Strategic Petroleum Reserve: Obama Threatens to Cry “Wolf” Again

With gasoline prices causing unrest among voters, President Obama is considering tapping America’s Strategic Petroleum Reserve. This purely political move would cause more harm than good—including costing American taxpayers $1.5 billion dollars.

Gasoline prices have surged 42 cents a gallon in the first two months of 2012, setting new records for the most expensive January and February ever at the pump. Americans now pay an average of $3.72 for one gallon of regular gasoline1, a 101 percent increase since President Obama took office. Energy analysts project even higher gas prices this summer, warning us to brace for pain at the pump in excess of $4 per gallon.

When faced with voter anger over similar prices last June, President Obama sold more than 30 million barrels of oil from the Strategic Petroleum Reserve (SPR) – a pool created for use only in emergencies to safeguard the U.S. economy and national security against severe supply disruptions. The SPR had sold oil twice before in response to supply emergencies. President Obama’s sale of reserve oil was for strictly political reasons.

Now Democrats are urging President Obama again to misuse the SPR2 in a transparent election-year attempt to look like he is doing something about skyrocketing gasoline prices. The White House has pointedly said that all options, including tapping the SPR, remain on the table.

There are five primary reasons why repeating this political draw-down would be bad for the American people.

The High Cost of a Political Raid on the SPR

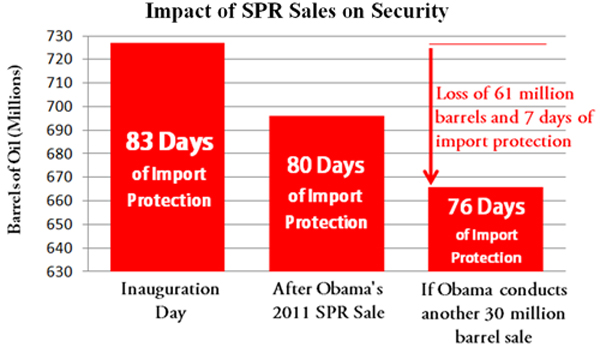

• President Obama has still not refilled the 30.64 million barrels of crude oil he plundered from the SPR last year. If the President were to release another 30 million barrels this year, he would leave the SPR with 665.9 million barrels of emergency oil reserves, a significant reduction from the 727 million barrels the critical reserve contained when he took office.

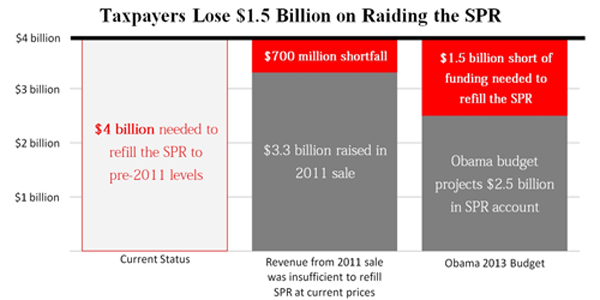

• The June 2011 sale, predominantly of Louisiana Light Sweet crude, yielded $3.3 billion. This amount was well below the market price in order to run up the quantity of the sale and imply there was a market shortage. If the President were to refill the SPR at last week’s price of $130 per barrel for Louisiana crude3, taxpayers would have to shell out $4 billion, leaving a $700 million shortfall.

• But subsequent rescissions from the SPR account make the shortfall even larger, by another $791 million. First the FY 2012 Omnibus Appropriations Act cut $500 million from the account. Then President Obama recently proposed cutting another $291 million from the SPR account in FY 2013.

• In total, that would leave the SPR account with a mere $2.5 billion, and thus $1.5 billion short of what would be needed to refill the reserve.

• Even worse, President Obama’s Interior Department has suspended the Royalty-In-Kind (RIK) program, which previously enabled the federal government to fill the SPR with royalty payments of oil in lieu of cash made by federal offshore oil and gas leases. So the federal government has no option but to purchase SPR oil with cash it does not have. The President’s latest budget proposed a permanent repeal of the RIK program.

• Tapping the SPR again for political reasons would only increase the amount of oil we would need to buy back and could be expected to produce the same kind of fiscal shortfall, as the President sells low and buys high.

The Potential Harm to Economic and National Security

• Congress created the SPR in 1975 in response to the oil embargo Arab countries imposed on the U.S. and other nations at the time of the 1973 Arab-Israeli war. This supply disruption increased the price of imported crude from approximately $4 per barrel at the end of 1973 to $12.50 per barrel in 19744, wreaking havoc on the U.S. economy.

