Democrats Steer America Toward A “Fiscal Cliff”

“We have lots to do. We are going to be working in the evenings, Mondays and Friday --weekends, if necessary, to get all our work done.” – Harry Reid, July 6, 2009

In 2009, with a filibuster-proof Senate, Majority Leader Reid felt that the Senate had a lot of important work on its plate and that the American people expected it to get that work done. Today there are even more pressing issues before the Senate, but Senator Reid has apparently lost his sense of urgency.

The Senate during the first session (2011) of the 112th Congress has been among the “laziest in 20 years,” in terms of productivity (days and hours in session). Through the first 129 days of this year, the Senate has been in session only 54 days, and Senators have gone to the floor to vote on just 31 of those days. Senator Reid has indicated that he intends to put off many important issues until after the election—during the lame duck session. That strategy may help Democrats who do not want to campaign on their failed policies, but it is bad for the Senate and bad for America. In a lame duck, the Senate will have to resolve some of the country’s most pressing spending, tax, and broader policy issues. Failure to act could mean 3.7 percent less GDP according to the Congressional Budget Office.

The Federal Reserve recently warned of a “fiscal cliff” and has called on Congress to act on major issues like the expiration of current tax policy and sequestration. Chairman Bernanke was clear: “If no action were taken by the fiscal authorities, the size of the fiscal cliff is such that there’s, I think, absolutely no chance that the Federal Reserve could or would have any ability whatsoever to offset that effect on the economy.”

The entire U.S. economy could hang in the balance of what happens in just 55 calendar days after the November elections and before January 1, 2013. That counts every day after the elections until the end of the year, including weekends, Thanksgiving, and Christmas.

The List of Important Issues Is Long and Growing

Among the many issues that must be addressed this year, but which Democrats have failed to act on or schedule:

Spending Provisions:

Appropriations Bills (equal to $1.047 trillion for one year)

The Senate has not passed a single appropriations bill this year, and only four of 12 bills (Commerce, Justice, Science; Transportation-HUD; Energy and Water; and Agriculture) have been reported out of committee. Without regular order on funding bills, the Senate will need to act on a continuing resolution, omnibus, or multiple minibus bills to fund the government beginning October 1, 2012 (fiscal year 2013).

Sequester ($110 billion)

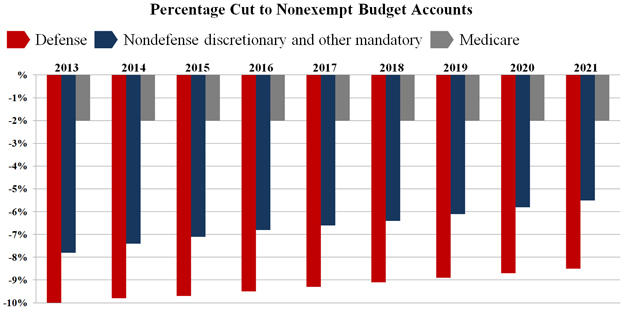

The sequester resulting from the Budget Control Act is set to take effect in January 2013 for a savings of $1.2 trillion through 2021. Aside from safety net programs, most federal spending will be cut. Of the $1.2 trillion savings, the cut is discounted by 18 percent for interest savings. The remaining $984 billion is divided equally over nine years for an annual cut of about $110 billion split evenly between defense (budget function 050) and non-defense spending.

• Defense. $55 billion cut from discretionary budget authority, an approximately 10 percent cut in 2013.

• Non-Defense. All non-exempt budget accounts will be cut by the percentage necessary to achieve a $55 billion cut. Reduction to most of the Medicare program is capped at two percent.

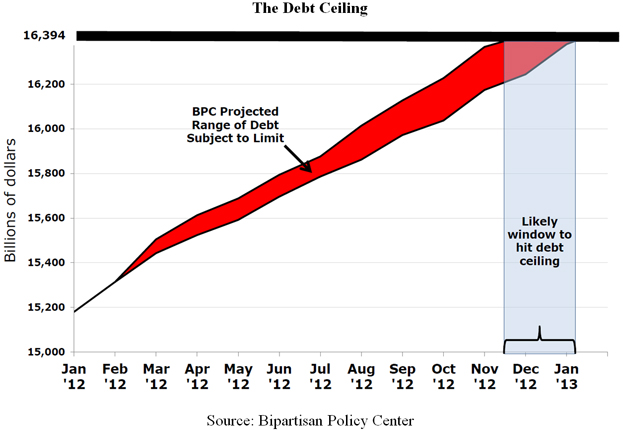

Debt ceiling (~$1 trillion)

The United States’ current debt ceiling is $16.394 trillion. The debt stands at approximately $15.7 trillion. Estimates are that President Obama will ask to increase the debt ceiling for a fifth time around December 2012. Treasury Secretary Geithner has indicated that the debt ceiling will be reached “significantly after the end of the fiscal year, but before the end of the calendar year.” An increase of another $1 trillion would pay for one more year of deficit spending. Any increase of the debt limit would need a corresponding amount of spending cuts.

