Trustees Reports Show Need for Reform Now

- Last week, the trustees for Medicare and Social Security issued stern new warnings about the finances of both programs.

- The Medicare trust fund will be bankrupt in 2028 if it remains on its current course, and harsh IPAB cuts could be triggered next year.

- Social Security is on pace to go bust in 2034. If nothing is done, benefits will need to be cut by 21 percent.

Last week, the trustees for Medicare and Social Security issued their annual reports outlining each program’s finances. Both programs are in grave danger.

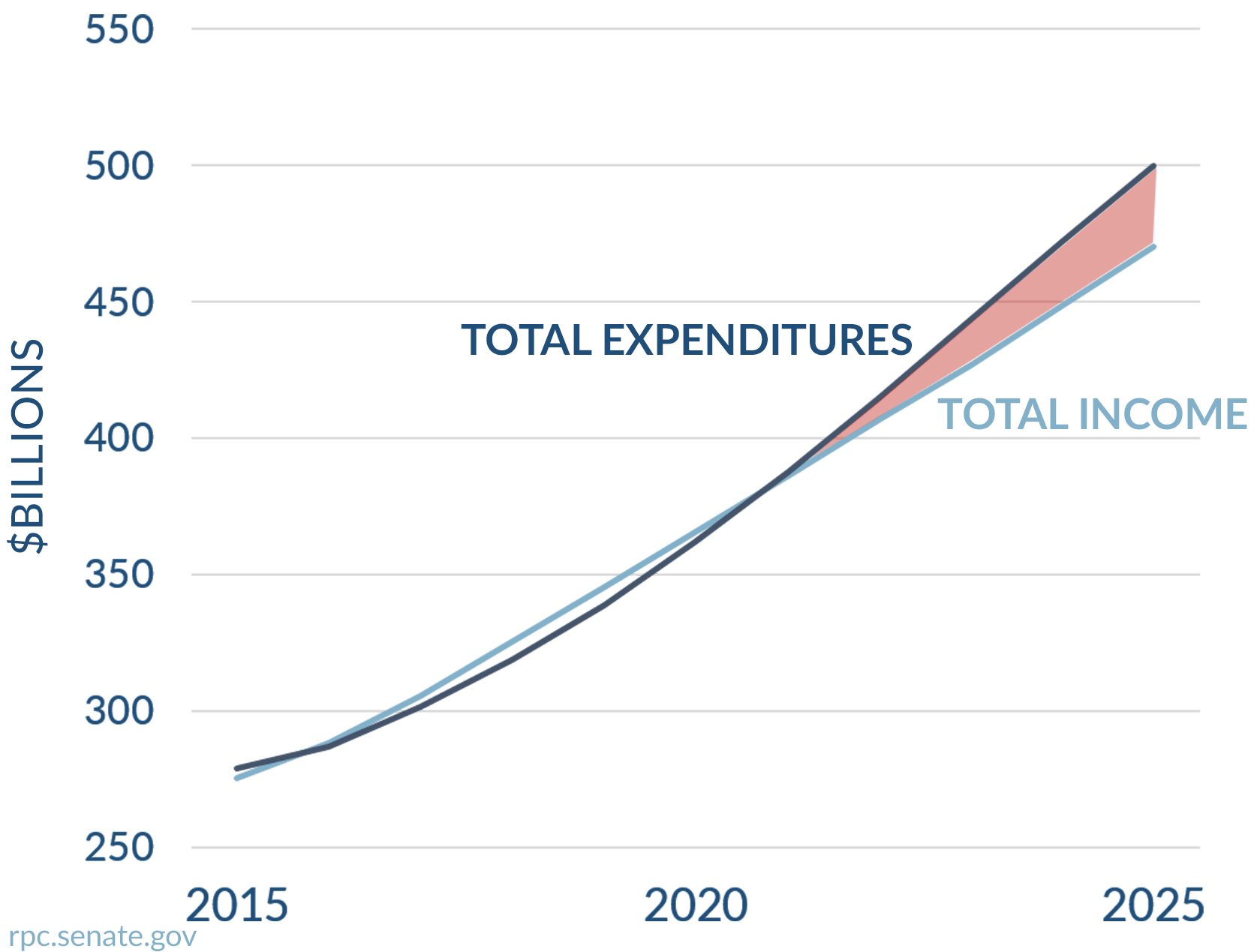

Medicare’s spending will outstrip its income

The trustees report that Medicare’s Part A hospital insurance trust fund will be depleted in 2028. This is two years earlier than the trustees projected just last summer. Though the trustees expect the trust fund to run slight surpluses from 2016 to 2020, it will begin running deficits in 2021 until the fund is depleted in 2028.

