Flood Insurance Reauthorization

- Millions of Americans are required to carry insurance through the National Flood Insurance Program as a condition of their mortgage.

- The program has more than $30 billion of debt, and its authorization expires on December 8. Reauthorization should include reforms to make the program sustainable.

- The Trump administration has requested that Congress cancel $16 billion of the program’s debt, the amount it estimates will be paid in claims related to Hurricanes Harvey and Irma.

After the flooding caused by Hurricanes Harvey and Irma in August and September, thousands of Americans began cleaning up the damage to their homes and businesses. For many, this process included contacting the National Flood Insurance Program to make a claim on their flood insurance policy. On September 20, the Federal Emergency Management Agency notified Congress that the NFIP had reached the limit of its $30.4 billion in borrowing authority.

The NFIP was created to offer primary flood insurance to property owners in areas with significant flood risks and to reduce the risk of flooding through floodplain management standards. The program was created largely due to the absence of flood insurance in the private market. It has three purposes: to provide flood insurance; to improve floodplain management; and to develop maps of flood hazard zones. In September, authorization for the NFIP was extended to December 8.

Flood Insurance Outstanding Debt

Source: GAO

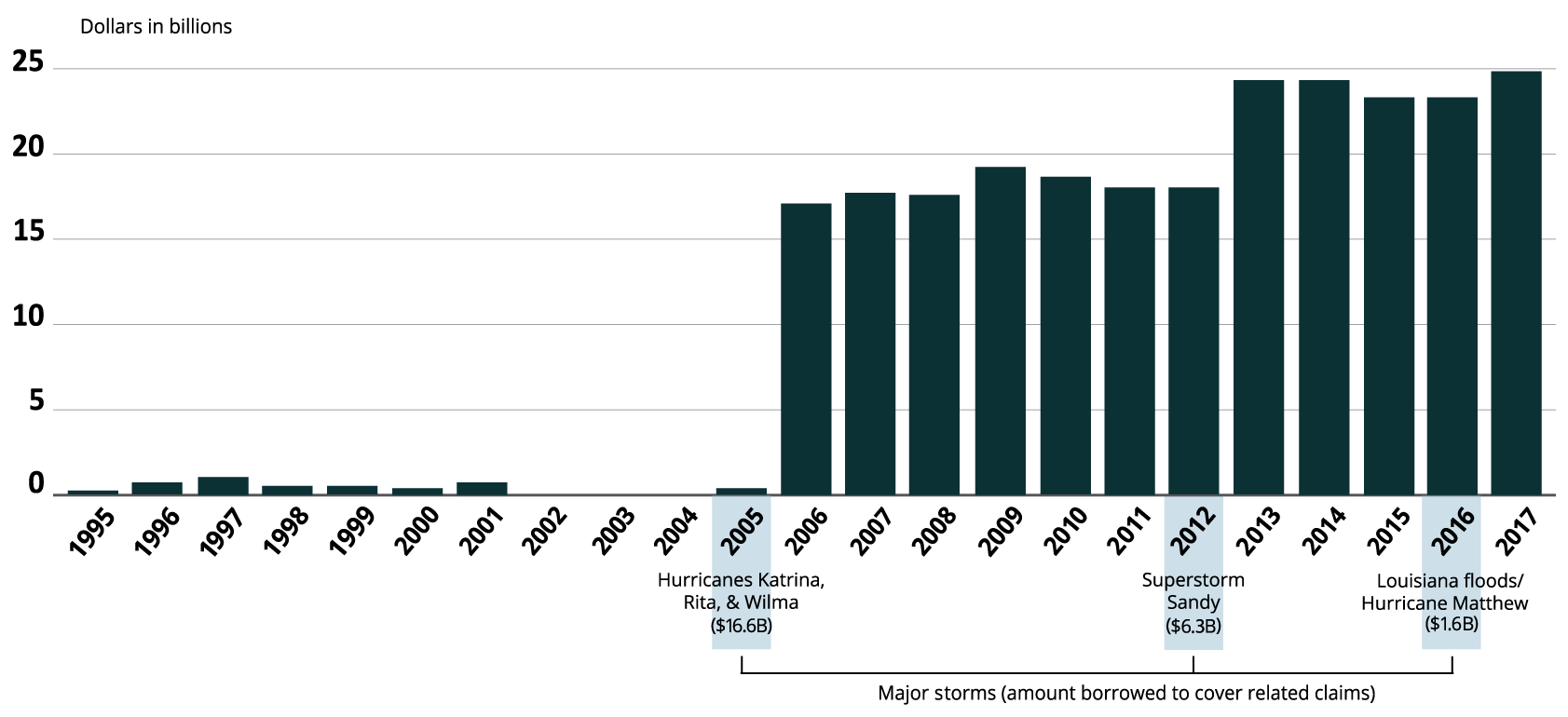

Before 2005, NFIP was mostly self-sustaining, only using its borrowing authority intermittently and repaying the loans with interest. Premiums paid by policyholders were sufficient. Starting with the 2005 hurricane season, which included Hurricanes Katrina, Rita, and Wilma, the NFIP began to borrow heavily to pay claims. In 2012, following Hurricane Sandy, the need to borrow heavily continued, causing Congress to raise the program’s borrowing cap to its current cap of $30.4 billion.

Origins of the NFIP and recent changes

The NFIP, created in 1968, is a federal program managed by FEMA. As of July 2017, there were 4.9 million policies in force, with approximately $1.23 trillion in aggregate coverage across 22,285 communities.

In 1994, flood insurance became mandatory for all federally backed mortgages of properties located in “Special Flood Hazard Areas.” The insurance is to assist with the cost of repairing structures and compensate homeowners for contents damaged by floods.

Congress implemented significant reforms to make the program more financially and structurally sound when it reauthorized the NFIP in 2012. The purpose of the legislation was to raise rates to reflect true flood risk and make the program more financially stable. The bill also changed how Flood Insurance Rate Map updates affect policyholders.

