The Obama Economy: Debt and Downgrade

On August 5, 2011, after the President played a game of political brinkmanship over the nation’s debt limit, Standard and Poor’s downgraded the credit rating of the United States for the first time in our history. S&P cited Washington’s out-of-control debt and the lack of a serious plan to address it as primary reasons for the Obama Downgrade. A year later, with the debt limit in sight once again, nothing has changed.

Obama Spends Too Much

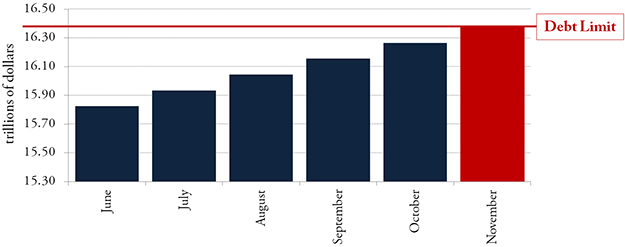

Last year, President Obama requested the largest debt limit increase in history -- $2.1 trillion -- hoping it would allow him to continue his reckless spending beyond the election. His spending, however, may exceed even that increase and cause the U.S. to hit the debt limit sooner than he had hoped. At current fiscal year 2012 spending rates, outlays will exceed revenue by more than $105 billion per month. The current debt is $15.8 trillion, just $600 billion less than the debt ceiling of $16.394 trillion.

Last week, the Treasury Department announced a $125 billion deficit for the month of May – more than double last May’s deficit of $58 billion. The deficit through the first eight months of the fiscal year is $845 billion. As early as next month, Democrats could achieve a record fourth straight year of trillion dollar deficits, thanks to their unrestrained spending and borrowing.

The deficits are even more alarming given federal receipts are at their highest levels since before the recession. But, despite President Obama’s claims to the contrary, government spending has not slowed. For the current fiscal year, the U.S. has already spent $2.4 trillion, essentially the same pace as last year.

Eurozone Problem

The Congressional Budget Office estimates the U.S. debt this year will reach 70 percent of GDP, up from about 40 percent in 2008. Even Senator Max Baucus, Chairman of the Senate Finance Committee, has conceded that the U.S. fiscal problems, “could lead towards crisis like some European countries.” The current Eurozone government debt is 92 percent of GDP. Under current policy, the U.S. will hit this level in nine years.

Meanwhile, foreign holdings of U.S. debt have hit a record high of $5.16 trillion. By 2022 we are projected to spend $900 billion annually just to cover the interest costs on Washington’s debt. We see new evidence out of Europe almost every day on what happens when you combine reckless borrowing, higher interest costs, and failure to take sensible steps to control spending. President Obama seems prepared to ignore these facts.

U.S. Credit and Economy at Risk

The fiscal cliff at the end of the year poses dire problems for U.S. economic growth. Going forward, the country’s debt will have severe effects on the U.S. economy. The spiral of interest costs, and the tax increases Democrats want to pay for it, will inevitably hurt our economy. Tax increases to pay off Democrats’ borrowing is private money that is not available to the private sector to invest in new plants or equipment that would create jobs and economic growth.

According to economists Carmen Reinhart and Ken Rogoff, high debt levels slow growth even at relatively low interest rates. According to the Carlyle Group, large debt levels reduce “private sector investment, labor supply, and consumption by reducing national savings, increasing discretionary taxes, or by creating expectations of future tax increases.”

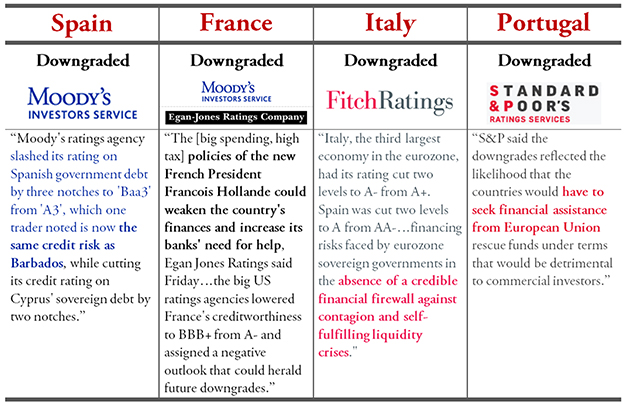

S&P lowered America’s credit rating last summer because of Washington’s out-of-control debt and lack of a credible plan to address it. Credit agencies have taken the same step in one European country after another for the same reason. One year later, President Obama has done nothing to get our triple-A credit back. He and Senate Democrats have steadfastly refused to rein in their spending and balance the books. Now they are doing all they can to avoid dealing with the looming fiscal cliff and the difficult decisions to get our fiscal house in order. The prospects for the U.S. economy are as hazardous as they are predictable.

Next Article Previous Article