Territorial Taxation – A Globally Competitive Tax System for Economic Growth

- Worldwide taxation makes the U.S. less competitive, hurts jobs, and depresses wages by encouraging businesses to leave money and jobs overseas.

- U.S. firms are holding $2.6 trillion in profits overseas because it would be taxed if brought back home.

- A territorial system and lower corporate rates would help keep tax policy out of business decisions, allowing American companies to invest in job creation and economic growth at home.

U.S. corporations operating overseas are currently taxed on every dollar they earn throughout the world, and then penalized for bringing their profits back home to invest. The tax reform framework crafted by congressional leaders and the Trump administration would create better incentives to create jobs at home by putting the U.S. under a territorial system.

The Territorial Tax Is Better for U.S. Jobs

Worldwide Tax – The Way Things Are

The United States has a worldwide tax system. Under this system, a corporation headquartered in the U.S. must pay the corporate income tax on all of its income, regardless of whether it is earned in the U.S. or overseas. The business pays this tax when the foreign earnings are “repatriated” by bringing the income back to the U.S. This is known as “deferral,” because the income tax owed can be deferred until a later date when the income is repatriated. When a business chooses to repatriate earnings and pay the U.S. corporate income tax, the law also allows what was paid to a foreign government to offset a portion of the amount of U.S. tax that the corporation would otherwise have to pay.

