Senate Amendment to H.R. 1628 – Graham-Cassidy-Heller-Johnson-Blunt

Noteworthy

Background: On September 13, Senators Graham, Cassidy, Heller, and Johnson released a bill to reform health care. The legislation is an amendment in the nature of a substitute to H.R. 1628, the House-passed reconciliation bill.

Floor Situation: The 20 hours of debate time allotted for H.R. 1628 under the reconciliation rules expired on July 28. Majority Leader McConnell is expected to make a motion to proceed to H.R. 1628 this week and this amendment is expected to be the first vote should the motion to proceed be adopted.

Executive Summary: The amendment repeals the structure of Obamacare’s coverage provisions and replaces them with a block grant given annually to states to develop their own health care reforms. The bill would:

-

Effectively repeal Obamacare’s individual and employer mandates.

-

Expand the allowable uses and contribution amounts to health savings accounts.

-

Allow states freedom from certain Obamacare insurance regulations, such as the essential health benefits package and premium rating restrictions.

-

Return power to states and patients through a more equitable block grant distribution of Obamacare’s spending to states.

-

Reform the traditional Medicaid program by capping spending and giving states the tools and flexibility to reform the program to best meet the needs of their citizens.

Overview of the Issue

The Graham-Cassidy-Heller-Johnson-Blunt amendment repeals the structure of Obamacare’s coverage provisions and replaces them with a block grant given annually to states. The grant dollars replace the federal money currently being spent on Obamacare’s Medicaid expansion, premium tax credits, cost-sharing reduction subsidies and the Basic Health Plan. The proposal gives states the resources and regulatory flexibility to innovate and create health care systems that lower premiums and expand coverage. It removes the Washington-designed, one-size-fits-all approach to health care and gives states significant latitude over how the federal dollars would be used to best take care of patients in each state. The block grant is subject to a mandatory appropriation and federal restrictions on abortion funding.

Notable Bill Provisions

Title I

Section 101 – Elimination of Limitation on Recapture of Excess Advance Payments of Premium Tax Credits

The bill repeals the dollar amount limits placed on subsidy repayment for people who received an excess advance premium tax credit, beginning in tax year 2018 and ending December 31, 2019. Under Obamacare, if someone received too much, there are limits on what the government can collect.

Section 102 – Premium Tax credit

Beginning in 2018, the bill modifies the definition of a “qualified health plan” to exclude plans that cover abortions other than to save the life of the mother or in the case of a pregnancy that is the result of rape or incest.

Repeals Obamacare’s premium tax credit beginning in 2020. However, the Secretary must continue to make any premium tax credit payments to any state with a Section 1332 State Innovation Waiver in effect before this bill.

Section 103 – Modifications to Small Business Tax Credit

Excludes any health plan that covers elective abortion from being eligible for the small business tax credit. The section also repeals the small business tax credit beginning in 2020.

Section 104 – Individual Mandate

Effectively repeals the individual mandate by lowering the penalty to $0 beginning in taxable year 2016.

Section 105 – Employer Mandate

Effectively repeals the employer mandate by lowering the penalty to $0 beginning in taxable year 2016.

Section 106 – Short Term Assistance for States and Market-Based Health Care Grant Program

All funds in this section are prohibited from paying for insurance coverage of abortion services.

Short-term assistance to address coverage and access disruption and provide support for states:

Creates a short-term fund and appropriates $10 billion in calendar year 2019 and $15 billion in 2020 to the administrator of the Centers for Medicare and Medicaid Services.

The administrator would have wide latitude to use the money to fund arrangements with health insurance companies to address coverage and access disruption and to respond to urgent health care needs. The funds appropriated will remain available until expended.

Five percent of the funds for short-term assistance each year shall be distributed to “low-density” states. The remainder of the funds would be distributed taking into account the proportion of each state’s population that are low-income.

Market-Based Health Care Grant Program:

The bill creates a new grant program to take all of the federal money being spent on Obamacare’s coverage provisions today and redistribute it to states based on a new funding formula.

