Education Aid in Congress' Coronavirus Response

KEY TAKEAWAYS

- The coronavirus has upended education for millions of K-12 and college students across the country, and some disruptions are likely to continue into the next school year.

- In the CARES Act, Congress provided money for K-12 schools and colleges to use on activities such as remote education, as well as funds for colleges to give as emergency grants to students.

- The law also suspends individuals’ payments on federally held student loans until September 30.

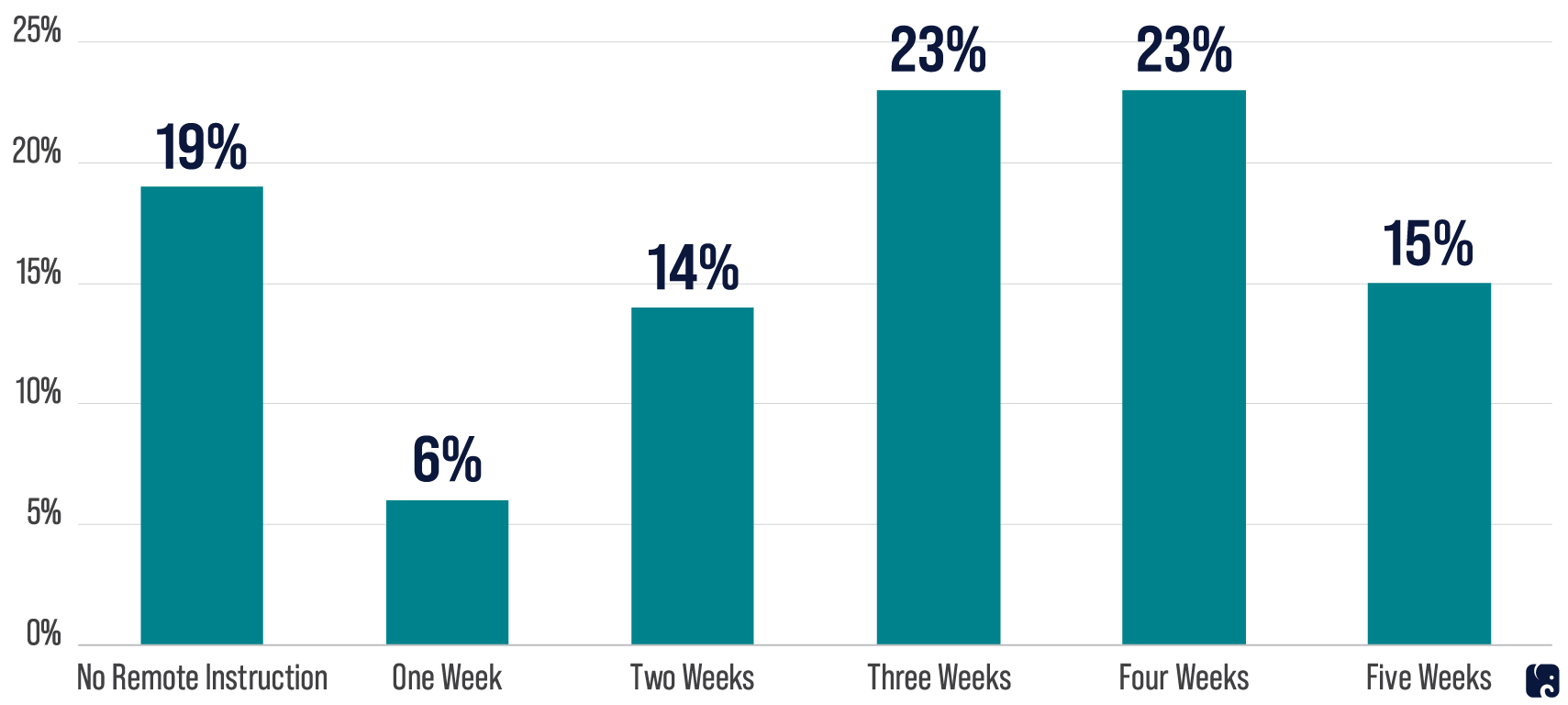

In the Coronavirus Aid, Relief, and Economic Stabilization Act, Congress provided funds to help schools and students respond to the coronavirus emergency. Most states began closing their K-12 schools the week of March 16, and many scrambled to set up virtual classes and other forms of remote education. The American Enterprise Institute found that by April 14, a “majority of schools had offered remote instruction for between two and four weeks.” More than half of schools started remote education within a couple of weeks of closing their buildings. As of April 24, only 6% of schools were in districts without such plans in place, down from 19% on April 14. Some schools will end this school year early due to their struggles with distance learning. Others provided students with new computers and set up mobile Wi-Fi access to help families get faster connections.