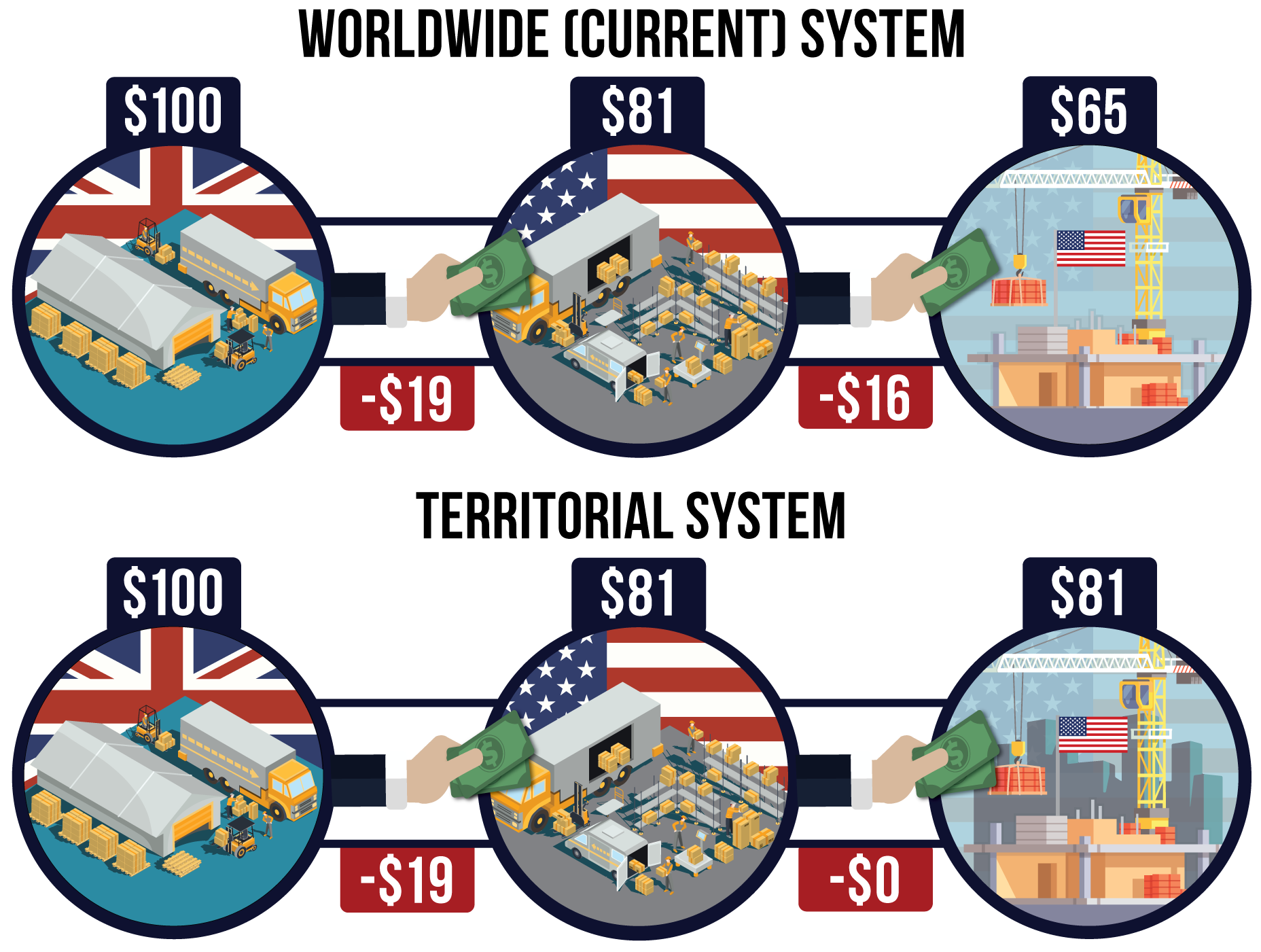

Here’s how it would work for a corporation in the 35 percent tax bracket that repatriates $100 of profit earned in the United Kingdom. Under our worldwide system, it would owe $35 in U.S. tax. It has already paid $19 in tax to the United Kingdom, covering the country’s 19 percent corporate tax rate. It would then owe the U.S. government another $16 in order to bring the total tax paid on the $100 to the U.S. 35 percent tax rate.

We did not always have an uncompetitive corporate tax code. In the 1980s, 24 countries in the Organization for Economic Cooperation and Development had a worldwide tax system. The tax rates of most countries were comparable to the U.S. After the Tax Reform Act of 1986 brought the U.S. corporate rate down to 34 percent, the U.S. had a lower rate than most other developed nations. After the U.S. lowered its rate, other countries began to lower their rates and move to a territorial system. Today only seven OECD nations have worldwide tax systems, while 28 have territorial systems. Ireland kept its worldwide system, but lowered rates to 12.5 percent. In contrast, the U.S. has both the highest corporate rate of any OECD country, and also a worldwide system.

Why the Worldwide Tax Hurts Jobs

The current worldwide system not only penalizes corporations for bringing money to the U.S. to create jobs, it creates incentives to keep money overseas to invest in foreign jobs.

Our tax system penalizes corporations for bringing money back to the U.S. by taxing profits at the high 35 percent rate, even though taxes were already paid where the money was earned. This has a big effect on decisions to invest in U.S. jobs. If a business keeps its foreign income overseas, it can reinvest the money there without paying the U.S. tax. For a U.S. company to repatriate money and invest it here, its expected return must be higher than the foreign investment plus the U.S. tax on the repatriated money. This is a high hurdle for any investment to clear. U.S. firms currently have an estimated $2.6 trillion sitting overseas in cash and investments.

America’s worldwide tax system also creates incentives to borrow in the U.S. to finance overseas investment. Because a U.S. corporation’s interest payments are tax deductible, an American company can borrow in the U.S. and then invest that money in foreign markets. If the foreign income is not repatriated, the federal government has just given a tax break to finance foreign investment, and it would impose a tax if that income were brought back to the U.S. to be invested.

the Worldwide Tax Makes U.S. Firms Less Competitive

A September study by the Business Roundtable and the consulting firm EY showed the disadvantage of combining a worldwide system with a high tax rate. From 2004 to 2016, the high corporate tax rate caused an estimated $1,715 billion swing in business investment in the U.S. If the corporate tax rate were 20 percent, U.S. firms would have bought $1,205 billion in business assets in the mergers and acquisitions market. Instead, the actual result with our 35 percent tax rate was that U.S. business assets were acquired by foreign firms to the tune of $510 billion. The study assumed our worldwide system was still in place, it just looked at the effect of lower rates. This shows what taking away a high rate’s application to business income can do.

Territorial TAx – A Level Global Playing Field

The tax framework recently released by the administration and Republican congressional leaders includes a proposed move to a territorial tax system for corporate profits.

Under a territorial tax system, the U.S. would tax only the U.S. income of a corporation and would exempt foreign income. This would allow U.S. corporations to compete with foreign corporations on a level playing field by ensuring business decisions are not overly influenced by tax policy. The Senate Finance Committee will work out the details of the Senate proposal, including measures to guard against corporations shifting profits overseas. The committee also will work to make sure that U.S. subsidiaries of foreign companies have no competitive advantage over purely domestic corporations.

The time has come to finally fix two things that are hampering job growth in the U.S.: our high corporate rate and our worldwide tax system. Reforming these two aspects of our tax code will create jobs, increase wages, and make our corporations more competitive in today’s global economy.

Next Article Previous Article