Sustainable Growth Rate/“Doc Fix” (~$25 billion)

The latest extension of the Medicare physician fee “doc fix” expires at the end of the year. Without congressional action, physician reimbursements will be reduced by 30.9 percent under the sustainable growth rate mechanism.

Unemployment Benefits ($38.5 billion)

The emergency Unemployment Compensation program expires at the end of the year. Additionally, the temporary federal financing of the Extended Benefit program and the option that allows states to use three-year lookback calculations to determine eligibility expires at the end of the year.

Temporary Assistance for Needy Families (TANF)

The TANF program expires September 30, 2012. Recent extensions of the program have been coupled with extensions of unemployment benefits and the payroll tax holiday.

Tax Provisions:

2001/2003 Tax Rates ($187 billion)

At the end of the year, the following 2001/2003 tax provisions will expire:

• Lower personal income tax rates for all taxpayers

o Current rates: 10%, 15%, 25%, 28%, 33%, 35%

o Rates without action: 15%, 28%, 31%, 36%, 39.6%

• 10 percent bracket for low-earners would increase to 15 percent

• Marriage Penalty relief

• Dividends rate of 15 percent would increase to as high as 45 percent

• Capital gains rate would rise from 15 percent to 23.8 percent (including Obamacare tax increases)

• Adoption credit of $10,000, plus $10,000 exclusion

• Dependent care credit of $3,000

• Credit for employer-provided child care

• Education savings accounts

• Personal exemption phase-out for high earners will return, as will the Pease itemized deduction phase-out for high earners

Death Tax ($28 billion)

Estate and gift taxes will increase from a top rate of 35 percent to 55 percent, and the exemption will drop from $5 million to $1 million. This tax increase will affect nearly 50,000 more families than it did last year.

Alternative Minimum Tax ($68 billion)

The Alternative Minimum Tax will hit more than 31 million taxpayers.

Business Tax Extenders ($26 billion)

Business tax extenders including the R&D credit, 100 percent bonus depreciation (it will be 50 percent in 2012 and zero in 2013), work opportunity tax credit, and others end this year.

Energy Tax Extenders ($11 billion)

Energy tax incentives will expire by the end of the year or have already expired, including the production tax credit (PTC) for wind, incentives for alcohol fuels, and Section 1603 grants in lieu of tax credits.

Policy Provisions:

Budget

The Senate Budget Committee met in April to ‘mark up’ the fiscal year 2013 budget. Senate Democrats essentially cancelled the mark up by only allowing opening statements. No amendments or votes were allowed. The Budget Committee Chairman announced the Committee would postpone the ‘mark up’ until after the election. The statutory deadline of April 15 for a budget resolution has passed.

National Defense Authorization Act

Major issues dealing with the national security of the United States are set forth in the annual defense bill, which Congress has passed every year since 1961. This year the issues are even more daunting than usual. A looming sequester of approximately $55 billion waits next year, and the bill may also have to deal with the President’s Base Realignment and Closure request. The President’s fiscal year 2013 budget requested “the authority for DoD to commence two additional rounds of BRAC and to establish an independent Commission that will provide an objective, thorough, and non-partisan review and analysis of DoD’s recommendations.” The defense bill will also have to deal with issues related to the nuclear complex, TRICARE fees, shipbuilding, end-strength levels, and major programs such as missile defense. Country specific issues relating to Syria, Iran, and North Korea may also arise.

Foreign Intelligence Surveillance Act (FISA)

The FISA Amendments Act of 2008 sunsets at the end of the year. The Director of National Intelligence has testified that reauthorizing this law is his highest legislative priority. The official legislative proposal from the Administration seeks an extension to June 1, 2017. FISA provides a statutory framework for the use of electronic surveillance and other intelligence tools in the context of foreign intelligence gathering, particularly within the United States.

