Understanding the New Obama CPI

The President included a chained Consumer Price Index (CPI) proposal in his budget, which is a start toward real reform. But he did not propose the traditional idea of chained CPI; instead he proposed a “superlative CPI.” The White House claims this is chained CPI that would “protect vulnerable populations.” In other words, it would be means tested.

“… means-testing chain CPI defeats the alleged purpose of the change. Why not just go all the way and invent a new measure called Obama CPI?”

-- “The Obama Price Index,” Wall Street Journal, 4/11/13

Even without this change, chained CPI is not a reform proposal in and of itself – it is a technical adjustment that the White House concedes would better estimate how consumer purchasing behavior changes when prices rise. In the first year, this more accurate inflation measure would reduce government overpayments by $0.25 on a $100 government check. This proposal should be a small portion of real reform that strengthens entitlements for generations to come. It speaks to how unserious the President’s budget is that this technical inflation adjustment placeholder is the “highlight” of his budget.

Differences between real chained CPI and the President’s proposal

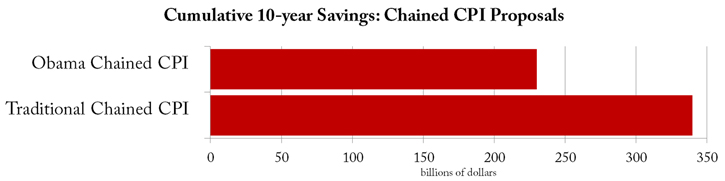

By proposing a new version of chained CPI, the President drastically reduces the amount saved. Obama’s proposal would save $230 billion over 10 years. A traditional chained CPI would save approximately $110 billion more -- CBO estimated in March that a traditional chained CPI would lower deficits by $340 billion over 10 years.

Moreover, the Administration insists that the President will only agree to chained CPI if it is included in a “balanced” package that includes separate tax increases.

Carve-outs from the New Obama CPI

The President would exempt the following groups from his new chained CPI:

(1) The “very elderly,” with age undefined;

(2) Others who rely on Social Security for long periods of time, with time undefined (presumably these are people on Disability Insurance benefits for long periods); and

(3) Means tested benefit programs. For example, Supplemental Security Income would continue to use the current CPI.

The Obama CPI change would apply to all portions of the tax code that are adjusted for inflation -- from the indexing of tax brackets to income-sensitive benefits such as the Earned Income Tax Credit.

While it is encouraging that the President has finally embraced at least a technical adjustment that affects entitlements, his actual proposal allows too much spending to continue to increase at more than the level of true inflation.

Next Article Previous Article