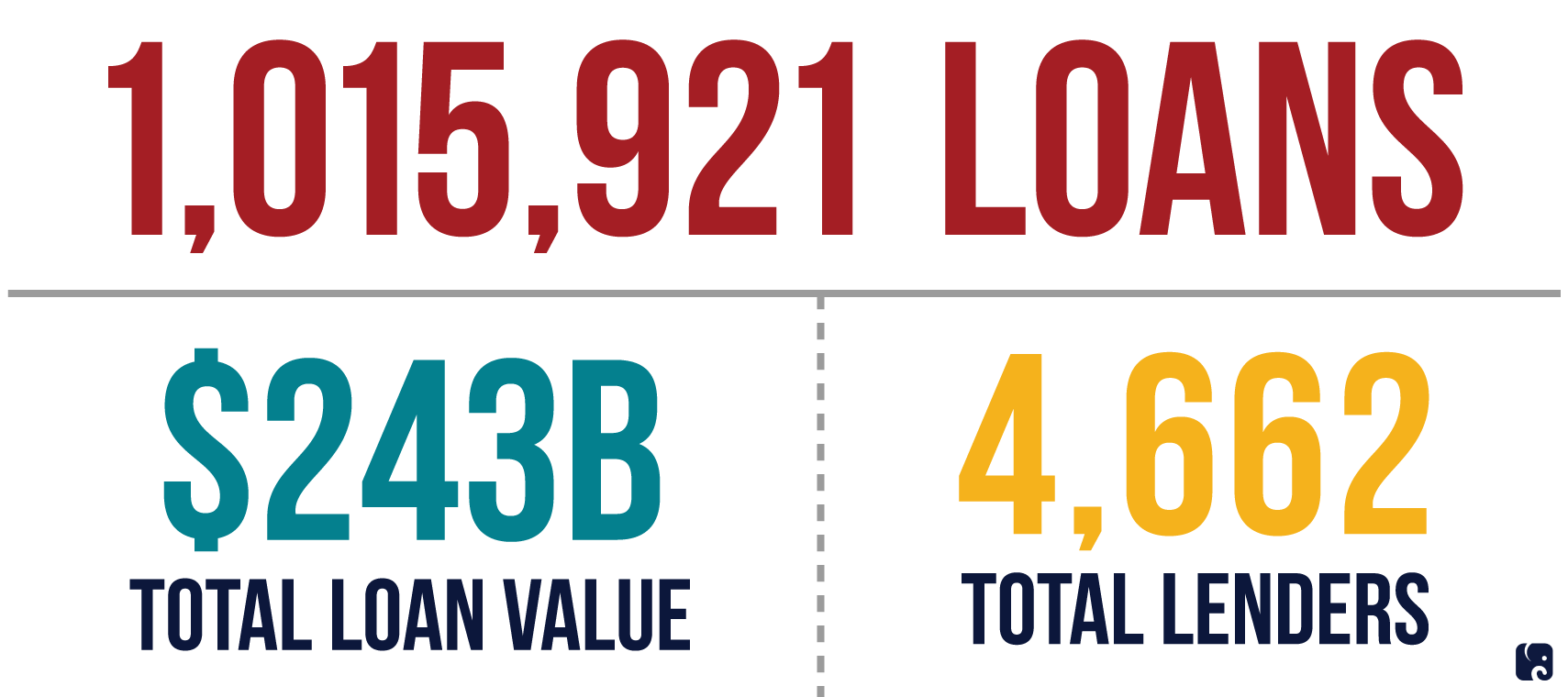

- As of April 13, lenders had approved 1,015,921 loans for a total of $243 billion. The initial $350 billion for the program could run out this week.

The CARES Act created the Paycheck Protection Program to help small businesses withstand the coronavirus emergency, stay open, and keep their employees on payroll. Congress has provided about $350 billion to support federally guaranteed Small Business Administration loans under this program. Businesses can get a loan of up to 250% of their average monthly payroll expenses – excluding compensation above an annual salary rate of $100,000 for any individual – up to $10 million total. The federal government will forgive loan amounts that employers spend on payroll, rent, leases, mortgage interest, and utilities. The Treasury Department and SBA have provided program guidance and applications for businesses and lenders.

