The Debt Limit Is Back

-

The debt limit will go back into effect on March 16.

-

The Treasury Department can delay the date by which Congress must act until October or November of this year.

-

Leader McConnell: “We’re … not going to shut down the government or default on the national debt.” (CBS, Face the Nation, 3/8/15)

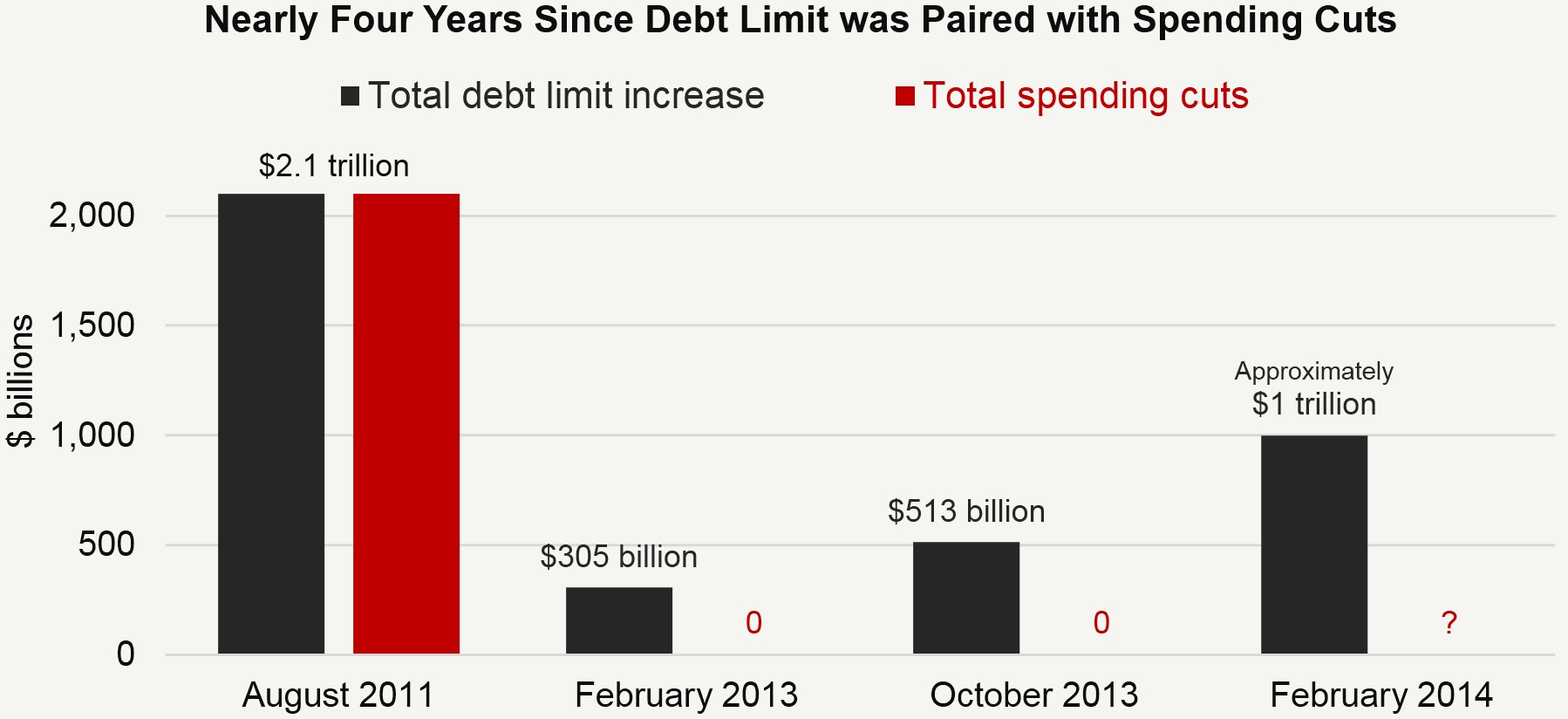

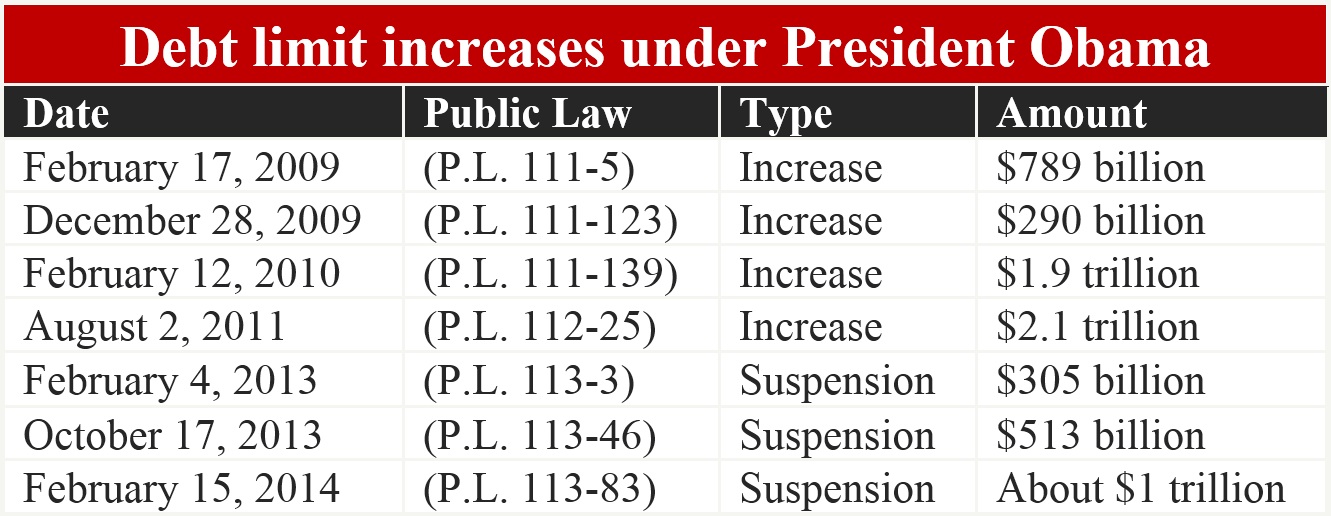

After disappearing for 13 months, the debt limit will be back on March 16. In February 2014, Congress passed P.L. 113-83, which suspended the debt limit statute. Beginning on March 16, the debt limit will go back into effect at a higher level, to reflect the debt that has accumulated over the last 13 months. The increase in the debt limit since that time will total approximately $1 trillion.

