Regulatory Reform Can Keep Oil Prices Low

-

Oil prices are half what they were just eight months ago, partly due to increased U.S. production.

-

While consumers benefit, low prices create challenges in the economics of oil production.

-

Regulatory reforms could sustain U.S. oil production at low prices.

Oil prices, and the prices for related things like gasoline, have plummeted recently. While low prices are good for the American people, low prices make oil production more difficult. To keep up the flow of oil, producers need to reduce their costs. The best place to look for those savings is reducing the expensive burden of needless regulations and red tape.

Brent crude spot prices have plummeted

Last Friday, crude oil traded at a price 50 percent lower than the peak it had reached in June 2014. Brent oil, the international benchmark, cost $56 per barrel on the spot market that day. Lower oil prices produce substantial economic and geopolitical benefits for Americans. They are in part a function of booming U.S. oil production, which has increased by four million barrels per day over the past six years. Those low prices can disappear just as quickly as they arrived if market balances are disrupted by any number of variables affecting global supply and demand. Unforeseen conflict in the Middle East, a production cut by the Organization of the Petroleum Exporting Countries, or increased economic growth in China could send oil prices skyrocketing.

A short-term snapshot of oil markets at the moment prices are low should not be used as an excuse to block long-term energy projects. That would be like deciding to cancel a long-needed bridge repair because one morning’s commute was lighter than normal. Instead, Washington policymakers should use today’s low prices as incentive to implement long overdue regulatory reforms. Improving Washington’s performance in issuing energy project permits, increasing energy producer access to oil-rich federal lands, scaling back unnecessary environmental rules, and removing other burdens on energy development would help to ensure the sustainability of domestic oil production.

Lower oil prices as an across-the-board tax cut

The economic benefits of lower oil prices are enormous. They translate into lower petroleum product prices that leave consumers with more money to spend on other things. Low prices function like a tax cut, distributed directly to all Americans, that immediately stimulates business activity across the economy. They are also a progressive tax cut in that they provide proportionally greater relief to families with lower incomes.

On Tuesday, motorists paid an average of $2.19 per gallon of regular gasoline, $1.11 lower than last year. Because of that, Americans are likely to have as much as $115 billion more in disposable income in 2015 than last year, according to a January 5 article in the New York Times. If gasoline averages $2.50 per gallon, a typical family could save $1,100 annually.

Other petroleum product prices also are falling in response to declining oil prices. For the week ending February 2, residential heating oil cost $2.80, a drop of $1.44 since last year, and residential propane cost $2.37, which is $1.52 lower than last year. Every dollar consumers save while fueling their cars or heating their homes is one they can use to generate economic activity and improve their standard of living.