• Over the next 36 years, Presidents sold oil from the SPR twice in response to genuine emergency supply disruptions threatening U.S. oil markets:

• Desert Storm

o In January 1991, President George H. W. Bush sold off 17.3 million barrels of oil upon the outbreak of the Persian Gulf War.

o Importantly, when Iraq invaded Kuwait a few months earlier in August 1990, President Bush refused to tap the SPR simply to lower gas prices. Complying with the statute and congressional intent, he waited for an actual, physical supply disruption to crude oil supplies before releasing SPR oil.

• Hurricane Katrina

o In September 2005, President George W. Bush sold 10.6 million barrels of crude oil in response to the emergency supply disruption caused by Hurricane Katrina.

o Hurricane Katrina severely damaged oil infrastructure, including production facilities, terminals, pipelines, and refineries, along the Gulf Coast. Oil development in the Gulf of Mexico shut down, causing the U.S. to lose 25 percent of its production overnight.

o In January 2009, President Bush refilled the SPR using the revenues generated by the 2005 emergency sale.

• In contrast, when President Obama withdrew 30.64 million barrels of oil from the reserve last June, there was no substantial prospect of a supply disruption.

• The Obama Administration claimed the move was in response to unrest in Libya, but the year before a paltry 0.6 percent of U.S. oil imports had come from Libya.

• In the months leading up to the SPR drawdown, worldwide demand for oil was actually down because of the recession, and Saudi Arabia had expanded production to replace any Libyan shortfall5.

• Even the Washington Post noted: “The oil release could be seen as a way for the President to take credit for gas prices that are falling anyway, or as an indirect, pre-election stimulus. Whatever the rationale, it is a bad idea.”6

• If President Obama releases SPR oil yet again for political reasons, he will further reduce our government’s ability to respond when we need our emergency energy supplies most. The SPR will be reduced to 76 days of import protection if the President conducts another 30 million barrel sale.

• There are actual potential threats to worldwide oil supply, including the possibility that Iran will close the Strait of Hormuz, the main oil shipping lane in the Persian Gulf.

• If President Obama cries “wolf” for a second time by drawing down SPR oil in response to high gas prices, we will be left with less ability to respond to an actual emergency in the future and more susceptible to the resulting economic and national security risks that would yield.

The Release Would Not Lower Prices

• The release of oil from the SPR has historically not helped relieve the price consumers pay for gas.

• President George H. W. Bush’s SPR oil drawdown in response to the Persian Gulf War was followed by a reduction in crude oil prices7 (mostly because of the swift victory in that conflict) and then the stabilization of gas prices around pre-announcement levels for the next decade.

• In the wake of President George W. Bush’s SPR drawdown after Hurricane Katrina, crude prices fell moderately while gas prices actually rose for the next couple of months.

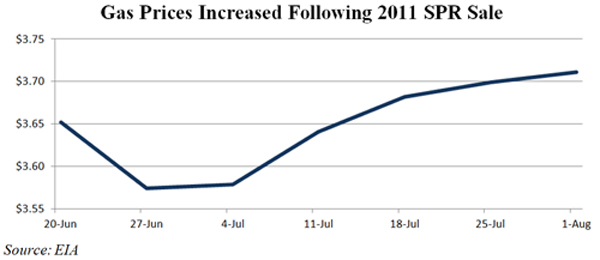

• Following the Obama Administration’s announcement that it would release 30 million barrels of oil last June, prices dipped slightly, but within a month had rebounded above their pre-announcement levels.

• The math is not difficult. U.S. net petroleum imports are 8.72 million barrels per day. A draw-down of 30 million barrels covers a little over three days of imports. Even if the President flooded the market with the entire SPR stock, it would cause barely a ripple in the price of oil and gas.

• Rather than lowering prices, any move to tap the SPR would be for the political benefit of appearing to do something in the face of voter unrest during an election year.

A Political Raid Could Actually Benefit Speculators

• The Democrats calling on President Obama to tap the SPR blame rising gas prices on “speculation in the oil markets” and argue that releasing “even a small fraction” of SPR oil could have a “significant impact” on speculators and prices8.

• If last year’s SPR drawdown is any indication, soliciting bids for SPR oil may actually increase, not decrease, speculation in the oil markets.

• Trading institutions and banks – including JP Morgan, Barclays, Valero, and Vitol -- were awarded 14.53 million barrels, or 47 percent of the SPR oil released.9

• On the day of the announcement, the price on the open market for the released crude was $110 per barrel.10 Barclays paid just $104.97 per barrel of SPR crude.

