Medicare Advantage: High-Performing Health Coverage

KEY TAKEAWAYS

- Democrats are pushing to expand the benefits provided under traditional Medicare coverage, a move that would harm the program’s already fragile finances.

- Medicare Advantage, a cost effective and high-performing health coverage option for seniors, contracts with private insurers and provides supplemental benefits such as vision, hearing, and dental at little or no additional cost.

- As policymakers look for strategies to improve health insurance coverage, they should build on the successes of Medicare Advantage.

Rather than address Medicare’s insolvency issues to protect the program for current and future beneficiaries and taxpayers, Democrats want to add new benefits to the program. This expansion would cost taxpayers hundreds of billions of dollars. Democrats conveniently forget that private Medicare Advantage plans already offer beneficiaries vision, hearing, and dental services at little or no additional cost. MA plans are already doing a good job of providing benefits for people who want them, without putting taxpayers on the hook for the added costs.

How medicare advantage fits

Traditional Medicare includes Parts A and B. Medicare Part A is a mandatory program covering inpatient hospital care, skilled nursing services, hospice care, and some home health care. Medicare Part B is optional coverage for doctors’ visits, outpatient hospital services, mental health, ambulance services, durable medical equipment, and certain physician-administered drugs. Beneficiaries pay premiums for Part B coverage, and after the patient meets a deductible, the program generally covers 80% of the cost of treatment. Traditional Medicare does not cover some services, such as routine dental and vision care, routine hearing exams and hearing aids, and long-term care. Beneficiaries pay for these out of pocket or may purchase a supplemental policy, such as a Medicare Advantage plan. The Centers for Medicare and Medicaid Services sets prices for provider services. The traditional Medicare program is based on a fee-for-service payment model with doctors paid for each service provided. In effect, providers are rewarded for providing more care, rather than providing high-quality care.

Medicare Advantage, known as Part C, was created in 2003 as an alternative to the traditional Medicare program. It combines Parts A and B into a single plan that provides more comprehensive benefits than traditional Medicare, including vision, hearing, and dental care. Many people enrolled in Medicare look at the network of doctors and the benefits and decide that the extra benefits of an MA plan are a good value for them. These plans often come with lower out-of-pocket costs and co-pays than traditional Medicare coverage.

