High Corporate Taxes Hurt All Americans

- Corporate tax reform is a critical component of any effort to simplify and reduce taxes.

- The 1986 tax reform gave the U.S. one of the lowest corporate rates in the world; since then the rest of the world has reformed and lowered rates, while ours have stayed high.

- Workers, consumers, seniors, and savers bear the burden of high corporate rates. The right reform can benefit them and create jobs, encourage innovation, and promote new businesses.

As Congress debates comprehensive tax reform, it is important to include commonsense corporate tax reforms that will help the groups that really pay corporate taxes: workers, consumers, seniors, and savers. Reform that makes the corporate tax code simpler and fairer will help create jobs, spur innovation, and encourage entrepreneurs to form new businesses.

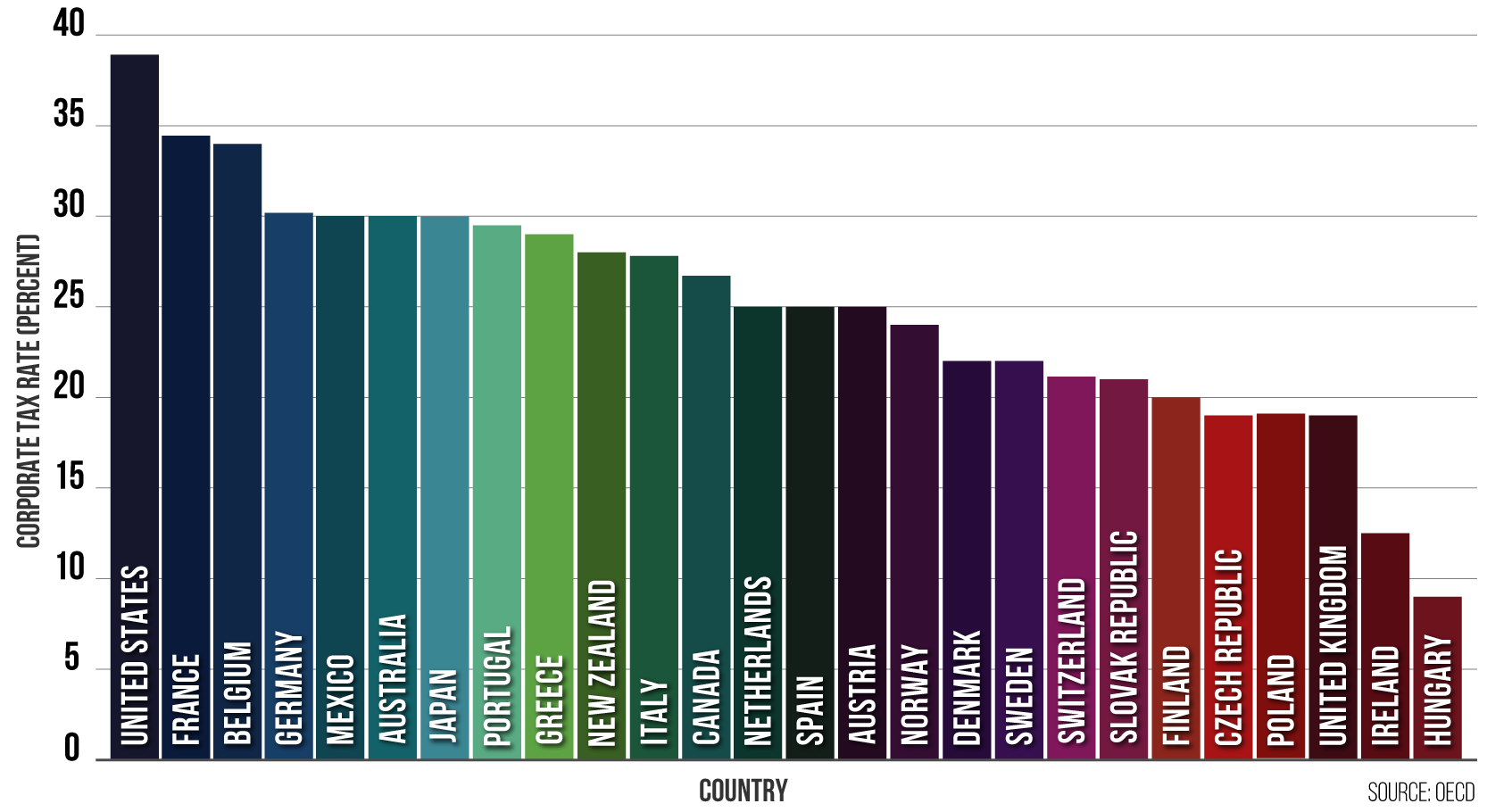

U.S. Has World’s Highest Corporate Tax Rate

People Pay Taxes

One of the most important things to understand about corporate taxes is that corporations do not pay them, people do. No matter what a corporation would have done with the money it paid in taxes, someone ends up with less money than they otherwise would have.

- Taxes hurt workers. The corporate income tax falls on workers by reducing wages. A study by scholars at the American Enterprise Institute concluded that a 1 percent increase in the corporate tax rate is associated with a 0.5 percent decrease in real wages. A 2007 Treasury Department survey of economic studies found that workers “bear a substantial burden” of the corporate income tax. The Congressional Budget Office concluded in 2006 that workers pay more than 70 percent of the cost of corporate taxes.

- Taxes hurt consumers. Corporate taxes raise prices for consumers. The amount varies depending on the product and how much buyers are willing to pay, but some of the cost always gets passed along.