• Bloomberg News reported that “some of the oil being released from the U.S. Strategic Petroleum Reserve to bring down prices may be held by traders for later sale rather than sent directly to refiners for processing into gasoline or other fuels.”11

A Temporary Political Fix Is not a Long-Term Supply Policy

• Releasing oil from the SPR would be, at best, a short-term benefit, while continuing to neglect the long-tem policies that could prevent true supply disruptions and price spikes in the future.

• Last weekend, President Obama mocked Republicans (and the 70 percent of Americans in one poll12) who urge increased domestic production of oil as a means to suppress gas prices.

• For more than three years the nation has waited for a credible plan from President Obama to lower gas prices. Any such plan must include increasing the supply of domestic oil, something the Obama Administration has resisted.

• Senator Schumer recently echoed the Administration’s policies by calling on Secretary of State Clinton to ask the Saudis to increase production. Calling for more Middle East oil instead of more domestic oil is exactly the opposite of what a rational energy policy would do.

• The U.S. has 22.3 billion barrels of oil in proven reserves and 139.6 billion barrels in technically recoverable reserves. Aggressive exploration and development of these resources would be enough to move global crude oil markets. Releasing 30 million barrels of oil from the SPR would not.

• President Obama can provide immediate and long-lasting price relief at the pump by lifting his moratorium and ceasing his “permitorium” on our nation’s vast and abundant oil resources.

• Truly opening up U.S. federal lands to energy exploration can lower crude oil, and thus gas, prices – as demonstrated when President George W. Bush and Speaker Nancy Pelosi lifted moratoriums on domestic oil and gas drilling in 2008.

Raiding the nation’s supply of SPR oil in a non-emergency may allow President Obama to claim he is doing something about rising gas prices, but it will not lessen our pain at the pump. As demonstrated by the President’s SPR release in 2011, it will only leave our vital emergency oil reserve program in even worse financial shape and create yet another net loss for American taxpayers. It will deplete our emergency oil reserves even further, leaving us more vulnerable to a genuinely “severe energy supply interruption,” such as the blocking by Iran of oil transports through the Strait of Hormuz.

| Tapping the SPR when faced with a political crisis is not a viable energy plan; tapping our vast and abundant domestic oil resources is. President Obama should open up America’s onshore and offshore oil reserves to energy development and preserve our vital SPR supplies for a truly rainy day. |

_________________________

[1] Gasoline and Diesel Fuel Update, February 27, 2012, Energy Information Administration, EIA.gov, http://www.eia.gov/petroleum/gasdiesel/

[2] “Democrats to Obama: Tap strategic oil reserve,” by Darren Goode, Politico, February 25, 2012, http://www.politico.com/news/stories/0212/73279.html

[3] Bloomberg Light Louisiana Sweet Crude Oil Spot Price, February 24, 2012, Bloomberg.com, http://www.bloomberg.com/quote/USCRLLSS:IND

[4] “The Strategic Petroleum Reserve and Refined Product Reserves: Authorization and Drawdown Policy,” March 11, 2011, Congressional Research Service, http://www.crs.gov/pages/Reports.aspx?PRODCODE=R41687&Source=search

[5] Id.

[6] “The wrong reason for depleting the strategic oil reserve,” June 23, 2011, editorial, Washington Post, http://www.washingtonpost.com/opinions/the-wrong-reason-for-depleting-the-strategic-oil-reserve/2011/06/23/AGuAf3hH_story.html

[7] Crude oil and petroleum products spot prices, released February 23, 2012, Energy Information Administration, EIA.gov, http://www.eia.gov/dnav/pet/pet_pri_spt_s1_d.htm

[8]Supra, note 2.

[9] Successful Awards Report, U.S. Department of Energy, July 11, 2011, http://www.spr.doe.gov/doeec/Notice_of_Sale%20DE-NS96-11PO97000/Successful_Awards_Report.pdf

[10] Supra, note 3.

[11] “U.S. Strategic Reserve Oil May Be Put in Storage by Traders,” by Paul Burkhardt, Bloomberg News, June 30, 2011, http://www.bloomberg.com/news/2011-06-30/u-s-strategic-reserve-oil-may-be-put-into-storage-by-traders.html

[12] “What America is Thinking on Energy Issues – 70 percent of voters favor more oil and natural gas development,” American Petroleum Institute, January 18, 2012, http://www.api.org/News-and-Media/News/NewsItems/2012/Jan-2012/What-america-is-thinking-70-percent-favor-more-oil-development.aspx

Next Article Previous Article