Social Security Trustees: Take Action “As Soon As Possible”

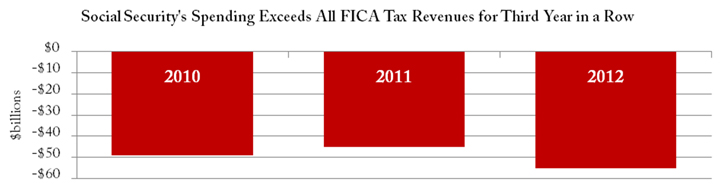

On May 31, the Social Security trustees issued their annual report on the financial status of the program. Their findings confirm that Social Security is in such financial trouble that delaying reform is not an option.

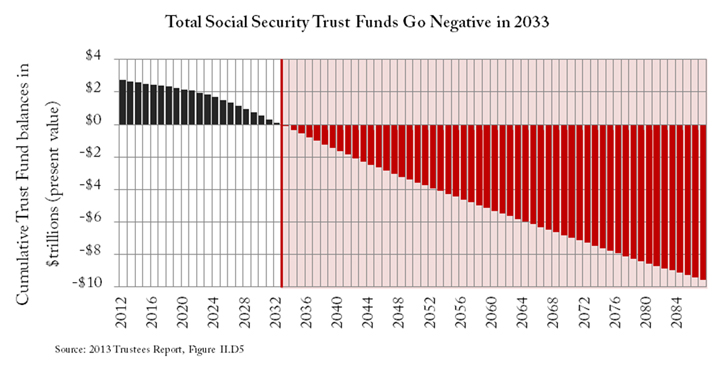

In 2033, Even the IOUs Are Gone

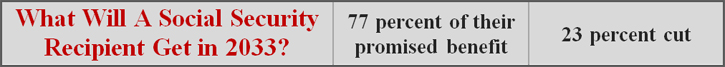

Social Security’s combined trust funds will be completely depleted in 2033. This means that even the Treasury bonds held by Social Security – IOUs Washington has given itself – will be gone, and Social Security will have to rely exclusively on incoming tax revenue to pay benefits.

It will be impossible to maintain any pretense that Social Security is pre-funded, since every dime retirees paid into the system while they were working will have been spent. Tax revenue from current workers will not be able to pay for promised benefits, and the program will have to cut benefits for all retirees by 23 percent. Since this cut will occur automatically in 2033, Americans who are now less than 47 years old will never get full Social Security benefits -- unless the program is reformed.

Social Security Disability Program in Even Bigger Trouble

Considered separately, Social Security’s trust fund for the disability program will run out of money in 2016. Disabled Americans should be able to rely on this program, but unfortunately rampant fraud, questionable approvals, and lax disability reviews have caused costs to be far higher than they needed to be. Disability benefits have increased by nearly 30 percent from pre-recession levels – from $106 billion in 2008 to $136.9 billion today. Those who truly need this program, as well as those who do not need to be on disability, will have their benefits cut by 20 percent without further action.

“There is a tendency…to talk about the combined finances of the Social Security Program. But by law, each of the Social Security Trust Funds separately has to maintain its solvency in order to avoid an interruption in benefit payments.”

–Charles Blahous, Social Security Trustee, May 31, 2013

Reforms Need to Happen Now

Earlier this year, President Obama said that he doesn’t believe we have an “immediate crisis” with regard to our national debt. He believes that we have had enough short-term deficit reduction to get along for the next 10 years. The President, along with congressional Democrats, has blocked attempts to further restrain the growth of Washington spending and reform our entitlement programs. These entitlements, including Social Security, are the largest drivers of America’s debt, and any changes to these programs need to be phased in so that taxpayers in or near retirement are not unfairly affected. That means reforms need to happen now to preserve the programs, to reassure the stock market and our nation’s creditors, and to provide some stability to our struggling economy.

Next Article Previous Article