Democrats' Minimum Tax Means Fewer U.S. Jobs and Lower Wages

KEY TAKEAWAYS

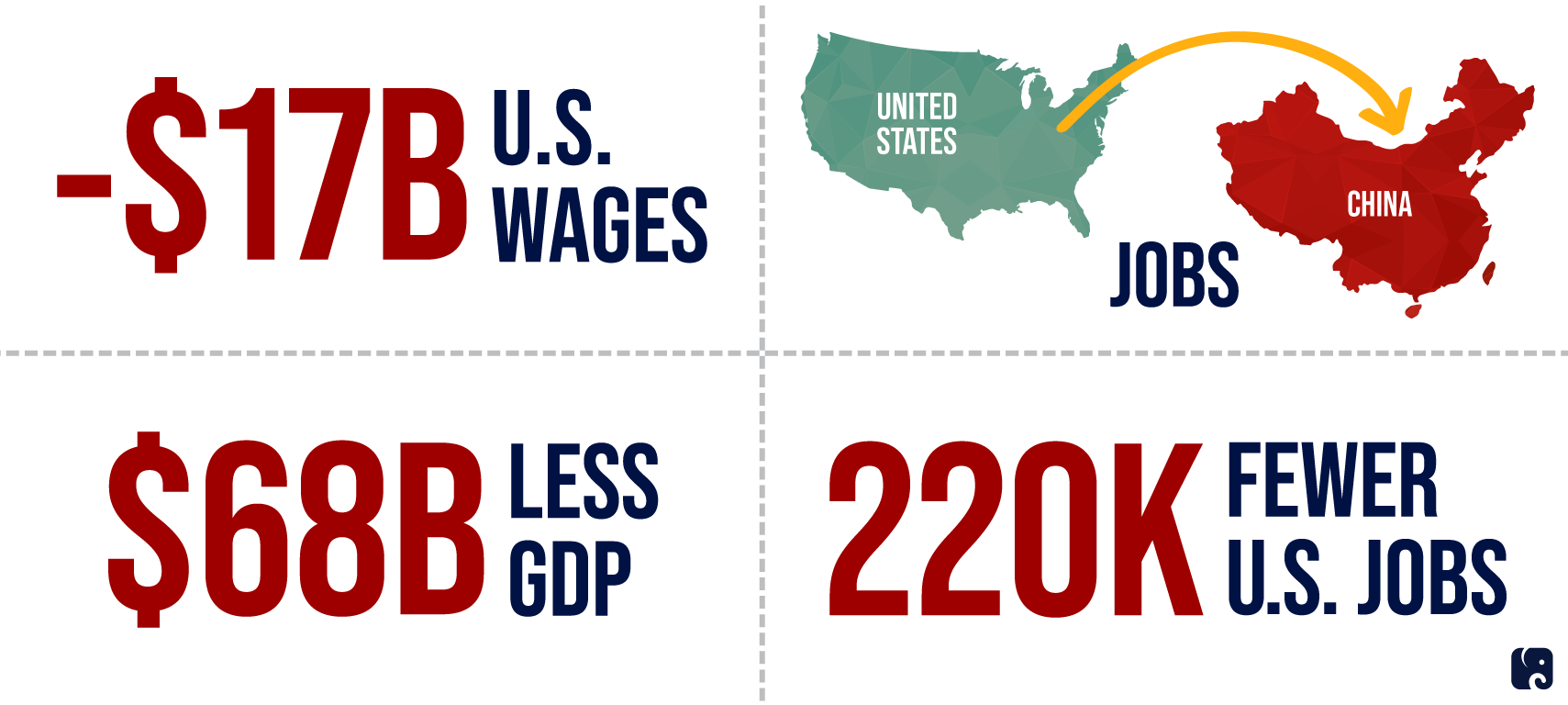

- Workers will lose $17 billion in wages next year, and 218,000 jobs will be lost, because of the Democrats’ new “book minimum tax.”

- Manufacturing, mining, and retail are only a few of the industries that will be hit hard by this new tax.

- Some businesses in these industries will find more competitive environments overseas for their investments in factories and jobs.

Democrats’ reckless tax-and-spend spree, the misnamed “Inflation Reduction Act,” does nothing to reduce inflation but will reduce the size of the U.S. economy. It raises taxes on low- and middle-income Americans and gives billions of dollars of handouts to companies with cozy government connections.

One policy in particular, the new “book minimum tax,” requires companies to pay the higher of their tax liability determined under the tax code or 15% of their income reported on their financial statements. This new tax will lead to lower wages and fewer jobs for Americans by encouraging companies to move factories and other operations overseas.

What the New Tax Costs

smaller Paychecks and Disappearing Jobs

Hard-working Americans struggled to keep their jobs during the pandemic, and they are still being hammered by inflation when they pay for groceries, gas, and utilities. Instead of trying to help, Democrats passed a new tax that will make buying essentials more difficult for many Americans. A study by the National Association of Manufacturers estimates that because of the tax, the total amount of money businesses spend on workers’ wages will decline by $17 billion next year, and 220,000 American jobs will be lost.

