Executive Actions on Health Care

- President Trump took several executive actions on health care last week.

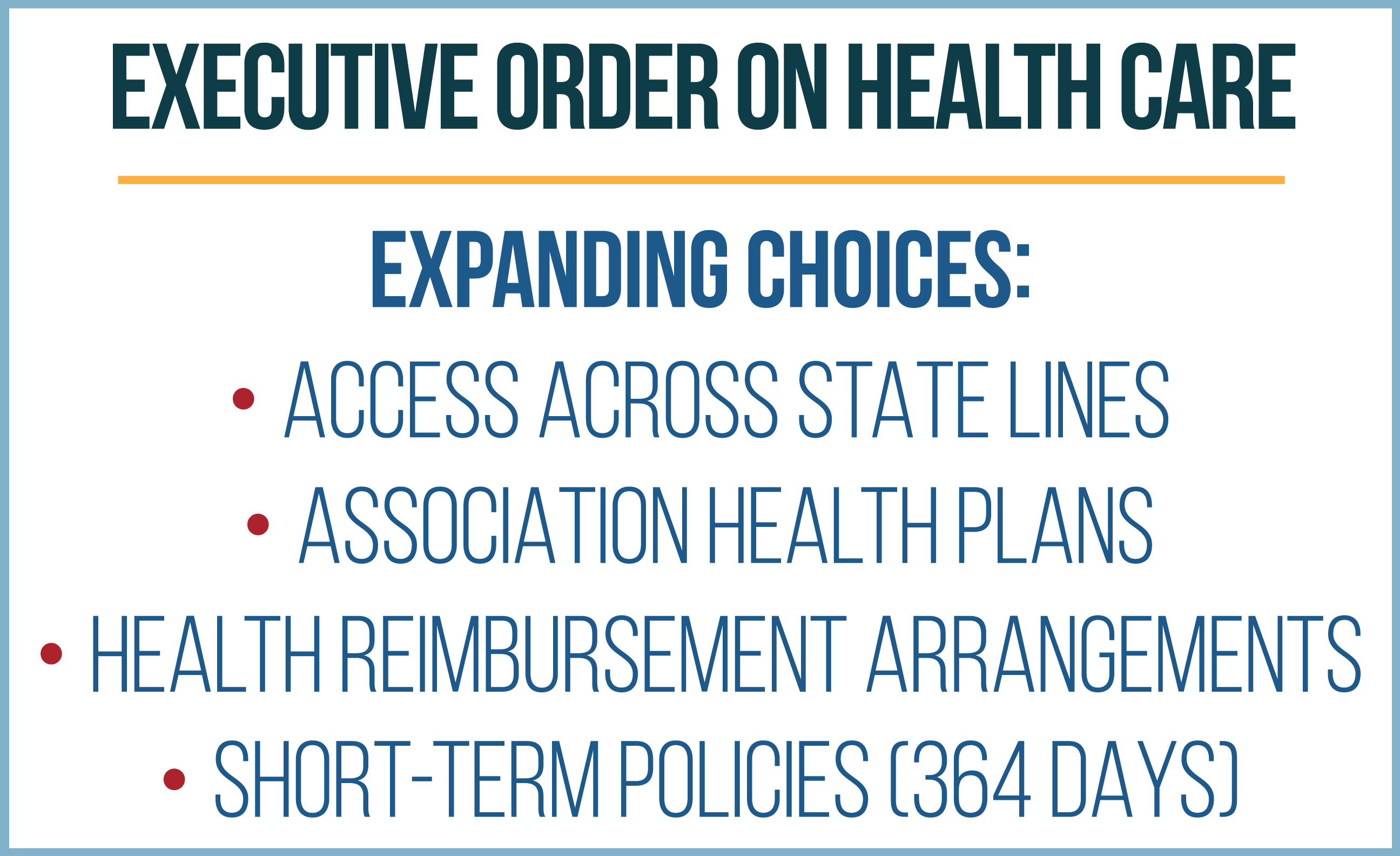

- First, he issued an executive order designed to increase consumer choice by facilitating the purchase of insurance across state lines and broadening the use of association health plans, health reimbursement arrangements, and short-term, limited-duration health plans.

- Second, the Trump administration ended the illegal payment of Obamacare’s cost-sharing reduction subsidies to insurers – estimated to cost almost $600 million a month in 2017.

The Trump administration took several steps in recent days, the first of which was designed to increase consumer choice while the second immediately ended payments to health insurers for Obamacare’s cost-sharing reduction subsidies.