Last year, total Medicare expenditures were $648 billion. The trustees predict that expenditures will increase at a faster pace than workers’ earnings and the economy overall. Expenditures are projected to increase from 3.6 percent of GDP in 2015 to 5.6 percent of GDP by 2040.

This dismal picture underscores the irrationality of Hillary Clinton’s proposal to expand the Medicare program. Without reform, Medicare is not in a position to keep its promises to current beneficiaries, let alone to new ones.

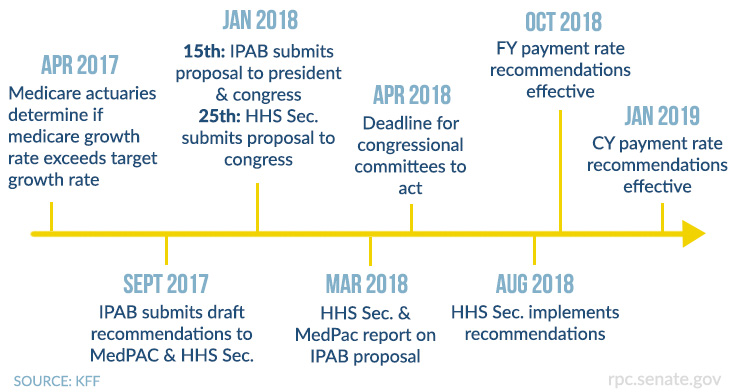

IPAB To Kick In

Obamacare created the Independent Payment Advisory Board, empowering a board of 15 unelected, unaccountable, and still-unnamed bureaucrats to mandate health care decisions for Medicare recipients. The board could move to reduce provider payments, which will lead to reduced care for seniors. The trustees say they expect IPAB action to be triggered next year. This is the second consecutive year the trustees have predicted that action by the board will be triggered in 2017. If IPAB does not submit a proposal as required by law – for instance, if the members of the board are not appointed and confirmed in time – the secretary of HHS is directed to develop and implement proposals. Congress would have to affirmatively act to alter or discontinue the secretary’s proposals in order for them not to go into effect. Reforms that protect and strengthen Medicare are needed, and they should not be made by unaccountable Washington bureaucrats.

Medicare Part B Beneficiaries Face Trouble

The trustees also project that there may be substantial increases in Part B premiums for some beneficiaries next year. Medicare Part B premiums, by law, cannot rise by more than the amount of the Social Security cost-of-living adjustment. However, this protection does not apply to about 30 percent of Part B beneficiaries, who face significant premium increases. These are high-income enrollees, “dual eligibles” who are beneficiaries of both Medicare and Medicaid, and enrollees who do not receive Social Security checks. Last year, Congress passed legislation to prevent a dramatic increase to premiums for these people in 2016. For 2017, the trustees estimate that these seniors will have to pay an extra $326 per year in Part B premiums.