In January 2013, following Hurricane Sandy, Congress passed legislation to raise the NFIP’s borrowing authority from $20.725 billion to $30.425 billion.

In 2014, the Homeowners Flood Insurance Affordability Act softened rate increases that had been implemented in the 2012 reforms. The legislation restored grandfathered rates so that homes and businesses that originally were built to code and later remapped into a higher risk area did not face increases due to remapping. It also reduced the pace of certain rate increases made in 2012 that had been intended to address the solvency of the program and reflect true flood risk.

main program components

Insurance: In collaboration with participating communities, FEMA develops Flood Insurance Rate Maps that depict a community’s floodplain and flood risk. A key piece is the identification of the Special Flood Hazard Area, which is intended to show areas with 1 percent or greater risk of flooding each year. Property owners in the hazard area are required to purchase flood insurance as a condition of receiving a federally backed mortgage. They may purchase flood insurance either through NFIP or through a private company, as long as the coverage is at least as broad as the NFIP’s. For residential policies, the maximum coverage is $250,000 for the building and $100,000 for its contents. The maximum coverage for non-residential policies is $500,000 for the building and $500,000 for its contents.

Beginning in 1983, private insurance companies could participate in the NFIP through the Write-Your-Own program. The program allows private companies to sell, write, and manage claims for NFIP policies. Approximately 86 percent of NFIP policies are sold by nearly 70 companies participating in the Write-Your-Own program. The program pays 30.9 percent of premiums to the private insurance company, while NFIP is responsible for covering any losses.

Mapping: FEMA is responsible for undertaking studies to identify flood hazards across the country. Communities may also submit data related to their flood hazards, flooding experience, and mitigation plans. FEMA, in coordination with participating communities, then maps hazards on a Flood Insurance Rate Map. Information contained in the map is used for floodplain management, flood insurance, and to help communicate flood risk to communities. While FEMA is responsible for creating the FIRM, the community must pass the map into state or local law in order for the map to take effect. Once adopted into state or local law, the FIRM guides communities’ adoption of minimum floodplain standards and determines whether the purchase of flood insurance is mandatory. FEMA is required to assess the need to revise floodplain areas and flood risk every five years, but it does not necessarily update the maps.