Paycheck Protection Program Loans

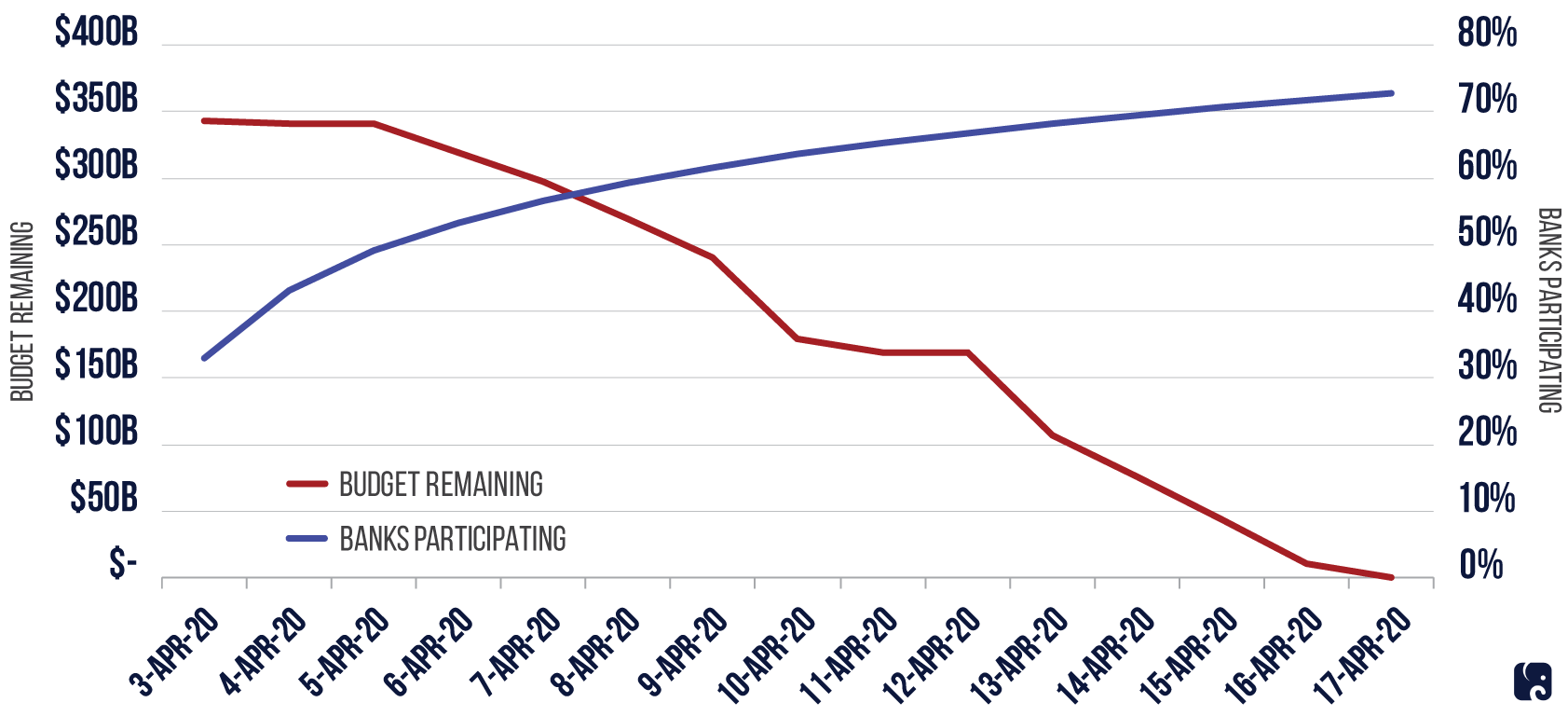

On April 3, participating banks began issuing these loans. As of April 13, according to the Small Business Administration, more than 4,600 lenders across the country have approved 1,015,921 loans totaling $243 billion. At this rate, the program could run out of the initial $350 billion this week. The White House has asked Congress to increase the program’s lending authority by about $250 billion – bringing the total to $600 billion – as well as for additional appropriations to pay for the higher lending. Last week, Senate Republicans sought to increase the authorization and funding for the program, but Democrats blocked the measure on the Senate floor.

Paycheck Protection Program Capacity

*Based on an internal model from the Senate Committee on Small Business and Entrepreneurship majority staff.

Next Article Previous Article