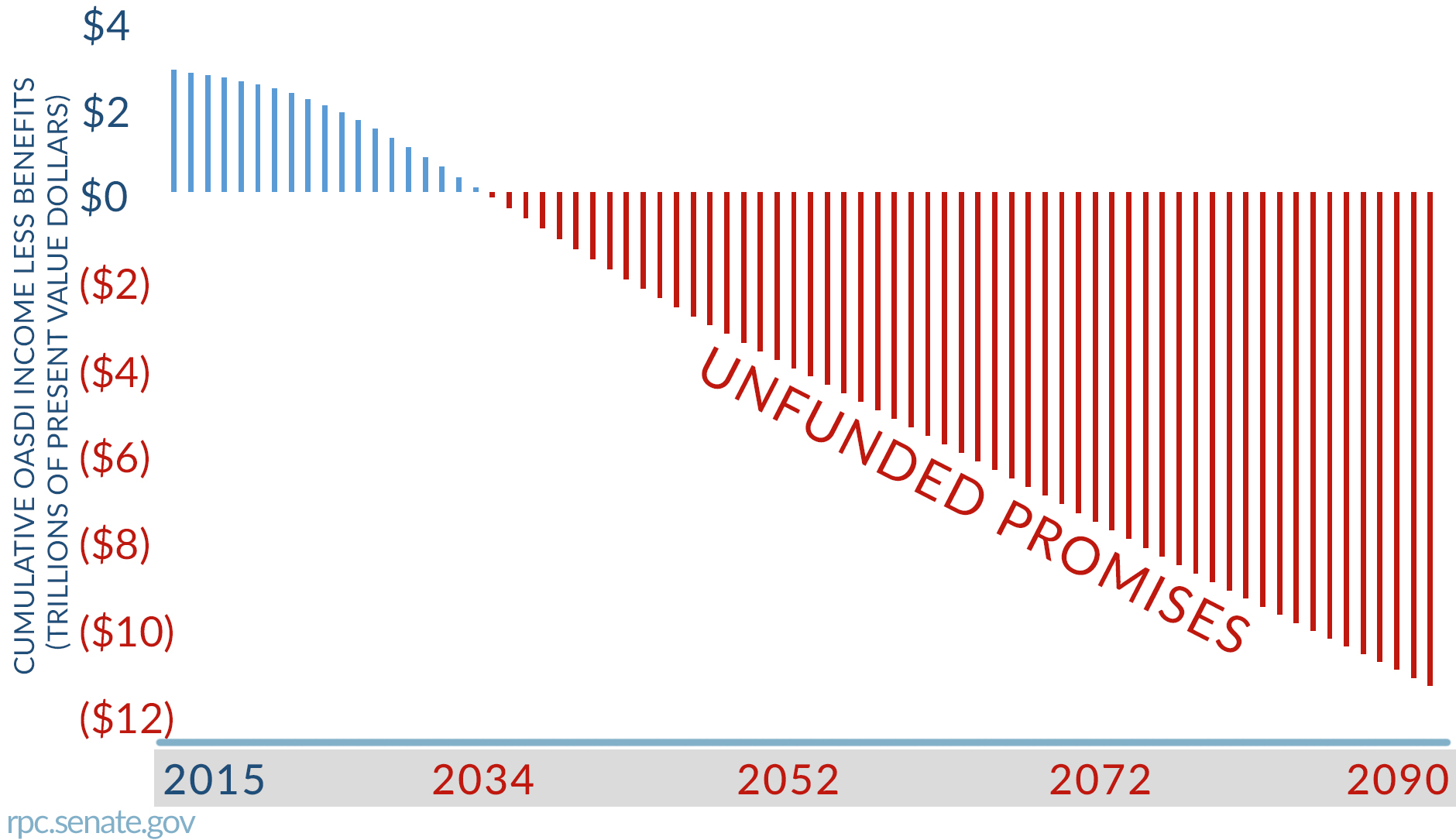

Social Security Goes Bankrupt in 18 Years

Despite efforts to shore up the Disability Insurance program last year, and lower costs by $168 billion over 75 years, the trustees still estimate that Social Security will empty its trust fund in 2034. This projection combines the finances of the Old-Age and Survivors Insurance trust fund with the DI trust fund. Since 2010, and for the foreseeable future, Social Security spending will exceed tax revenue coming in to the system. In 2015, spending exceeded tax revenue by $70 billion. This year’s report is similar to last year’s for the combined OASDI trust funds. The year of trust fund bankruptcy is the same – 2034 – and the trustees continue to warn that people will have their benefits cut by 21 percent at that point.

Social Security in the red by 2034

To fully fund Social Security over the next 75 years, payroll taxes will have to rise to 14.98 percent. In 2015 dollars, this would mean more than $1.6 trillion in tax increases over 10 years. This is just to keep the program solvent.

Despite knowing all this, President Obama recently advocated expanding Social Security benefits. He tried to spin this irresponsible proposal by saying, “we could start paying for it by asking the wealthiest Americans to contribute a little bit more.” There are several problems with this idea.

First, since Social Security is designed to pay benefits based on how much people paid in taxes, Democrats would ensure that high-income earners collect more from Social Security while doing nothing to improve the long-term future of the program. Democrats have traditionally viewed this system as sacrosanct, so any attempt by them to make some Americans pay more but not receive more in future benefits would be a huge change of position.

Second, if the program needs a 20 percent tax increase just to shore up its current finances, there is no telling how much President Obama would need to hike taxes to fund his expansion.

Third, by expanding benefits, the Democrats would highlight the dirty secret about Social Security: most seniors receive more in benefits than they paid in taxes. By expanding benefits after seniors have already paid their Social Security taxes during their working lives, it would be clearer that Social Security is a transfer program from those who are working to those who are retired.

The Time for Action is Now

Every year the trustees for Medicare and Social Security say that the two largest entitlement programs need reform or they will face large cuts in benefits. Every year these warnings seem to be ignored, including by the very officials who sign the trustees’ reports: the secretaries of the Treasury and HHS.

“Solutions can and must be found to ensure the financial integrity of HI in the short and long term and to reduce the rate of growth in Medicare costs through viable means. … The sooner the solutions are enacted, the more flexible and gradual they can be.” – Medicare Trustees Report,

06-22-2016

In 2015, Congress passed reforms that will lower the 75-year actuarial deficit of Social Security by $168 billion, but that was only 1.5 percent of the 75-year shortfall at the time. Congress also passed Medicare reforms in the Bipartisan Budget Act of 2015 and the Medicare Access and CHIP Reauthorization Act of 2015. These show that reform is possible, but they are not enough.

Big issues still remain. Both programs are still going bankrupt, still overspending, and still would require large tax increases if there aren’t reforms. If more is not done, Americans will not have access to these programs that are pillars of health and economic security.

Next Article Previous Article