Tax Law's Opportunity Zones Fight Poverty

KEY TAKEAWAYS

- The Republican tax law created Opportunity Zones to fight poverty with long-term investment and free enterprise, rather than government planning, in areas that need it most.

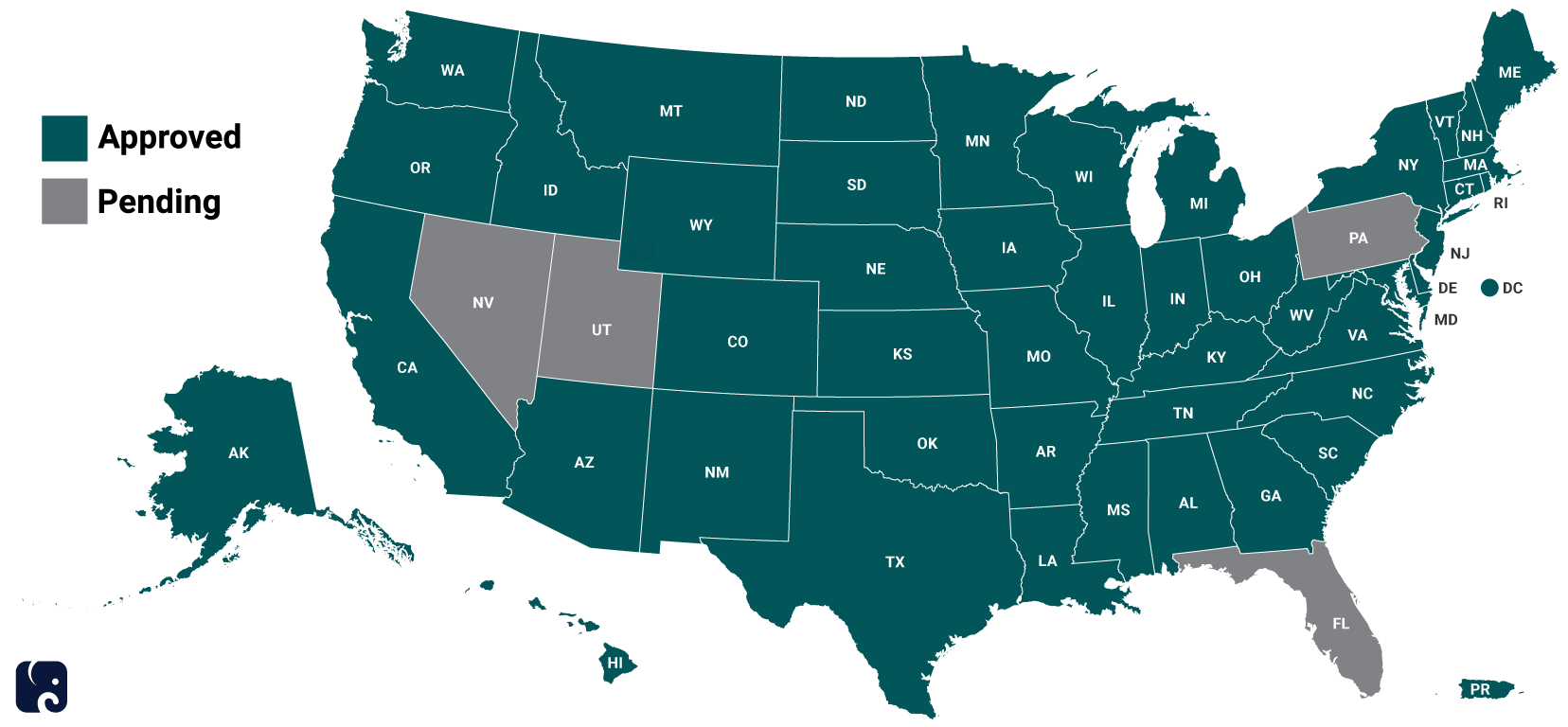

- The Treasury Department has designated zones in 46 states and five territories, including Puerto Rico – others are awaiting final approval.

- Unlike other federal programs, Opportunity Zones are not “guarantee zones” – investors must risk their own capital to earn any tax benefit.

For decades, Democrats have had two approaches to addressing poverty in America – more Washington regulations and more Washington spending. The tax law Republicans passed in December created a new, free-market plan to address poverty: Opportunity Zones.

Opportunity Zones Designated Across the Nation

How Opportunity Zones Work

The tax law’s “Investing in Opportunity Act,” championed by Senator Tim Scott, cuts taxes on investment in these zones and encourages businesses to do things like expand manufacturing and retail operations that create jobs.

Governors can select up to 25 percent of their low-income census tracts to be Opportunity Zones. A census tract typically contains about 4,000 people and is considered “low-income” when at least 20 percent of its residents are below the poverty line and earn no more than 80 percent of what others in the area earn.

There are three tax benefits that spur investment:

(1) temporarily deferring taxes on capital gains from Opportunity Zone investments if they are reinvested in Opportunity Zones;

(2) reduced taxes on Opportunity Zone investments held for 5-10 years;

(3) permanent exclusion from taxable income of all Opportunity Zone investment gains if the investment is held for at least 10 years.

The vast majority of the tax advantage from Opportunity Zone incentives comes from entrepreneurs holding the investment for at least 10 years. This makes it much more likely that investments will be long-term ones that work for the best interests of the community, and not temporary, short-sighted projects.

46 States Have Opportunity Zones so Far

In 2017, it was estimated that one in six Americans live in “economically distressed communities.” These are places that have low average incomes, high unemployment, a poorly educated workforce, and other challenges.

As of May 18, Opportunity Zones have been designated in 46 states and five territories, including Puerto Rico. The Bipartisan Budget Act of 2018 designated every low income area in Puerto Rico to be an Opportunity Zone, instead of the usual limit of 25 percent of such areas. Other states and the District of Columbia are awaiting Treasury approval. Final designations from the Treasury will be made soon, and communities can start to share the benefits of more investment, more jobs, and more opportunities.

Next Article Previous Article