Only the 50 states and District of Columbia are eligible for grant money. States must submit a one-time application that would be approved by the administrator and deemed approved through December 31, 2026.

The application must include a description of how the funds will be used to do one or more of the following:

-

To establish or maintain a program or mechanism to provide financial assistance – including by reducing premium costs – to help high-risk people who have or are projected to have a high rate of utilization of health services, as measured by cost, who do not have access to employer coverage and purchase in the individual market;

-

To establish or maintain a program to enter into arrangements with health insurance issuers to assist in the purchase of health benefits by stabilizing premiums and promoting state health insurance market participation and choice in plans offered in the individual market;

-

To provide payments for health care providers for the provision of health care services;

-

To provide assistance to reduce out-of-pocket costs, such as copayments, coinsurance, and deductibles, of people enrolled in plans offered in the individual market;

-

To establish or maintain a program to help people purchase health coverage, including by reducing premium costs for plans offered in the individual market;

-

To provide health insurance coverage for those eligible for Medicaid by establishing or maintaining relationships with health insurers to provide such coverage (No more than 15 percent of the amount allotted to a state may be used for this purpose unless a state submits an application to waive this limit. If a state obtains a waiver, it may use up to 20 percent of its allotment for this purpose. The secretary of health and human services must determine that the state is using the funds to supplement, not supplant, state spending on Medicaid.);

-

To assist in the purchase of health coverage by establishing or maintaining a program, as specified by the state, to establish coverage programs through arrangement with managed care organizations for people who are not eligible for Medicaid or CHIP.

A state must describe “how the state shall maintain access to adequate and affordable health insurance coverage for individuals with pre-existing conditions.”

In addition, states must certify that they will be in compliance with several components of existing law: coverage of kids on a parent’s plan until age 26, standards related to newborns and mothers, prohibition of health discrimination based on genetic information, parity for mental and substance abuse coverage, and required coverage of reconstructive surgery after a mastectomy.