Floodplain Management: In order to participate in the NFIP, and allow property owners to purchase flood insurance through the program, a community must adopt and agree to enforce floodplain standards that are at least as stringent as those set by FEMA. These standards set minimums related to land use planning, development, and zoning.

Communities can also voluntarily participate in the Community Rating System, which allows policyholders to receive premium discounts if the community’s floodplain standards exceed the NFIP minimums.

FEMA administers three programs that fund mitigation planning and projects both before and after disasters: the Hazard Mitigation Grant Program; the Flood Mitigation Assistance Program; and the Pre-Disaster Mitigation Program.

GAO URGES comprehensive reforms

In an April 2017 report, the Government Accountability Office recommended comprehensive reform of the NFIP to reduce federal exposure and improve resilience to flooding. The agency noted that reform will be essential to keep flood insurance affordable while keeping the program solvent. GAO highlighted six areas to consider:

-

Outstanding debt – It is unlikely FEMA will collect enough in premiums to repay the program’s current debt of $30.4 billion. Additional premiums are needed to reduce the need to borrow, yet GAO cautioned that raising premiums could make the insurance unaffordable for some property owners and discourage some from participating in the program.

-

Premium rates – NFIP premiums do not reflect the full risk of payouts due to floods. This increases federal fiscal exposure, obscures exposure from Congress, masks property owners’ risk of flooding, and discourages private insurers from selling flood insurance. GAO suggested that means-based assistance could offset reductions in affordability.

-

Affordability – As an alternative to subsidies, GAO suggested a federal appropriation to help control costs and increase transparency of federal exposure. Some people have recommended that federal assistance should go toward mitigation efforts, to help reduce flooding risk and the need for higher premiums.

-

Consumer participation – Expanding the mandatory purchase requirement to properties outside the highest risk areas could expand participation in the program. This could also help property owners understand the risk of floods.

-

Barriers to private-sector participation – Private companies cite regulatory uncertainty, lack of data, and below-market rates charged by NFIP as barriers to their ability to sell flood insurance. They also cite the uncertainty of mortgage lenders having to determine if private policies meet the mandatory purchase requirement. “Clarifying the types of policies and coverage that would do so could reduce this uncertainty and encourage the use of private flood insurance,” GAO said.

-

NFIP flood resilience efforts – GAO noted concerns that greater private sector participation could reduce funds available for NFIP mitigation and mapping programs that improve flood resilience.

ADMINISTRATION WEIGHS IN

With NFIP having exhausted its borrowing authority, the Trump administration wrote to Congress on October 4 asking that it cancel $16 billion of the program’s existing debt, the amount it estimates will be paid out in claims related to Hurricanes Harvey and Irma. It also stated that this cancelation of debt should be treated as an emergency for budgetary purposes. On October 12, the House passed H.R. 2266, the disaster relief supplemental, which includes the $16 billion relief of NFIP debt provision, by a vote of 353-69.

In his letter, Office of Management and Budget Director Mick Mulvaney stated that the program is not designed to handle catastrophic losses like those caused by Hurricanes Harvey, Irma, and Maria, and that the program is simply not fiscally sustainable in its current form. Mulvaney suggested reforms such as means-testing to allow low-income policyholders to maintain subsidized rates, along with accelerated premium increases for policyholders who can afford to pay risk-based rates, and improving the program’s management of properties that have sustained multiple losses. The administration also proposes a series of reforms to allow the private insurance market to expand and improve NFIP’s fiscal conditions.

need for reauthorization and reform

Without reauthorization, the NFIP loses its authority to issue new flood insurance policies after December 8. A lapse in authorization will prevent many new mortgages in communities mapped in Special Flood Hazard Areas. In addition, authority for the NFIP to borrow funds from the Treasury will be reduced from $30.425 billion to $1 billion, and appropriations related to the program and mapping will lapse.

Next Article Previous Article