Obamacare SCOTUS Ruling Looms

-

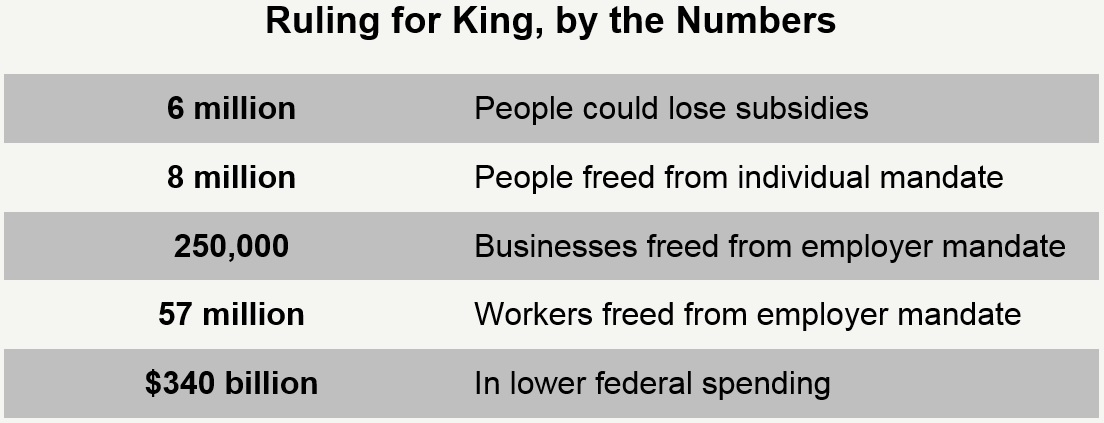

In states using the federal exchange, a ruling in favor of King would eliminate subsidies and the employer mandate, and lessen the individual mandate – significantly reducing federal spending and deficits.

-

It would preserve separation of powers, and protect against unauthorized executive branch taxing and spending schemes.

-

Republicans are crafting policies to protect people harmed by unlawful administration actions and to create a bridge away from Obamacare.

Last week, the Supreme Court heard oral arguments in the case King v. Burwell. The key issue in the case is the legality of an IRS regulation that extends subsidies to people in states using the federal health insurance exchange. As written, Obamacare limits these subsidies to people buying insurance in exchanges established by states, not the federal government.

Relief from individual and employer mandates

The plaintiffs in King are harmed by the IRS rule due to how the subsidies trigger penalties under the individual mandate. They are suing on behalf of millions of people who have been subjected to the individual mandate by the IRS’ unlawful interpretation of the Obamacare statute. Obamacare contained an affordability exemption from the mandate penalty for people with unaffordable premiums. Without the subsidies to lower their out-of-pocket premium, Obamacare coverage would meet the law’s definition of “unaffordability” for many more people.

Three other sets of plaintiffs – including the states of Oklahoma and Indiana – have also brought suit over the IRS rule. They are suing, in part, because the subsidies also trigger penalties under the employer mandate, meaning that IRS’ actions also expanded the employer mandate beyond what the law allowed.

One expert estimates that a ruling in favor of King would free more than eight million people from the individual mandate and more than 250,000 businesses and 57 million workers from the employer mandate.

Coverage implications

A ruling for King would also likely affect the out-of-pocket premium share of about six million federal exchange enrollees receiving subsidies. On average, these enrollees are receiving subsidies to cover about three-quarters of the cost of their coverage. Experts assume that most people getting subsidies would drop Obamacare’s costly coverage when faced with the full price. As healthier people are more likely to drop coverage, insurers will potentially face large losses.

Despite urging from Senate Republican leaders last year, the president and his secretaries at Treasury and Health and Human Services refused to tell people signing up for coverage through the federal exchange about the potential implications of the court case.

In contrast, the administration negotiated relief for insurance companies late last year if the subsidies were determined unlawful in states with federal exchanges. According to an October 21, 2014, Forbes article, the administration, at the request of insurers, included in their 2015 contracts a “clause assuring issuers that they may pull out of the contracts, subject to state laws, should federal subsidies cease to flow.”

