A Universal Government Income During a Worker Shortage

In their reckless tax and spend spree, Democrats are plotting a long-term transformation of the Child Tax Credit into a universal, government-paid income, with no requirement to work. Modeled after “temporary” changes enacted in their partisan “COVID relief” law, the CTC would be reestablished as a monthly child allowance.

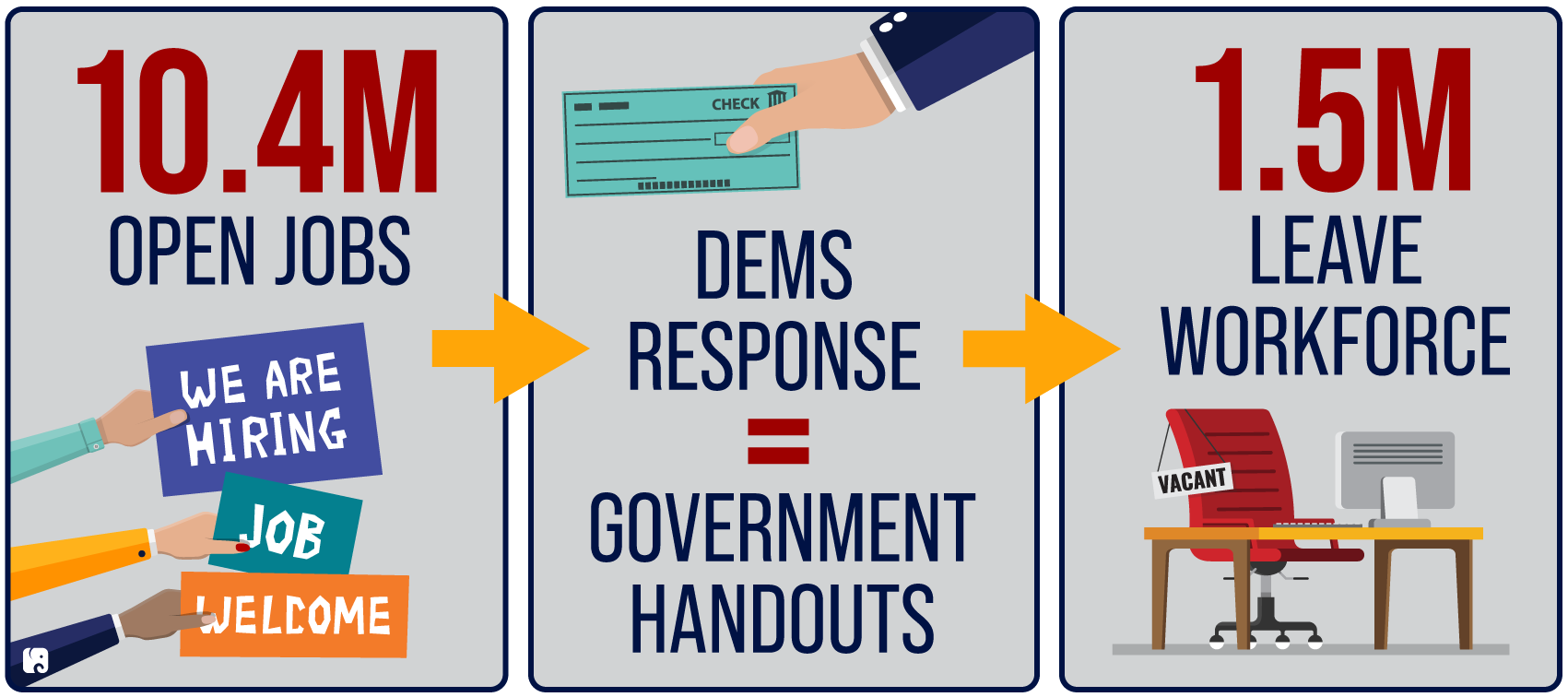

A new study from the University of Chicago found that the proposal’s design disincentivizes work and would cause a whopping 1.5 million parents to leave the labor force altogether. That doesn’t even take into account people who would choose to work less. Meanwhile, there are 10.4 million open jobs across the country. The lackluster September jobs report showed little progress, and the U.S. is already missing about 4.3 million workers compared to pre-pandemic labor force participation levels. American businesses are struggling to meet consumer demand without sufficient workers.

Democrats’ Bad Answer to the Worker Shortage

To accelerate our nation’s economic recovery, we need more people joining the labor force, not more people leaving it. But Democrats are pushing a plan that will lead to an exodus of workers. Notably, the researchers estimate that the income people lose as a result of this exit will significantly diminsh child poverty reduction effects Democrats claim they can achieve through their scheme. Underwriting able-bodied people who choose not to work will do nothing to help families secure better opportunities for their children, and it will exacerbate the threats to our nation’s long-term economic vitality.

Next Article Previous Article