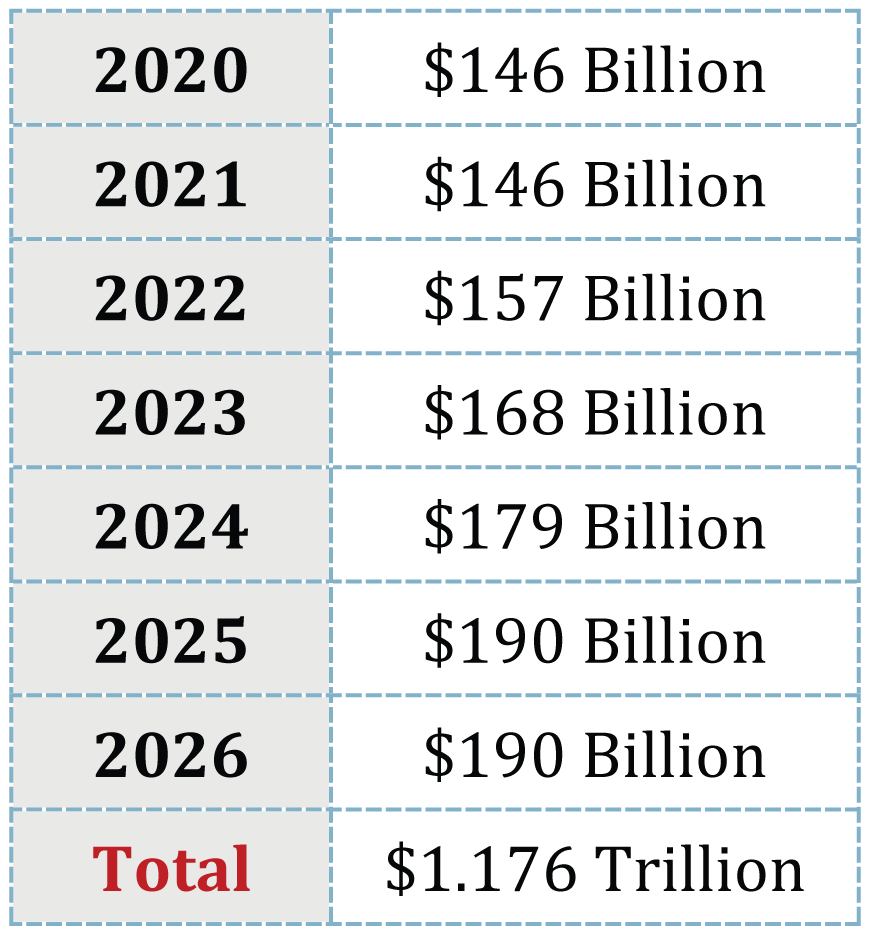

For the purpose of providing grants to states, the following amounts are appropriated:

Funds are available for obligation by the state for two years except that no funds remain available for obligation after December 31, 2026. Any unused funds allotted to a state shall be used for deficit reduction.

The 2020 amount includes $10 billion that states may apply for, which would serve as an advance on their 2026 allotment. However, the advance any state chooses to take cannot exceed 5 percent of the amount it would have received under the base calculation. If any of the $10 billion is not spent, it is reserved to be spent in 2026. A state’s 2026 grant amount shall be reduced by the amount it received from the extra $10 billion in 2020.

At least 50 percent of funds paid to a state must be used by the state to provide assistance to people between 50 percent and 300 percent (incorporating the 5 percent income disregard under current law) of the federal poverty level.

Determination of state allotment amounts:

The amount each state would receive as a block grant is initially pegged to the amount of federal funding it received under Obamacare – an amount called the “base period amount.” Over time, the block grant amounts are calculated to reflect the state’s proportion of low-income residents compared to the rest of the states. This section defines “low-income individual” as a legal resident or citizen with an income between 50 and 138 percent of the federal poverty level.

To calculate their base period amount, there would be a three-step process. First, states may select any four consecutive fiscal quarters between the first quarter of 2014 and the first fiscal quarter of 2018. Second, funding for that period is totaled, including federal payments received by the state for Medicaid expansion enrollees, the Basic Health Program, premium assistance tax credits, and cost-sharing reduction subsidies. Third, the amount of base period funding would then be increased at different rates for each category of funding to determine what that state would receive in 2020. For Medicaid payments, the growth rate is determined by the Medicaid and CHIP Payment and Access Commission. For all other spending categories, payments are increased at the rate of the medical component of the urban consumer price index, or CPIU-M. The amount determined for 2020 is the state’s base period amount.

For low-density states – defined as those with fewer than 30 people per square mile – with per capita health care spending that is 20 percent greater than the national average, their base period amount is the product of the state’s base period (as determined above) and the percentage by which the state’s per capita health care spending is above the national average.

The funding formula determining each state’s block grant for 2021-2026 uses the following blended equation:

2020 – Base rate period amount (as calculated above)

2021 – 9/10 2020 base rate period amount, 1/10 based on state’s proportion of population between 50-138 percent of FPL (low-income population)

2022 – 8/10 2021 base rate, 2/10 low-income population

2023 – 7/10 2022 base rate, 3/10 low-income population

2024 – 6/10 2023 base rate, 4/10 low-income population

2025 – 5/10 2024 base rate, 5/10 low-income population

2026 – 4/10 2025 base rate, 6/10 low-income population

There is a 25 percent cap on the amount a state’s allotment may increase from one calendar year to the next.

Beginning in 2023, the administrator will adjust the grant amount for each state based on the state’s “risk index.” The administrator must develop a risk index that will include exhaustive and exclusive risk categories such that every low-income individual is assigned to a risk category. The risk adjustment factor is gradually phased in from 2023 to 2025, but cannot alter a state’s payment by more than 10 percent.

