Democrats' Handout for the Wealthy

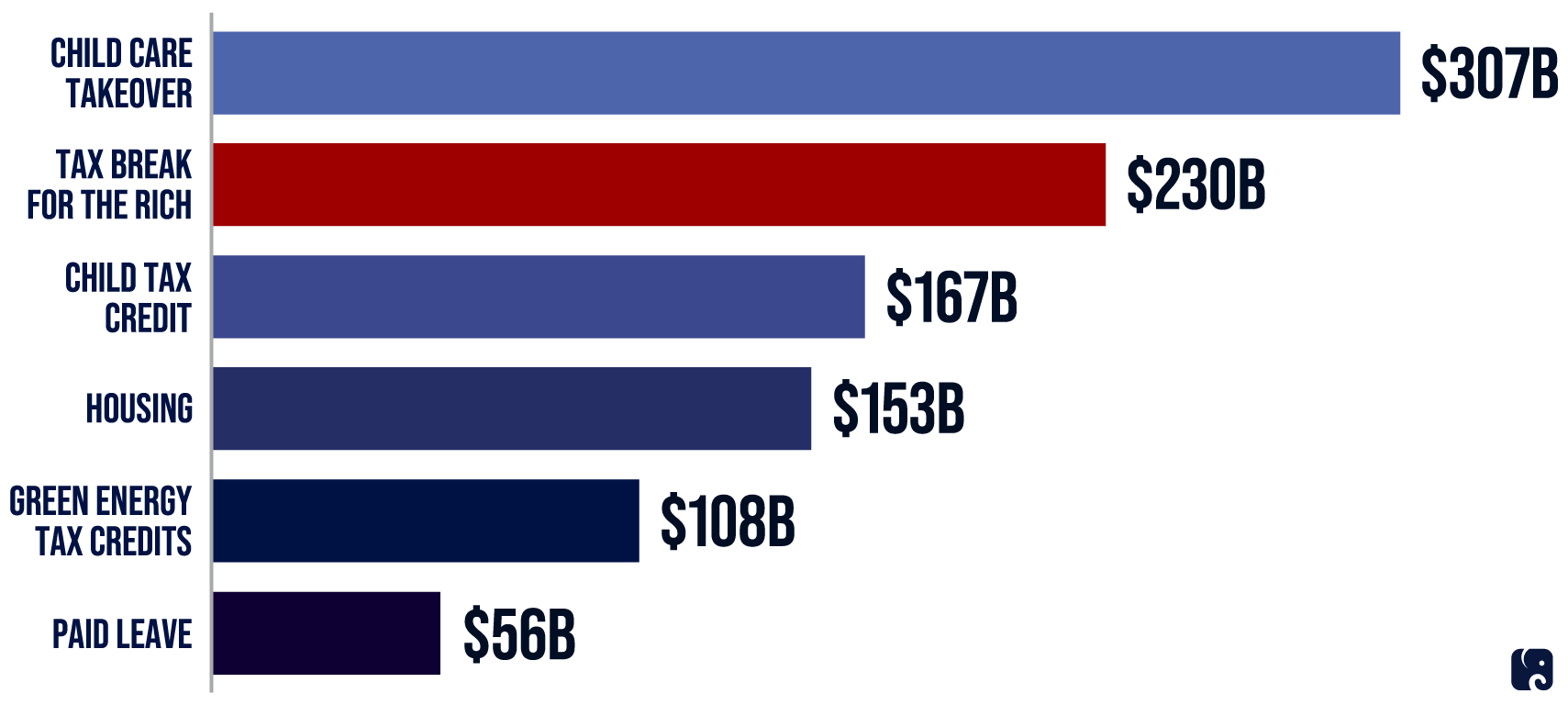

As Democrats negotiate with themselves on their out-of-touch, reckless, tax and spending spree, they continue to prioritize tax breaks for the wealthy. The House-passed bill would increase the cap on the deduction for state and local taxes from $10,000 to $80,000 – and even make the tax break retroactive for 2021. This handout, estimated to carry a $230 billion price tag, is one of the most costly policies in the first five years of their legislation. Democrats try to sell the bill as their “transformational” agenda for things like housing, welfare, and energy, but it’s clear what their priority really is.

Democrats Prioritize Tax Breaks for the Rich in their Spending Bill

Like previous iterations of their SALT schemes, the benefits of increasing the SALT deduction cap to $80,000 would go almost exclusively to the highest earning Americans. The liberal Tax Policy Center calculated that nearly 85% of the benefit would go to the wealthiest 10% of tax filers, and 94% would go to the top 20%.

Benefits Almost Exclusively for the Rich

Aware that handouts to high earners fail any test of what the American people want, Senate Democrats have floated plans to make the bailout a little less obvious. But they haven’t changed the basic bias toward the richest. No matter how they spin it, a more generous SALT deduction is an expensive idea that disproportionally benefits wealthy Americans living in expensive ZIP codes.

Next Article Previous Article