The Obama Budget Fails Again

-

For the final time, President Obama submitted his budget proposal to Congress.

-

The proposal makes no difficult choices, instead choosing to increase taxes and increase spending.

-

The president’s budget is dead on arrival in Congress.

The president’s budget is radically liberal. It proposes to raise taxes to 20 percent of GDP in a decade – a level only seen once since the end of World War II (in 2000), and far above the 17.4 percent average of the last 50 years. It seeks to raise spending to 22.8 percent, a level only seen five times since the end of World War II and much higher than the 50-year average of 20.2 percent. It envisions the federal government getting larger and larger, and punishing job creators if they happen to be in an industry that liberals disapprove of. Meanwhile, the budget proposal does nothing about our record debt level. Despite being able to put whatever he wants in his final budget proposal, all these tax increases still lead to significant overspending.

Tax increases on everyone

The president’s budget includes $3.4 trillion in tax hikes from 2017 to 2026. These include:

- $783 billion in tax increases on international business

- $38 billion in tax increases on energy producers

- $35 billion in tax increases on insurance and financial firms

- $153 billion in tax increases on various business accounting mechanisms

- $646 billion in tax increases by limiting tax expenditures

- $235 billion by raising taxes on capital gains

- $38 billion by implementing the Buffett Rule/“Fair Share Tax”

- $111 billion by imposing a fee on large financial institutions

- $30 billion by limiting how much Americans can save in tax-advantaged retirement accounts

- $202 billion in estate and gift tax increases

- $319 billion in a new fee of $10.25 per barrel of oil

- $115 billion in tobacco tax increases

Spending

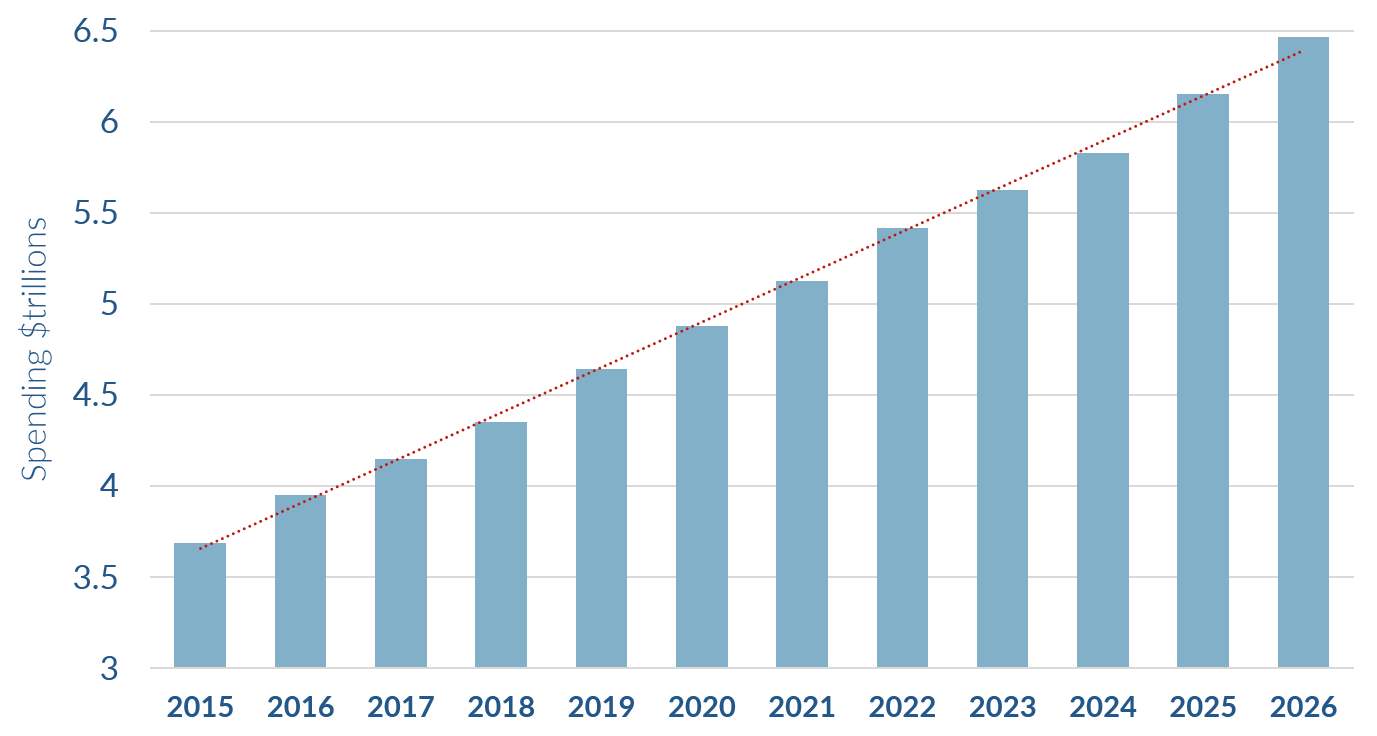

In total, the budget would increase spending by $2.5 trillion over 10 years. This spending is offset by the above-mentioned tax hikes. For fiscal year 2017 only, the budget proposal sticks to the discretionary budget caps agreed to in the Bipartisan Budget Act of 2015. The budget then proposes increasing the caps by $227 billion total from 2018 through 2021, with reductions in future years as an offset.

Debt and overspending

By 2026, the national debt will be $27.4 trillion. The budget proposes deficits that total $6.1 trillion from 2017 to 2026. The trend in the later years of the budget is for deficits to increase, since President Obama has not adequately addressed rapidly growing entitlements during his time in office. When his party controlled the Senate with a filibuster-proof majority, he could have addressed entitlements by making them more solvent with whatever liberal idea came to mind. Instead he chose to expand the federal government’s role in health care and actually exacerbate the entitlement crisis.

Economic growth

The administration forecasts 2.6 percent GDP growth for calendar years 2016 and 2017, with growth declining to 2.4 percent in 2018 and 2.3 percent from 2019 through the end of the 10-year window.

The administration forecasts a return to a more historically normal interest rate environment, with the interest rate on 10-year Treasury notes expected to eventually reach and remain steady at 4.2 percent. This is shown in the budget’s interest costs forecast – $787 billion in 2026, and $5.8 trillion over 10 years.

The U.S. is in worse shape

President Obama came into office promising hope. Now in the last year of his presidency, he leaves the United States in a worse long-term financial condition. His defenders – valuing the short-term more than the long term – say that the deficit is lower than it was during the financial crisis. This is true, but despite all of his enacted and proposed tax increases, deficits will continue to climb in future years. These high and increasing budget deficits will lead to interest costs on the national debt being higher than the entire budget for the Department of Defense by 2022. This will leave the U.S. with little room to maneuver if another war or emergency requires swift action to protect the American people.

Next Article Previous Article