The Changing Gig Economy

KEY TAKEAWAYS

- Technological innovations and the proliferation of smartphones have driven much of the advancement of the gig, or freelance, economy in recent years.

- Gig economy workers have been hit hard by the coronavirus pandemic and state shutdown orders, though some fields like food delivery have seen an increase in demand.

- Last year, California passed a law requiring many companies to classify their workers as employees rather than independent contractors; independent contractors get more control over their daily life than employees but do not qualify for the same benefits and protections.

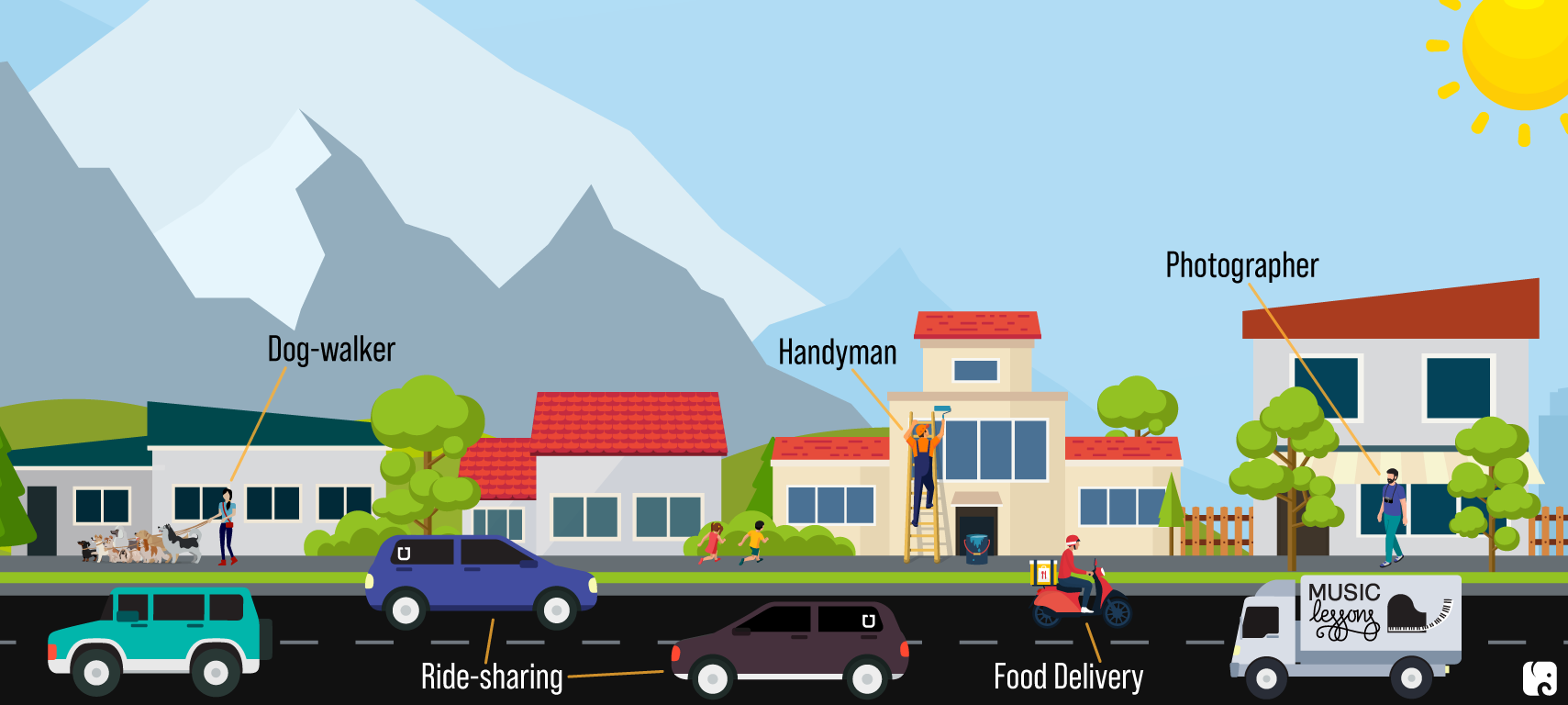

The “gig economy” is a relatively new term for a traditional way of earning a living: being paid on a per-job basis for work performed directly for a customer. It also generally involves the jobs being connected through a third party that the two sides of the transaction use to find each other. Examples include ride-sharing services like Lyft, chore services like TaskRabbit, and delivery services like Instacart. Gig economy workers are generally classified as independent contractors, though California recently passed a law limiting this classification.

using tech to match the modern economy

There have always been people whose income came from working “gigs” as musicians, freelance writers, handymen, movers, home cleaners, seamstresses, and other jobs. What’s new is the technology that has enabled service providers to connect with customers in ways they couldn’t before, with smartphones and apps as the cornerstone. For example, GPS technology and software allow ride-sharing companies to connect riders and the nearest driver much more easily than a taxi dispatcher could have previously. Instant feedback in the form of driver ratings encourages better service. Encryption technology keeps transactions secure and allows the apps to be trusted middlemen between two parties, for a more streamlined experience. These and other technologies have opened the door for millions of additional people to work as drivers and to use the services much more easily.