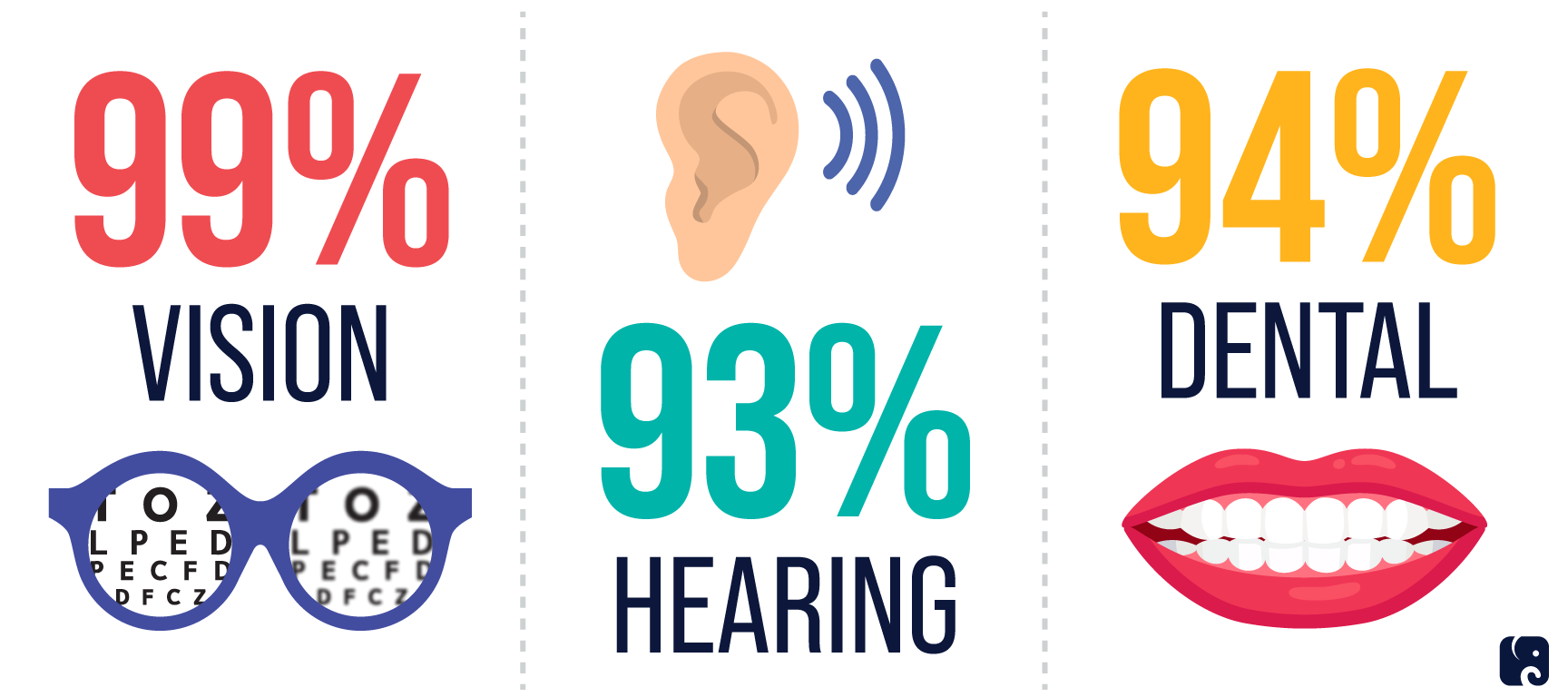

Most MA Plans Cover Services Medicare Does Not

CMS approves private insurers to offer Medicare coverage; these insurers are paid by Medicare to cover members’ health care claims. MA plans compete for customers and structure their plan benefits according to patients’ wants and needs. Priced at an affordable cost due the program’s private market structure, MA plans offer enrollees more comprehensive coverage and outperform traditional Medicare in caring for the sickest people.

MA plans Offer comprehensive coverage

Vision, hearing, and dental benefits are almost universally available to people who enroll in MA plans. Ninety-nine percent of the plans include vision, 93% cover hearing, and 94% cover dental benefits. Nearly all plans offer fitness services as well, such as coverage for gym memberships. Last year, the Trump administration also allowed MA plans to broaden access to health care through telehealth services in their benefit package.

In 2019, CMS also expanded the kinds of benefits MA plans can cover to include medically related transportation and meal delivery. Plans can offer additional supplemental benefits as long as the benefits help diagnose, prevent, or treat sickness or injury and help reduce avoidable emergency health care. These can include benefits for the chronically ill such as in-home support, adult day care services, pest control, and transportation, depending in the plan.

Nearly 4 million Medicare beneficiaries are enrolled in MA “special needs” plans. These plans are available to people with certain specialized health care needs or people who are eligible for both Medicare and Medicaid. MA plans do a better job than the traditional program at managing these “dual eligible” enrollees. According to a 2019 study, MA outperformed traditional Medicare by 17% on overall cost of care. The MA program also had better quality outcomes, and dual eligible patients “experienced significantly lower rates of complications, avoidable hospitalizations and readmissions, and received more preventive care services compared to dual eligible fee-for-service Medicare patients.” The better care and lower cost in the MA program is partly due to it allowing for more flexibility to coordinate care and tailor benefits to patient needs.

increasing enrollment

This year, 42% of Medicare beneficiaries – 26 million people – are enrolled in an MA plan, and they had an average of 33 coverage options to choose from. This is the largest number of plans on the market in a decade. Enrollment in MA plans has more than doubled in the last decade, and the Congressional Budget Office expects enrollment to keep increasing. By 2030, CBO estimates roughly 51% of all Medicare enrollees will have an MA plan. Enrollment in the plans varies across the country. In Florida, 49% of all beneficiaries are enrolled in an MA plan, while less than 5% in Alaska, North Dakota, and Wyoming are. Many of the areas with lower enrollment are in rural counties. The average monthly individual plan premium is $21 this year, and the majority of enrollees do not pay a premium beyond the Part B premium. Premiums for MA plans have remained relatively stable since the program began, and have been declining since 2015. Democrats should work with Republicans to make low-cost MA plans available in more areas.

Democrats attack what is working

The traditional Medicare program is on the path to insolvency and needs reform. Each year, the Medicare trustees warn about the trust fund’s financial problems. They have pointed out the growing strain of increased enrollment in the program and the decline in the number of workers supporting beneficiaries. According to CBO, the Part A hospital insurance trust fund will reach insolvency by 2024. Increasing payroll taxes to address Medicare insolvency would ultimately harm small businesses and their workers and families. Cutting payments to health care providers would result in less access to quality care for beneficiaries. Instead of addressing the fiscal and structural issues with the program and building on MA’s success, Democrats are proposing to expand Medicare, adding vision, hearing, and dental coverage to the program in their $3.5 trillion budget plan.

Medicare Advantage allows for consumer choice and private market competition, resulting in improved care and cost control. The program has succeeded because it offers good service and fair value. Even though MA plans have been working well and are popular, Democrats see them as a threat. They do not want to the see the private sector do a job well when government could do that job worse and at greater cost.

Next Article Previous Article