The Obama Budget: Punting on Third Down

On Tuesday, President Obama released a budget that makes no tough choices. He increases spending. He increases taxes to pay for it. He allows the national debt to continue to increase without the slightest reforms. It shouldn’t be this way.

The President has three years left in office, yet he has abandoned all pretense of bipartisanship in favor of election year pandering. He has proposed “investments” in programs his base favors and tax increases on businesses that create jobs to pay for them.

According to Erskine Bowles, the U.S. faces “the most predictable economic crisis in history,” yet this budget is the political and economic equivalent of punting on third down.

More Debt, More Spending, More Taxes

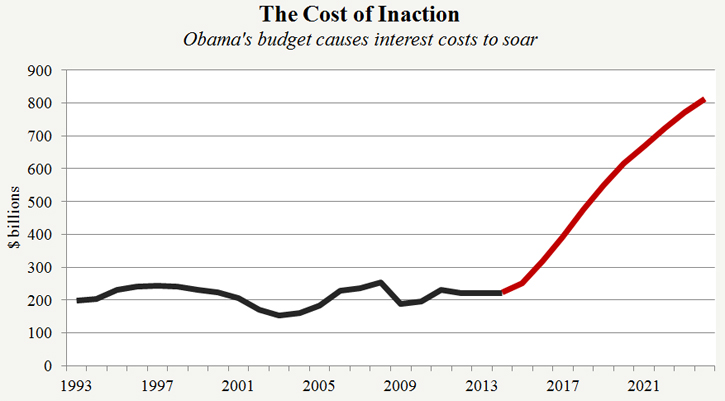

Under the Obama budget, the national debt hits $25 trillion in 2024, an increase of $8.3 trillion from the debt at the end of fiscal year 2013. The cost of all of this overspending must eventually be paid, so interest payments increase to $812 billion in 2024.

Total spending will rise by $2.261 trillion compared to fiscal year 2014. Compared to levels resulting from the Bipartisan Budget Act signed by the President in December 2013, spending would increase by $791 billion. This includes a $56 billion fund dubbed the “Opportunity, Growth, and Security Initiative.” President Obama would cancel mandatory sequestration, one of the few spending restraints he has signed into law. This would cost $171 billion.

The budget also includes tax increases of $1.76 trillion, with approximately half of this new revenue going to fund new spending. Included in these tax increases are: $598 billion from capping the value of tax deductions at 28 percent; $53 billion from the Buffet Rule, which the Administration is calling the “Fair Share Tax”; $118 billion by reverting to the 2009 estate and gift tax policies; $56 billion through a financial crisis responsibility fee; and $78 billion by nearly doubling federal tobacco taxes.

Budget Details

- Total spending of $3.9 trillion in fiscal year 2015.

- Includes an “Opportunity, Growth, and Security Initiative” that would increase spending by $56 billion, evenly split between Defense and nondefense. The Administration does not include these spending increases in the detailed appendix that is provided to show Congress the level at which the Administration proposes funding each federal program. This means that the Administration wants to say that it supports these spending increases, without actually advocating for them in Congress.

- The DOD budget complies with budgetary caps at $496 billion.

- Requests are $26 billion over caps this year, and $115 billion over five years if the Obama tax increases are granted.

Other highlights include:

Department of Education

- $1.3 billion in 2015 and $75 billion over five years in mandatory spending to support the Administration’s Preschool for All initiative. Spending is offset by raising federal tobacco taxes.

- $500 million for competitive Preschool Development Grants, said to pave the way for implementation of the Preschool for All initiative. An additional $250 million is included in the Opportunity, Growth and Security Initiative.

- New $4 billion State Higher Education Performance Fund of competitive grants to support, reform, and improve public higher education systems.

Department of Health and Human Services

- The proposed HHS budget totals $1 trillion in outlays – with $77.1 billion in discretionary budget authority.

- Contains Medicare, Medicaid, and other health policy changes cutting a total of $402 billion over 10 years.

- The President’s fiscal year 2015 health care proposals are generally repeats of his 2014 budget, with two notable exceptions: a two-year Medicaid primary care provider payment bump to Medicare equivalent rates ($5.4 billion); and increased Medicare Advantage cuts ($31 billion over 10 years) achieved using coding intensity adjustments.

- A White House fact sheet claims implementation of the President’s health care law reduces the deficit. This conflicts with a Government Accountability Office report estimating that the law will, under a realistic set of assumptions, increase the deficit by 0.7 percent of GDP or roughly $6.2 trillion over the next 75 years.

Internal Revenue Service

- Requests nearly $12.5 billion for the IRS, a 10 percent increase over the $11.3 billion appropriated in January for fiscal year 2014.

- Requests an increase of $451.7 million, and 2,046 FTEs, to implement the President’s health care law.

- Treasury proposes to use these increased funds as follows:

- Expanding telecom infrastructure to answer increased phone call demand related to the health care law’s implementation. ($16 million, 0 FTEs)

- Increasing taxpayer services -- phone calls, correspondence, and individual and business outreach. ($73.9 million and 829 FTEs)

- Helping the IRS implement programs to ensure taxpayers understand the health care law’s tax changes and non-compliance. ($56.1 million and 399 FTEs)

- Making IT changes to implement more than 45 Obamacare tax provisions, including the law’s premium subsidies. ($305.6 million and 818 FTEs)

Department of Labor

- $5 million to encourage paid leave programs, with an additional $100 million as part of the Administration’s Opportunity, Growth and Security Initiative to get more states to establish paid leave programs.

- New $6 billion in mandatory funding for Job-Driven Training for Youth and Long-Term Unemployed initiatives:

- $2 billion in mandatory funding to encourage states to adopt Bridge to Work programs that let people receive unemployment insurance benefits while participating in short-term work placement; and

- $4 billion in mandatory funding, to be obligated over two years, to support partnerships to train long-term unemployed workers for new jobs.

- Includes support for raising the federal minimum wage to $10.10 an hour.

Next Article Previous Article