Lower oil prices as a geopolitical weapon

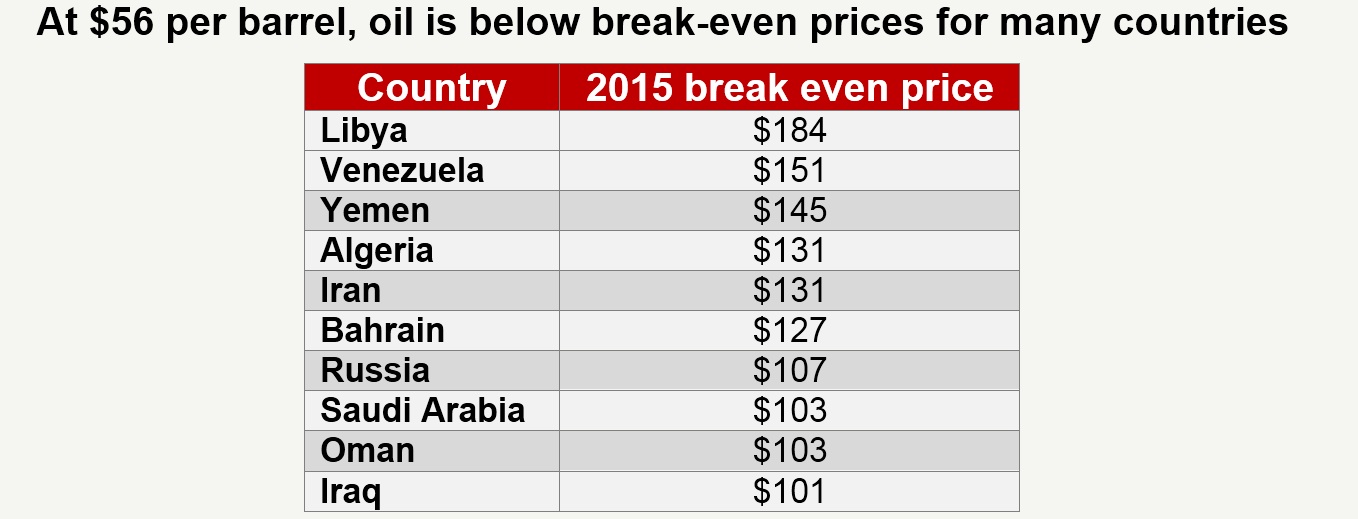

Beyond the economic benefits, there are substantial geopolitical advantages to lower oil prices as well. Falling oil prices undermine the finances of several American adversaries whose budgets depend on energy revenues. Russia, Iran, and Venezuela will need oil prices well past $100 per barrel to balance their budgets in 2015.

Source: Citi

Russia derives 68 percent of its foreign currency earnings from oil exports; and around 50 percent of its annual budget from the oil and gas industry. In December, the Russian ruble “lurched towards a financial crisis” largely because of plunging oil prices, according to a December 16, 2014 article in the Financial Times. “It has fallen more than 50 percent since the start of the year, reviving memories of the 1998 crash when Russia defaulted on its domestic debt.” Oil accounts for about half of Venezuela’s revenues and as much as 75 percent of Iran’s revenues. At today’s prices, their economies are also in a tailspin.

With substantially less oil revenue, these countries are less able to pay for the government services they need to maintain social order and ensure regime stability. They are in weaker positions when negotiating with the U.S. and other foreign powers over their military aggression, nuclear ambitions, and other provocative positions. At home and abroad, their power correlates with oil markets – and it declines as oil prices fall.

Regulatory reform to sustain oil production and defend low prices

Oil prices are not guaranteed to stay at today’s low levels. They could move up if supply falls, demand increases, or both. If OPEC cuts oil production, or the Middle East ignites into conflict, supply could fall. If our economic growth picks up speed, demand could increase. In either case, oil prices could rise. Washington should hedge against such risks to lower oil prices with policies that support continued growth of American energy production.

The oil industry does not need taxpayer handouts or regulatory favoritism to continue adding barrels to global oil markets. It simply needs Washington to get out of the way.

- Approving the Keystone XL oil pipeline can ensure the safe and efficient transport of 830,000 barrels per day of oil – including 100,000 from Montana and North Dakota – to the Gulf Coast.

- Lifting the ban on crude oil exports can empower oil producers to shore up the economics of their domestic production and give them access to foreign markets.

- Opening federal lands to oil production can support responsible development of currently unavailable resources, including in energy-rich western states, off the coasts, and in Alaska. Stopping federal bureaucrats from exploiting the Endangered Species Act, the Antiquities Act, and other statutes to prohibit economic development can keep federal lands open to oil production.

- Providing certainty in energy project permitting can ensure the federal government will not arbitrarily reject or slow-walk routine permits. Streamlining applications, insulating reviews from manipulation, requiring regulators to make timely decisions, and prohibiting preemptive and retroactive permit vetoes can encourage investment.

- Stopping unnecessary and burdensome regulations can unleash additional oil production that otherwise would be prohibited by restrictions under the Clean Air Act and Clean Water Act. Stopping rules that target ozone and methane emissions, hydraulic fracturing, and land use can restrict Washington’s efforts to shut down domestic oil production.

Scaling back barriers to oil production would have the added benefit of improving the economics of developing domestic oil wells. A November 2014 IHS report found that 80 percent of domestic production anticipated in 2015 will break even between $50 and $69 per barrel of West Texas Intermediate crude. WTI crude, the U.S. benchmark, trades at a discount to Brent crude and cost $52 per barrel on the spot market last Friday. American energy producers remain largely competitive and are not under as much duress as Russia, Venezuela, and Iran at today’s prices. But as of last Friday the total number of U.S. oil and natural-gas drilling rigs actively exploring for or developing oil or natural gas fell to 1,456 – that is down 17.8 percent from a year ago and is the lowest level in almost five years. This equates to lost American jobs. The International Energy Agency projected on Tuesday that the “price correction will cause the North American supply ‘party’ to mark a pause; it will not bring it to an end.”

Washington should help American businesses produce oil at lower prices by removing excessive, government-imposed costs on their business models. Republicans are supporting America’s energy producers as they develop affordable and reliable fuel for transportation and home heating. Democrats must join Republicans in reforming our nation’s energy regulatory regime and insist on policies that will generate affordable energy, economic growth, and geopolitical competitiveness for all Americans to enjoy.

Next Article Previous Article