Hurts blue collar workers, not just tech giants

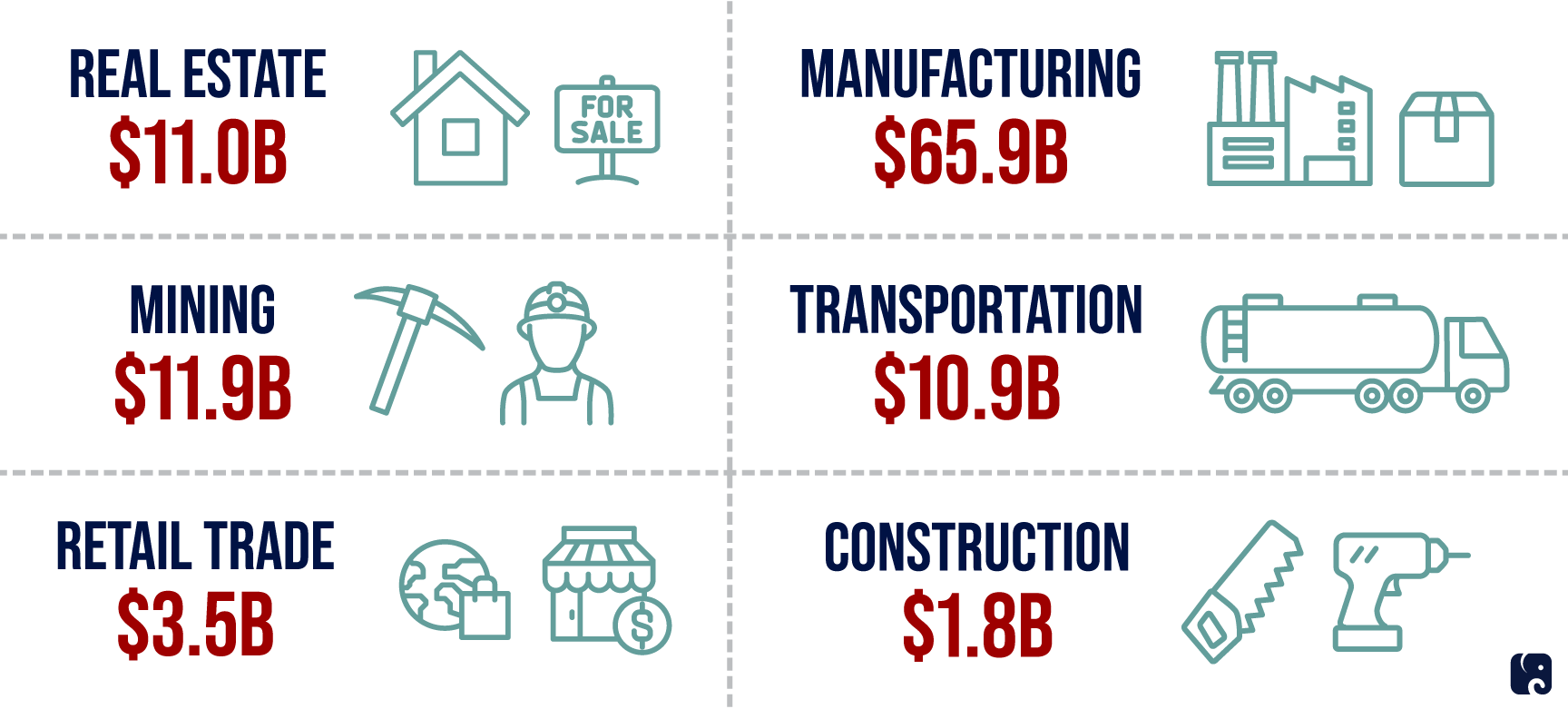

Democrats like to claim their new book minimum tax will only affect a small number of business. Senators Ron Wyden and Elizabeth Warren bragged in a press release that their new tax will “make big pharma, tech, apparel companies pay their fair share.” But the tax does not only apply to multinational technology companies. A Tax Foundation analysis predicts that the new tax also will hit workers who wear hard hats and steel-toed boots. The organization says that over the next 10 years the law increases taxes by $66 billion on manufacturing businesses, $12 billion on the mining industry, and more than $3 billion on the retail trade industry.

Who Will Pay the Tax?

less manufacturing and investment in the U.S.

Congress should pass laws that encourage American companies to create jobs and build manufacturing facilities in the United States. Instead, Democrats’ book minimum tax is a backdoor way to eliminate the benefit of provisions Congress specifically enacted to make the U.S. an attractive place for investment and innovation.

During President Biden’s first year and a half in office, Democrats pushed policies that caused higher inflation, hurting American families. Now they’re adding to that pain by shipping American investment overseas.

Next Article Previous Article