Also beginning in 2023, the administrator may adjust a state’s grant amount (including any risk adjustment changes) by a state-specific population adjustment factor. The administrator is charged with developing a population adjustment factor no later than July 31, 2021. The factor shall account for factors that impact health care spending beyond the clinical characteristics of the low-income population (e.g., state demographics, wage rates, and income levels).

The section includes an $11 billion contingency fund. For calendar years 2021 and 2022, the state grant amount for low-density states or non-expansion states may be increased by the administrator. It appropriates $6 billion in 2020 and $5 billion in 2021. The administrator must reserve 25 percent of the contingency funding for low-density states, 50 percent for non-expansion states, and 25 percent for expansion states.

For state’s that expanded their Medicaid program after December 31, 2015, (draft error—text says 2016 but sponsors intend 2015, change forthcoming) there is a $750 million appropriation to increase their grant allotment for calendar years 2023 through 2026.

Section 107 – Better Care Reconciliation Implementation Fund

The Department of Health and Human Services is provided $2 billion to implement the bill.

Section 108 – Repeal of Tax on Over-the-Counter Medications

Repeals the exclusion of over-the-counter medicines from the allowable uses of tax-advantaged health accounts, effective beginning in taxable year 2017.

Section 109 – Repeal of Tax on Health Savings Accounts

Repeals the tax increase for making purchases related to nonqualified medical expenses with tax-advantaged health accounts, effective for distributions made beginning in 2017. Obamacare raised the penalty from 10 percent to 20 percent for HSAs, this lowers it back to 10 percent.

Section 110 – Repeal of Medical Device Excise Tax

Repeals the 2.3 percent excise tax on medical devices, effective for sales beginning in calendar year 2018.

Section 111 – Repeal of Elimination of Deduction for Expenses Allocable to Medicare Part D Subsidy

Repeals the elimination of the employer deduction for retiree prescription drug coverage, effective beginning in taxable year 2017.

Section 112 –Purchase of Insurance from Health Savings Accounts

Allows a parent to use their HSA funds to pay qualified medical expenses for children under the age of 27. Also allows HSA funds to be used to pay premiums for a high-deductible health plan to the extent the premium exceeds: any tax deduction allowable; any amount excludable from income tax; and any tax credit amount allowed. This section would become effective in 2018.

Section 113 – Maximum Contribution Limit to HSAs Increased

The maximum contribution for health savings accounts is nearly doubled. It is increased to the sum of the annual deductible plus the maximum out-of-pocket expenses permitted under a high deductible health plan. Effective beginning in taxable year 2018.

Section 114 – Allow Both Spouses to Make Catch-Up Contributions to the Same HSA

Both spouses can make catch-up contributions to the same health savings account, beginning in taxable year 2018.

Section 115 – Special Rule for Certain Medical Expenses Incurred Before Establishment of HSA

HSA funds may be used to pay for qualified medical expenses incurred during the 60 day period after enrollment in a high-deductible health plan and before the account is established, beginning for coverage that begins in 2018.

Section 116 – Exclusion from HSAs of High Deductible Health Plans Including Coverage for Abortion

HSA funds could not be used to pay for a high-deductible health plan that covers abortions except if necessary to save the life of the mother or if the pregnancy is the result of rape or incest.

Section 117 – Federal Payments to States

Prohibits for one year federal payments – including Medicaid, CHIP, Maternal and Child Health Services Block Grants, and Social Services Block Grants to states – from going to certain non-profit, family planning entities that receive more than $1 million a year in Medicaid funding and provide abortion services.

Section 118 –Medicaid

Repeals the state option to extend coverage to non-elderly, non-disabled, non-pregnant adults up to 138 percent of FPL after September 1, 2017. Obamacare’s expansion is entirely repealed for all states beginning January 1, 2020.

Section 119 – Reducing State Medicaid Costs

Limits retroactive enrollment in Medicaid to the second month before the month in which the applicant applied, beginning October 1, 2017.

