How the $80 Billion Democrats Gave the IRS Hurts Taxpayers

KEY TAKEAWAYS

- In their latest reckless tax and spending spree, all 50 Senate Democrats voted to give the IRS nearly $80 billion, most of which will target taxpayers with audits and other enforcement.

- The miniscule portion of funds aimed at the agency’s main problem – atrocious service – means that taxpayers can expect little help if they have a problem or questions.

- Even before the agency’s new windfall, 95% of IRS audits are directed at taxpayers earning less than $200,000, and Democrats made sure their law doesn’t change that.

When Democrats united to pass their latest reckless tax and spending spree last month, one of their main goals was to dramatically increase funding for the IRS. The so-called “Inflation Reduction Act” increased the agency’s budget by nearly $80 billion. Most of the money is reserved for audits, investigations, and other ways for the tax agency to target Americans rather than help them.

Where the Money Goes

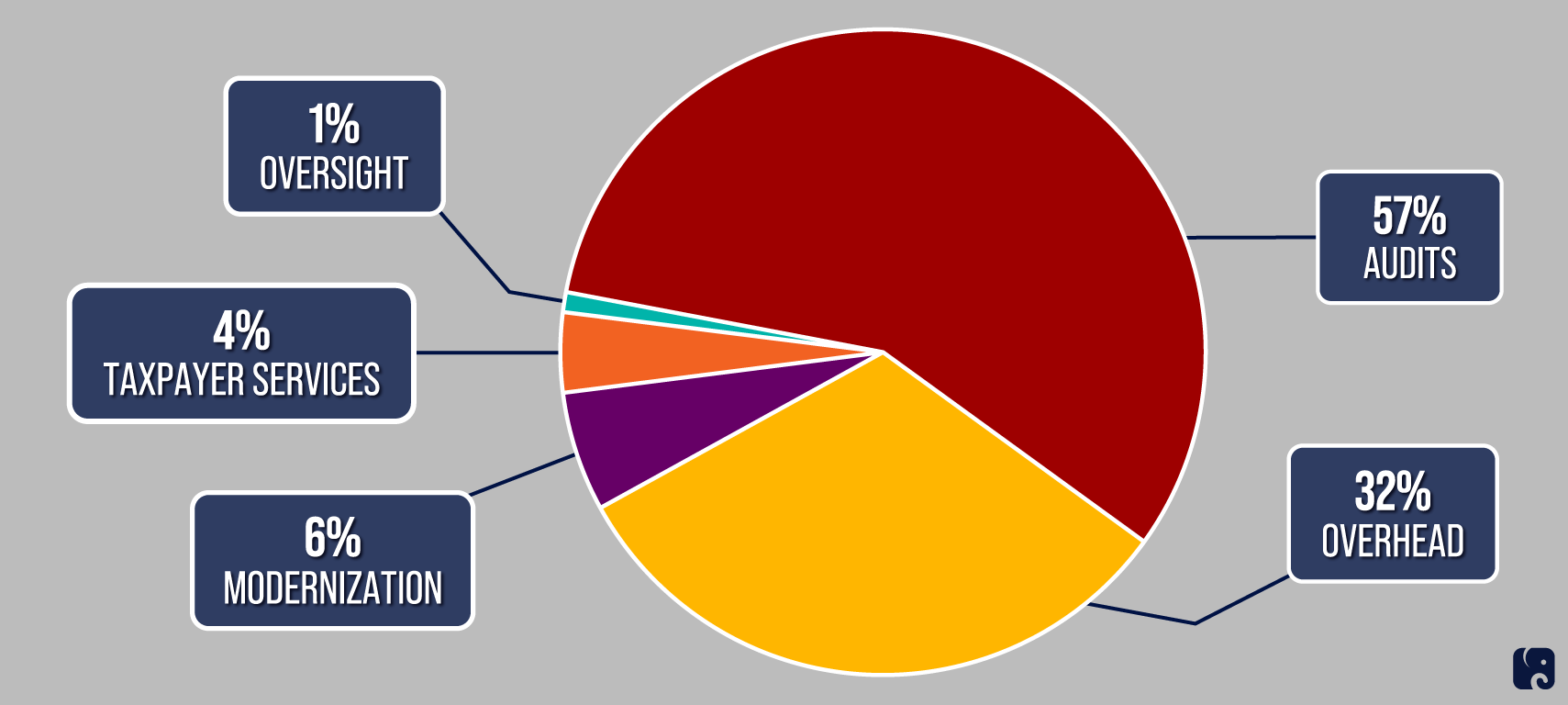

4% to help taxpayers, 57% to Audit Taxpayers

The IRS has a long record of dismal taxpayer assistance. Democrat bragged their legislation will improve customer service, but they only allocated 4% of the spending to actually assist taxpayers. Democrats allocated 57% of spending to increase audits, investigations, and other enforcement. It is not clear at all that this small amount of additional funding will meaningfully enhance abysmal IRS customer service. Recent history suggests not. Despite billions in additional money to draw upon, as of the end of April tax filing season in 2022 the IRS had answered only 10% of incoming calls. Tens of millions of calls went unanswered, and taxpayers who got through languished on hold for at least 45% longer than they did in 2021. The IRS had a backlog of 21 million 2021 tax returns and 14 million “math error” notices, and the agency was taking on average of 251 days to respond to a letter. The extra money Democrats earmarked for more audits will only increase the number of taxpayers who will need to contact the IRS, meaning the backlog is likely to grow.

breaking promises and Raising taxes

President Biden made a simple promise to Americans in his 2022 State of the Union address: “under my plan, nobody – let me say this again – nobody earning less than $400,000 a year will pay an additional penny in new taxes. Not a single penny.” The Democrats’ latest reckless tax and spending law violates that pledge. According to the Congressional Budget Office, the new flurry of audits will generate $180 billion in new tax revenue, and some of this money will specifically come “from taxpayers with income less than $400,000.”

95% of audits on households under $200,000

According to the most recent data, the IRS conducts 95% of audits on households making less than $200,000, and 75% of audits are of households making less than $75,000. Treasury Secretary Janet Yellen instructed IRS Commissioner Charles Rettig that new funding “shall not be used to increase the share of small business or households below the $400,000 threshold that are audited relative to historical levels.” Secretary Yellen’s pledge is unenforceable, and importantly did not say that the number of audits of taxpayers earning less than $400,000 could not increase, just that the “share” may not increase. Even that weak reassurance only applies to the new $80 billion, not to the rest of the agency’s budget. Said another way, Secretary Yellen directed that as much as 95% of the new audits should be directed at taxpayers making less than $200,000.

After Democrats passed legislation last year that led to record inflation and has pushed us toward a recession, their next priority was spending $80 billion to audit and investigate American workers. Once again, Democrats are showing they have no real ideas to ease the economic struggles of families around the country.

Next Article Previous Article