FY 2013 Budgets: Senate Democrats Complicit in Obama’s Record Debt

President Obama and Senate Democrats have not provided solutions or results to America’s debt crisis. They have refused to make difficult decisions because they are concerned about their next election rather than the next generation. The President’s latest budget is full of tricks, accounting gimmicks and empty promises that encourage wasteful spending and skyrocketing debt. The Congressional Budget Office estimates that the President’s budget would spend $1.2 trillion more than current law.

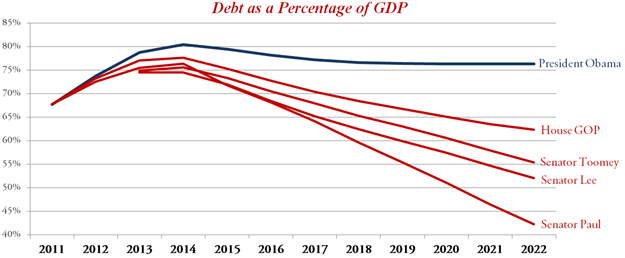

When the President entered office, the national debt was $10.6 trillion and today it is over $15.6 trillion. President Obama has increased the national debt by $5 trillion, more than any other President. He has done this with four straight years of trillion-dollar deficits. The fifth year, 2013, will see an estimated deficit of $977 billion under the Obama budget. The President’s budget will make high government spending permanent; spending never goes below 22 percent of GDP in his 10-year budget. His budget also does not seriously address entitlement reforms necessary to strengthen Social Security and Medicare.

The Senate is expected to vote on five budget blueprints this week: President Obama’s budget, the House Republican budget, and budgets from Senator Lee, Senator Paul, and Senator Toomey. Senate Democrats are the only ones who have refused to propose a budget blueprint, shirking their responsibility to spend tax dollars carefully. When Budget Chairman Conrad planned to mark up a budget, Democrat leaders made the decision not to have any committee votes.

H.Con.Res 112, the fiscal year 2013 House Republican budget resolution, passed the House on March 29, 2012, by a vote of 228-191. The President’s budget failed to gain a single vote when it lost 0-414 in the House.

This paper outlines the key fiscal stats and policy assumptions of the various budget blueprints.

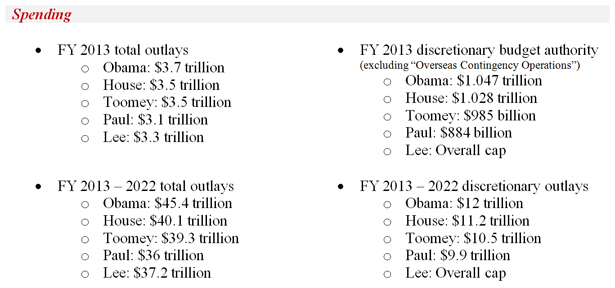

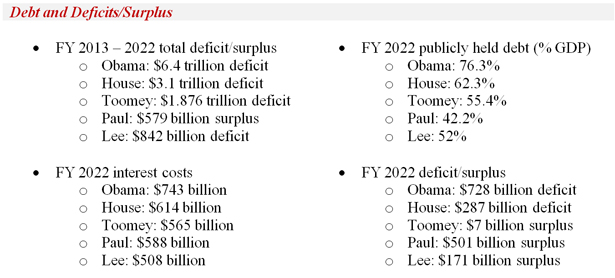

Fiscal Stats on the Five Budget Proposals

More information is available on the Republican budgets from the House Budget Committee, Senator Toomey, Senator Paul, and Senator Lee.

Highlights

• The House budget replaces the Budget Control Act’s (BCA) first-year sequester, scheduled to take place in January 2013, by: (1) reducing the fiscal year 2013 discretionary cap by $19 billion; (2) assuming the mandatory portion of the sequester scheduled for January 2013 does in fact take place; and (3) reconciliation instructions that instruct six House committees to produce 10-year savings of $261 billion. The House recently passed this reconciliation bill. This approach protects national security funding from the 2013 across-the-board sequester.

• CBO estimates that the House budget would balance by 2040 and run annual surpluses thereafter. In 2050, debt held by the public would be 10 percent of GDP, down from today's 73.2 percent of GDP

• The three Senate budgets balance within the 10-year budget window. Senator Lee’s budget balances in fiscal year 2017, Senator Paul’s budget also balances in fiscal year 2017, and Senator Toomey’s budget balances in fiscal year 2020.