Section 120 – Eligibility Redeterminations

Allows states to increase the frequency of Medicaid eligibility redeterminations to every six months and increases administrative funding for states that opt for more frequent redeterminations.

Section 121 – Optional Work Requirement for Non-disabled, Non-elderly, Non-pregnant Individuals

Beginning October 1, 2017, states may impose work requirements on their non-disabled, non-pregnant, non-elderly adult populations, with certain exceptions. The bill provides enhanced administrative funding for states that take this option.

Section 122 – Provider Taxes

Phases down the allowable Medicaid provider tax threshold from 6 percent to 4 percent. The phase down is a 0.4 percentage point reduction each year from fiscal years 2021-2025.

Section 123 – Per-Capita Allotment for Medical Assistance

Starting in fiscal year 2020, states will receive a capped amount of money per Medicaid enrollee, based on the category of eligibility into which the enrollee falls. There will be four Medicaid categories: elderly; blind and disabled; children; and nonelderly, non-expansion adults.

The initial payment amount would be based on a state’s per capita base period calculation. For this calculation, a state may pick any eight consecutive fiscal quarters from quarter one of 2014 to quarter three of 2017. The total funding from those eight quarters is then divided in half to create an artificial four fiscal quarter period to use as the per capita base period.

States that expanded their Medicaid programs later than the fourth quarter of 2015, but before the fourth quarter of 2016, may select a period shorter than eight consecutive quarters, but not less than four.

Funding for the elderly and the blind and disabled will be indexed to annual increases in the medical care component of the urban consumer price index plus 1 percent from 2020-2024. Funding for children and nonelderly adults will be indexed to increases in the medical care component of the urban CPI from 2020-2024. For fiscal years after 2024, the cap amount will be indexed to increases in the CPI-U for nonelderly adults and kids and CPI-M for the elderly and the blind and disabled. If a state’s spending exceeds the cap, its federal Medicaid funding will be reduced the following year.

Non-DSH supplemental payments will be included in the caps. Certain populations, such as blind and disabled children, CHIP and Indian Health Service enrollees, breast and cervical cancer services-eligible enrollees, and partial-benefit enrollees, would be exempt from the caps.

In addition, between January 1, 2020, and December 31, 2024, if HHS declares a public health emergency in a state, the state’s Medicaid spending would be excluded from the caps. In addition to other exclusions, the total amount excluded from the caps cannot exceed $5 billion.

Beginning in 2020, a state’s per capita funding will be adjusted if its spending in that category in the previous year deviates from the national average by 25 percent or more. If a state’s spending was less than 25 percent below the national average, the secretary of health and human services could increase the payment. If it was greater than 25 percent above the national average, the secretary could decrease the payment. These adjustments would not apply to low-density states.

The secretary shall create a new demonstration project to provide and improve the quality of home and community-based services beginning January 1, 2020, and ending on December 31, 2023.

Section 124 – Flexible Block Grant Option for States

Beginning in fiscal year 2020, states may choose to receive a block grant for providing health care for their children, elderly, and non-expansion adult population rather than the per capita allotment.

Funding for the block grant would be determined using the same base year calculation as the state’s per capita allotment. The grant amount will be indexed to the CPI-U inflation rate. The block grant lasts for five fiscal years.

States that elect to use the block grant option have the ability to determine scope, duration, and amount of all mandatory benefits. At a state’s discretion, optional benefits can also be included.

The secretary may make additional payments to states with a block grant in the case of a public health emergency.

Section 125 – Medicaid and CHIP Quality Performance Bonus Payments

There will be $8 billion available beginning in fiscal year 2023 through fiscal year 2026, for a state that spends below the per capita allotment. Because states may not keep what they save if they spend below the cap, this fund provides some money to reward the most efficient states.

Section 126 – Optional Assistance for Certain Inpatient Psychiatric Services

States have the option to lift the Medicaid exclusion for institutions for mental disease from facilities based on beds in a facility. Instead, they can cover inpatient psychiatric services for substance use disorders and mental health for up to 30 consecutive days, but no more than 90 days per year.