If the subsidies cease, people’s coverage does not immediately end. As long as people continue to pay the total premium, they will remain covered. One American Enterprise Institute health care economist has noted that federal rules would let people keep their coverage for at least another 30 days, even if they fail to pay their next monthly premium. He pointed out that “some state laws provide similar or additional protections. Insurers wishing to quickly exit the non-state exchanges cannot do so immediately under their current contracts.” If insurers want to cancel exchange plans, they must offer people similar coverage for the rest of the year.

On March 6, a report on CNBC quoted one tax expert who expected that IRS “can, and likely will, let HealthCare.gov customers keep their Obamacare subsidies through the end of this year if the high court rules in June that those subsidies are illegal.” He noted that continuing credits for the rest of the year for people already receiving them would be consistent with past IRS practices.

Preserving separation of powers

The central issue in King is not Obamacare – it is whether the executive branch must enforce the laws that Congress passes or whether it can make up laws and rules to its own liking. A court ruling against the IRS’ actions would help preserve the proper balance of powers among the three branches of government.

By expanding subsidies to states using the federal exchange, the IRS rule increased spending beyond what Congress authorized. According to the Congressional Budget Office, Obamacare’s subsidies will increase Washington’s debt by $849 billion over the next decade. CBO estimates that about 87 percent of the budgetary cost of Obamacare’s subsidies will result from new spending, with the rest coming from a decline in tax revenue.

Since most states have opted against creating an exchange, a court decision striking down the IRS rule would reduce future taxpayer obligations by several hundred billion dollars over the next decade alone. The Urban Institute estimates that a ruling for King could reduce federal spending on subsidies by $340 billion over the next decade.

A bridge away from Obamacare

Without any congressional action, a court ruling against the administration would end the IRS’ unlawful enforcement of the individual mandate and employer mandate in states using the federal exchange. That ruling would put Congress in a position to create a bridge away from Obamacare, while protecting people harmed by the administration’s unlawful distribution of subsidies.

The administration has attempted to scare the court by predicting major disruption if the IRS rule is struck down. In a February 24 letter, Health and Human Services Secretary Sylvia Burwell wrote: “We know of no administrative actions that could, and therefore we have no plans that would, undo the massive damage to our healthcare system that would be caused by an adverse decision.” With such statements, the administration acknowledges that expensive subsidies are needed for relatively young and healthy people to purchase Obamacare’s mandate-laden, high deductible, narrow provider network insurance. Without these people in the risk pool, average premiums would rise even higher.

The administration is ignoring a commonsense proposal raised by health insurance actuaries. On February 24, the American Academy of Actuaries wrote to Burwell asking her to give health plans flexibility with bids next year – allowing plans to resubmit bids or allowing plans to submit two initial bids – if the court rules for King. That would ensure that premiums are sufficient to cover costs.

Justice Alito noted that if the court sides with the challengers, it could delay the remedy for the rest of the year. He also commented that states would still have the option of establishing exchanges.

“But here, it’s not too late for a state to establish an exchange if we were to adopt petitioners’ interpretation of the statute. So going forward, there would be no harm.”

– Justice Alito

Justice Scalia added that, if the problem were so severe, Congress would take action.

Justice Scalia: “You really think Congress is going to sit there … Congress adjusts, enacts a statute that takes care of the problem. It happens all the time. Why is that not going to happen here?”

Mr. Verrilli: “Well, this Congress, your honor …” (Laughter)

Justice Scalia: “I don’t care what Congress you’re talking about. If the consequences are as disastrous as you say, so many million people without insurance and whatnot, yes, I think this Congress would act.”

In the last two weeks, Republican leaders in both the Senate and House have put out plans for providing states with an alternative to Obamacare’s heavy-handed rules and mandates. These plans recognize that states know the needs of their unique populations better than Washington and that states do a better job of regulating health insurance than the federal government.

Other lawmakers have introduced creative ideas as well. Republicans will continue to develop these proposals during the spring with the aim of stopping Obamacare’s damage while increasing health care freedom and lowering health care costs.

Next Article Previous Article