Defense funding

• House: Defense non-overseas contingency operations (OCO) budget authority of $554 billion in fiscal year 2013, compared to non-OCO budget authority of $551 billion in fiscal year 2011. Replaces the BCA’s sequester cuts to defense with reconciliation that targets savings in non-defense areas.

• Toomey: Defense non-OCO budget authority of $546 billion in fiscal year 2013. Defense budget authority of $664 billion in fiscal year 2022. Maintains defense funding at the BCA’s pre-sequester levels. These numbers are based on full withdrawal from Iraq and Afghanistan by 2015.

• Paul: Defense non-OCO budget authority of $546 billion in fiscal year 2013. Defense budget authority of $651 billion in fiscal year 2022. Does not contain funding for OCO in fiscal year 2014 and beyond.

• Lee: Including OCO, contains defense budget authority of $697 billion in fiscal year 2013, compared to $711 billion in fiscal year 2011 and an estimated $670 billion in fiscal year 2012. Defense budget authority of $881 billion in fiscal year 2022. Assumes full withdrawal from Iraq and Afghanistan by 2015.

Non-defense discretionary

• House: Brings non-defense discretionary spending below the Budget Control Act caps.

• Toomey: Freezes non-defense discretionary funding at fiscal year 2006 levels through fiscal year 2020; indexed to inflation in later years.

• Paul: Funding for most non-defense discretionary spending is set at fiscal year 2008 levels.

• Lee: Does not separate non-defense discretionary spending.

Policy Assumptions

Since budget resolutions do not become law, they require future legislation to implement many of their policy goals. In the various budget proposals, the following policies are assumed to be implemented through future legislation.

Medicare

• House: Create a premium support system for beneficiaries turning 65 in 2023. Those turning 65 prior to 2023 would have the option of staying in traditional Medicare or using premium support. The premium for a 65-year old entering the program in 2023 would receive support of about $7,500 per year, which reflects traditional Medicare estimated spending on the average 65-year old in 2023. Benefits would be indexed to the growth of the economy plus 0.5 percentage points – the same inflation assumption used in the President’s budget. The traditional Medicare fee-for-service plan would be preserved as one option for premium support enrollees to choose, beginning in 2023. Also beginning in 2023, the eligibility age for Medicare would be raised by two months per year, so that the eligibility age would reach 67 in 2034.

• Toomey: While not outlined in the budget resolution text, the resolution sponsor indicates that the numbers in this budget assume the adoption of Medicare reforms assumed in the fiscal year 2013 House Republican budget resolution, with the exception that the Toomey budget assumes larger means testing is implemented immediately.

• Paul: Beginning in 2014, all seniors will be required to enroll in the Federal Employee Health Benefits Plan. A transition period will be allowed for beneficiaries to change plans. This new program will be means tested. Over 20 years, the eligibility age will gradually rise to age 70.

• Lee: Implements a five year transition period to a defined contribution premium support plan by 2017. Current and future Medicare enrollees can choose to stay in traditional Medicare or move to the new system. For each region, the base Federal premium support would be initially set at 88% of the average of the 3 lowest bids. The program would be means tested. Over ten years, the eligibility age will rise to 68. Although the text does not specify additional policy changes, the Heritage Foundation report on which this budget is based, “Saving the American Dream,” includes additional policy changes: traditional Medicare becomes one program after the five year transition period (parts A, B, C, and D disappear); and premiums for parts B and D rise from 25 percent to 35 percent during the transition.

Medicaid

• House: Convert the Medicaid program to a block grant. The block grant would be increased annually to reflect population growth and inflation. States would gain additional flexibility to manage their Medicaid programs.

• Toomey: The resolution text does not include changes to Medicaid, but the resolution sponsor assumes that Medicaid will be block granted to the states, the funding will be frozen at fiscal year 2012 levels through fiscal year 2017, and funding will be indexed to inflation thereafter.

• Paul: Block grant Medicaid to the states at 2008 levels and allow funding to increase with inflation and population growth.

• Lee: Block grant acute and long-term care Medicaid funding. Provide premium support of between $3,500 and $9,000 per Medicaid family.

Other health reforms

• House: Repeal the President’s health care law’s coverage expansions scheduled to take effect in 2014. Repeal the Independent Payment Advisory Board, a board of unelected bureaucrats empowered to enforce caps on Medicare spending. Enact medical liability reforms, including a cap on non-economic damages.