EXECUTIVE ORDER TO EXPAND CONSUMER CHOICE

On October 12, President Trump signed an executive order to promote consumer choice and insurer competition. It included the following elements:

-

Insurance across state lines. A statement that, to the extent possible under current law, it is the policy of the executive branch to facilitate the purchase of health insurance across state lines.

-

Association health plans. Instructs the secretary of labor to consider proposing regulations or revising guidance to expand access to association health plans by allowing more employers to form these associations. This broadening could be done by allowing employers in various lines of business in the same state to form AHPs.

-

Short-term, limited-duration health plans. Instructs the secretaries of treasury, labor, and health and human services to consider proposing regulations or revising guidance to expand short-term, limited-duration insurance policies. These short-term policies, which do not abide by Obamacare’s coverage mandates, were previously available for as long as 364 days and could be renewed. The Obama administration limited the availability of these plans to no longer than three months and prohibited renewability.

-

Health reimbursement arrangements. Instructs the secretaries of labor, treasury, and HHS to consider proposing regulations or revising guidance to expand the use of health reimbursement arrangements. Employers use tax-advantaged HRAs to reimburse workers for health care spending.

-

Choice and competition study. Instructs the secretary of HHS, in consultation with the Treasury Department, Labor Department, and Federal Trade Commission, to report to the president within 180 days on federal and state laws, regulations, and policies that limit health care competition and choice.