States that utilize this option will be required to maintain: 1) the number of licensed beds; 2) the annual level of state spending for inpatient services and active psychiatric care and treatment. States would receive a 50 percent federal medical assistance percentage for Medicaid enrollees over age 21 and under 65 except if a state was already receiving a higher FMAP for such services and people, in which case the greater FMAP shall apply. This provision would be effective October 1, 2018.

Section 127 – Enhanced FMAP for Medical Assistance to Eligible Indians

The bill changes the FMAP to 100 percent for services provided to Indians and eligible for assistance under a Medicaid state plan.

Section 128 – Non-Application of DSH Cuts for States with Low Market-Based Health Care Grant Allotments; One-Time DSH Allotment Increase for 2026

For 2021-2025, any state that has a grant allotment that does not grow by at least CPIU-M shall have their DSH reduction offset by the difference between their grant allotment and the grant allotment if it had grown at that rate. Any state that has a grant allotment that does not grow by at least the increases in CPIU-M in 2026 shall receive additional DSH for 2026.

Section 129 – Determination of FMAP for High-Poverty States

Beginning in the second quarter of 2018, the FMAP for states that have a separate federal poverty guideline (Alaska and Hawaii) from the other 48 states and the District of Columbia shall be increased. For the state with the highest separate poverty guideline (Alaska), the FMAP will be increased by 25 percent of the average FMAP of states that do not have a separate poverty guideline. For the state with the second-highest separate poverty guideline, the FMAP shall be increased by 15 percent of the average FMAP for states that do not have a separate guideline.

Title II

Section 201 – The Prevention and Public Health Fund

Rescinds all funds for the Prevention and Public Health Fund beginning in fiscal year 2019.

Section 202 – Community Health Center Program

Increases funding for community health centers by $422 million in fiscal year 2017.

Section 203 – Repeal of Cost-Sharing Subsidy Program

People between 100 percent and 250 percent of the federal poverty level get cost-sharing reduction subsidies to reduce their out-of-pocket expenses. These are in addition to any premium tax credit they receive. A person must be enrolled in a silver plan to receive CSR payments. Beginning in 2020, CSRs are repealed.

Section 204 – Conditions for Receiving Market-Based Health Care Grant

Non-application of existing rules:

For any calendar year 2020 through 2026 that a state receives funds from the new block grant, if a state establishes rules that conflict with the following, the rules shall not apply:

-

Essential health benefits package, annual limits on cost-sharing and deductibles, actuarial value requirements and definition of levels of coverage;

-

Restrictions on premium rating for rating area and age;

-

Requirements for insurers to cover essential health benefits package and requirement to offer child-only policies;

-

Obamacare’s preventative services mandate to cover with no cost-sharing;

-

Single risk pool requirement for insurers offering coverage in the individual market.

Health coverage under a program or mechanism that uses grant money must include a description of the following rules:

-

The criteria and degree to which health insurers may vary premiums, except that an insurer may not vary rates on the basis of sex or genetic information;

-

Whether and the degree to which a health insurer can require as a condition of enrollment an individual to pay premiums that are greater than premiums paid by a similarly situated individual;

-

The level of benefits the health insurer is required to include in coverage;

-

The number of risk pools an insurer can use to group enrollees.

Any rule that is not complied with but deemed to comply under this section shall only apply to coverage provided by an insurer receiving funding through the grant program and to a person that is receiving a direct benefit from the grant. The direct benefit to a person cannot include benefits from broad measures such as reinsurance.

Administration Position

A Statement of Administration policy is not available at this time.

Cost

The Congressional Budget Office’s preliminary estimate is that the legislation would reduce the on-budget deficit by at least $133 billion over the 2017-2026 period, matching or exceeding the level of savings achieved in the House passed reconciliation bill, H.R. 1628.