K-12 Schools Offering Remote Education as of April 14

Most states have decided to keep school buildings closed for the rest of this school year and have begun planning safety measures for when they reopen. Going into the next school year, K-12 schools face many challenges, including how to help students make up for lost learning time and avoid falling behind academically.

Many U.S. colleges and universities also closed their campuses and moved to online learning. Students had to move out of residence halls, and some lost the campus jobs they use to pay for school. Colleges are deciding whether to stay online, reopen campuses, or do a combination of both for the fall semester. Some students may be reluctant to enroll due to financial or health concerns.

helping schools and students

The CARES Act created a $30.75 billion education stabilization fund at the Department of Education to help meet immediate education needs and plan for the next academic year. Major parts include:

Elementary and secondary school emergency relief fund. On April 23, the department said states could start applying for their share of $13.2 billion the law provided. States must send 90% of their allocation to school districts, which may use the money for a wide range of activities. These include improving remote learning and technology by training staff and expanding high-speed internet access; cleaning facilities; and making up for lost learning time. Some districts have indicated they plan to use their funds for internet access and devices for students and summer programs.

Governor’s emergency education relief fund. A second pot of money, $3 billion, will go to governors to distribute. They have latitude in disbursing their share, though the money must help their state’s “most significantly impacted” K-12 schools and colleges. Recipients may pay for education services, child care, social and emotional support services, and similar things. On April 14, the department opened the application process, and some states have received grants. Maine plans to pay for devices and internet access, and Kentucky will fund remote learning and food distribution.

Higher education emergency relief fund. Congress provided about $14 billion for higher education. The department first made nearly $6.3 billion available for colleges and universities to give as emergency grants to students for housing, food, child care, and other needs due to the coronavirus-related campus disruptions. Education Secretary Betsy DeVos urged schools to give priority to students with the most need, while considering a per-student limit to help more students. Schools have begun disbursing this aid to students. In late April, the department announced about $6.3 billion more for colleges and universities to use for remote education; reimbursing students for room, board and fees; cleaning facilities; and similar expenses related to disruptions of campus operations. Some schools in North Carolina, for example, plan to spend their funds on technology for online teaching, laptops, and operational expenses.

The Education Department also announced $1.4 billion for historically black colleges and universities, minority serving institutions, and tribally controlled colleges and universities. They may give the money to students or pay for institutional expenses such as payroll and technology.

Other help for students. The department also created two new grant programs with about $308 million from the education stabilization fund.

Rethink K-12 Education Models grants will be for increasing student access, such as by setting up statewide virtual learning programs or by giving families small grants to buy technology or pay tuition and fees for remote learning programs for their children.

Reimagining Workforce Preparation grants will fund short-term postsecondary education and work-based programs to equip students and jobless workers for job market changes due to the coronavirus.

The CARES Act says that students who have to drop out of college due to the coronavirus will not have to return the portions of their Pell Grants or federal loans they otherwise would have had to repay for that term. The current academic term will not count toward their lifetime eligibility limits for Pell Grants or subsidized loans. Congress also allowed this partial school year to count as a full year of service for teachers trying to meet Teacher Loan Forgiveness and TEACH Grant program requirements.

Colleges may give additional supplemental education opportunity grants to students with financial need because of a coronavirus-related emergency. Schools may pay students in the federal work-study program for the rest of the school year if they cannot work at their campus job due to the coronavirus.

providing Student loan relief

Under the CARES Act, the Education Department is automatically suspending loan payments and interest accrual on federally held student loans. The suspension was retroactive to March 13 and lasts until September 30. Borrowers in a loan rehabilitation or repayment plan that offers forgiveness will get credit as if they were making payments. Those seeking public service loan forgiveness still must be in an eligible repayment plan and work for a government or qualifying nonprofit. Borrowers may still pay down their loans during the suspension. The 0% interest rate means once they pay off any accrued interest, their payments will reduce the principal they owe.

Loans owned by the department – which are most loans outstanding – qualify for the payment suspension. These include the Direct Loan Program, which has 35 million borrowers with more than $1.2 trillion outstanding, as well as the share of Federal Family Education Loan Program and Perkins Loan Program loans that the department owns. The FFELP and Perkins loans owned by commercial lenders and schools do not qualify and neither do private loans, though some lenders and schools are offering relief. The University of California has said its former students with Perkins loans can stop payments through September 30. New York announced an agreement with most private lenders in the state to offer borrowers 90 days of forbearance, no late fees, and no adverse reports to credit agencies. Another multi-state agreement with lenders offers borrowers similar relief.

Workers with student loans also may benefit from a CARES Act provision that lets employers make up to $5,250 in student loan payments in 2020 on a tax-free basis to the worker.

Next Article Previous Article