Relief from Harmful Regulations: Week Two

- Last week, Congress passed the first two resolutions of disapproval since 2001 that will be made law under the Congressional Review Act.

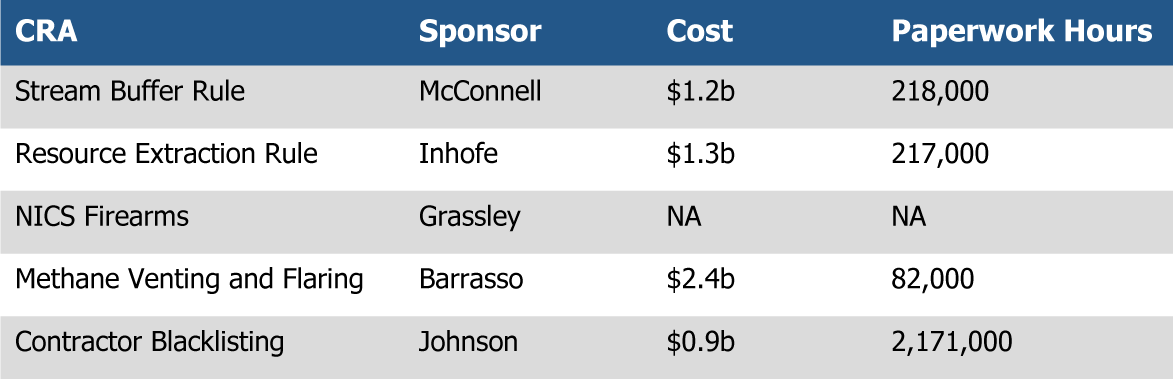

- The first set of five CRAs being considered will provide total savings of $5.8 billion and 2.6 million paperwork hours.

- While Congress takes legislative steps to reverse overregulation, the Trump administration has also moved to reduce the number and cost of regulations.

Congress has now passed, and the president will sign, two resolutions of disapproval under the Congressional Review Act. The first rescinds the Interior Department’s Stream Buffer Rule. This CRA passed the House 228-194 and the Senate 54-45. It will save $1.2 billion in costs and 218,000 paperwork hours. The second rescinds the Securities and Exchange Commission’s resource extraction rule. This CRA passed the House 235-187 and the Senate 52-47. It will save $1.3 billion in costs and 217,000 in paperwork hours. “Both moves represent the first successful use in 15 years of the Congressional Review Act,” Politico wrote on February 3.

These are the first of many resolutions this Congress will pass to nullify the last-ditch regulatory efforts of the Obama administration. In total, the first set of five CRAs being considered will provide savings of $5.8 billion and 2.7 million paperwork hours.

The first five CRAs

As Congress works to give regulatory relief to Americans, the administration will be doing its part through an executive order on reducing regulation and controlling regulatory costs.

The president’s January 30 executive order says, “it is important that for every one new regulation issued, at least two prior regulations be identified for elimination.” The order applies to “significant” regulatory actions, defined as having an annual cost of $100 million or more, or being likely to adversely affect the economy or state, local, or tribal communities. According to Office of Management and Budget interim guidance on implementing the executive order issued February 3, disapprovals of rules under the CRA would qualify for savings that agencies could use to offset the cost of new rules.

The order also sets a regulatory cap for fiscal year 2017 of $0 in net new costs. Going forward, it creates a “regulatory budget” in order to cap regulatory costs. Agency heads will have to fit the cost of new regulations under these caps when making their budget requests. Regulations that address health, safety, or financial emergencies will be exempt.

financial regulations and the fiduciary rule

Last Friday, President Trump also started the process of reviewing the harm Obama-era financial and banking laws and regulations are doing to America’s economy.

First, he signed an executive order that establishes core principles for how the administration will regulate the U.S. financial system. Administration policy will be to prevent taxpayer-funded bailouts and to help the economy “through more rigorous regulatory impact analysis.” Americans will be empowered to make “independent financial decisions and informed choices in the marketplace.”

In the executive order, the president directed the secretary of the treasury to consult with members of the Financial Stability Oversight Council and report within 120 days on which existing laws, treaties, regulations, guidance, and other government policies promote the new administration’s principles. The FSOC consists of the heads of nine federal financial regulatory agencies that have had key roles in issuing more than 250 rules tied to the Dodd-Frank Act alone. The order begins the overdue process of revamping how the U.S. approaches financial regulations to promote economic growth safely.

In a second action Friday, President Trump issued a memorandum directing the secretary of labor to look at the “fiduciary rule” to see if it harms Americans’ ability to get retirement information and financial advice. If the economic and legal analysis ordered by the president concludes that the rule is hurting American savers, the secretary is directed to rescind or revise it.

The fiduciary rule, which is scheduled to take effect in April, holds advisors who work on tax-advantaged retirement savings to a fiduciary standard. Republicans have consistently said that the rule will restrict access to retirement advice, particularly for low- and moderate-income workers. According to one analysis, the fiduciary rule will cost $31.5 billion over 10 years and require nearly 57,000 hours in compliance effort. In 2016, the House and Senate both passed a resolution of disapproval on the fiduciary rule, but President Obama vetoed it.

Next Article Previous Article