The Coming IRS Dragnet

KEY TAKEAWAYS

- President Biden’s Treasury Department wants to expand the reach of the IRS in a scheme that would capture most Americans in a new dragnet of bureaucracy.

- Under the proposal, the IRS would collect account data on all Americans who have just $600 in total transactions flowing in or out of their bank account in a year.

- Even if Democrats end up raising the program’s dollar threshold or implementing various carve-outs, Biden’s plan still means more sensitive information gets sent to the IRS, and more people are vulnerable to invasions of their privacy.

President Biden’s Treasury Department wants to expand the reach of the IRS in a scheme that would capture most Americans in a new dragnet of bureaucracy. The proposal would give the treasury secretary broad authority to establish a new comprehensive reporting regime for financial institutions and third-party payment providers. Banks, credit unions, and apps like PayPal and Venmo would be required to report to the IRS gross deposits and withdrawals for all business and personal accounts with an annual “flow threshold” as low as $600. Americans who have more than $600 going in or out of their account or payment app in a year would have the data reported to the IRS.

Small Transactions, Big IRS Net

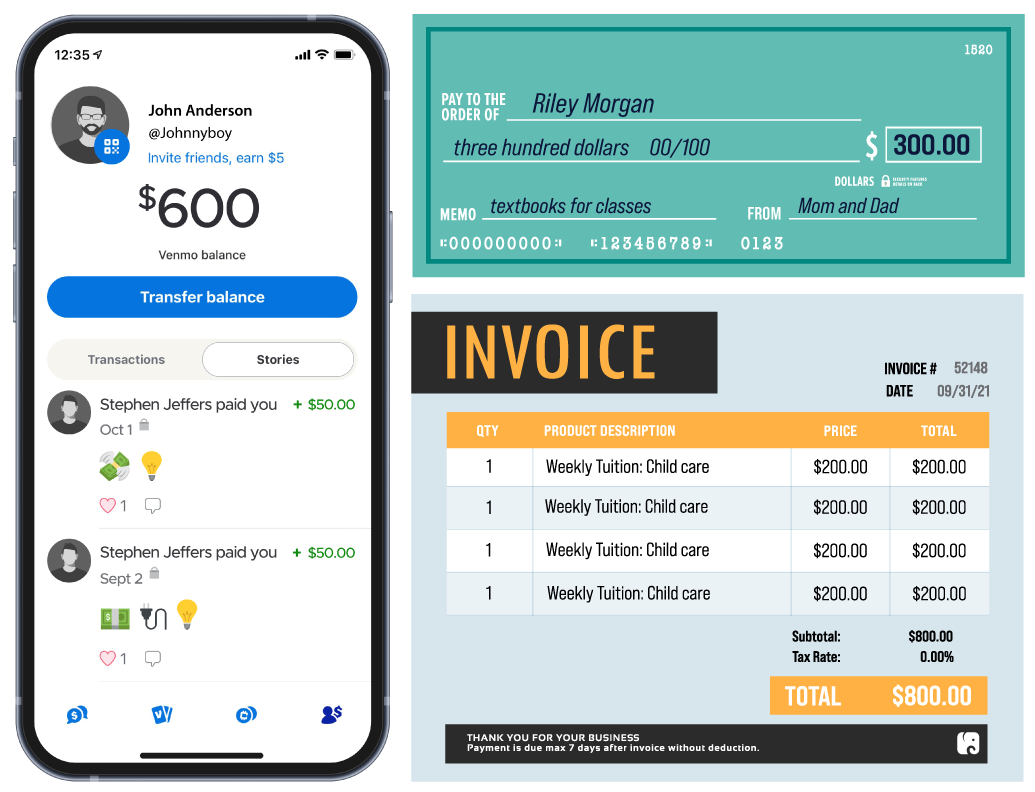

The administration claims its goal is to target wealthy tax evaders, but this dragnet would capture Americans from all walks of life. A student whose parents transfer $300 to her bank account each semester to help pay for textbooks? Caught. A young professional who uses Venmo to pay his roommate for his $50 share of the electric bill each month? Snagged. A single mother who pays $200 a week to her child care provider? Swooped up in the dragnet. In fact, it’s harder to find examples of people who wouldn’t meet the requirements than those who would.

Democrats now say they plan to set a higher aggregate threshold, in an attempt to mitigate Americans’ serious concerns with the plan. But they still have offered no legislative language to make their talking points official. And even the “compromise” level of $10,000 that they have floated would capture tens of millions of taxpayers. For example, a recent graduate paying $850 a month in rent would exceed the $10,000 threshold. Whether the threshold is moderately or even substantially higher, Biden’s plan still means more personal information going to the IRS, and more people who are vulnerable to invasions of their privacy.

more information to the irs, less taxpayer privacy

This type of reporting regime would be a dramatic expansion of IRS scrutiny of people’s financial activities. It would produce a massive volume of data for the IRS to manage, which raises questions about the agency’s competence to use it and the privacy controls in place to protect it. The IRS is already struggling to do its primary job as the nation’s revenue collector. Instead of focusing on doing this basic job right and providing a minimum level of customer service, the Biden administration would inundate the IRS with more data. One analyst at the liberal Tax Policy Center noted, “The IRS’ task would be daunting and, in fact, bury the agency in a sea of unproductive information.”

Even if the IRS could make use of the new data to expand its auditing activities, it would mean more of Americans’ personal financial information would be vulnerable. Earlier this year there was a massive, illegal leak of private taxpayer information to the media. Despite congressional demands for accountability, the IRS has not yet identified – or resolved – the source of the leak or even acknowledged that there has been a threat of a data breach.

Not just the fat cats

Democrats in Congress and the Biden administration claim that their scheme is designed to capture only high earners. A Treasury official recently asserted that “audit rates will not rise relative to recent years for those with under $400,000 in actual income.” But the administration has provided no specific proposal to translate this promise into policy. In fact, Democrats’ plan would give the treasury secretary broad authority to make up regulations to implement their dragnet. There is no reason to believe middle-class taxpayers would be protected from the government’s reach once it has reams of new data on their financial histories.

increased paperwork burden

To comply with this new regulatory scheme, banks and other payment providers would be hit with new reporting requirements that would add layers of administrative complexity and raise costs. This problem would be especially acute for smaller community banks and credit unions.

Democrats are reportedly considering various carve-outs to make their plan more palatable to Americans, like exempting mortgage payments or payroll direct deposits from the reporting threshold. But the more carve-outs there are, the more complex it becomes and the more it would cost to administer.

As Americans catch wind of this intrusive government scheme, banks across the country are being flooded with queries from concerned customers. The role of financial institutions in facilitating this flow of personal data could erode trust in the banking system.

written behind closed doors

Another sign that many Democrats worry about how taxpayers will react to their plan is the secrecy in which they are trying to operate. The only publicly available text about their scheme is a short sketch in the 2022 Treasury Green Book: “Introduce Comprehensive Financial Account Reporting to Improve Tax Compliance.” President Biden and Democrats in Congress are crafting their plan behind closed doors, with no public legislative text and no markups of text in any committee in the House or Senate.

Shrouded in secrecy, this invasive IRS dragnet is just one piece of Democrats’ plans to “pay” for their reckless spending by taking from the wallets of American families, workers, and job creators on every rung of the socioeconomic ladder.

Next Article Previous Article