Obama Budget: Health Care Law Costs Soar

The President’s budget doubles down on his health care law – proposing billions of dollars in new taxpayer spending to implement its components. Increases in discretionary spending to implement the health care law outlined below total approximately $5.4 billion next year.

Upon close review, the Obama plan shows Washington Democrats were not honest with the American people about two things: 1) the total cost to administer the health care law; and 2) the ease with which the law’s programs would be designed, implemented, and run.

More Taxpayer Money for:

- Washington Bureaucrats

- The Federal Exchange

- State Exchange Grants

- Exchange “Outreach and Education” Spin

- Information Technology Systems

- Medical Loss Ratio Oversight

- Medicaid Expansion Implementation

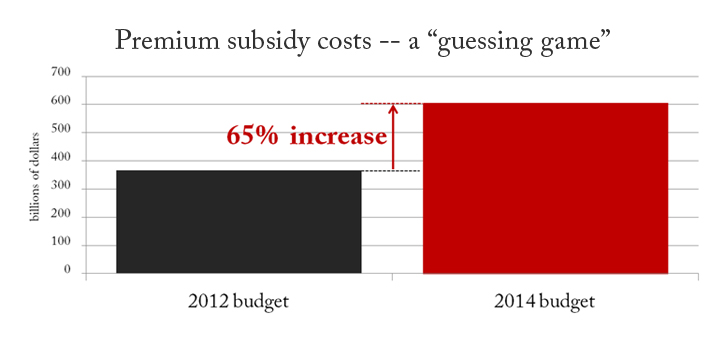

Taxpayer Premium Subsidy Costs Skyrocket

Buried deep in President Obama’s budget is an estimate showing that the Administration will spend approximately $606 billion from 2014 to 2021 on premium subsidies. These subsidies can go to people between 100 and 400 percent of the federal poverty limit who need extra help to buy more expensive, government mandated insurance in the new exchanges.

Using the White House’s own data, the subsidy program’s cost projections have dramatically spiked in just the past two years. This year’s cost is 27 percent higher than the President’s fiscal year 2013 budget submission, which totaled $478 billion for the same years: 2014 to 2021. And it is 65 percent more than the estimate included in the fiscal year 2012 Obama budget totaling $367 billion for the same eight years. A recent Politico article says the Obama Administration’s budget is simply a “best guess of how much it will spend to subsidize insurance on Obamacare exchanges” but that “the truth is that the cost is still a guessing game.”

More Taxpayer Money for Washington Bureaucrats

Implementing the health care law is not only about money – it’s also about workforce capacity. According to the Department of Health and Human Services:

“For FY 2014, the Budget requests $772 million for [Centers for Medicare and Medicaid] CMS administrative costs … Of this total, $634 million will support a full-time equivalent (FTE) level of 4,635, an increase of 280 FTEs over FY 2012. This staffing increase will enable CMS to address the needs of a growing Medicare population as well as oversee expanded responsibilities resulting from the Affordable Care Act and other legislation passed in recent years.” (HHS Budget in Brief, p. 89)

Additionally, the Internal Revenue Service budget requested a $439.6 million funding increase and 1,954 FTEs in order to conduct its health law responsibilities. (IRS Budget in Brief, p. 19)

Recall that the Treasury Inspector General for Tax Administration (TIGTA) found that the IRS is not equipped to implement a law containing the “largest set of tax law changes in more than 20 years.” It said the IRS had not conducted a thorough review of each provision of the law it will be required to implement. Consequently, TIGTA said it was “unable to determine whether the IRS has an adequate workforce in place or planned.”

More Taxpayer Money for the Federal Exchange

The health care law mandates states create a health insurance exchange. If a state refuses to create its own exchange, then the health care law mandates that the federal government step in and do it for them. While the law appropriates generous sums to help states create their own exchange, it did not provide any funding to set up the federal exchange.