The new opportunities created by technology, connecting service providers with customers, has caused enough growth that gig work can be considered its own segment of the economy, and one that had become something of a bright spot prior to the coronavirus pandemic. While the lack of a formal definition or industry classification prevents precise calculations, one group estimated that in 2018 “independent” workers contributed $1.28 trillion to the U.S. economy. Another study, by a labor union, estimated that 57 million Americans engaged in at least some freelance work last year and accounted for 4.8% of U.S. gross domestic product.

Gig Economy Covers a Wide Range of Jobs

Workers may be attracted to gig work, either as their only source of income or as a side job, by the low barriers to entry, autonomy, and flexibility of hours. The basic requirements for becoming a shopper on Instacart are being at least 18 years old, being eligible to work in the U.S., having consistent access to a vehicle and a smartphone, and being able to lift 50 pounds. Pay varies widely, but has been estimated to fall between $10 and $17 per hour on average.

Workers tend to have a great degree of flexibility on the platforms, with the ability to sign on and off when they choose and to work as many or as few hours as they want. This is a significant benefit to people who work in the gig economy as a second job, students, older people looking to supplement retirement income, and workers who just prefer to set their own schedules.

The nature of work in the gig economy is not without its drawbacks. The lack of predictability of hours and earnings can have negative effects on people’s control over their finances and can increase stress and anxiety.

impact of the coronavirus pandemic

Gig economy workers have been hit hard by the coronavirus pandemic. While some gigs like food and grocery delivery have seen an increase in demand, many others, like those in the ride-sharing industry, have seen a dramatic drop. Some gig workers have become “essential,” delivering groceries, meals, medicine, and other items. Without them, the economy might have suffered even greater declines. Yet some workers have reportedly quit the platforms due to a sharp drop in demand, as well as concerns about their own safety. Some of these workers may move to other sectors of the economy as jobs become available – Amazon announced in March that it would hire hundreds of thousands of warehouse workers to respond to an increase in online shopping orders.

Other people have switched jobs while still doing gig work. Uber reported revenue from rides dropped by 73% in the second quarter of 2020 versus a year earlier. But some drivers who lost work moving people around added jobs moving objects – revenues for UberEats meal deliveries increased 113%. Overall, the company’s revenue was down 32% in the quarter.

Uber Rides Plummet, Food Deliveries Skyrocket during Pandemic

One informal survey of 21 industry executives found that they expect some sectors of the freelance economy will suffer in the short term, but overall they believe the long term prospects for gig work are still good. As the economy rebounds, the flexible nature of the work will likely prove a strength, as companies will be cautious with their spending in the face of uncertainty.

The Coronavirus Aid Relief and Economic Security Act that Congress passed in March included a number of provisions to help gig economy workers weather the coronavirus pandemic. It enabled gig workers for the first time to qualify for unemployment insurance. Generally, they can receive up to 39 weeks of benefits if they are unemployed or unable to work because of certain COVID-19 related reasons. Gig workers also qualified for the additional $600 per week in unemployment benefits that expired at the end of July. On August 8, President Trump directed the Federal Emergency Management Agency to work with states to continue extra unemployment payments. Gig workers would not be specifically excluded from these payments.

The Health, Economic Assistance, Liability Protection, and Schools Act introduced by Senate Republicans would let gig workers continue to qualify for unemployment insurance benefits. But it would require them to provide documentation showing they were employed or self-employed, rather than just self-certify that they lost income, as they did under the CARES Act. The HEALS Act also includes a provision to help workers by allowing the gig economy companies to provide some COVID-related benefits, including testing, tax free.

The future of GIG work

Workers in the gig economy are usually classified as “independent contractors” for purposes of labor and employment law. Independent contractors are hired and paid by the job and are not employees. They are more free to set their own schedules, take gigs that interest them, and come and go as they please.

Traditional employees generally have much less flexibility at work. They are often expected to report to work at a certain time and stay until a certain time, and they may have less autonomy in terms of the tasks they do. These workers trade away some control over their work day, and in return they get a consistent paycheck, legal protections like workers’ compensation, and benefits such as health insurance and paid time off for vacation and illness. Gig workers get much more control over their daily life, but they do not qualify for the same benefits and protections as traditional employees. Since the start of the pandemic, workers who have seen their way of making a living disappear virtually overnight may value things like health benefits, sick pay, and the stability of traditional jobs in a way they may not have before.

In 2018 the California Supreme Court created a three-part test to determine if companies should classify workers as employees or independent contractors, and the state legislature passed a law last year implementing this test. The practical effect is that many more gig economy companies are required to classify their workers as employees. The legislation was controversial, as freelancers and gig workers from industries as varied as truckers, musicians, and writers claimed the law would devastate their businesses. Some professions were able to secure exemptions from the law, including doctors, dentists, psychologists, insurance brokers, real estate agents, architects, accountants, and lawyers. Supporters of the law argue it will strengthen workers’ rights and provide benefits like a guaranteed minimum wage. There is also an initiative on the November ballot in the state that would retain the classification of gig workers as independent contractors while offering some wage and benefit guarantees.

Uber and Lyft refused to reclassify their workers as employees, and California filed suit. Earlier this week, a California judge ruled in favor of the state and granted a preliminary injunction requiring the companies to classify drivers as employees. The companies have requested the judge’s order be stayed while they appeal and said they would need to shut down in California until at least November to retool their business models and technology if the ruling remains in place. The CEO of Uber has argued for a “third way” that would allow workers to have the flexibility of gig work along with access to benefits like health insurance and paid time off. The outcome of the case may have significant repercussions for how ride-share and other gig economy companies classify workers across the country.

Next Article Previous Article