Democrats Play Politics on Student Loans

If Congress does not act before July 1, the interest rate paid by college students on subsidized federal Stafford loans will return to 6.8 percent. Bipartisan solutions have been offered to simplify the interest rate structure, but Senate Democrats are standing in the way.

Federal Stafford Loans and Interest Rates

As a political strategy, Democrats promised in 2006 to cut student loan interest rates in half -- to 3.4 percent. The rates applied to subsidized and unsubsidized federal Stafford loans. They quickly realized that doing so was very costly, so they created the College Cost Reduction Act of 2007 to provide a stepped reduction of interest rates. Rates for subsidized Stafford loans would drop a little each year until June 30, 2012, when the rate was to return to 6.8 percent.

Last year, with 1.5 million, or more than one of every two, recent college graduates jobless or underemployed (53.6 percent), and a national unemployment rate of 8.2 percent, the 3.4 percent interest rate was extended for one year at a cost of $5.985 billion.

The temporary, interest rate reduction only applied to subsidized Stafford loans. These are need-based loans on which the government pays the interest while the borrower is enrolled in school at least half time, during loan deferments, and, in some cases, during a grace period after graduation. Subsidized loans are available only to undergraduate students and account for roughly 40 percent of all federal student loans.

In 2010, the government had essentially taken over the student loan program in America as part of the health care law. It took $8.7 billion from changes to the student loan program to fund the President’s health care changes.

Impact of Resetting

An estimated 7.7 million undergraduate students are expected to take out subsidized Stafford loans during the 2013-2014 academic year. For fiscal year 2014, which roughly corresponds to this period, the U.S. Department of Education estimates that the average loan amount will be $3,206 -- slightly lower than the $3,385 for the year before.

- If the interest rate on subsidized loans resets to 6.8 percent, the average student borrower with a $3,206 subsidized Stafford loan will owe approximately $727 more in interest -- $6.06 more per month over a standard 10-year repayment period.

- For a student who borrows $5,500 -- the maximum amount permitted for a subsidized Stafford loan for students in their third and subsequent years of undergraduate study -- the change in interest rate will amount to a difference of $1,248 in total interest paid, or approximately $10 more per month.

All but Senate Democrats Propose Permanent, Market-Based Solutions

Republicans in the House and Senate, along with the Administration, have put forward proposals to move Stafford loans to a market-based interest rate, in an effort to tie interest rates to economic conditions. In all three plans, as the economy struggles, rates would fall; as markets improve, rates would rise. The President and Republicans agree on a market-based approach. Senate Democrats stand alone in pushing for a permanent tax increase as a temporary solution.

- House Republicans. On May 23, a bipartisan majority in the House passed H.R. 1911, the Smarter Solutions for Students Act. Under the House bill, student loan interest rates would reset once a year and adjust as market rates adjust, much like they did before 2006. Interest rates for new Stafford loans, subsidized and unsubsidized, would be based on the 10-year Treasury rate plus 2.5 percent, and would be capped at 8.5 percent. PLUS loans, those loans for graduate students and parents, would be based on the 10-year Treasury rate plus 4.5 percent, capped at 10.5 percent. The House plan requires different annual rates while the borrower is in school and allows borrowers to consolidate loans to a fixed rate after graduation. According to the Congressional Budget Office (CBO), H.R. 1911 would reduce direct spending by about $1 billion over five years and by $3.7 billion over 10 years.

- Senate Republicans. Senators Coburn, Burr, Alexander and Isakson have introduced S. 682, the Comprehensive Student Loan Protection Act, that would also base new student loan interest rates on market rates. Under S. 682, the interest rate for all Stafford loans and PLUS loans would be based on the 10-year Treasury rate plus 3.0 percent. The Senate bill fixes the rate of interest for the life of the loan. With the current Treasury note at 1.75 percent, a student who takes out a covered student loan for next year would pay 4.75 percent for the life of that loan. The CBO reports a cost of $25.8 billion over five years and a savings of $15.6 billion over 10 years.

- Obama Administration. The Administration’s proposal is similar to legislation sponsored by House and Senate Republicans. In its Fiscal Year 2014 Budget Summary for the Department of Education, the Administration also proposed market-based interest rates for new student loans that would be determined annually and fixed for the life of the loan. Rates would be equal to the 10-year Treasury rate plus 0.93 percent for subsidized Stafford loans, 2.93 percent for unsubsidized Stafford loans and 3.93 percent for PLUS loans. The proposal does not include a cap on interest rates. However, it seeks to expand the Pay As You Earn plan to all borrowers. Borrowers who take part in this program, would be eligible to have their student loan payments capped at 10 percent of their prior-year discretionary incomes and to have any remaining balances forgiven after 20 years. The Pay As You Earn program is similar to the Income-Based Repayment (IBR) program in the law since 2009. Under the existing IBR program, student loan payments are limited to 15 percent of income, and the balance is forgiven after 25 years. The 2009 stimulus bill included a provision that limits payments to 10 percent of income over a 20-year period for loans issued after July 1, 2014. As the IBR is existing law, its caps would apply under both H.R. 1911 and S. 682. CBO has not scored the Adminstration’s proposal.

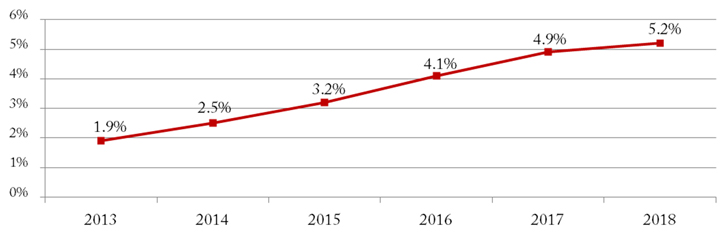

Under all three market-based proposals, interest rates for Stafford loans would continue to be below 6.8 percent for the next few years as the economy continues to recover. Based on current forecasts, the 10-year Treasury rate is expected to be:

Senate Democrats’ Agenda: Politics First

Senate Democrats are pursuing a completely different approach. S. 953 seeks to provide a two-year extension of the current 3.4 percent student loan interest rate. To offset the $8.3 billion cost of a two-year extension, Senate Democrats seek to raise taxes permanently in several ways for their short-term extension. They would modify rules for required distributions from tax-exempt pension plans; raise taxes on certain international business transactions; and redefine crude oil to include tar sands for some tax purposes.

In looking at the various proposals to address the expiration of the 3.4 percent interest rate, it appears Republicans and the White House are close to a consensus, with S. 953 as the outlier. Senate Majority Leader Reid was recently quoted stating, “I hope my Senate Republican colleagues will put politics aside and join us in providing middle-class families with the security of knowing they won’t be forced to pay thousands more for student loans on July first.” Majority Leader Reid is expected to bring S. 953 before the Senate shortly, despite the consensus for linking student loan interest rates to market rates. He should heed his own advice and set aside politics in favor of a better, bipartisan, market-based solution to help America’s families afford a college education.

Next Article Previous Article