Ending Illegal CSR Payments

ENDING THE ILLEGAL PAYMENT OF COST-SHARING REDUCTION SUBSIDIES

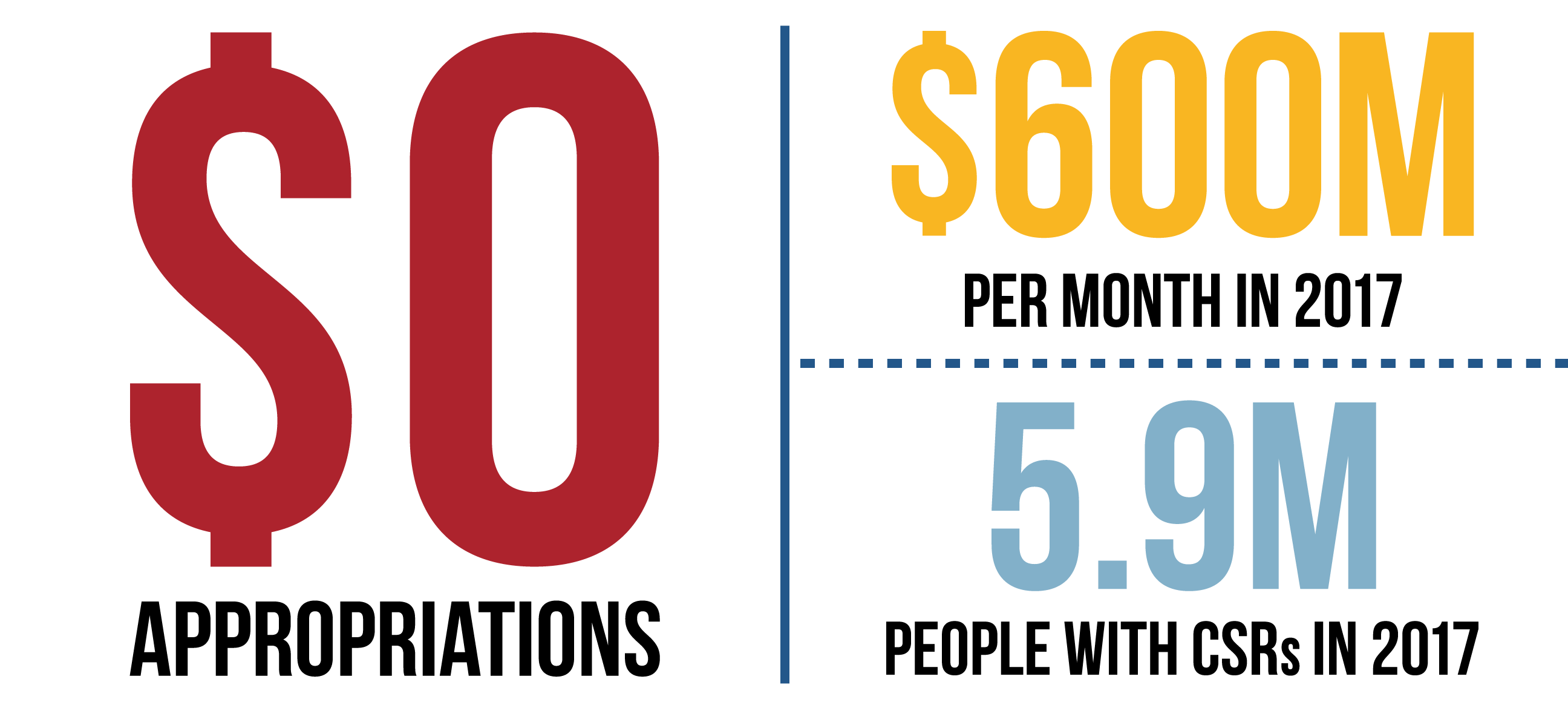

The Trump administration has ended the CSR payments to insurers, in a move that acknowledges Congress’ constitutional power of the purse. Congress has never appropriated funds for Obamacare’s cost-sharing reduction program. Despite this, the Obama administration illegally sent billions of dollars in cost-sharing reduction subsidies to health insurance companies.

In November 2014, the House of Representatives filed a lawsuit against the Obama administration’s Department of Health and Human Services to stop the illegal payments to insurers. In 2016, a federal district court judge ruled that there was no permanent appropriation for CSRs and that the Obama administration was illegally funding the program. The Obama administration appealed that decision but the issue was not resolved before the Trump administration began. The Trump administration sought a delay for the case as it evaluated the issue and determined how to proceed.

Last week, the Justice Department concluded that there is no appropriation for CSRs, affirming the district court’s ruling. Acting Secretary of HHS Eric Hargan instructed the administrator of the Centers for Medicare and Medicaid Services that the CSR payments must stop immediately.

HOW CSR SUBSIDIES WORK

Obamacare includes two different subsidies to offset the cost of insurance coverage purchased through the law’s exchanges: premium tax credits and cost-sharing reduction subsidies.

Cost-sharing reduction subsidies reduce the out-of-pocket expenses enrollees are responsible for covering, including deductibles, copayments, and coinsurance. CSR subsidies vary in generosity depending on income level. These subsidies are only available to people enrolled in silver plans who have incomes between 100 percent and 250 percent of the federal poverty level. In 2017, this range is $12,060-$30,150 for an individual and $24,600-$61,500 for a family of four.

People with incomes that qualify to receive CSR subsidies get enrolled in variants of silver plans that have increased actuarial values, depending on income. Standard silver plans are required to have an actuarial value of 70 percent. This means the insurer generally covers about 70 percent of costs and the enrollee pays the remaining 30 percent. The higher the actuarial value, the more costs covered by the insurance company.

With CSRs, people with incomes between 100 percent and 150 percent of FPL qualify for a variant silver plan with an actuarial value of 94 percent. This means their plan is expected to cover 24 percent more of the cost for covered services than the standard silver plan that has an actuarial value of 70 percent. For those with incomes between 150 percent and 200 percent FPL their plan’s actuarial value is increased to 87 percent, and for those with incomes between 200 percent and 250 percent the actuarial value is increased to 73 percent.

The subsidies are given directly to the insurance companies to subsidize their costs for providing the more generous plans. As of February 2017, 68 percent of subsidized enrollees were receiving cost-sharing reduction subsides, for a total of 5.9 million people, at an estimated annual cost of $7 billion or almost $600 million a month.

WHAT HAPPENS NEXT

Regardless of payment from the government, insurers are still obligated by Obamacare to lower cost-sharing levels for eligible enrollees through an increased actuarial value.

In the absence of a CSR appropriation from Congress, insurers can pay for the increase in the actuarial value of plans by charging a premium that reflects the higher actuarial value. CBO estimates that this will increase premiums an average of about 20 percent for benchmark silver plans on the exchange in 2018.

Obamacare’s premium tax credits reduce the amount of the premium paid by the customer. Recipients must spend a certain percentage of their income on health insurance premiums, and then the premium tax credit kicks in to pay the rest. If insurance companies raise premiums, low-income people who get subsidies do not pay more for the benchmark plan. It does not really matter how much their premiums rise, because the amount they pay is capped based on their income, not the cost of the plan.

However, it does matter to taxpayers, because Washington picks up the cost of the increased premiums through increased spending on premium tax credits. CBO estimates that ending the CSR payments and adding the costs of increased actuarial values to the premium would increase net federal spending on Obamacare subsidies by $6 billion in 2018 and add $194 billion to deficit from 2017-2026.

Given the long-standing uncertainty on CSRs, most health insurers selling coverage on the federal exchange included in their 2018 rate filings the assumption that CSR payments would end. Therefore, no adjustment to their rates is needed. In some states, insurance companies were prohibited from making this kind of assumption. CMS has said it is working with insurers in these states. It is unclear if these insurers will be able to refile in time, as the 2018 open enrollment period begins on November 1.

Next Article Previous Article