Treasury Secretary Lew said in a March 6 letter to Congress that his department will begin using “extraordinary actions” this week to avoid breaching the debt limit while still paying all obligations. CBO estimates that these actions will allow all payments to be made until October or November.

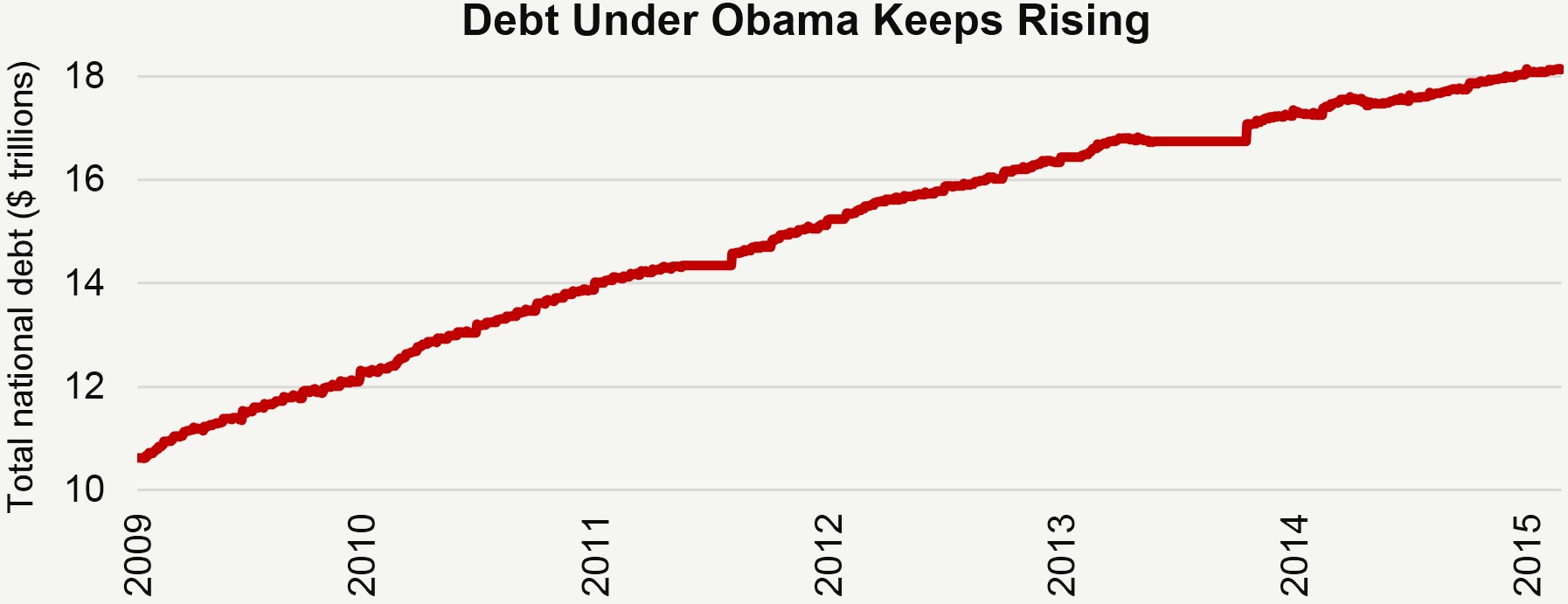

Debt Continues to Increase

The national debt has increased by more than $7.5 trillion since President Obama took office. He still refuses to negotiate on the debt limit, and instead brags about cutting the deficit. Any deficit means that the national debt continues to increase; and deficits are slated to increase again in just two years.