The Obama Administration now wants “$803.5 million for CMS activities to support Marketplace operations in FY 2014. CMS will also collect user fees from insurers participating in the [Federally-Facilitated Marketplace] and [State Partnership Marketplaces] beginning in January 2014 to support Marketplace operations.” (HHS Budget in Brief, p. 88)

More Taxpayer Money for State Exchange Grants

President Obama’s budget shows the Administration spent $1.5 billion on state exchange grants in 2013 – even though HHS has only conditionally approved 17 states and the District of Columbia to operate state based exchanges starting next year. The budget blueprint requests an additional $2.1 billion in 2014. (HHS Budget in Brief, p. 79) Secretary Sebelius has budget authority to fund exchange grants through 2015, but she does not have the authority to divert these dollars to help HHS construct the federal exchange.

More Taxpayer Money for Exchange “Outreach and Education” Spin

According to HHS’ own documents, the agency spent $56.1 million during fiscal year 2012 on health care law public relations work with outside contractors. The Obama budget includes an additional “$837 million in discretionary funding for beneficiary education and outreach activities through the National Medicare Education Program and consumer support in the private marketplace, including $554 for the [exchanges].” (HHS Budget in Brief, p. 88)

More Taxpayer Money for Information Technology Systems

The budget “includes $519 million for general IT systems and other support, such as systems to manage and administer Medicare Advantage and the Part D benefit, the [federal exchange] IT systems and Marketplace data services hub, and CMS’ data center and telecommunications infrastructure.” (HHS Budget in Brief, p. 88)

More Taxpayer Money for Medical Loss Ratio (MLR) Oversight

The health care law mandates very strict MLR standards. The MLR measures the share of a health care premium dollar spent on medical benefits – not other company expenses or profits. It is unclear how much more insurance companies could reduce costs without negatively affecting the quality and supply of health insurance in the marketplace. However, President Obama’s budget “requests $18.4 million for CMS contracts to ensure compliance with the private insurance provisions contained in the Affordable Care Act, notably the Medical Loss Ratio and Rate Review Premium provisions.” (HHS Budget in Brief, p. 88)

More Taxpayer Money for Medicaid Expansion Implementation

Health care reform could have given states flexibility to enact common sense reforms to meet the unique needs of their state. Instead, President Obama’s health care law traps millions of low-income Americans in a failing Medicaid system where nearly one-third of physicians say they cannot afford to accept new patients. The Obama budget ignores state ingenuity and asks Congress provide “$24 million to fund administrative activities to improve Medicaid and CHIP program operations and implement new responsibilities under the Affordable Care Act.” (HHS Budget in Brief, p. 89)

Health Care Law Crushing Small Business

The health care law included a tax credit for small businesses. It was intended to help small business owners offset the cost of the federal government mandating employers offer health insurance. The Democrat’s tax credit, however, was a failure. It actually penalized small businesses for raising wages and hiring new workers. As designed and implemented, job creators balked at the credit’s complex format and application process.

President Obama’s budget proposes expanding the health care law’s small business health insurance tax credit. (Treasury Green Book, p. 29). The new policy would allow all employers with up to 50 full-time workers to be eligible for the tax credit. It also increases the credit phase-out from 10 to 20 full time employees. The Office of Management and Budget estimates this policy change will cost $10.4 billion over 10 years. (Treasury Green Book, p. 242)

Doubling Down on IPAB

IPAB’s sole purpose is to cut Medicare spending based on arbitrary budget targets. These are cuts above and beyond the $716 billion taken from a bankrupt Medicare program to spend on the health care law. IPAB empowers 15 politically appointed Washington bureaucrats to make these Medicare cuts, without full transparency and accountability to America’s seniors and their elected officials.

In creating IPAB, the President demonstrated that he did not possess the courage to make tough Medicare reform decisions. Instead, he took the easy road. President Obama and Democrats in Congress abdicated responsibility to explain to the American people specific payment changes necessary to keep Medicare solvent and protect the program for future generations. When the decision was politically tough, President Obama refused to lead.

Once again, the President’s budget contains a proposal enhancing IPAB’s authority. The President increases the health care law’s IPAB to cap Medicare cost growth per patient to GDP plus 0.5 percent beginning in 2020. In the fiscal year 2013 budget, an identical policy had no score. In his fiscal year 2014 budget, the President now says this policy saves $4.1 billion over 10 years. (HHS Budget in Brief, p. 56)

Next Article Previous Article