• Toomey: While not contained in the resolution text, the sponsor indicates that the budget’s numbers assume repeal of the President’s health care law as well as implementing medical liability reform.

• Paul: While not contained in the resolution text, the sponsor indicates that the budget’s numbers assume repeal of the President’s health care law as well as block granting SCHIP, food stamps, and child nutrition to the states; and allow funding to increase at inflation and population growth.

• Lee: Repeal the President’s health care law. Create a tax credit for purchasing health insurance; low income individuals receive a higher tax credit.

Social Security

• House: If Social Security is unsustainable, the President and congressional leaders will be required to propose reforms to secure Social Security’s finances.

• Toomey: No policy assumptions.

• Paul: Beginning with people born in 1955 (age 56/57 today), increase the retirement age by three months per year until reaching a retirement age of 70 for those born beginning in 1970 (41 or 42 today). Increase the early retirement age by three months per year for those born in 1959 (53 or 54 today), and stop when the early retirement age reaches 64 for those born beginning in 1966 (45 or 46 today). Gradually means test benefits for those with average lifetime income above the 40th percentile.

• Lee: Reform Social Security from an “income replacement” program to one that provides a flat payment to seniors to ensure that they do not fall into poverty. This payment will be $1,200 per month in 2012 dollars, indexed for wage growth. The transition to this system begins in 2013. The transition would occur by gradually decreasing benefits for individuals with over $55,000 in non-Social Security income or married couples with over $110,000 in non-Social Security income. Current and new beneficiaries with non-Social Security income over $110,000 (individuals) or $165,000 (married couples) would receive no Social Security benefit in 2013. Over 10 years, increase the normal retirement age by four months per year, beginning with those born in 1954 (age 57 or 58 today) until reaching a retirement age of 68 for those born beginning in 1959 (age 52 or 53 today). Over 18 years, increase the early retirement age by three months per year beginning with those born in 1953 (age 58 or 59 today) until reaching a retirement age of 65 for those born beginning in 1964 (47 or 48 today). Both early and regular retirement ages will be indexed to longevity when they reach 65 and 68, respectively.

Taxes

• House: Eliminate unspecified tax expenditures necessary to implement an individual income tax system of just two rates: 10 percent and 25 percent. Lower the top corporate income tax rate to 25 percent and move to a territorial system. Eliminate the Alternative Minimum Tax.

• Toomey: Index the Alternative Minimum Tax (AMT) to inflation. While not contained in the resolution text, the sponsor indicates the budget’s numbers assume tax reform that would lower current tax brackets by 20 percent in a revenue-neutral way by eliminating tax deductions and exclusions, as well as lower the top corporate rate to 25 percent and move to a territorial system.

• Paul: Institute a 17 percent flat tax for individuals and corporations, eliminating all deductions and credits except for the mortgage interest deduction. Tax reform would include a higher standard deduction and personal exemption. Business tax reform would include a 17% flat rate and would eliminate all business deductions and credits. Transition to a territorial system. Eliminate the AMT.

• Lee: Institute a flat consumption tax that will replace income, payroll, death, and excise taxes. The new system would exempt charitable deductions, home mortgage interest, higher education deduction, deduction for seniors of the value of Social Security and Medicare benefits, exclusion for seniors of up to $10,000 in other income, and the EITC. This also permits a $3,500 non-refundable tax credit for families to purchase health insurance. Assumes flat corporate tax on par with the individual flat tax. According to Heritage’s plan, this would result in a 25 percent to 28 percent flat consumption tax for individuals and corporations, and a move to a territorial system.

Other Reforms

• House: Includes several budget reforms, including requiring periodic congressional review of mandatory spending, and a binding cap on total government spending as a percentage of GDP.

• Toomey: While not contained in the resolution text, the sponsor indicates the budget’s numbers assume most welfare programs will be block granted to the states and phase in spending caps for these programs that will total $230 billion in fiscal year 2020, approximately $30 billion more than in fiscal year 2007.

• Paul: Eliminate Davis-Bacon requirements, sell excess federal land, reduce the federal vehicle fleet, and pass the REINS Act. While not contained in the resolution text, the sponsor indicates the budget’s numbers assume the elimination of the departments of Commerce, Education, Energy, and HUD as well as freezing foreign aid at $5 billion annually.

• Lee: Assumes passage of REINS Act, elimination of Davis-Bacon requirements, sell excess federal land, reduce the federal vehicle fleet, and sunset regulations.

Next Article Previous Article