Tax Relief's Strong Economic Growth: A Response to JCT

KEY TAKEAWAYS

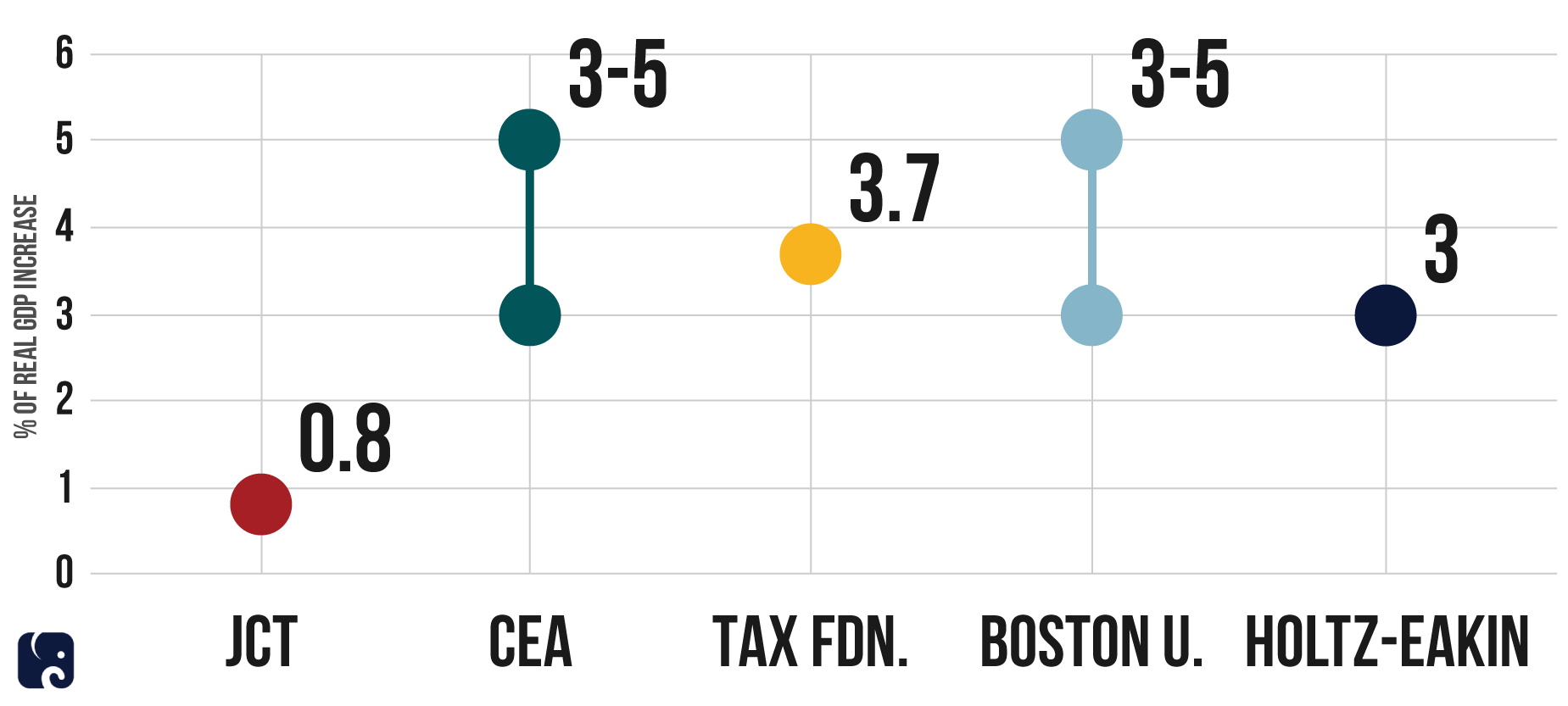

- Mainstream economists believe that the tax relief bill will lead to an economy that is 3 to 5 percent larger.

- The Joint Committee on Taxation, on the other hand, predicts that tax relief will lead to an economy that is only 0.8 percent larger.

- JCT’s assumptions are overly pessimistic and cause its prediction to be far below consensus estimates.

Growth is critical for our nation’s economic future. More growth will provide jobs, raise wages, and make it easier to address our future debt. This is why it’s so important to have an accurate gauge of how much economists expect the tax relief bill to grow our economy. The JCT score on the Senate tax reform bill was outside the consensus view and provides a skewed picture of the bill’s effects.

Tax Relief Growth Estimates (Total Real Growth Over 10 Years)

Four Out of Five Economists Recommend Tax Cuts

Many economists have studied the growth effects of tax relief. Four recent studies concluded that tax relief will increase the size of the economy by somewhere between 3 and 5 percent over 10 years. This would be an annual increase of roughly 0.3 percent to 0.5 percent in inflation-adjusted dollars.

-

The Council of Economic Advisers predicts that the economy will be 3 to 5 percent larger in 10 years.

-

A study by economists at Boston University, MIT, and the National Bureau of Economic Research also predicts 3 to 5 percent growth, though it used calculations independent of CEA’s.

-

The Tax Foundation estimated a 10-year higher growth of 3.7 percent.

-

A group of nine prominent economists, including Douglas Holtz-Eakin, John Taylor, and Robert Barro, expect tax relief to boost the economy by 3 percent over 10 years.

A study by the Joint Committee on Taxation, however, estimates additional 10-year growth of only 0.8 percent, making it an outlier among recent studies. The JCT study should be considered carefully within the proper context, to show why its estimate was lower than the others. The current tax code is so complex, and rates are so high, that cutting rates and simplifying the code will almost certainly produce stronger economic growth.

WhY JCT is an outlier

JCT’s estimate is based on several methodological decisions that lead to its estimate being far off from other dynamic estimates.

First, it gives greater weight to low-growth estimates than to high-growth estimates. Of the three different economic models JCT incorporated into its estimate, the one most inclined to higher growth was weighted at 20 percent of its score, while two others that assume lower growth were weighted at 40 percent each.

Second, it assumes the U.S. operates similarly to a closed economy, walled off from the rest of the world. The models predict that cross-border investment is slow to respond to lower tax rates in the U.S. Much growth from this bill comes from lowering the corporate rate and moving to an international system, which will make the U.S. a much more attractive place for foreigners to invest. Since U.S. businesses do not see an influx of foreign investment in JCT’s models, this negates much of the growth from the business and international tax relief.

Third, it assumes the Federal Reserve will significantly change its approach to interest rates. JCT’s score assumes that the Federal Reserve “will act aggressively to counteract any demand stimulus” produced by the bill – despite the fact that the Federal Reserve seems content to gradually raise interest rates. These rate increases have already been priced into the market and should not hamper growth coming from the yet-to-be-enacted tax relief.

Next Article Previous Article