FDA User Fee Authorizations

The statutory provisions authorizing user fees for prescription drugs and medical devices expire on September 30, 2012. These fees fund the FDA’s drug approval process. If reauthorization is not completed by the August recess, FDA will begin notifying personnel of impending furloughs which will hamper the drug approval process.

Export-Import Bank

The charter of the Ex-Im Bank of the United States, the country’s official export credit agency, will expire on May 31, 2012. The current holdup is due to the opposition of domestic airlines. They view the bank’s loan guarantees for Boeing sales to foreign airlines as subsidies to their competitors. The Import Export Banks in the European Union issue similar guarantees to Airbus sales to airlines located outside of Airbus’s home market, which could give Airbus an advantage if the U.S. Ex-Im Bank is not renewed. Senate Amendment 1836, which failed largely for process reasons, would have reauthorized the Export-Import Bank through fiscal year 2015 and increased the aggregate loan, guarantee, and insurance authority.

Surface Transportation

Surface transportation programs are currently operating under their ninth short-term extension, which expires June 30, 2012. The Senate passed S. 1813, a two-year $109 billion reauthorization on March 14, 2012. The House passed H.R. 4348, a three-month extension on April 24 which included acceleration of permitting for the Keystone XL pipeline, the RESTORE Act, devolution of coal ash regulation to the States and other provisions. The House and Senate are currently in a conference committee to reconcile differences.

Farm Bill

The 2008 farm bill expires on September 30, 2012, or with the 2012 crop year. The Senate Agriculture Committee reported out a five-year farm bill on April 26, 2012. It now awaits further consideration on the Senate floor. Without an extension or a new farm bill, more than 100 discretionary programs receiving $2.3 billion in fiscal year 2012 will be left without statutory authority to receive appropriations. Programs relying on mandatory spending, including those focused on commodities, crop insurance, nutrition assistance, conservation and trade, will also be at risk. A series of mothballed provisions from the 1930s and 1940s known as “permanent law” would be reinstated. According to the Congressional Research Service, this system is “radically different from current policy – and inconsistent with today’s farming practices, marketing system, and international trade agreements – as well as potentially costly to the federal government.”

National Flood Insurance Program

The National Flood Insurance Program, a program to insure Americans living in flood-prone communities, has not been fully reauthorized since 2008. The latest short-term reauthorization will expire on May 31st which means no new policies can be underwritten after that time. The House of Representatives passed H.R. 1309, the Flood Insurance Reform Act of 2011, by a vote of 406-22, which would extend the program through May 31, 2016. This legislation has been waiting since last July for Senate consideration.

Midnight Regulations

At the end of the year, it is likely some economically significant regulations will be finalized. The most expensive is a joint rule by the Environmental Protection Agency (EPA) and the Department of Transportation relating to new corporate average fuel economy (CAFE) standards for cars and light-duty trucks. According to the EPA, the cost of this rule is $141 billion. The Department of Labor has several pending rules expected to be finalized at the end of the year. These include OSHA “fall protection” regulations at a cost of $1.5 billion; controversial workplace dust rules at a cost of $5.5 billion; and a new application of the Fair Labor Standards Act to domestic service at a cost of $122 million and 1,706 jobs. According to one estimate, there are at least 25 significant regulations that could be finalized at the end of the year at a cost to the economy of $220 billion.

Do-Nothing Senate Democrats

Coming off one of its least productive years in modern history, the Senate has set a snail’s pace so far in 2012.

• In 2011 the Senate spent 195 days out of session — 53 percent of the year.

o The days it was in session, the Senate averaged 6.5 hours of work, the second lowest since 1992.

o Compared to 2009, the number of amendments offered plummeted 55 percent, and the number of roll-call votes dropped 40 percent.

• So far in 2012, the Senate has taken just 89 recorded votes – less than half of what it took by this date in 2009.

• It has been three years since the Senate last passed a budget.

• Senator Reid has “filled the tree” on amendments 59 times – more than the four previous majority leaders combined.

The Democrats who control the Senate have been unusually sluggish for more than a year. By wasting time on messaging instead of governing, Democrats have shown themselves unwilling to lead. America faces a $16 trillion dollar debt, four straight years of trillion-dollar deficits, and unemployment over eight percent for 39 straight months. Harry Reid may want to run out the clock until November, but the American people deserve better from their elected representatives.

Next Article Previous Article