Mandatory Spending Continues to Drive the Debt

Mandatory spending is the driver behind Washington’s long-term debt problems. Last summer, CBO reported that health spending will increase as a share of the total federal budget – from 24 percent in 2014, to 31 percent in 2039. Interest costs will triple as a share of the budget – from six percent in 2014 budget to 18 percent in 2039. Social Security will stay roughly the same as a share of the budget under CBO’s assumption that benefits will continue to be paid in full, regardless of the finances of the trust funds.

These increases squeeze other portions of the budget. Discretionary spending will decrease from one-third of the budget in 2014 to just one-fifth in 2039. By putting the budget on autopilot and refusing to make tough choices now, the president is putting the nation on a path to a budgetary crisis in which our creditors will force us to make even tougher choices.

The last three debt limit bills passed by Congress suspended the limit instead of raising it. Under this process, when the debt limit goes back into effect, the previous limit is raised by the amount of debt subject to the limit that was accumulated during the suspension period. These last three debt limit suspensions total approximately $1.8 trillion.

Treasury Tries to Delay the Inevitable

The following are methods that the Treasury Department can use to delay the date on which the U.S. government can no longer pay its obligations without additional borrowing.

Routine methods:

- Use cash balances. Treasury maintains cash balances with the Federal Reserve, and can draw on these to pay obligations that would otherwise be financed with new borrowing. However, it must maintain an adequate balance in the Federal Reserve account, because the Fed is legally prohibited from loaning the Treasury funds in the event of an overdraft.

- Issue cash management bills. CM bills are Treasury’s method of borrowing cash for very short periods, usually just a few days at a time. When close to the debt limit, Treasury can use CM bills in a two step process that favors short-term borrowing over long-term borrowing. First, Treasury either reduces the overall amount it seeks to borrow via long-term securities auctions, or it actually delays those auctions by a few days or weeks. Second, it replaces the lost borrowing with CM bills. Because this strategy involves altering regularly scheduled securities auctions and borrowing less money over a shorter time, GAO has said that it likely increases the long-term cost of borrowing money.

Extraordinary actions:

- Suspend G-Fund investments (approximately $191 billion of headroom under the debt limit). The Thrift Savings Plan, a federal employee retirement program, invests a portion of its employee and employer contributions in Treasury securities through what it calls the G Fund. Treasury can suspend this investment when close to the debt limit. This action ensures that no new debt is incurred in this program until after the debt limit is increased. After the limit is raised, Treasury is legally obligated to repay lost interest on these uninvested funds.

- Suspension and disinvestment of CSRDF investments (approximately $186 billion through September). The Civil Service Retirement and Disability Fund is a trust fund for federal retirement that invests in Treasury securities. Once the debt limit has been reached, Treasury can declare a “debt issuance suspension period” that allows Treasury to take two separate actions: (1) suspend new CSRDF investments in Treasury securities; and (2) disinvest some Treasury securities held by the CSRDF. By law, the treatment of investments in the CSRDF must be duplicated for investments to the Postal Service Retiree Health Benefits Fund.

- Suspend issuance of SLGS securities and savings bonds ($40 billion to $90 billion through September). Established in 1972, State and Local Government Series securities are offered by Treasury to help state and local governments invest their bond proceeds. This Treasury action does not actually lower the debt subject to the limit. Since SLGS securities can be issued any day that a state or local government would like to purchase them, suspending their issuance temporarily halts Treasury borrowing in this particular program until after the debt limit is raised. CBO reports that SLGS borrowing is between $6 billion and $15 billion per month, while savings bonds typically are less than $1 billion per month. This action is typically the first extraordinary one used when the government gets close to the debt limit. Secretary Lew confirmed this in his letter of March 6, when he said that Treasury will suspend the issuance of these securities on March 13.

- Suspend ESF investments (approximately $23 billion). The Exchange Stabilization Fund holds several types of assets, one of which is U.S. dollars. ESF often invests its excess dollars in Treasury securities. By suspending ESF investments, Treasury prevents another program from increasing the debt subject to the limit.

- Other methods outside of Treasury’s authority. Congressional action is required to allow any additional borrowing if all Treasury options have been exhausted. For example, Congress once passed a measure that allowed the March 1996 Social Security benefits to be paid with borrowing that was temporarily designated as not subject to the debt limit.

Next Article Previous Article