- Taxes hurt seniors and savers. The majority of Americans own stocks, often in an IRA or 401(k) retirement plan. Millions of other people are invested in the markets through pension plans. These Americans bear the portion of any corporate taxes that cannot be passed on to workers or consumers.

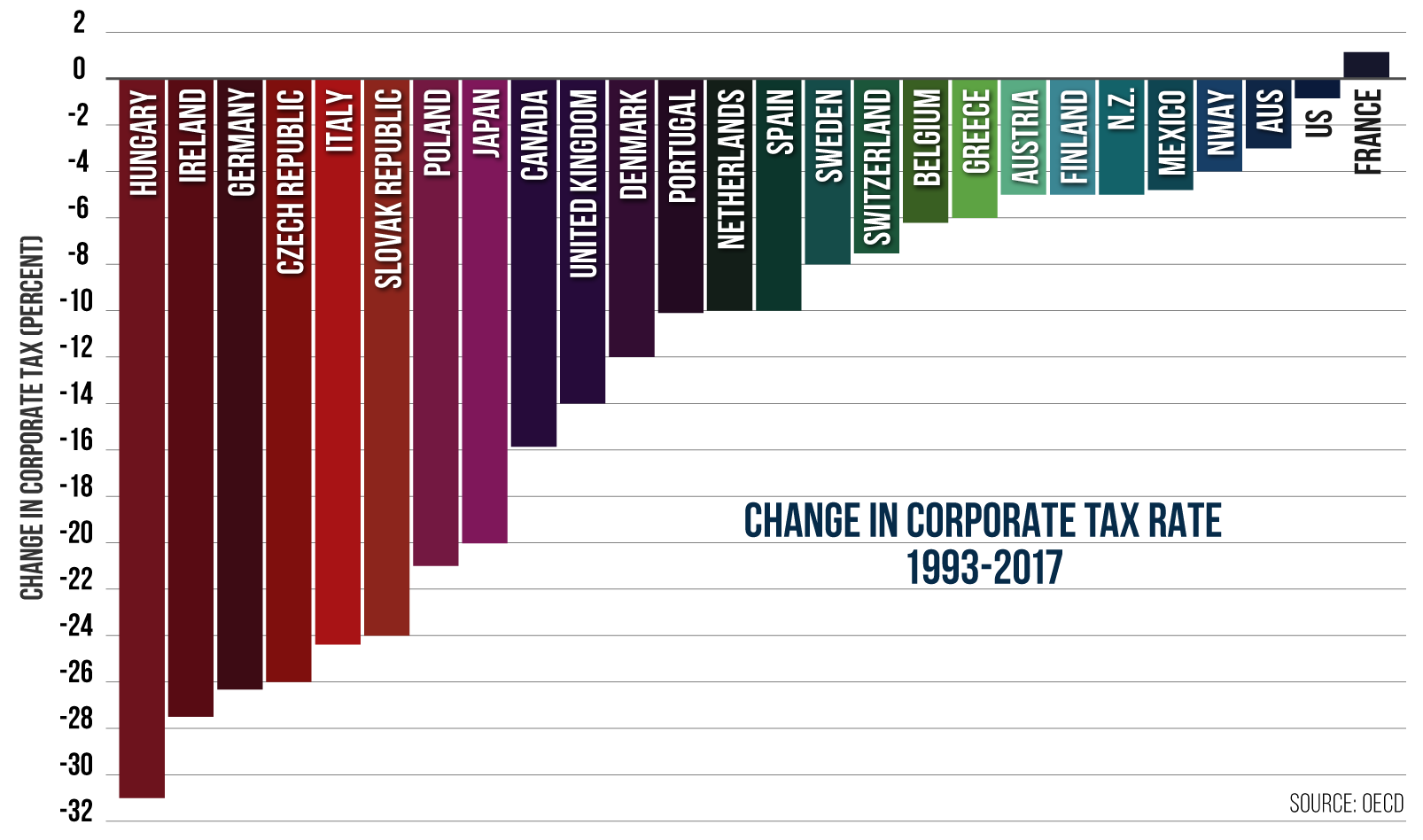

Other Countries Have Lowered Rates

Our Uncompetitive Corporate rate

The U.S. corporate tax rate has always been high, but at least it used to be competitive. In the early 1980s, Germany had a corporate tax rate of 60 percent, Britain was at 52 percent, France was 50 percent, and the U.S. was nearly 50 percent. After the 1986 corporate rate reduction was fully phased in, the U.S. had the fifth-lowest corporate rate in the Organization for Economic Cooperation and Development: 38.6 percent for the federal rate plus the average of state and local rates.

The rest of the world quickly caught on and lowered rates, while the U.S. has failed to keep up. The average rate among all OECD nations is now 24 percent, with Hungary the lowest at 9 percent. The U.S. is at 38.9 percent. This disparity encourages businesses to invest overseas instead of here at home and encourages them to keep overseas profits overseas. One analysis released in April estimated that U.S. companies are holding $2.6 trillion in cash overseas.

tHE rEWARD for reform – Entrepreneurship and Jobs

Reform that simplifies and reduces business taxes is long overdue. These changes will make us more competitive internationally. They will ease the burden that corporate taxes place on all Americans. They will also help our economy. A 2008 study by economists from Harvard and the World Bank found that high business tax rates are linked to lower investment and lower entrepreneurship. By reforming the tax code and lowering tax rates on businesses, including “pass-through” businesses, Congress can encourage more investment, more entrepreneurship, and more jobs.

Next Article Previous Article